The Pace of Annual Home Price Appreciation Slows End of 2018

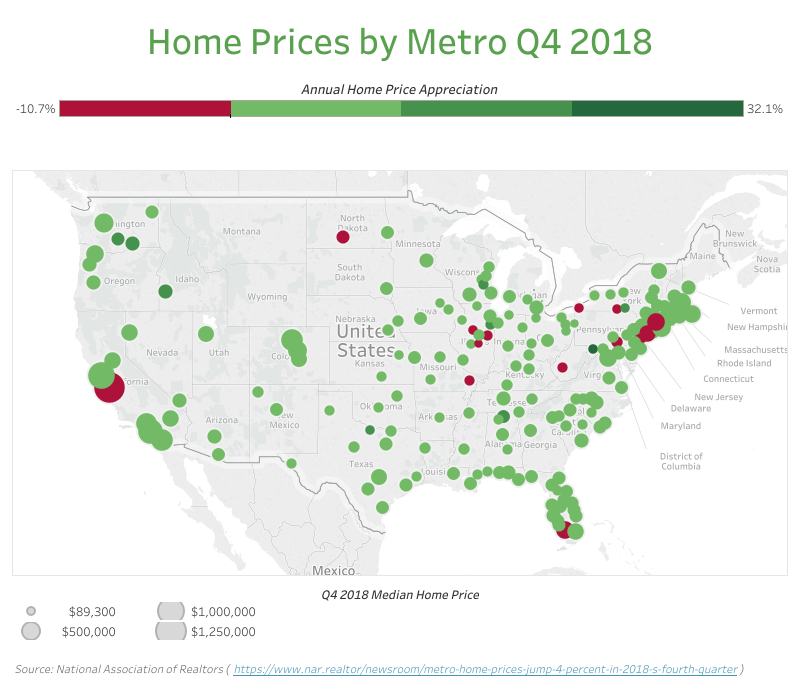

The pace of annual home price appreciation slowed nationwide and in most local markets in the fourth quarter of 2018, but median home prices actually decreased from a year ago in a relatively small minority of markets, according to the most recent quarterly report from the National Association of Realtors.

Median home sale prices decreased from a year ago in 15 of 178 metropolitan statistical areas included in the NAR report (8 percent). That alone is not abnormal — in Q3 2018 median home prices dropped annually in 12 of the 178 metro areas, and in Q4 2017 median home prices dropped annually in 16 of the 178 metro areas.

San Jose Surprise

More surprising was which metro areas were on that list of 15 with declining home prices. Most notable were a handful of the nation’s highest-priced markets, led by San Jose, California, where the median home price of $1,250,000 was highest among the 178 metro areas analyzed in the report, but was down 1.6 percent from a year ago.

Other high-priced markets where median home prices decreased annually in Q4 2018 were Naples, Florida (down 1.3 percent); Bridgeport-Stamford-Norwalk, Connecticut (down 5.3 percent); and New York-Jersey City-White Plains straddling the New York, New Jersey and Pennsylvania tristate area (down 0.4 percent).

Given that San Jose has been one of the bellwether markets leading the housing boom of the last seven years, the decrease there could foreshadow a significant shift in the national housing picture.

Western Market Pullback

NAR chief economist Lawrence Yun noted this shift is most dramatic in western markets.

“The West region, where home prices have nearly doubled in six years, is undergoing the biggest shift with the slowest price gain and large buyer pullback,” he said in a statement released with the fourth quarter report.

Home sales in the West region of the country decreased 13.9 percent in Q4 2018 compared to a year ago, according to the NAR report. That was the biggest decline among the four regions broken out in the report, although all four posted declines.

It’s not a coincidence that home affordability is most challenging in the West region, with the top five markets requiring the highest qualifying income to buy a home located in that region: San Jose, San Francisco, Honolulu, Anaheim and San Diego.

Double-Digit Increases in Affordable Markets

Meanwhile, major markets still posting double-digit annual home price appreciation in Q4 tended to be much more affordable. A prime example was Boise, Idaho, where median home prices increased 14.3 percent from a year ago, the second highest annual appreciation among the 178 metro areas analyzed in the NAR report. Qualifying income needed to buy a median-priced home in Boise was $60,377. Other markets with at least 10 percent annual appreciation in home prices with qualifying income to buy below $70,000 included Huntsville, Alabama, Abilene, Texas, Las Vegas, Nevada, and Omaha, Nebraska.

“Housing affordability will be the key to sustained healthy growth in the housing market in the upcoming years,” Yun said. “That requires more homebuilding of moderately priced homes.”

Ripple Effect on Investor Market

This affordability-driven buyer pullback in the owner-occupant housing market is also rippling out to the investor market.

Investors buying homes on the Auction.com are often rehabbing and reselling those homes to owner-occupant buyers. As those owner-occupant buyers become less willing and able to purchase because of affordability constraints, investors will be extra diligent about landing the best deals to hedge against slowing owner-occupant demand. This adjustment by fix-and-flip investors is evident in the slowdown in home flipping in late 2018.

Another option for investors is to migrate from a fix-and-flip strategy to a buy-and-hold rental strategy. The cash flow rental approach typically pencils out with a higher acquisition cost than the flipping approach, but the pool of properties that make sense as rentals may be more limited given the investor will typically be holding them long-term.