Reserve met triggers a 40 percent increase in bidding activity and a 21 percent lift in sales price

Auction theory is having a bit of a moment, with advances in auction theory made by two Stanford professors winning the 2020 Nobel prize in economics.

The cornerstone of auction theory is the reservation price. A buyer’s reservation price is the maximum amount he or she is willing to pay for an item, while a seller’s reservation price is the minimum amount at which he or she is willing to sell an item. When a buyer’s reservation price equals or exceeds a seller’s reservation price during the course of an auction, a mutually beneficial sale can occur.

In an optimal auction environment, both the buyer and seller reservation prices will ultimately be revealed: the highest bid provided by any given buyer reveals that buyer’s reservation price; whether or not the seller accepts the highest bid reveals if that high bid at least met the seller’s reservation price.

In the context of the online bank-owned (REO) auctions on Auction.com (a variation of which the Nobel prize committee noted has been in existence since Ancient Rome), sellers often choose to strategically reveal the reservation price before the bidding begins as the “Reserve” amount and also notify all bidders during the auction when a bid has met or exceeded that reservation price with a “Reserve Met” indicator.

Leveraging Reserve to Maximize Revenue

That strategic use of Reserve and Reserve Met can be used to maximize the final sale price of a property.

In a white paper announcing the 2020 Nobel prize in economics, the Royal Swedish Academy of Sciences touches on the importance of a seller’s strategic use of the reserve to optimize revenues realized from an auction. The white paper references “a carefully selected reserve price” as a key element — along with the actual format of auction used — in solving the “optimal auction problem: which mechanism maximizes the seller’s expected revenue?”

The white paper goes on to cite “excessively high reserve prices” as one possible reason that some auctions formats have not “lived up to what they promised.”

Real-World Power of Reserve Met

The real-world power of Reserve Met shows up in an analysis of an auction of more than 2,200 REO properties on Auction.com in September.

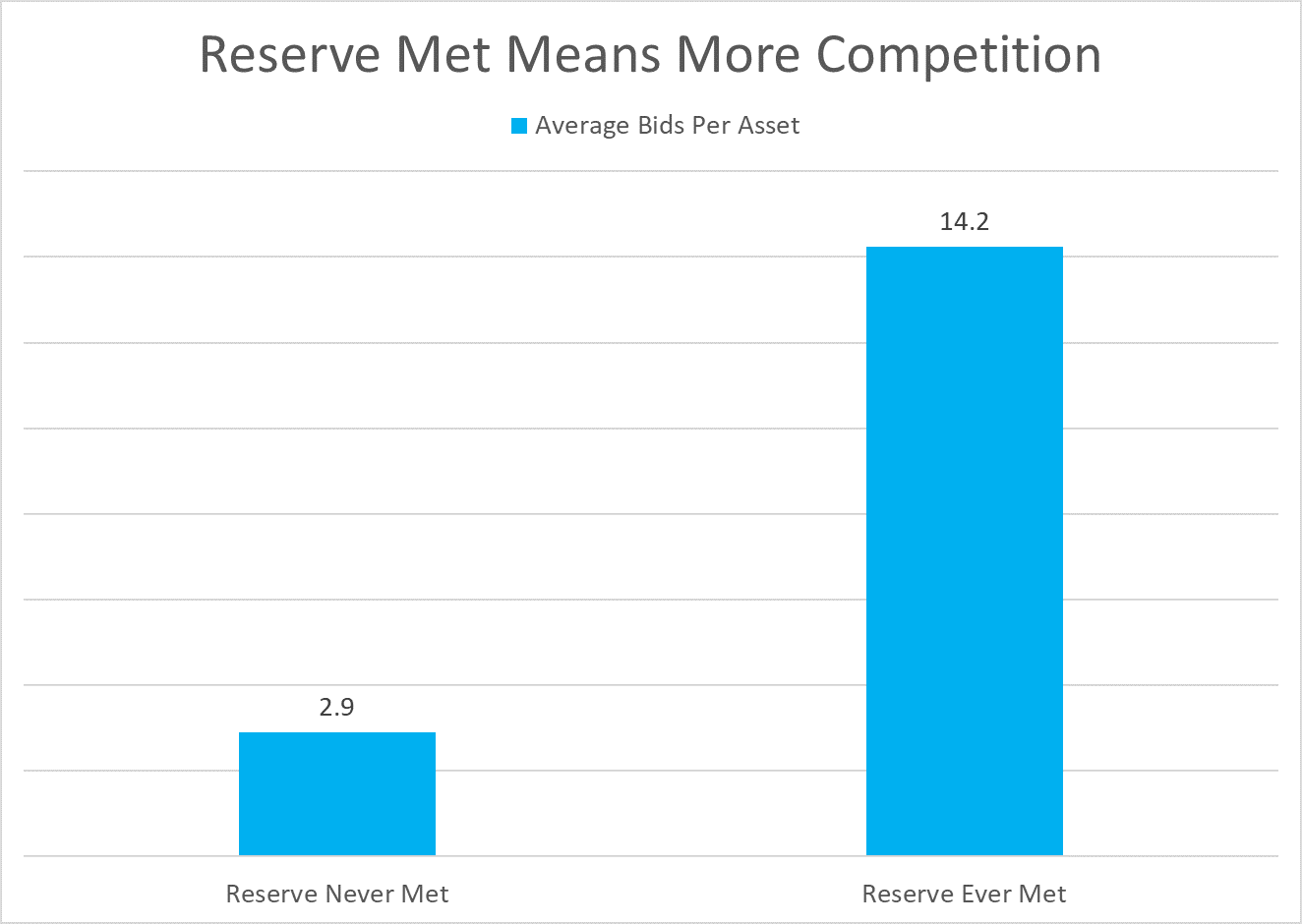

First, properties where reserve was met at some point during the auction attracted much more competition: more than four times the number of average bids compared to properties where reserve was never met. Properties where reserve was met at some point received an average of 14.2 bids over the course of the entire auction event compared to an average 2.9 bids for properties where reserve was never met.

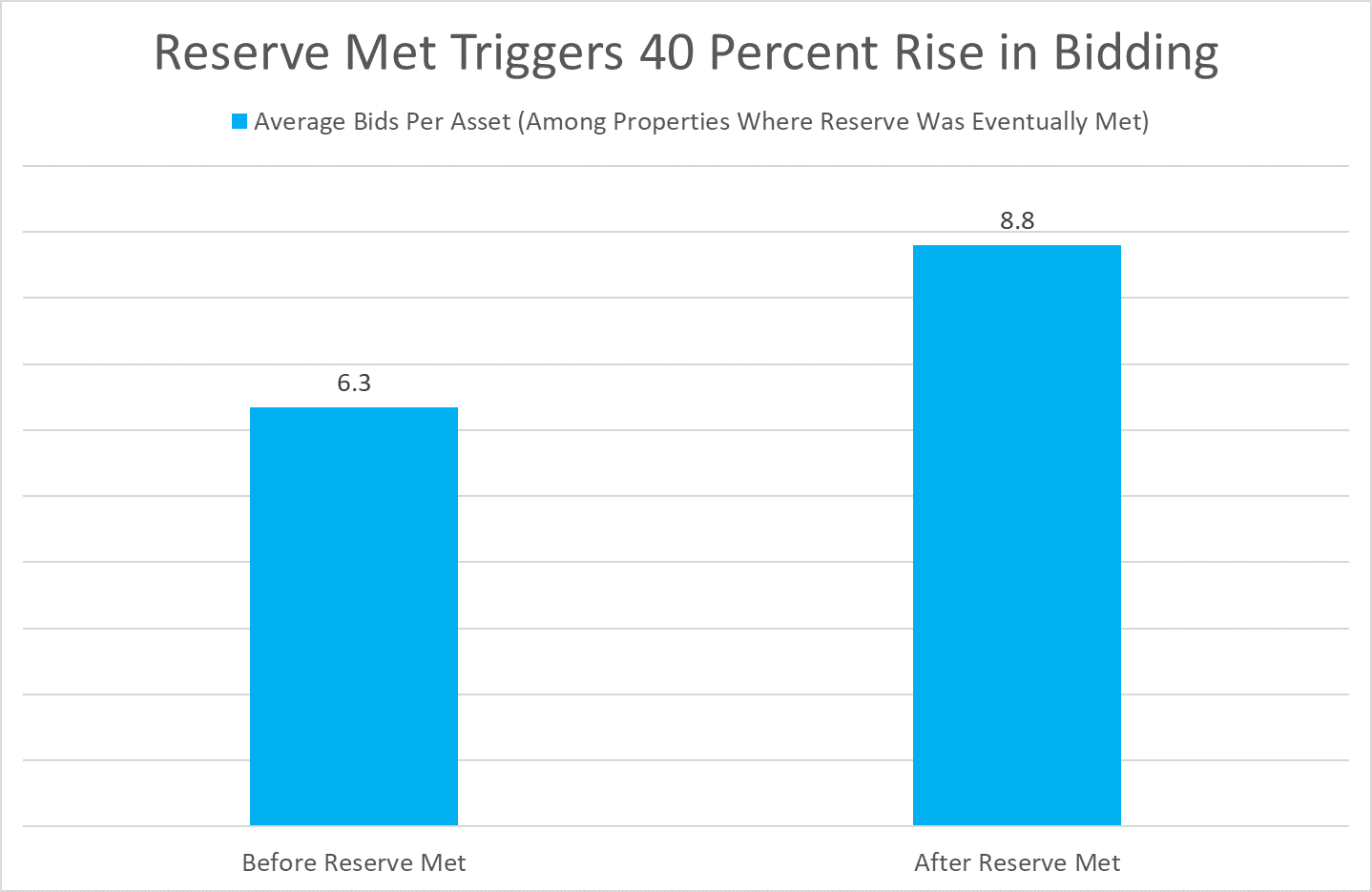

These reserve-met properties attracted more bidding competition thanks, in part, to a significant uptick in bidding once bidders became aware that reserve was met. Among properties where reserve was eventually met, the average number of bids increased by 40 percent after reserve was met (8.8 bids) compared to before reserve met (6.3 bids).

The accelerated bidding activity triggered by reserve met is grounded in basic human psychology as described by Auction.com buyer Tyrone Velasquez. Velasquez and his husband, Scott Stuber, buy and renovate distressed properties in Dayton, Ohio.

“When I see that reserve is met, then I’m really gung-ho. I’m ready to go,” said Velasquez. “Because now I know it’s met the reserve so now I know whoever wins that bid is going to win the prize, win the house.”

It’s worth noting that the reserve met milestone is not the only reason that the reserve-met properties attracted more bidding. That’s evident in the average of 6.3 bids even before the reserve was met among properties where reserve was eventually met — more than double the average of 2.9 bids for properties where reserve was never met. The higher level of competition for these properties even before reserve was met is likely grounded in a combination of factors, including property location, condition, and a seller reserve (displayed upfront) that is in closer alignment with reservation prices of potential bidders.

Price Execution Lift

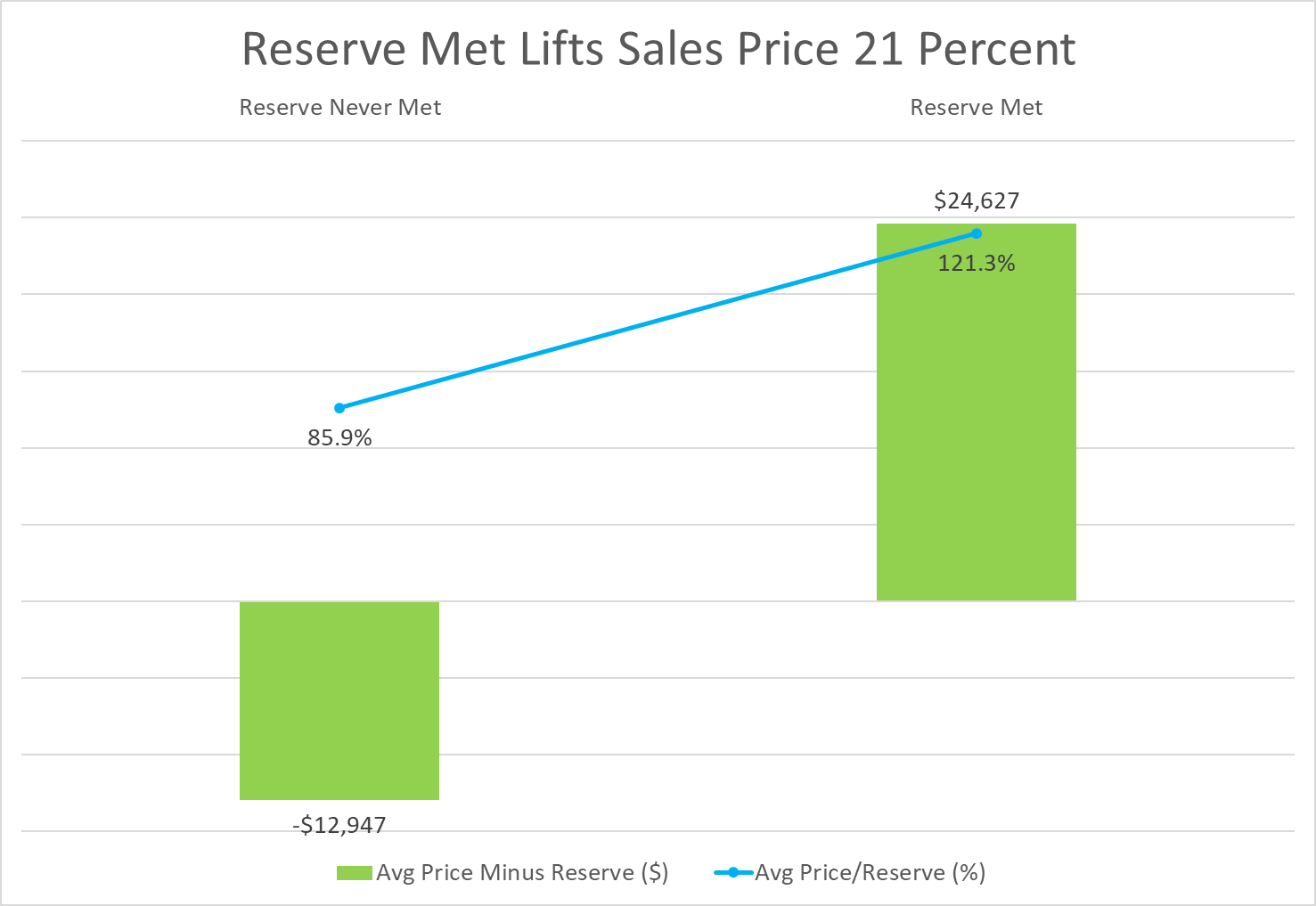

The 40 percent jump in bidding activity after reserve is met contributes to a significant lift in price execution, according to the Auction.com analysis. Among properties where reserve was eventually met, the final sale price was 121 percent of the seller reserve on average. In dollars those properties sold for an average of nearly $25,000 above the seller’s reserve.

This lift in execution demonstrates how the certainty of sale and competitive environment both present when reserve is met drives bidders to reveal their ultimate reservation price, even if it’s significantly higher than the reservation price provided by the seller.

“You can keep bidding and the (seller’s desired sale price) might be $75,000 but people don’t know. But once (buyers) see that the reserve has been hit at $50,000, they’re going to go up to that 75 anyhow. They just don’t know it yet,” said Stuber.