Three ways to lift homeownership rates for auction sales: more online, broader marketing, and first-look auctions for local community developers who renovate and resell to owner-occupants.

Distressed properties purchased at auction typically sell for 30 to 40 percent below full “after-repair” market value. So why aren’t more individual homebuyers — particularly first-time homebuyers — taking advantage of this affordable path to homeownership?

That’s the question the Urban Institute explores in a recent brief that incorporates proprietary data from the Auction.com marketplace. The analysis focused on more than 85,000 properties sold via the Auction.com marketplace between 2019 and 2021.

The brief not only provides data-supported answers to the question, but also provides data-supported solutions that could increase owner-occupant participation at distressed property auctions and encourage more resales of renovated foreclosures (most of which sell at affordable price points for local buyers) to owner-occupants. The brief is authored by Laurie Goodman, director of the Urban Institute’s Housing Finance Policy Center, Jung Hyun Choi, a senior research associate at the Housing Finance Policy Center, and Liam Reynolds, a research assistant at the Housing Finance Policy Center.

Owner-Occupancy Rates for Auction Sales

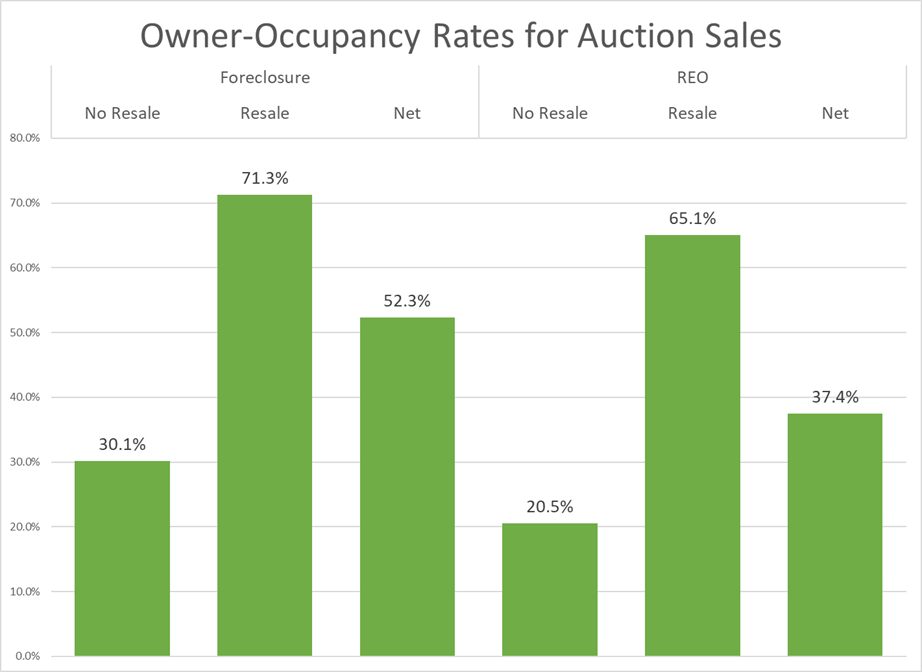

About one-quarter of all distressed properties sold via auction — either at the foreclosure auction or at an online bank-owned (REO) auction — sold directly to owner-occupants, the analysis found. The owner-occupancy status was based on public record tax assessor and recorder data from ATTOM Data Solutions. A property was considered sold directly to an owner-occupant if there were no subsequent sales after the Auction.com sale in the public record data and if the county tax assessor showed the property as owner-occupied as of Q4 2021, when the analysis was done.

The direct-to-owner-occupant rate was higher for foreclosure auctions (30.1 percent) than for REO auctions (20.5 percent), a disparity that the Urban Institute researchers attributed largely to the fact that the REO properties tended to be older and smaller. This would mean those REO properties were more likely to need extensive repairs that an owner-occupant buyer may not be able or willing to take on.

Distressed properties sold at auction go “overwhelmingly to mom-and-pop investors”, the researchers note in the brief. The silver lining for affordable homeownership here is that many of these mom-and-pop investors are renovating the homes and reselling to owner-occupants at relatively affordable prices when compared to the larger retail market and even when compared to the full “after-repair” market value of the homes being resold.

The researchers found that 71.3 percent of renovated foreclosure resales go to owner-occupants while 65.1 percent or renovated REO resales go to owner-occupants. The average renovated foreclosure resale price was $256,369, and the average renovated REO price was $241,498 — both more than 30 percent the average price of $366,388 for all existing home sales between 2019 and 2021, according to public record sales data from ATTOM Data Solutions.

Despite this silver lining, the data still shows net owner-occupancy rates for distressed property auctions that lag the nationwide homeownership rate of more than 65 percent: 52.3 percent for foreclosure auctions and 37.4 percent for REO auctions.

Three Barriers to Owner-Occupant Buyers

The brief identifies three primary barriers to higher owner-occupancy rates for distressed properties sold at auction: property condition that often requires major renovations, lack of ability to finance, and the presence of current occupants that may require eviction. After detailing the complexities of each of these barriers, the authors of the brief conclude there are no silver bullet solutions.

“Distressed sales could provide a cost-effective way for owner occupants to buy a home,” the authors write. “But few distressed homes that trade at auction initially trade to owner-occupants; most trade to mom-and-pop investors. The properties often trade to owner-occupants at resale because distressed properties tend to require major renovations, and most owner-occupants do not have the expertise or inclination to undertake major renovations. And potential owner-occupants who can handle major renovations will find two additional obstacles: financing issues and a lack of access to the properties to estimate repair costs. Neither of these dimensions has an easy solution.”

Three Proposals to Increase Owner-Occupancy Rates

Despite this somewhat deflating answer to the original question, the authors still propose some changes that could bring about incremental change when it comes to improving the homeownership rate for distressed properties sold at auction.

For foreclosure auctions, which in most states are still in-person events, the authors advocate moving them online and marketing them more broadly to help attract more owner-occupant buyers.

“Most foreclosure auctions require potential buyers to be physically present at the auction; transferring this process online would make it easier for individuals, including owner-occupants, to attend and would encourage the owner-occupant base to buy. Second, requiring broad marketing of properties before auction would help. These actions could increase the share of owner-occupant purchases at foreclosure auctions.”

For REO auctions, the authors propose wider use of first-look auctions that allow certain qualified buyers the opportunity to bid on properties before they are open for bidding to all buyers. Owner-occupant buyers would automatically qualify for the first-look auction, and other buyers could qualify based on their ability, willingness and track record of renovating and reselling to owner-occupants.

“The first-look auction would give owner-occupants—along with mission-driven nonprofits and mom-and-pop investors who agree to provide high-quality affordable housing for low- and moderate-income families—the ability to bid on a home before it is available to other potential bidders. Nonprofits and mom-and-pop investors would go through a certification process to qualify as local community developers who can bid during the first-look auction. This would likely increase the share of homes owner-occupants could purchase directly, or indirectly through a nonprofit or local community developer.”