The Super Tuesday of Real Estate

In the world of politics, Super Tuesday comes around once every four years and acts as a strong indicator of which way political winds are blowing.

There’s also a Super Tuesday in the world of real estate, specifically foreclosure auctions. This Super Tuesday occurs on the first Tuesday of every month when Texas and Georgia conduct a one-day flurry of foreclosure auctions for all properties in each county. Similar to the Super Tuesday in politics, the foreclosure auction Super Tuesday acts as a strong bellwether for the health of the housing market.

The April 2019 foreclosure auction Super Tuesday metrics indicate that housing market headwinds have subsided, and the market is regaining some of the steam it lost in the latter half of 2018.

Real-Time Super Tuesday Buyer Data

Proprietary data from the Auction.com app’s Foreclosure Interact™ feature — which allows prospective auction buyers to engage with live foreclosure auctions from their mobile devices — provides a first-ever data-based look at real-time buyer behavior on Super Tuesday.

Views on the app’s Foreclosure Interact feature on April’s Super Tuesday (April 2) increased 15 percent nationwide compared to the previous month’s Super Tuesday (March 5), to the highest single-day total since the app was launched in September 2018. Not surprisingly, this trend occurred in states with a Super Tuesday foreclosure auction event: views for users located in Texas increased 15 percent from the previous month while screen views for users located in Georgia increased 26 percent.

Increased Interest Outside Super Tuesday States

More surprising were month-over-month Foreclosure Interact view increases posted in states without a Super Tuesday foreclosure event: New York (up 18 percent); California (up 14 percent); New Jersey (up 29 percent); Florida (up 63 percent); and Tennessee (up 61 percent). These increases may be due to some users crossing state lines to participate in Super Tuesday events — a practice that buyers are more comfortable with thanks to the wealth of information available in advance through the Foreclosure Interact feature as well as the online Auction.com platform.

But the increases in states without a Super Tuesday foreclosure auction also reflect a general increase in interest from prospective buyers. Buyers at foreclosure auction lead the retail market by six to 12 months since the majority of them are rehabbing and then reselling back into the retail market. Increased interest from these buyers should bode well for the overall retail market over the next year.

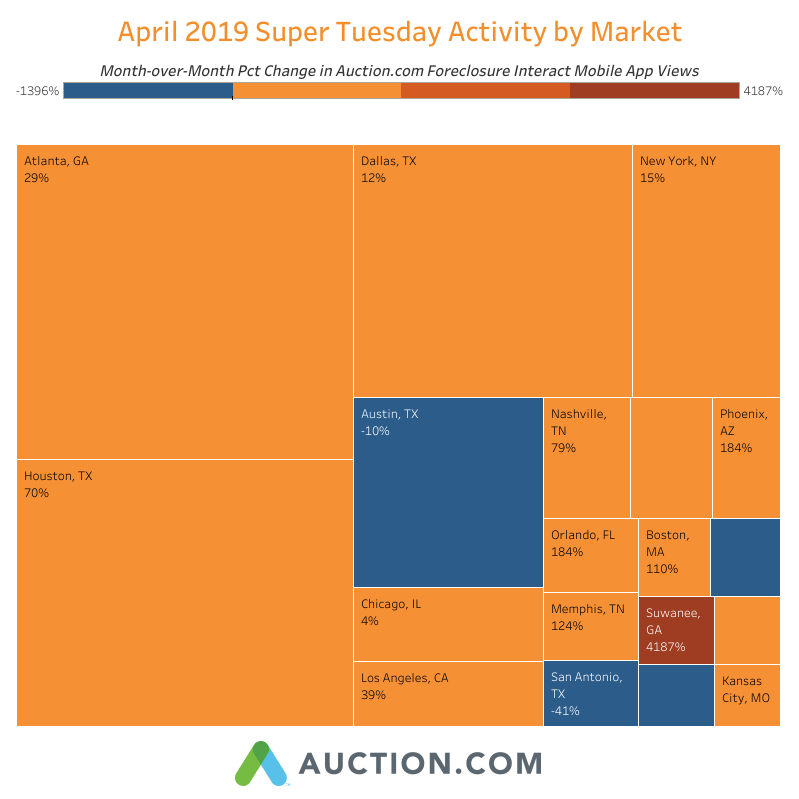

Hottest Super Tuesday Markets

The Foreclosure Interact data can also help identify hot markets where investors are more active. Within the state of Texas, for instance, the biggest increases in April Super Tuesday screen views were in Round Rock (a suburb of Austin), Irving (a suburb of Dallas-Fort Worth), and Cypress (a suburb of Houston). Meanwhile, Super Tuesday screen views were down from the previous month in Fort Worth, San Antonio, Austin and El Paso.

In Georgia, cities with the biggest increases in Super Tuesday screen views were in Gainesville and Suwanee (both northeast of the Atlanta) and Canton (directly north of the Atlanta metro area), while cities with decreases in Super Tuesday screen views included Duluth and Lawrenceville.