Foreclosures Continue to Dry Up

The pipeline of foreclosures continued to dry up nationwide in April, but the pipeline is slowly filling back up in some markets.

U.S. foreclosure starts in April decreased 5 percent from the previous month and were down 10 percent from a year ago to 30,524, according to the ATTOM Data Solutions. It was the third consecutive month with a year-over-year decrease and part of a much longer-term downward trend. To put it in perspective, foreclosure starts averaged more than 150,000 per month during the Great Recession, hitting a high of more than 200,000 in April 2009.

But not all markets saw a decrease: 17 states posted a year-over-year increases in foreclosure starts in April 2019, including Florida (up 34 percent); Texas (up 1 percent); Illinois (up 3 percent); Georgia (up 11 percent); and Arizona (up 6 percent), according to the ATTOM data.

Foreclosure Increases in Healthy Markets

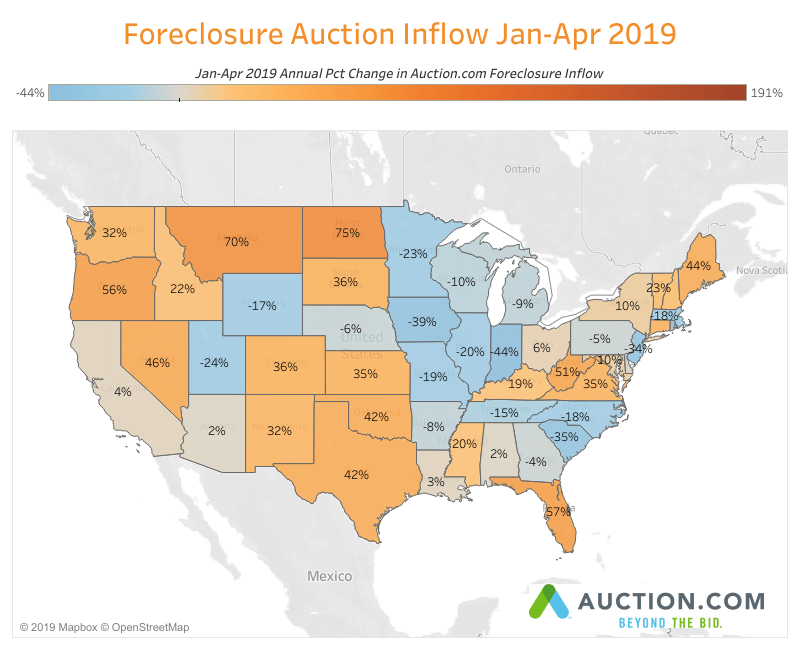

That upward trend in some local markets is mirrored in proprietary foreclosure auction data from Auction.com, which is on track to handle close to 50 percent of all foreclosure auctions nationwide in 2019. The number of new foreclosure auction properties received by Auction.com in April increased from a year ago in 34 states. Similar to the ATTOM Data, the Auction.com data shows increases in Texas (up 17 percent), Florida (up 68 percent), and Arizona (up 17 percent).

Increases in those states may surprise some given they represent some of the healthiest real estate markets in the country, by many measures.

The increases in these states are not just a one-month anomaly, according to the Auction.com data. Arizona has seen year-over-year increases in foreclosure auction inflow in five of the last seven months, while Texas has posted eight consecutive months of year-over-year increases and Florida has posted year-over-year increases for nine consecutive months.

Not All Natural-Disaster Related

The increases in Texas and Florida can at least partially be chalked up to the after-effects of the hurricanes that hit those states back in late 2017. Foreclosure moratoriums were imposed in areas impacted by the hurricanes in the immediate aftermath, creating a build-up of distress that has been flowing into the foreclosure pipeline over the past year after the moratoriums were lifted.

But natural disaster impact does not explain all of the increases in Texas and Florida, and that becomes apparent when looking at some of the counties in those states with increasing foreclosure inflow. According to the Auction.com data, April foreclosure inflow increased 63 percent in Tarrant County, Texas in the Dallas area. Foreclosure inflow was up 154 percent from a year ago in Hillsborough County, Florida, in the Tampa Bay area.

And natural disasters clearly can’t explain the increase in Arizona. The increase in Arizona was consistent across the state, with increases from a year ago in all counties covered by the Auction.com data. In Maricopa County, where Phoenix is located, foreclosure inflow increased 18 percent from a year ago. Similar to the statewide trend, foreclosure inflow in Maricopa County has increased in six of the last seven months.

While foreclosure inflow is increasing in some areas, the volume of that inflow is not yet enough to raise a red flag of concern about anything along the lines of a market crash or collapse; however, these increases do reinforce that the real estate recovery is losing steam.