Scarcity of Distressed Supply Provides a Window of Opportunity to Sell

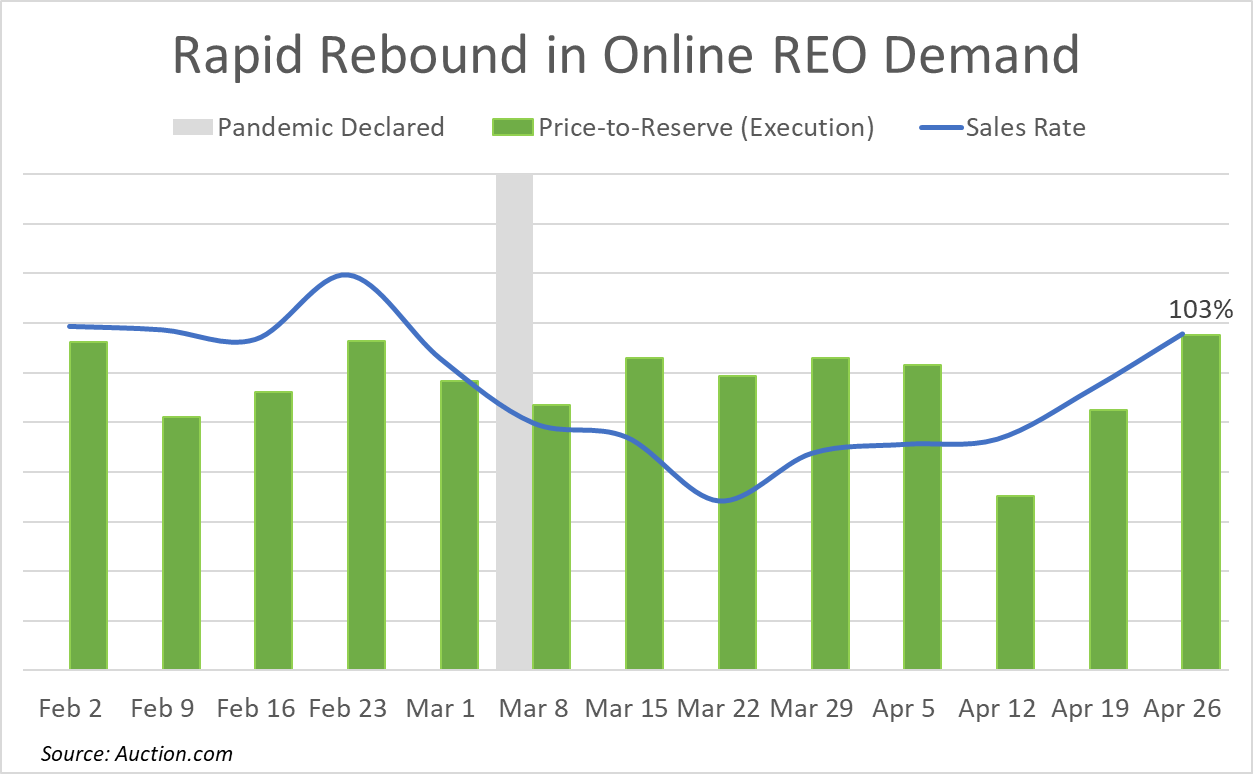

Price execution for bank-owned homes sold via online auction increased to a 14-week high in the last week of April while the sales rate jumped to a nine-week high as competition heated up in a supply-challenged distressed property market.

In the week starting April 26, bank-owned homes — also known as real estate owned (REO) — sold on average for 103 percent of the reserve price set by the seller, according to proprietary Auction.com data. That 103 percent price execution was the highest since the week of January 25th and was also up from the same week a year ago.

Meanwhile the net sales rate of all REO properties available for online auction in the week of April 26 increased to the highest level since the week of February 23 and was up 5 percent from the same week a year ago.

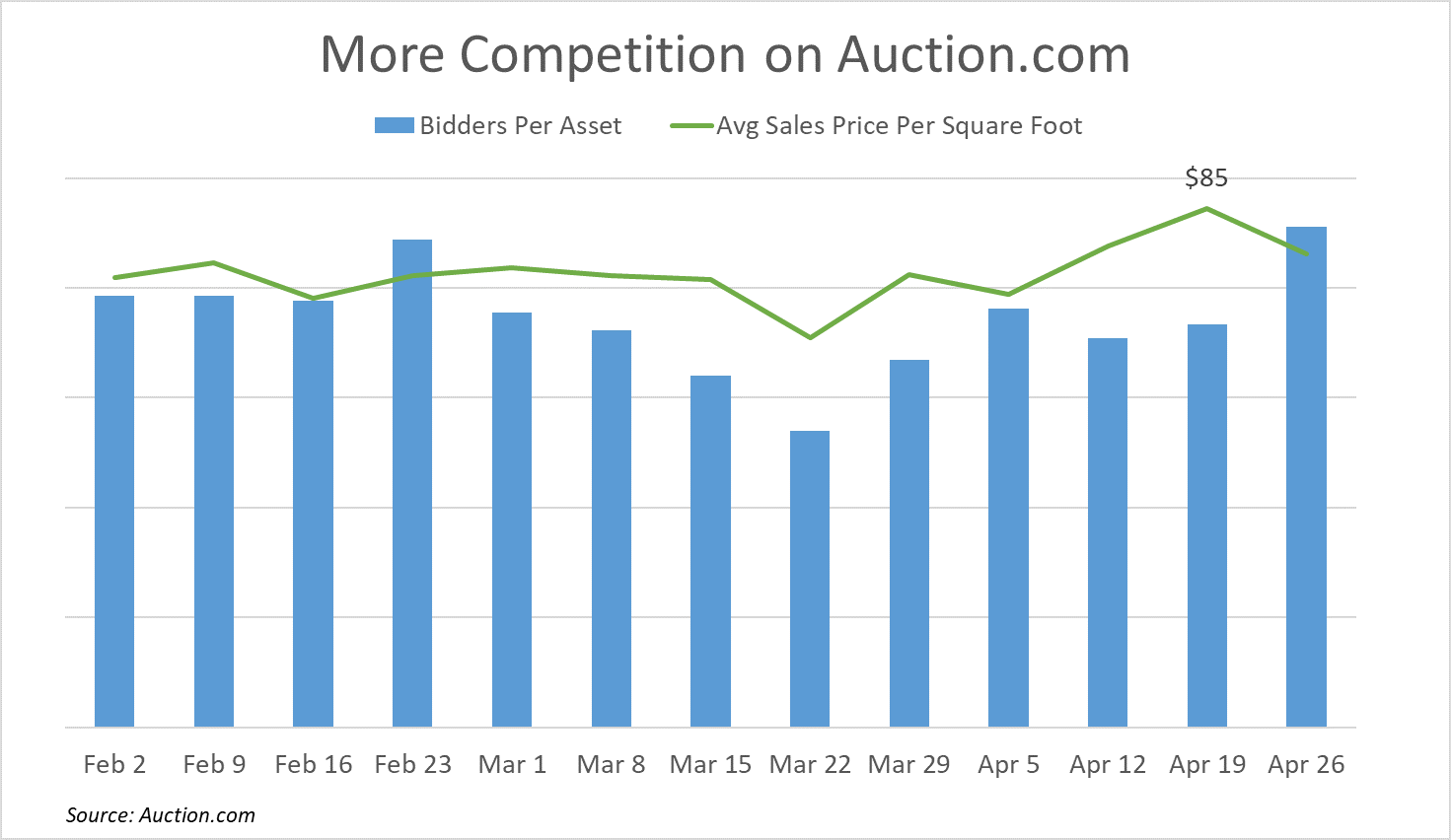

Increasing Competition

The new multi-week peaks in sales rate and price execution for online REO auctions were driven largely by a highly competitive bidding environment in April. REOs sold in the last week of April garnered an average of 10.7 bids each, up from both the previous week and a year ago to a nine-week high. Additionally the average number of bidders per REO sold increased to a 14-week high.

More competition for online REO auctions translated into higher bids from prospective buyers. The average high bid submitted for available REO auctions in the week of April 26 was $51.9 per square foot, up for the third consecutive week to a nine-week high.

Despite the recent market turmoil triggered by the coronavirus crisis, many real estate investors are actively looking for more distressed property inventory. An April survey of Auction.com buyers found that more than half of those whose top acquisition strategy is online REO auctions plan to increase or keep the same their property acquisitions despite the pandemic declaration and ensuing market upheaval.

“We are buying everything now if the price is right,” said Alex Sifakis, president of JWB Real Estate Capital, a real estate investing company based in Jacksonville, Florida, in a March 30th phone interview. “We have capital, so we are ready to go.”

Dwindling Inventory

Meanwhile, the inventory of distressed properties available to real estate investors has quickly contracted since a nationwide foreclosure moratorium was implemented on March 18, 2020, by Fannie Mae, Freddie Mac and the U.S. Department of Housing and Urban Development. Combined, those three agencies backed about 60 percent of all U.S. mortgages originated in 2019, according to data from Inside Mortgage Finance. The Fannie, Freddie and FHA moratoriums were recently extended through June 30, and many servicers have also implemented foreclosure moratoriums.

This low-supply environment is prompting real estate investors to look for inventory outside of their usual acquisition sources.

“I have the money to spend but need more properties to spend it on,” wrote one real estate investor in an email sent to Auction.com on May 7, inquiring about the possibility of buying properties via online REO auction — a new acquisition source for this investor.

The combination of contracted distressed property supply and still-strong demand from real estate investors provides a window of opportunity for REO sellers that may start to close once foreclosure moratoriums end and more distressed inventory comes online.

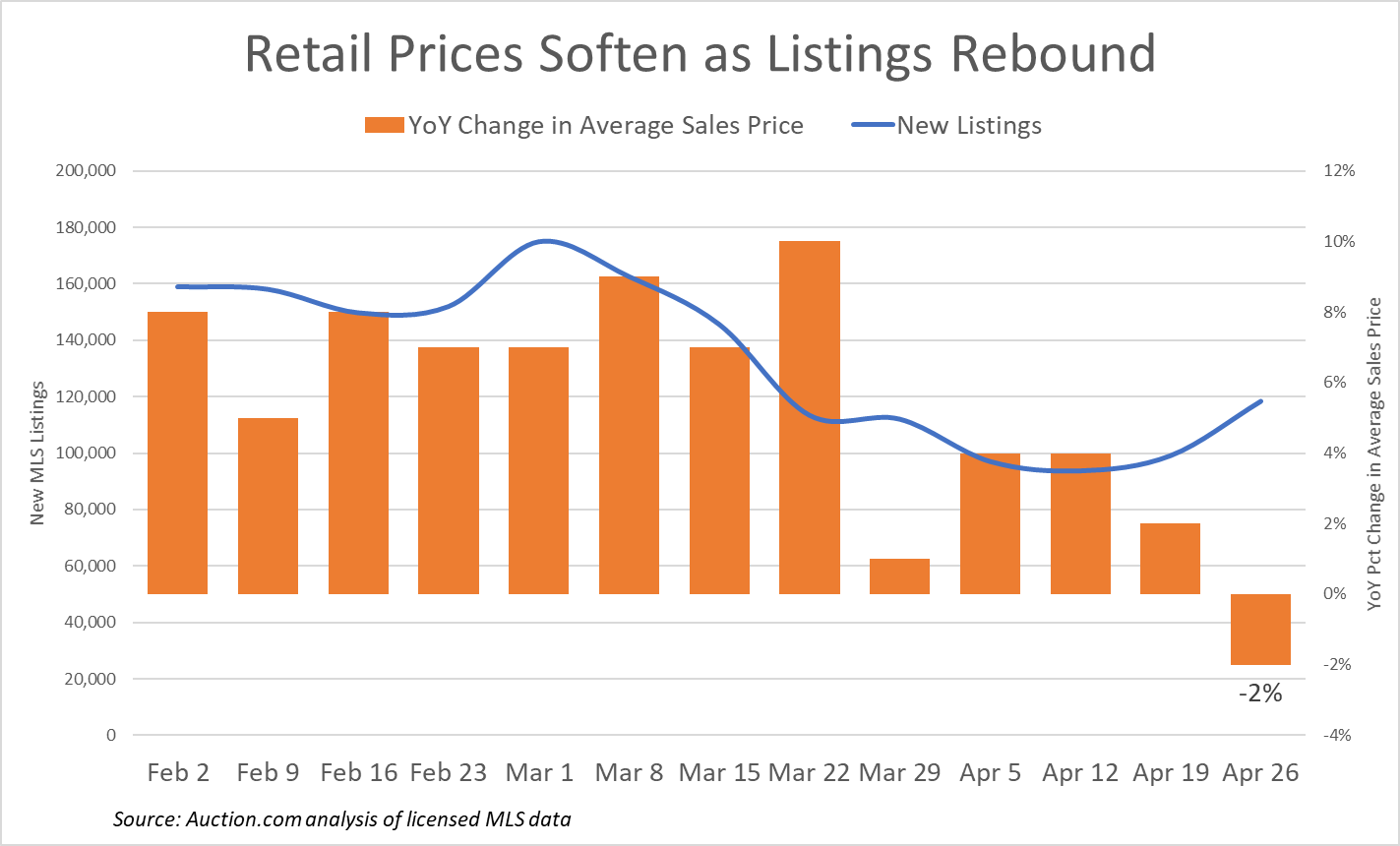

That closing window of opportunity for sellers is already starting to play out in the retail market as listings begin to rebound after a sharp drop-off in late March. In the week beginning on March 22, new listings for sale on the Multiple Listing Service (MLS) dropped 22 percent from the previous week and were down 37 percent from a year ago, according to an Auction.com analysis of data from the MLS.

Drops in for-sale retail inventory accelerated through the week of April 5, when they were down 51 percent, but since then have begun to rebound, rising 19 percent on a week-over-week basis for the week of April 26.

As retail supply has rebounded, home price appreciation has slowed and even went negative for the first time this year in the week of April 26, according to the MLS data analysis. The average sales price for home sold in the week of April 26 was $363,644, down 2 percent from the $371,659 average sales price for homes sold on the retail market in the same week of 2019.