30 percent of renovated distress in low-income neighborhoods with average resale price under $200,000

Most distressed property buyers are responsibly renovating and returning previously foreclosed homes to the retail market as quality, affordable housing supply — often in low-income and minority neighborhoods.

That’s according to a post-disposition analysis of more than 130,000 homes that were purchased on the Auction.com platform between 2018 and 2020.

Profits and Passion

The investing strategy that leads to these positive neighborhood outcomes isn’t sustainable without consistent profits, but it’s often initiated by buyers with strong emotional ties to the neighborhoods where they invest.

“We’re really proud of our work.” said Will Wenzel, an Auction.com buyer partnering with a long-time friend and an architect to renovate distressed properties in suburban Connecticut communities near where both were raised. “We wanted to see the area do well. We wanted to invest capital back in the area we grew up in and build for the future generation.

“Our investing strategy is finding distressed assets that need renovation because they don’t fit what the modern buyer is looking for. The homes might have a missing bathroom, low ceilings or a funky layout,” Wenzel continued. “We find home in which we can increase the square footage, add a bedroom, add a bathroom. … Buyers appreciate it, too, because they’re not going to have to do any work for the next 10 to 15 years.”

A similar investing strategy is employed by most Auction.com buyers for a wide variety of properties and in a diverse set of neighborhoods — from suburban Connecticut to sub-$150,000 homes for first-time buyers in rural Georgia and urban Dayton, to quality affordable housing that is helping to revitalize underserved neighborhoods in Memphis.

Added Value, Still Affordable

Data backs up these Auction.com buyer stories of adding value while still providing quality, affordable housing.

A post-disposition analysis of homes sold on the Auction.com platform between 2018 and 2020 identified more than 57,000 subsequent sales using public record and Multiple Listing Service (MLS) data.

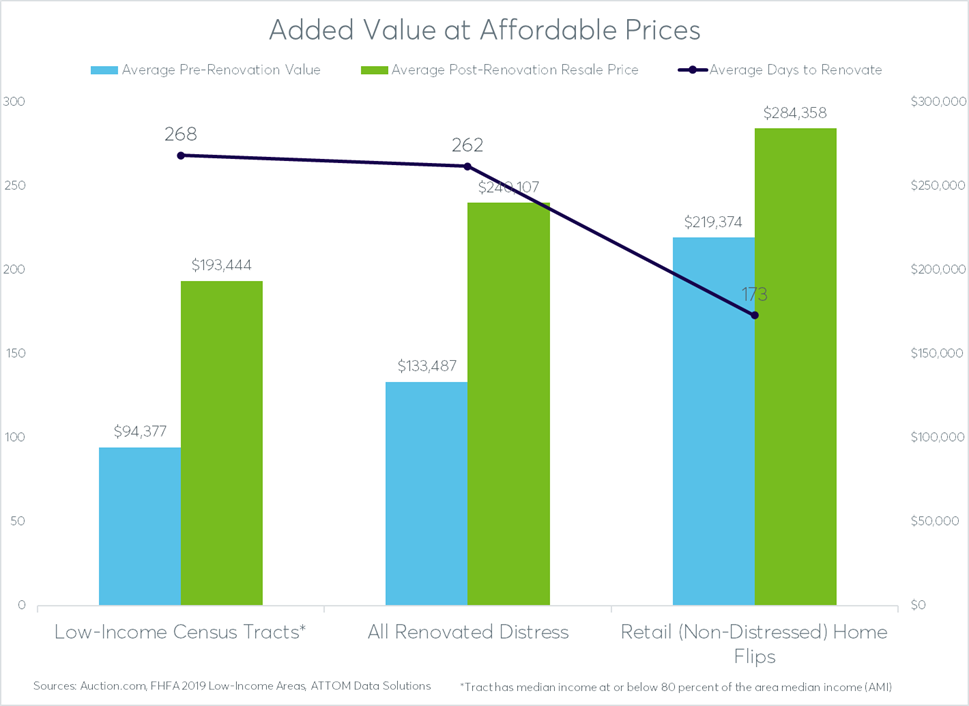

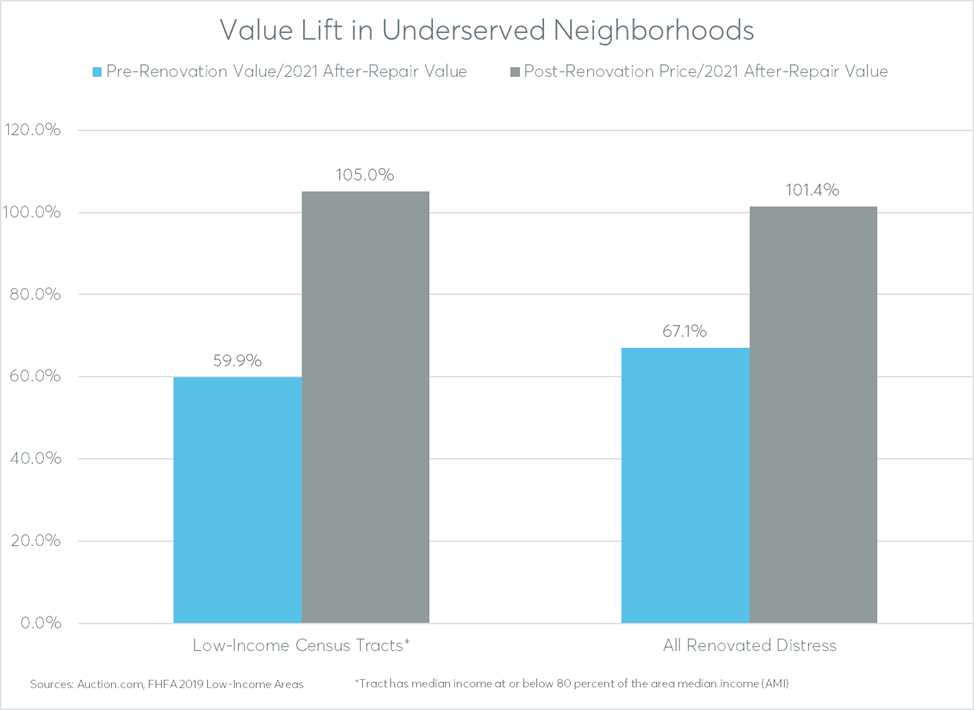

These resales sold for slightly above their 2021 after-repair estimated market value (101 percent). That represented a 34-percentage-point gain in value from their distressed purchase price, which was 67 percent of the 2021 after-repair market value on average. That value gain came over an average of nearly nine months of rehab (262 days).

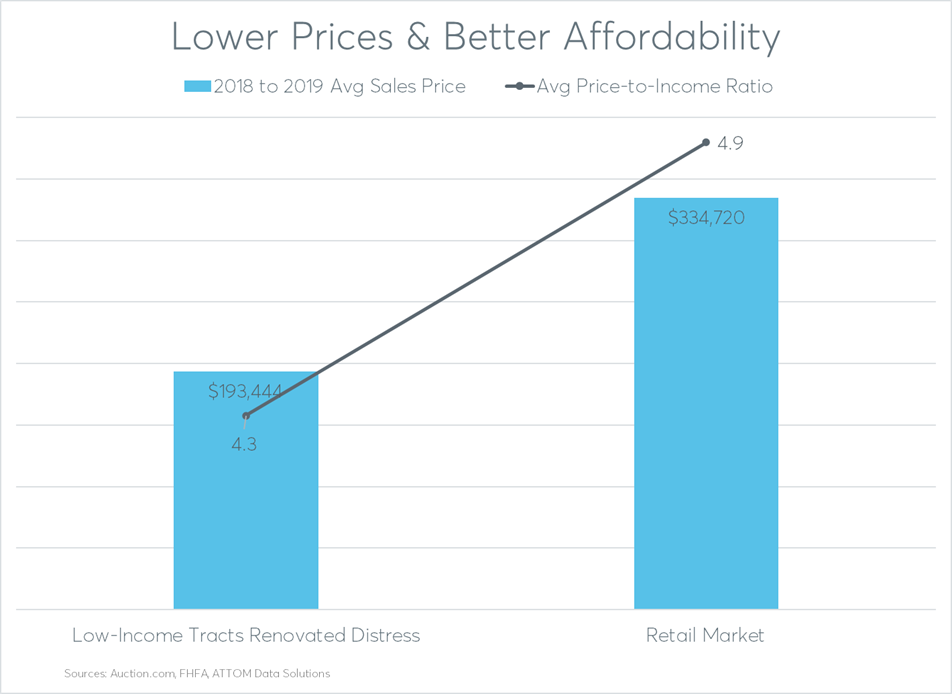

The average resale price for all renovated distress over the past three years was $240,107. That was 16 percent below the average resale price of $284,358 for non-distressed homes that were resold within 12 months after being purchased between 2018 and 2020, according to public record data from ATTOM Data Solutions. It was 28 percent below the average sale price of $334,720 for all U.S. retail home sales during that three-year period.

Affordable for Low-Income Buyers

The average resale price for renovated distress was below $200,000 in low-income neighborhoods, which accounted for 30 percent of all homes renovated and resold after being purchased on the Auction.com platform over the past three years.

Homes in low-income Census tracts — defined as those with a median income that is at or below 80 percent of the surrounding area’s median income — resold for an average $193,444. The low-income designation comes from data on underserved neighborhoods from the Federal Housing Finance Administration.

Renovated homes in low-income neighborhoods resold below $150,000 in more than 65 cities with at least 20 resales in the past three years, including Memphis, Saint Louis, Cincinnati, Birmingham, Detroit and Dayton.

Prices weren’t just lower than the overall market for renovated distress; in many cases they were more affordable for families making the median income in those tracts. Nationwide, the price-to-income ratio for renovated distress in low-income Census tracts was 4.3, using the median income in those tracts. By comparison, the price-to-income ratio for all retail home sales was 4.9, using the median income across all Census tracts.

Nearly 60 percent of all renovated distress in low-income tracts across the country sold below the 4-to-1 price-to-income ratio, an important threshold given that the Neighborhood Homes Tax Credit proposed by President Joe Biden can only be claimed for renovated distress that sells for no more than four times the area’s median income.

Lifting Values in Low-Income Neighborhoods

Distressed property renovators still added value in the low-income neighborhoods, selling at a price point that was 105 percent of the estimated 2021 after-repair market value on average. That represented a 45 percentage-point gain in value from the average 60 percent of after-repair value at purchase.

A similar trend plays out in minority Census tracts — defined as those with a minority population of at least 30 percent and a median income that is less than 100 percent of the area median income. Renovated homes in minority neighborhoods resold for 104 percent of after-repair value, a 42-percentage-point gain in value.

Memphis Microcosm

The 38127 zip code in Memphis serves as a good microcosm for how Auction.com buyers are adding value while providing affordable housing in underserved neighborhoods.

There are eight low-income Census tracts in the zip code with sales on the Auction.com platform over the last three years. All eight of those low-income tracts are also classified as minority Census tracts, according to the FHFA data.

The average median income in those eight low-income tracts is $30,579 compared to an average median income of $61,881 in the greater Memphis metro area. Minorities account for 86 percent of the population in those eight tracts on average.

Auction.com buyers have renovated and resold more than 50 properties in the eight low-income Census tracts in the 38127 zip code over the past three years. Renovations took an average of 299 days, and the average post-renovation resale price was $61,767, up from an average pre-renovation distressed value of $25,771. Despite that impressive increase in value, the renovated homes still sold at an affordable 2.3 times the median income in the surrounding Census tract on average.