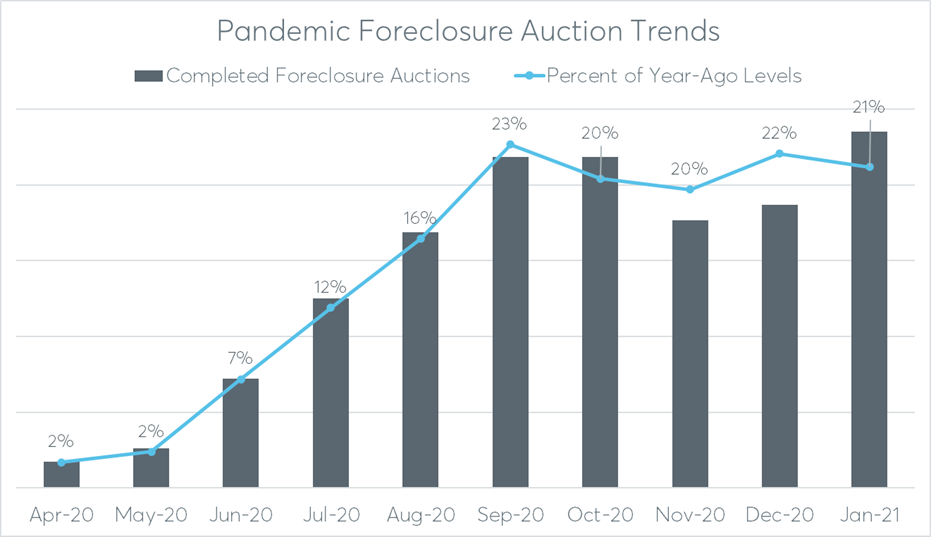

Completed foreclosure auctions increased 26 percent in January to a 10-month high even as foreclosure moratoria on government-backed mortgages were extended.

Nearly all these foreclosures were on vacant or abandoned properties exempt from the moratoria — a good sign for the future health of the housing market.

“Mortgages servicers and neighborhood stabilization advocates agree that keeping these vacant or abandoned properties in foreclosure limbo does more harm than good for neighborhood quality and surrounding home values,” said Ali Haralson, chief business development officer at Auction.com. “Servicers continue to implement processes and procedures that will quickly alert them to when a property in foreclosure becomes vacant or abandoned, and that is helping to stymie any surge in so-called zombie foreclosures.”

It’s also important to note that none of the completed foreclosure auctions in January — or previous months during the pandemic — were on mortgages in active forbearance.

Data from Auction.com shows more January foreclosure auctions increased 26 percent from the previous month to the highest level since March 2020 — although still only 21 percent of year-ago levels given the narrower universe of just vacant or abandoned properties. Auction.com has accounted for more than 45 percent of all U.S. foreclosure auction sales over the past two years, according to an analysis of public record data from ATTOM Data Solutions.

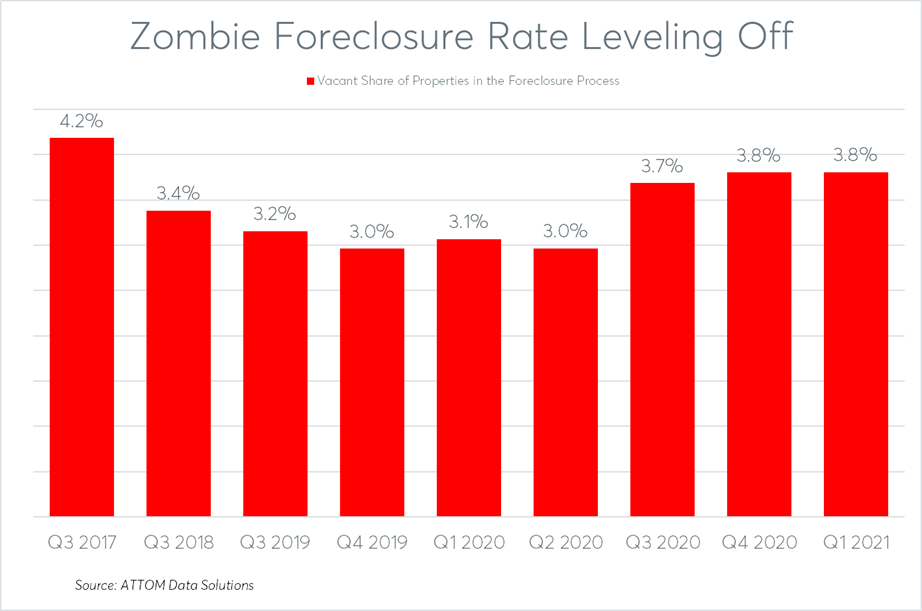

The rise in vacant foreclosure auctions coincides with a leveling off in the vacant “zombie” foreclosure rate, according to a recent report from ATTOM Data Solutions. The report shows the zombie foreclosure rate leveling off in Q4 2020 and Q1 2021 after jumping to a three-year high in Q3 2020 — one quarter after the nationwide foreclosure moratoria were implemented by the CARES Act.

The high share of vacant or abandoned properties at foreclosure auction has likely helped to strengthen demand from real estate investors and other foreclosure auction buyers. Vacant properties are typically more appealing to buyers given they don’t require the eviction of a current occupant. Vacant properties are even more appealing in light of the nationwide eviction moratoria —extended by President Biden via executive order during his first day in office.

Stronger demand for foreclosures is evident in the Auction.com sales rate — the percentage of properties brought to foreclosure auction that sell to third party buyers. That sales rate was 56 percent in January, up from 55 percent in December. The sales rate hit a more than seven-year high of 57 percent in September 2020.

From Vacant to Occupied, Faster

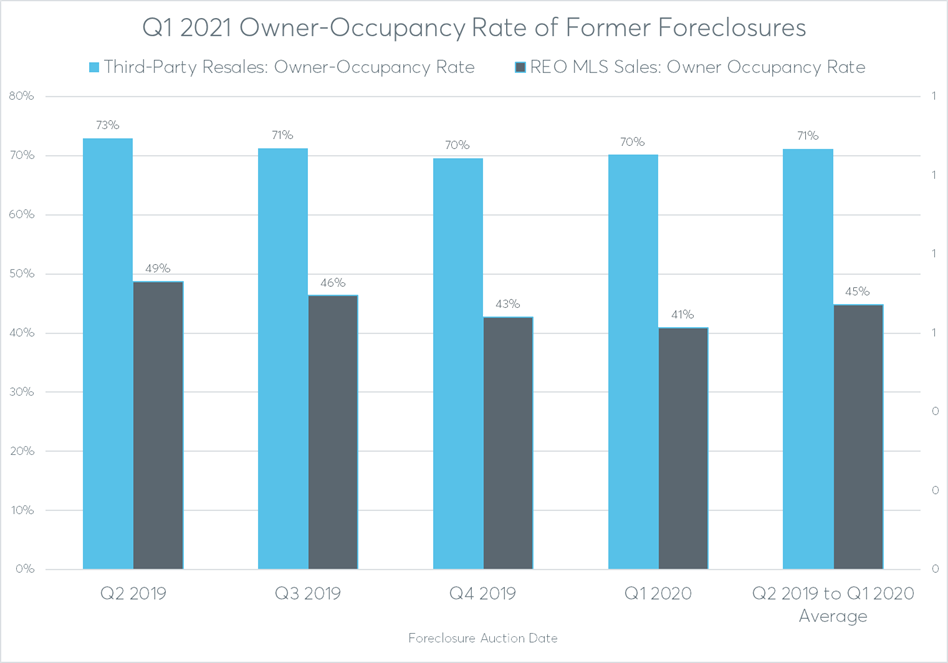

The multi-year high in the foreclosure sales rate also has a broader housing impact: more third-party purchases at foreclosure auction mean more vacant foreclosures will be able to be converted to affordable, owner-occupied homes at a higher rate and in a quicker timeframe.

More than 70 percent of properties subsequently resold after being purchased at foreclosure auction by third-party buyers were owner-occupied as of January 2021, according to an Auction.com analysis of nearly 70,000 properties brought to foreclosure auction in the four quarters ending in Q1 2020. The analysis used public record and MLS data matched against proprietary Auction.com data to track subsequent sales and owner-occupancy status post-foreclosure.

By comparison, only 45 percent of properties that reverted back to the foreclosing lender at the foreclosure auction and then were subsequently resold by the lender on the Multiple Listing Service (MLS) were owner-occupied within a year of the foreclosure auction date.

Healthier Housing Market

All this data leads to a somewhat surprising conclusion: foreclosures completed during the pandemic-induced foreclosure moratoria are likely to be contributing to a healthier housing market. These foreclosures represent a reduction in neighborhood-blighting vacant properties and an infusion of much needed housing inventory — particularly affordable housing inventory. In the case of foreclosures sold to third-party buyers at foreclosure auction, more than 70 percent of that housing inventory is owner-occupied within a year of the foreclosure auction.

As such, foreclosure activity during the pandemic acts as a barometer of local market housing health over the next six to seven months — the average time it takes investors to renovate and return foreclosures back to the retail market.