Where to find foreclosure auction deals in these tax-incentivized neighborhoods

Opportunity Zones represent a potential win-win-win scenario for real estate investors, low-income neighborhoods and servicers selling distressed properties in those neighborhoods.

“Demand is strengthening for properties located in Opportunity Zones as real estate investors learn more about the tax benefits associated with them — and that should aid in the disposition of distressed assets located in these areas,” said Jason Allnutt, CEO at Auction.com.

Opportunity Zones are a late-blooming outcome from the tax reform legislation passed in December 2017. Early on, many of the headlines relating to the tax reform law focused on the legislation’s potential negative impact on the real estate market resulting from the new limits on the mortgage interest tax deduction and the state and local taxes deduction — including property taxes.

Buzz Building for Opportunity Zones

But more recently the buzz has been building for Opportunity Zones, which allow investors to defer tax on gains from other investments while also avoiding taxes on gains from the investment in the Opportunity Zone — the latter tax benefit contingent on the investment being held for at least 10 years (see the “What Are Opportunity Zones” section below for more details).

“Everybody has been talking about it,” said Bruce Bartlett, managing partner at Sequoia Real Estate Partners and founder of FlipGreat, a company that rehabs fixer-upper properties and splits the increased value with the owner. “I know guys are raising money for it. … the money [to be made for investors] is in finding and packaging deals to sell to the operators who have raised money promising their clients a return.”

It wasn’t just the “if-it-leads-it-bleeds” effect that crowded out the potentially more positive Opportunity Zone topic from the headlines. Many of the details of the program were unclear until the IRS issued its proposed regulations for the tax incentives available under the program in October 2018. Furthermore, because the designation of Opportunity Zones was left up to the states, it took some time for the full list of zones to be announced.

Investor Demand Rising in Opportunity Zones

Now with a list of more than 8,700 Opportunity Zones designated and clearer regulations, investors have begun to act. Sales of development sites located in Opportunity Zones jumped 80 percent in the first three quarters of 2018 compared to the same time period in 2017, according to The Wall Street Journal, citing data from Real Capital Analytics.

An analysis of residential property sales in Opportunity Zones by ATTOM Data Solutions indicates that demand for homes in Opportunity Zones was increasing even before the zones were designated. Home prices for homes located in Opportunity Zones increased 72 percent in the five years ending in 2018, while five-year appreciation for homes located outside of Opportunity Zones was 46 percent during the same period.

Michael Johnston, an investor in New Orleans who runs Rehab2Home Properties, was already investing in lower-income neighborhoods in the city, building new homes or rehabbed “shotgun double” homes. Many of those homes appreciate by more than 20 percent in the year or two after he sells them, and the introduction of Opportunity Zones is shifting his investing strategy.

“Essentially I’m going to be in this area developing lots over the next year and a half … those that are in the blue [Opportunity Zones], I’m going to hold those,” he said, noting that he may also take proceeds from homes sold outside of Opportunity Zones and roll those into Opportunity Zone investments. “It’s not just about what money you can make today, it’s about how much you can keep.”

For Johnston, the Opportunity Zone investment hits close to home given that he grew up in the lower-income areas he is now investing in.

“I used to ride my bicycle through the neighborhood,” he said. “If I build enough homes in these areas, and other people join in, what could happen in 10 years? We’ll see.”

Auction.com Deals in Opportunity Zones

Even with stronger price appreciation over the past five years, Opportunity Zones are still sources for lower-priced housing inventory. According to the ATTOM analysis, the average sales price for homes in Opportunity Zones that sold in 2018 was $163,746, 43 percent below the average price of $287,150 for homes sold outside of Opportunity Zones.

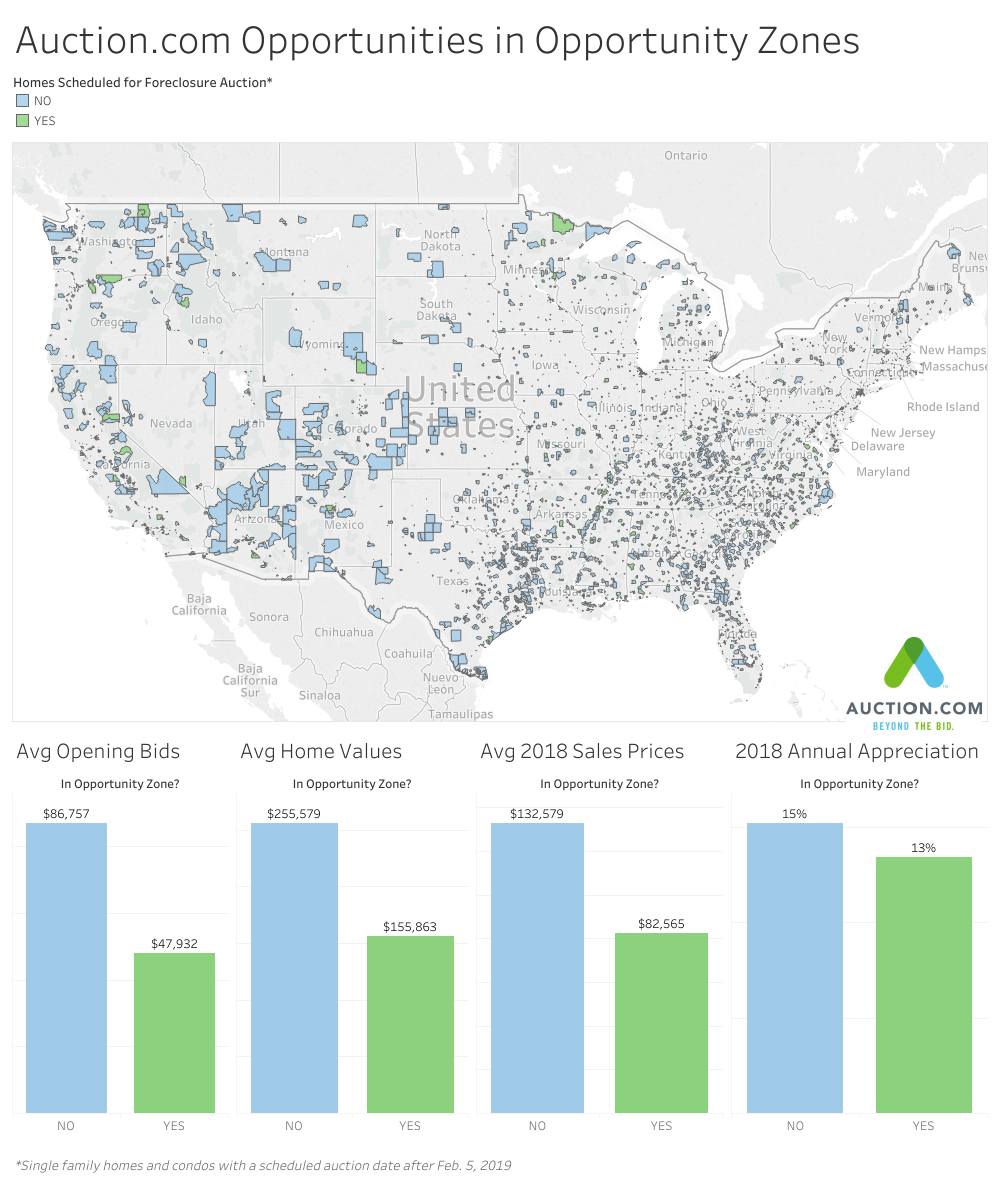

A similar trend plays out for homes listed on the Auction.com platform: the average sales price for homes located in Opportunity Zones that sold in 2018 was $82,565, 38 percent below the average sales price of $132,579 for homes not located in Opportunity Zones.

Average home prices increased 13 percent for homes in Opportunity Zones that sold via the Auction.com platform in 2018 — more than twice the home price appreciation of 5.5 percent for all U.S. homes sold during the year, according to ATTOM. That was still slightly below the annual appreciation of 15 percent for homes located outside of Opportunity Zones sold via the Auction.com platform in 2018, indicating there is strong demand for foreclosures and bank-owned properties — even without the tax incentives.

Single family homes and condos in Opportunity Zones that were scheduled for a future auction on the Auction.com platform as of Feb. 5, 2019 had an average opening bid of $47,932, 44 percent below the average opening bid of $86,757 for homes located outside of Opportunity Zones. The average estimated value of those Opportunity Zone homes scheduled for future auction was $155,863, 39 percent below the average estimated value of homes not located in Opportunity Zones.

What are Opportunity Zones?

Opportunity Zones are geographic areas — specifically Census Tracts — designated for special tax incentives designed to encourage investment in those areas, which tend to be lower-income, distressed communities.

The Opportunity Zone concept was introduced in the 2017 Tax and Jobs Act signed into law by President Trump on Dec. 22, 2017, but it was left up to the states to delegate Census Tracts as Opportunity Zones and the Internal Revenue Service to issue more specific proposed regulations on the tax impacts.

States had successfully nominated 8,761 Census Tracts as Opportunity Zones in June 2018, and in October 2018 the IRS issued the proposed regulations, giving prospective investors more clarity on the tax incentives available and how to take advantage of those incentives:

- Investments in Opportunity Zones must be made through a Qualified Opportunity Fund (QOF)

- The QOF must hold at least 90 percent of its assets in Opportunity Zones

- Taxes are deferred on almost all capital gains invested in a (QOF)

- There is a 10 percent exclusion of the deferred gain if the QOF investment is held for longer than five years

- There is a 15 percent exclusion of the deferred gain if the QOF investment is held for longer than seven years

- If the QOF investment is held for at least 10 years, the investor can qualify for an increase in basis of the investment equal to its fair market value when it is sold or exchanged.