The Development of Opportunity Zones in New Orleans

New Orleans real estate investor Michael Johnston is focused on preserving as much of his investing profits as possible.

“It’s not just about what money you can make today, it’s about how much you can keep,” said Johnston, who runs Rehab2Home Properties and got his start in real estate rehabbing flood-damaged homes in the wake of Hurricane Katrina.

When Johnston learned that some of the New Orleans neighborhoods where he already invests are located in recently designated Opportunity Zones, he quickly moved to add this new tax-mitigating program to his repertoire as another avenue for preserving profits.

“Between 1031s, Opportunity Zone developments and things of the sort, I’m looking to build a portfolio and minimize taxes,” he said, noting that he grew up in and around the low-income Census Tracts that are now the focus of the Opportunity Zone program. “I used to ride my bicycle through the neighborhood.”

The Evolution of Opportunity Zones

Designed to fuel investment in “economically-distressed” communities, Opportunity Zones were created as part of the tax reform legislation that was signed into law by President Donald Trump in December 2017. But it has taken more than a year for the details of the program to be hashed out.

The details of the program have become more clear through a series of regulations and clarifications issued by the Internal Revenue Service — the most recent announced in an April 17 news conference attended by President Trump, Secretary of Housing and Urban Development Ben Carson and Treasury Secretary Steven Mnuchin.

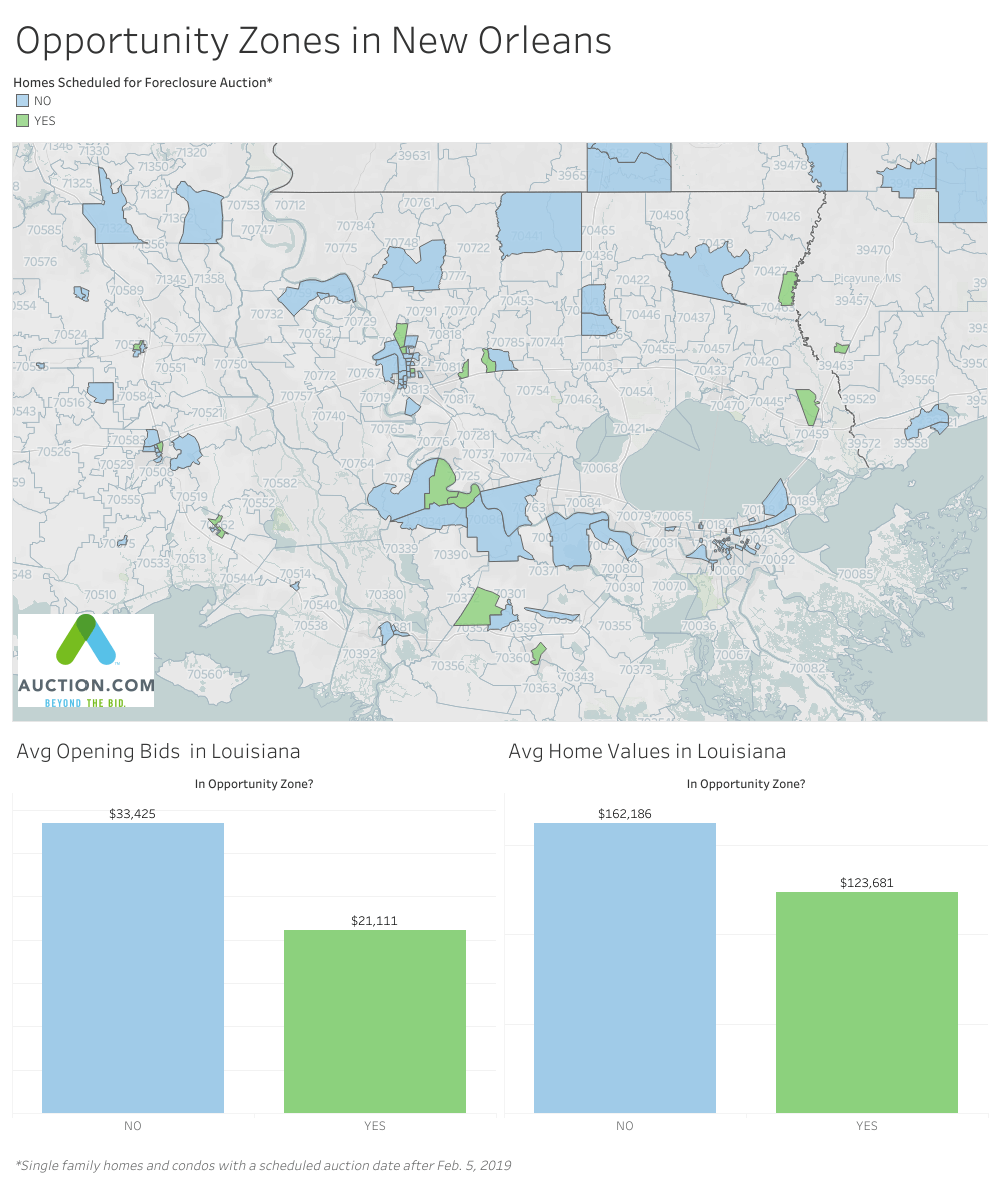

Essentially Opportunity Zones allow investors to defer tax on gains from other investments while also avoiding taxes on gains from the investment in the Opportunity Zone — the latter tax benefit contingent on the investment being held for at least 10 years. More than 8,700 Opportunity Zones have now been designated nationwide — 40 of which are in the greater New Orleans metro area, according to an Auction.com analysis of foreclosure and REO auction properties available in Opportunity Zones.

“If you’re willing to buy a property and hold it for 10 years or more, then the capital gains tax you would pay on a sale would actually disappear,” said Johnston, adding that he believes the neighborhoods he’s investing in could see more rapid appreciation over the next decade as a result of being designated as Opportunity Zones. “If I build enough homes in these areas, and other people join in, what could happen in 10 years? We’ll see.”

Investment Strategy Icing on the Cake

Johnston primarily focuses on two investment strategies in New Orleans: building new homes on vacant lots; and rehabbing so-called “shotgun doubles”. Opportunity Zones provides an icing on the cake for both of those strategies.

In the neighborhoods where he is investing, Johnston said he typically can build a new home for an all-in cost of $165,000, including acquisition and construction. In the past, he’s been able to immediately sell those homes for $200,000 or more, which he will continue to do for properties outside of Opportunity Zones. New home builds in Opportunity Zones Johnston plans to keep as cash-flowing rentals for at least 10 years, and he expects to be able to sell them for well north of $300,000. The tax breaks in the Opportunity Zone program will eliminate the capital gains taxes he would otherwise pay on the sale 10-plus years down the road.

“It becomes almost like an annuity,” he said. “If you’re willing to buy a property and hold it for 10 years or more, then the capital gains tax you would pay on a sale (will) actually disappear.”

Johnston will be employing a similar strategy for his rehabbed shotgun doubles — two family properties that typically have a bigger unit for the owner-occupant and a smaller second unit that can be used as a rental, an in-law unit or for a home-based business. Johnston will continue to resell rehabbed shotgun doubles outside Opportunity Zones while holding those inside Opportunity Zones as rentals.

“Because of that Opportunity Zone, it changed my strategy,” he said, referring to a recent shotgun rehab double that he decided to hold rather than resell when he found out it is located in an Opportunity Zone. “Essentially I’m going to be in this area developing lots over the next year and a half … these that are in the (Opportunity Zones), I’m going to hold those.”