Allowing vacant or abandoned properties to continue through the foreclosure process is one coronavirus crisis housing policy that enjoys widespread support from a broad set of stakeholders.

“When a property is abandoned but does not go through foreclosure in a reasonable period of time, it will invariably blight the community,” said Julia Gordon, president of the National Community Stabilization Trust, a nonprofit organization focused on promoting homeownership in distressed neighborhoods. “The best way to help homeowners stay in their home while also protecting neighborhoods is to provide an appropriate suite of individualized options, rather than using the blunt instrument of a foreclosure moratorium in lieu of effective loss mitigation.”

The mortgage forbearance option established by the CARES Act on March 27, 2020, two weeks after the coronavirus pandemic declaration, gives consumer advocates like Gordon some measure of confidence that many homeowners who want to avoid foreclosure can avoid foreclosure — although Gordon doesn’t believe the legislation went far enough when it comes to protecting distressed homeowners through pro-active forbearance. If legislation addressing those forbearance program shortcomings was signed into law, Gordon said she would be more comfortable supporting a removal of the foreclosure moratoria.

Real estate investors like Cleveland-based Josh Cantwell agreed that vacant foreclosures should not be blocked from sale at auction — especially when many investors are ready, willing and able to purchase these properties and get them occupied in a relatively short period of time.

“Vacant is certainly more appealing to investors because … you can probably get a better deal, a lower price, and you can execute your strategy quicker, whether it’s rehab to sell or rehab to rent,” said Cantwell, who is also CEO of Freeland Ventures, a real estate investment company that invests in multifamily properties and apartments in the Midwest and Southeast. “I see no benefit for the investor, I see no benefit for the homeowner, I see no benefit for the lender, I see no benefit for the community to leaving that property vacant. For the most part, if the house is vacant, there is no benefit to withholding the foreclosure for anyone.”

[Texas-based real estate investor Aaron Amuchastegui said he recently purchased this boarded-up, vacant “zombie” foreclosure at auction after it sat abandoned for two years. Following extensive renovations, the property was rented out and is now occupied by a family.]

Ripple Effects on Home Prices

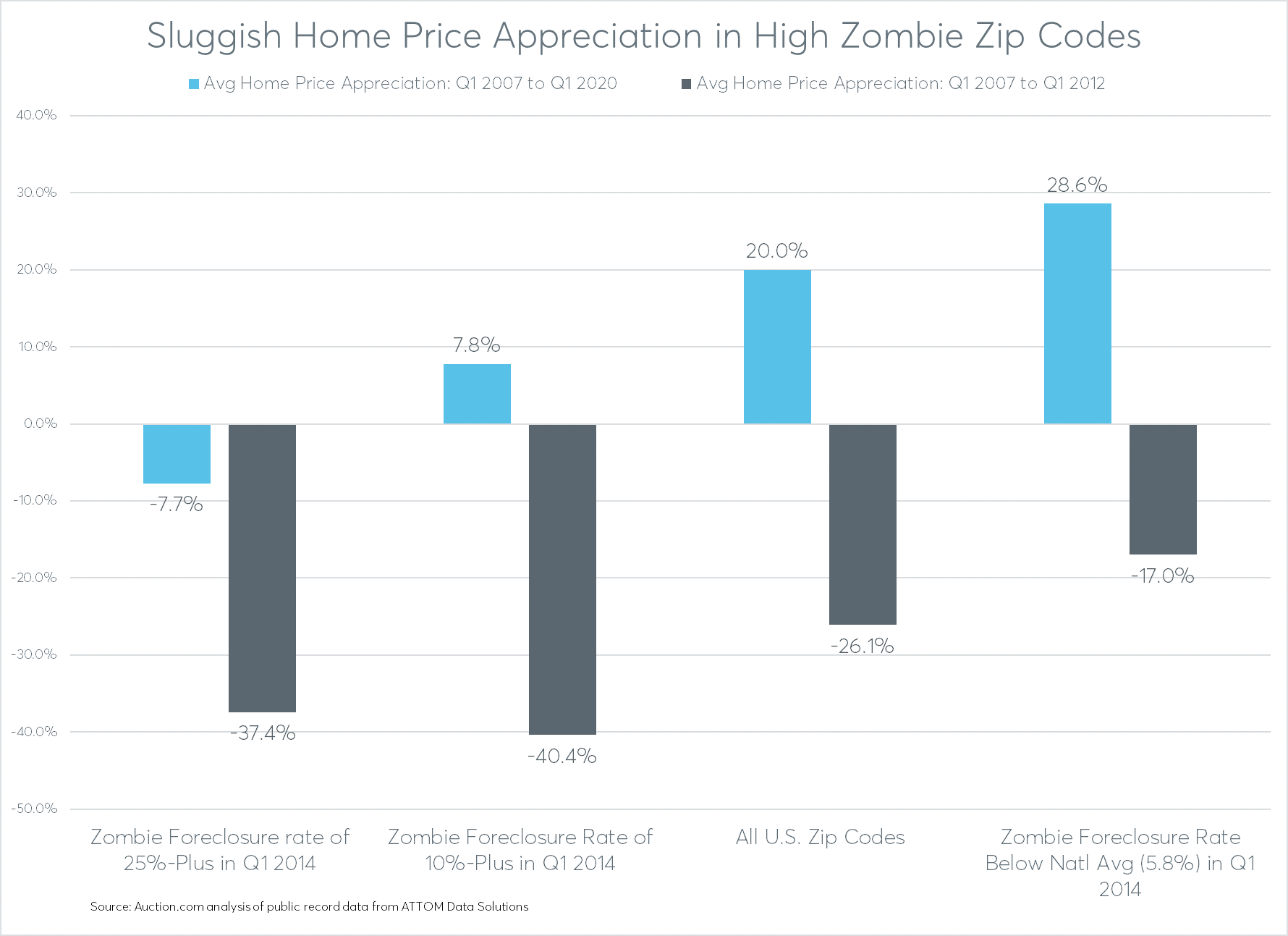

The backlog of zombie foreclosures that built up in the wake of the Great Recession continued to have ripple effects into 2020, according to an Auction.com analysis of public record data from ATTOM Data Solutions.

Among 487 U.S. zip codes with at least 10 zombie foreclosures and a zombie foreclosure rate of at least 10 percent (nearly twice the national average) in Q1 2014, median home prices in Q1 2020 were just 7.8 percent higher on average than median home prices 14 years earlier, in Q1 2007. Nationwide, median home prices were up 20 percent over that same 14-year period, and in zip codes with below-average zombie foreclosure rates in Q1 2014, median home prices were up an average of 29 percent.

Among 25 zip codes with at least 10 zombie foreclosures and a zombie foreclosure rate of at least 25 percent in the first quarter of 2014, median home prices in Q1 2020 were still 7.7 percent below median home prices in Q1 2007 on average, according to the public record data analysis. Leading this top 25 list in terms of most zombie foreclosures in Q1 2014 were zip codes in the Tampa-St. Petersburg, Florida, Youngstown, Ohio, Baltimore, Maryland, Indianapolis, Indiana, and Columbus, Ohio metro areas.

Still Wreaking Havoc

Texas-based real estate investor Aaron Amuchastegui said he continues to witness the negative impact of zombie foreclosures on home values — for the vacant property itself as well as for surrounding properties.

“We have had many neighbors thank us after buying the beat up, abandoned house because it serves as a danger to the neighborhood, an eyesore, and decreases their property values,” said Amuchastegui, who shared a story of a recent vacant foreclosure purchase in Killeen, Texas, that illustrates the damage done to neighborhoods by zombie foreclosures as well as the potential lift to the surrounding neighborhood when a zombie foreclosure is purchased and rehabbed by a responsible investor. The property sat vacant for two years after it was abandoned by the previous owner, according to Amuchastegui, who said the property experienced regular break-ins and illegal parties that degraded its condition over the two-year period.

“By the time we bought the property the garage door was boarded up with plywood and covered in graffiti. The windows were boarded up. The inside was covered in graffiti and full of beer bottles and drug paraphernalia,” said Amuchastegui, noting he purchased the property at the “Super Tuesday” Texas foreclosure auction and quickly had his professional crew perform extensive renovations. “The following Thursday we listed for rent, and within two weeks of us buying it, a family had moved in and started renting it. Everyone started winning: a vacant eyesore restored, a new family gets a home, and the former owner gets to start to rebuild their credit with a fresh start since the sale finally occurred.”

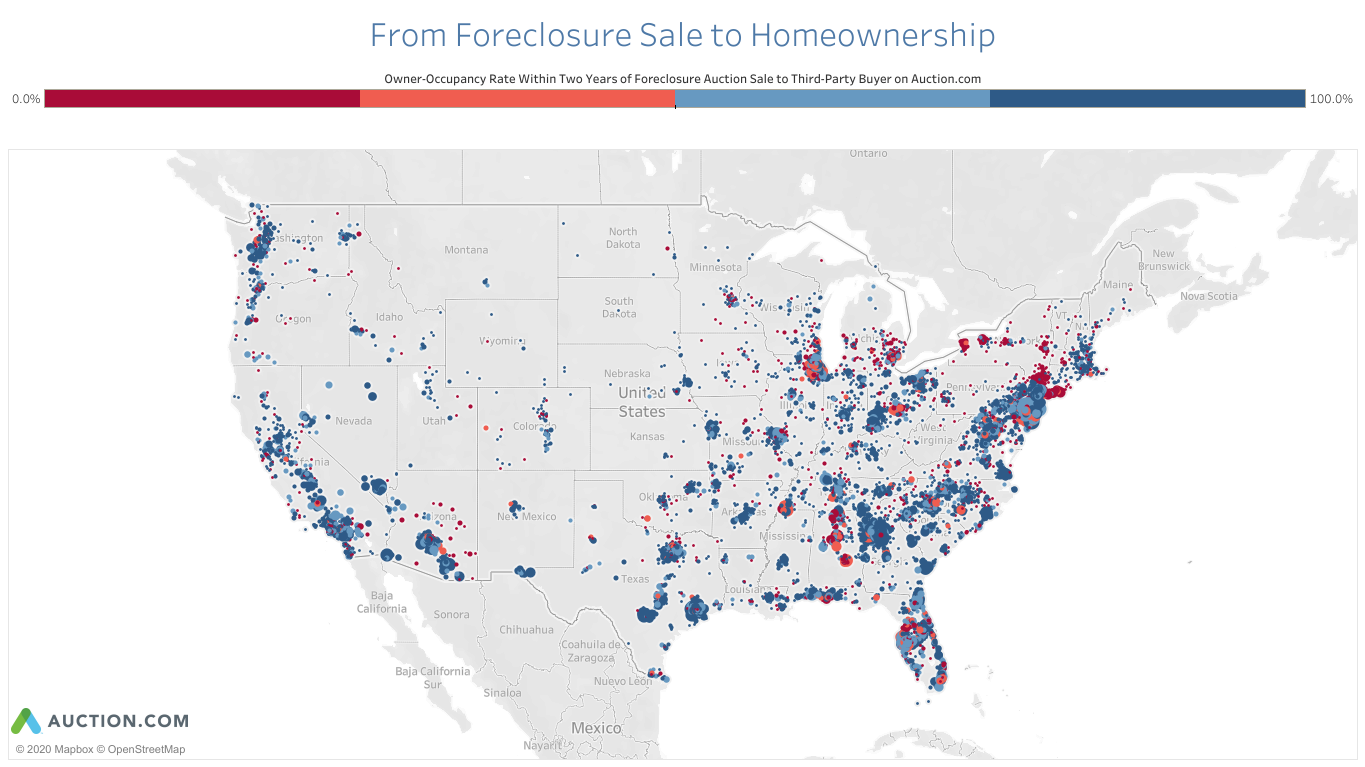

From Vacant to Owner-Occupied, Faster

Demand for vacant “zombie” foreclosures from investors like Amuchastegui and Cantwell also benefits neighborhood stabilization in the form or increased homeownership. An analysis of 165,000 properties brought to foreclosure auction on the Auction.com platform in 2018 and 2019 shows that the majority (69 percent) of properties sold to third-party buyers at the foreclosure auction — and then were subsequently resold by those third-party buyers — ended up owner-occupied within a year after the foreclosure auction.

Meanwhile, only 46 percent of properties that reverted to the lender (REO) at foreclosure auction and then were subsequently sold on the Multiple Listing Service — presumably with the goal of selling to owner-occupants — were actually owner-occupied within a year after the foreclosure auction.

Similar research by the NCST found that most of the low homeownership rates for previously foreclosed homes were in highly distressed neighborhoods. While the NCST is working to promote homeownership even in those distressed areas, Gordon said an occupied property — even if it’s a rental — is always better than a vacant property when it comes to neighborhood stabilization.

“Homeownership is my number-one goal, but I’d rather have it rented than sit there as a zombie foreclosure,” she said.