Opportunity Zones Case Study: Bringing Historic Buildings Back to Life

U.S. Army veteran Matthew Masiel has a clear mission for real estate development.

“Most of my real estate development, I focus on rehabbing historic buildings,” said Masiel, who served in the 101st Airborne from 2001 to 2005. “We enjoy bringing old buildings back to life.”

Masiel said that his company, founded in 2016 and aptly named Screaming Eagle Development, has about $60 million in its development pipeline, including three projects in his native St. Louis. Given its focus on historic buildings that tend to be in low-income communities, the company often leverages government tax credits. Those tax credits are an area of specialty for Masiel, who previously managed new markets and historic tax credit development for U.S. Bank.

Given his deep experience with tax-incentivized real estate development, Masiel became an early adopter of the Opportunity Zones program created with the passage of the Tax Cuts and Jobs Act legislation in December 2017.

Opportunity Zone Early Adopter

“I actually closed a deal utilizing Opportunity Zones back in July (2018) just based on the knowledge we had,” he said, explaining that it has taken time for the specifics of the Opportunity Zones program to be fleshed out. “There is a lot of money sitting on the sidelines waiting for the rules to come out to make sure.”

The details of the program have gradually become more clear through a series of regulations and clarifications issued by the Internal Revenue Service — the most recent announced in an April 17 news conference attended by President Trump, Secretary of Housing and Urban Development Ben Carson and Treasury Secretary Steven Mnuchin. (The interviews and research included in this article were conducted before these latest guidelines were announced.)

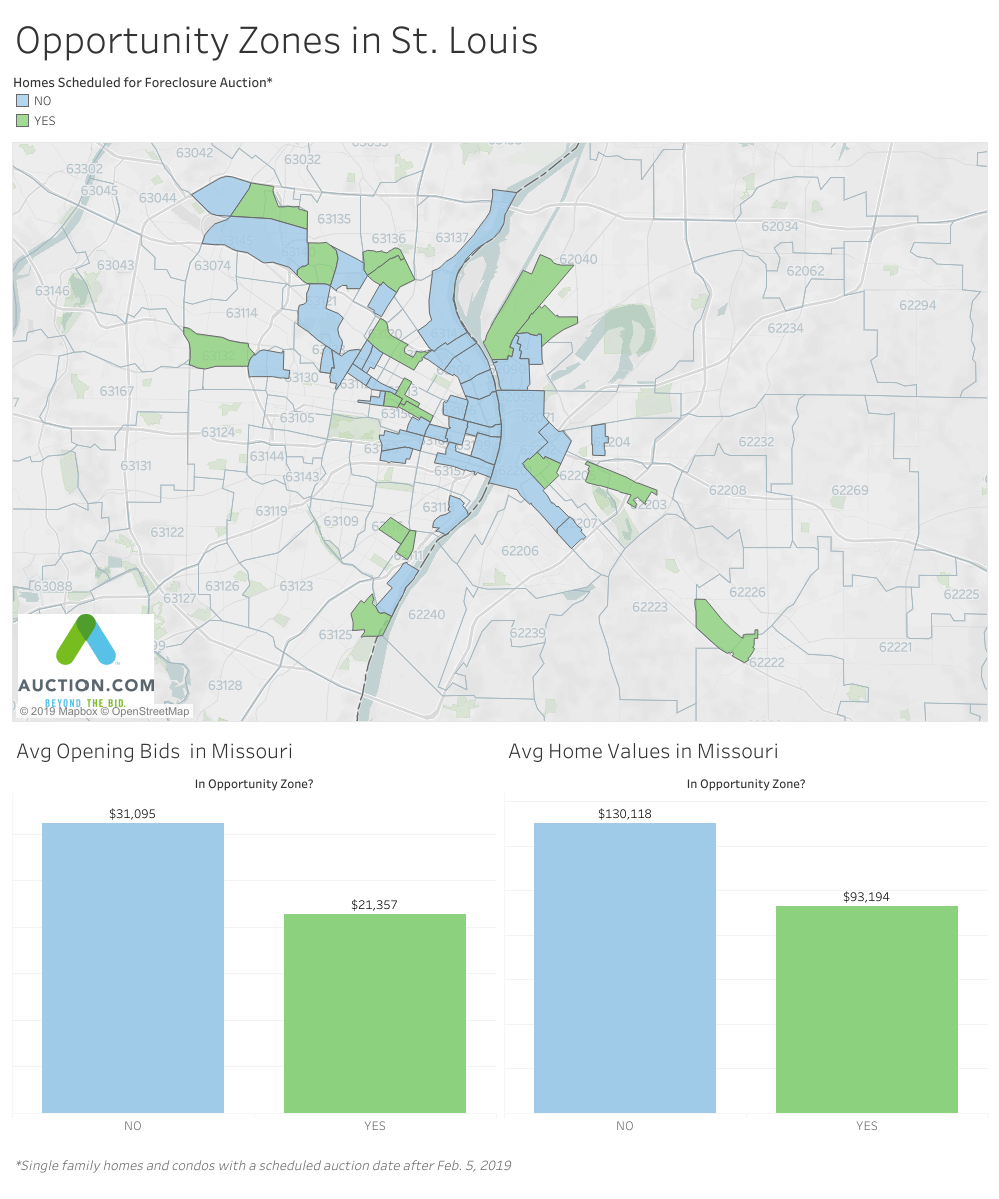

At its core, the Opportunity Zone program allows real estate developers like Masiel to defer tax on gains from other investments while also avoiding taxes on gains from the investment in the Opportunity Zone — the latter tax benefit contingent on the investment being held for at least 10 years. More than 8,700 Opportunity Zones have now been designated nationwide — 41 of which are in St. Louis City or St. Louis County, according to an Auction.com analysis.

“We have two deals in St. Louis that are in Opportunity Zones,” said Masiel, adding that the presence of an Opportunity Zone provides another avenue for raising capital. “If we have to go to the secondary market to raise equity, it would definitely be part of the marketing package I would put out, is that you would receive favorable tax treatment.”

Targeting Growth & Opportunity

The Opportunity Zone angle helped attract Jamie Moyle to participate with Masiel and other investors in a mammoth project to redevelop the 80-year-old St. Louis Armory. Originally built for the 138th Infantry Regiment of the Missouri National Guard, the 264,000-square foot building had fallen into disrepair in recent years.

“Part of the appeal of Opportunity Zones for us is there are a lot of cool buildings that just don’t exist now that just need some love,” said Moyle, whose company, Lazlo Group, provides data-driven research and invests in real estate projects across the country. “You look at a building, that’s awesome. What’s in it? Nothing. Let’s turn it into something.”

Moyle said his company shifted its real estate investing strategy when the Opportunity Zone program was unveiled.

“We’ve actually been choosing our markets based on this,” he said. “We’re looking at areas where the right segment of the population, the younger folks, are moving to. … We’re showing growth, and overlaying Opportunity Zones on top of that.”

Playing One-Handed

This type of analysis led Moyle to the Armory project in St. Louis, which he noted pencils as a profitable project even without the extra tax benefits that come with being in an Opportunity Zone. That’s important given the details of Opportunity Zones are still being hashed out and there aren’t really any true experts in the space yet.

“The fact that I get calls, five or 10 a day, where I am considered an expert on Opportunity Zones, demonstrates that there is a lack of information out there,” said Moyle, noting that the program’s tax incentives are already restricted by some hard-and-fast guardrails. “You have to do substantial improvement (which) hasn’t been a factor for us because we’re buying the land for a nickel and we’re going to spend a fortune.”

Some of the timelines associated with Opportunity Zone investments are confusing at best and overly constraining at worst, according to Masiel.

“You have 180 days from when you realize your capital gains to invest in an Opportunity Zones. … People are trying to figure out how to extend that time,” he said, adding that the rules also indicate that investments will need to be made by the end of 2019 to take full advantage of some of the tax incentives. “It seems like you have to invest in the Opportunity Zones by the end of 2019 to take full advantage of the increase in basis.

“The rules not being set is the biggest challenge right now,” Masiel added. “You’re playing one-handed a little bit because you don’t know what all the rules are going to be.”

Another Tool in the Toolbox

Masiel sees enough potential in the Opportunity Zone program to leverage it for projects, but he’s not relying on it as the sole rationale for any of his development deals.

“It doesn’t create deals on nothing, but it will definitely help deals that were on the border or help deals that were average be better,” he said. “For me personally we were already looking at projects in those areas and now it’s just another tool in the toolbox.”

Although Masiel is taking advantage of the Opportunity Zone program for larger, commercial real estate developments, he believes it will benefit smaller, residential real estate investors also.

“If you’re a rehab investor, you should be using this all day long. It’s a similar concept, just on a smaller scale,” he said.