Broader Pool of Foreclosure Buyers Means Steady Demand even in Stormy Markets

Foreclosure buyers are now more likely to be individuals purchasing a handful of homes each year rather than institutions scooping up dozens of properties each month, and that broader pool of buyers is ensuring steady demand for distressed properties even in stormy markets.

“Forty years as an owner-occupant; one year as an investor,” said Houston-based Alan Goodwin, describing his experience in real estate. Goodwin purchased his first investment property — a bank-owned home — via an online auction on Auction.com in 2019 and just closed on a second investment home in late March. “I am a flipper trying to add a greater than 15 percent return to my retirement funds.”

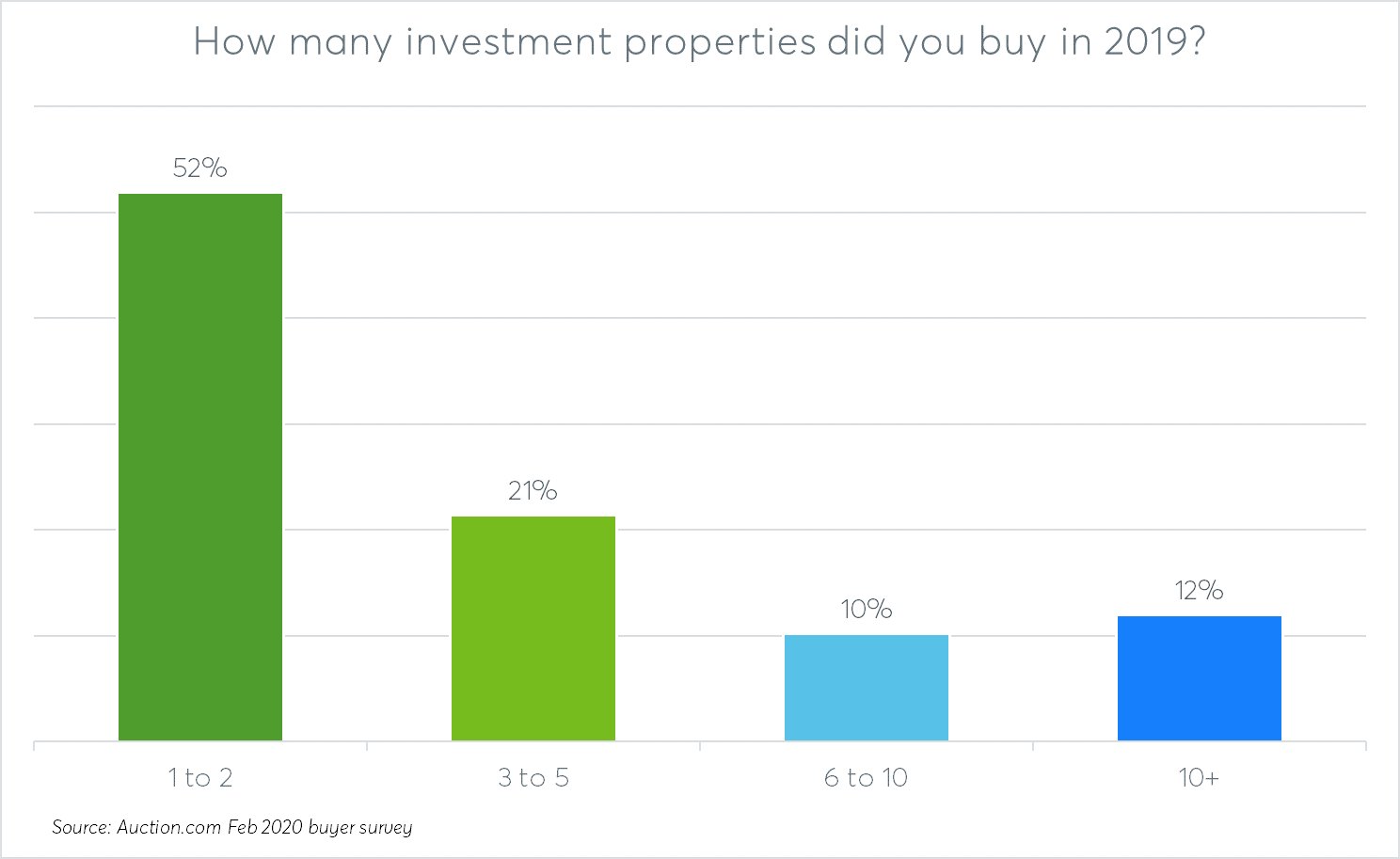

Goodwin is typical of most real estate investors purchasing at foreclosure auction or online bank-owned (REO) auction, according to an Auction.com buyer survey conducted in February. More than half (52 percent) of survey respondents said they purchased one or two properties in 2019 while an additional 21 percent said they purchased between three and five properties during the year.

The share of buyers who said they purchase fewer than five investment properties a year has jumped dramatically even over the past year, from 51 percent in a similar Auction.com buyer survey conducted in June 2019 to 73 percent in the February 2020 survey.

“Five to 10 years ago, the dominant buyer at foreclosure auction or online REO auction was the institutional investor with ample access to large amounts of capital,” said Ali Haralson, Chief Business Development officer at Auction.com. “Auction.com has democratized the distressed property marketplace with innovative marketing and state-of-the art sales technology, empowering smaller investors to compete — and often win — in this arena.”

Institutional Buyers: Swimming Against the Flow

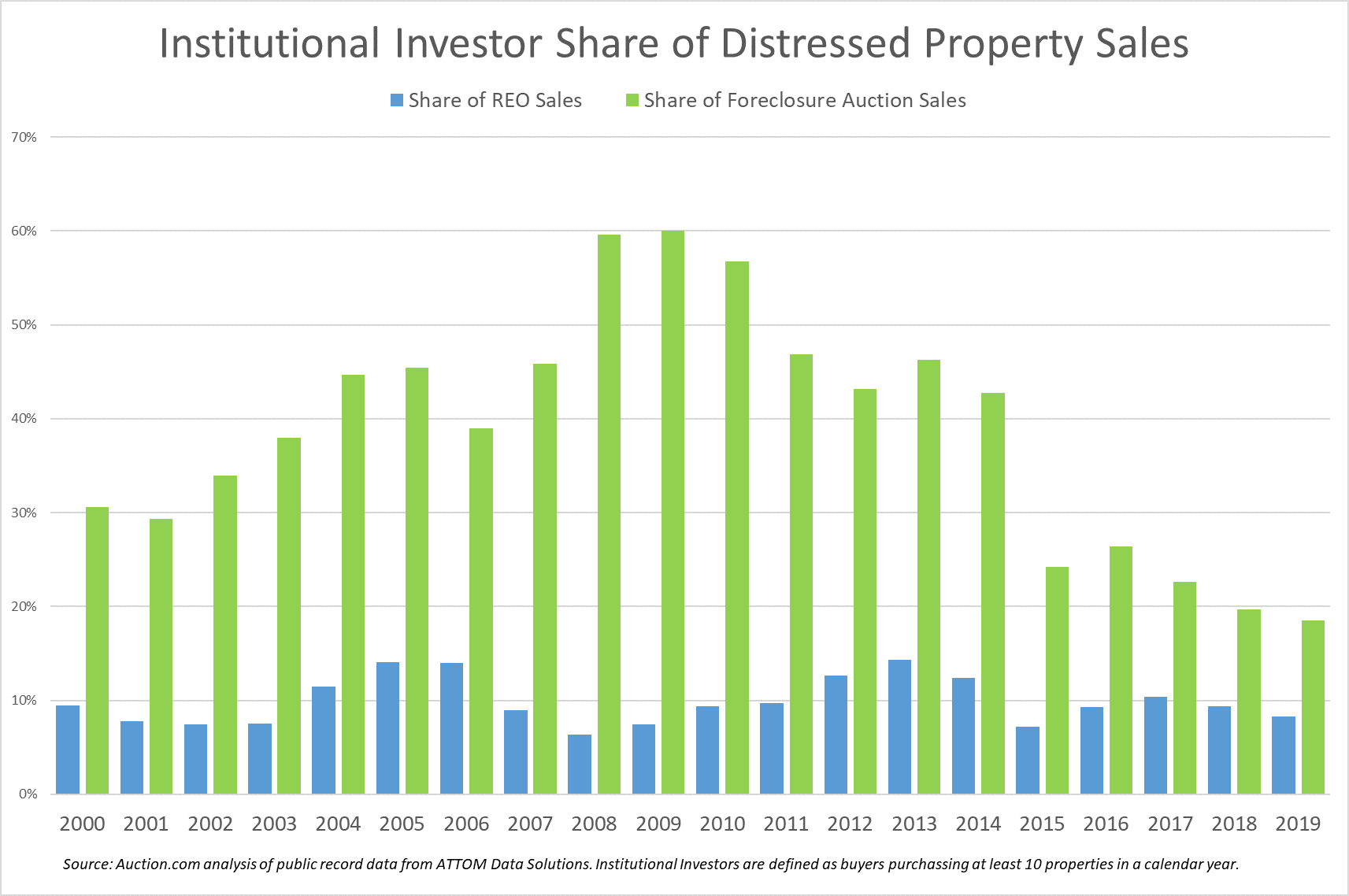

As the competition for distressed properties increased in recent years, many of the midsized to mammoth institutional investors who gobbled up tens of thousands of foreclosure properties near the bottom of the real estate market have pulled back on their acquisitions.

Eighteen percent of homes sold at foreclosure auction were purchased by institutional buyers — defined as buyers who have purchased at least 10 properties in a calendar year — in 2019, according to an analysis of public record data from ATTOM Data Solutions. That was down from 20 percent in 2018 to a 20-year low (as far back as data is available).

The institutional investor share of purchases at foreclosure auction peaked in 2009 at 60 percent, according to the ATTOM data. It gradually decreased from there but remained above 40 percent through 2014, after which it dropped to below 30 percent in 2015 and 2016 and then below 20 percent in 2018 and 2019.

For REO purchases, the peak institutional investor share came a few years later in 2013 at 11 percent, but the share has similarly decreased steadily since then, dropping to a 16-year low of 8 percent in 2019.

JWB Real Estate Capital is an example of an institutional buyer that pulled back in recent years on its purchases of existing homes, including at foreclosure auction. Since it was founded in January 2006, the company has purchased and renovated more than 2,000 existing homes — many of them purchased at foreclosure auction or as REO — and built more than 1,300 properties. But the company’s ratio of existing purchases to new builds was reversed in the past few years. In 2019 the company built over 400 new homes and purchased about 150 existing homes, according to JWB president Alex Sifakis.

Sifakis said JWB — which resells most of the homes it acquires as turnkey rentals — is looking to potentially increase its purchases of existing homes via foreclosure auction and other acquisition sources given the recent market turmoil triggered by the coronavirus pandemic.

“We are buying everything now if the price is right,” he said. “We’re 100 percent privately capitalized … (so) we are not subject to the whims of Wall Street.”

Midsized Investors: Adjusting to the Current

Access to funding during the coronavirus crisis is a concern for Chicago-based investor Michael Hallman, who said he has been rehabbing and reselling 12 to 20 properties a year since 2012 and also owns about 15 rental properties.

“I’ve got about 10 properties right now for sale. … I’ve taken lower prices than normal. … I’ve had people pulling out of them because of the coronavirus,” he said, adding that he can no longer rely on his usual funding source to buy more properties. “I want to get in a cash position where I am using my own money to buy.”

Still Hallman said he plans to start buying again once he’s sold a couple of his properties and has the capital for more purchases.

“I’m willing to buy, but the price has got to be right,” he said, noting that he resells mostly to owner-occupant buyers, and he expects them to be looking for lower price points given the market turmoil. “If there are not enough buyers, prices are going to go down. … I’ve got to factor in if buyers aren’t going to pay as much.”

Individual Investors: Still Riding the Wave

The recent market turmoil didn’t deter Goodwin, the Houston-based real estate investor, from closing on his second investment property in late March. It helped that he was able to bid on and buy the property remotely.

“I was able to do everything remotely: due diligence, bid, purchase and successful closing on the property following the easy–step process provided by Auction.com,” he said. “After my winning bid, Auction.com staff communicated with friendly prompts leading me to an efficient transfer of funds and quick closing.”

Social distance-friendly technology such as online auctions and remote buying are empowering investors of all shapes and sizes to buy even in the unprecedented market conditions caused by the coronavirus pandemic.

Shift to Online Auctions

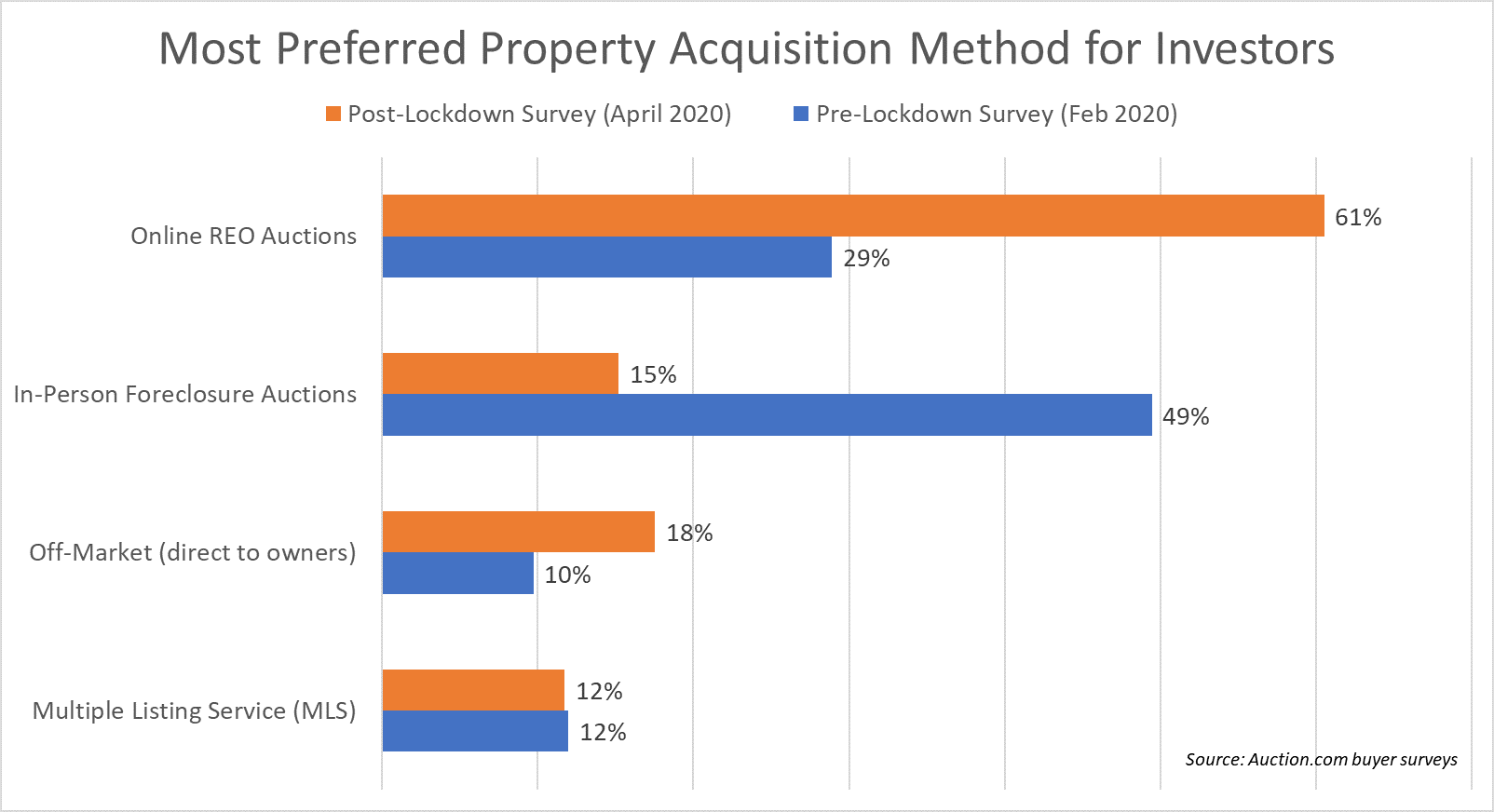

Proprietary Auction.com data shows investor interest has quickly shifted away from in-person foreclosure auctions — which have effectively been halted nationwide due to the coronavirus pandemic — and toward online auctions.

An Auction.com buyer survey conducted between April 3 and April 10, after much of the country had gone into lockdown, found that online REO auction was the most preferred property acquisition method for 61 percent of survey respondents, beating out off-market (18 percent), in-person foreclosure auction (15 percent) and the Multiple Listing Service (12 percent).

Those post-lockdown survey results represented a dramatic shift from preferred property acquisition methods identified in the pre-lockdown survey conducted in mid-February. In that survey, 29 percent of respondents identified online REO auction as their top acquisition method, second to in-person foreclosure auction (49 percent), but still beating out the MLS (12 percent) and off-market (10 percent).

“With what we’re seeing now with the coronavirus, which will go away at some point, it makes sense to stay at home,” said a Portland-based real estate investor who said he buys rental properties remotely in Las Vegas and Albuquerque via online auction. That investor said he’s slowly built up a portfolio of about 30 rental properties over the past 10 years, and he doesn’t expect the economic shock caused by the coronavirus pandemic to derail his conservative investing strategy.

“We’re not highly levered. We’re older. We could withstand (another) 2008. We wouldn’t be happy about it, but we could stand it,” he said.

The increased interest in online auctions is showing up in website traffic data along with competitive bidding behavior on Auction.com.

Online REO auctions accounted for more than half of all property page views on the Auction.com website on March 18, the first day this year that share broke 50 percent. Since then, the share of property page views for online REO auctions has continued to trend higher, reaching a new high of 65 percent on March 31.

Additionally, more than 89 percent of online auction properties sold in the first quarter of 2020 received multiple, competing bids. That was up from 85 percent in the previous quarter and 86 percent a year ago to the highest level since Q3 2017, the earliest that data is available.

An Ark for the Coming Foreclosure Flood

In-person foreclosure auctions nationwide largely ground to a halt in the second half of March due to the widespread foreclosure moratoriums and courthouse closures triggered by the coronavirus pandemic.

As a result, many investors have shifted their focus in the short term to online REO auctions, but investors are also readying for the expected flood of foreclosure auctions that will hit as the moratoriums and courthouse closures are lifted.

“We’ve dealt with a shortage of inventory this year to be honest,” said Jason Epstein, Co-Founder and President of CastleRock REO, which buys 1,500 to 2,000 distressed properties a year nationwide. “I think we will be in a good position when we come out the other side of this.”

Helping investors to absorb the expected influx of foreclosure auction inventory is new remote bidding technology launched by Auction.com in March.

“The remote bid technology will allow investors to maintain social distance when bidding at a foreclosure auction, which traditionally has required bidders to be physically present to participate,” said Haralson. “Auction.com has invested heavily in the remote bid technology over the past several years and is accelerating the roll–out process to make it available in as many counties as possible as soon as possible.”