Online Auctions Attracting New Highs in Page Views, Bidding Wars

Even as the coronavirus crisis forces the retail housing industry to curb much of the in-person interaction involved in the traditional tactics used to sell a home, interest in online auctions that require little or no in-person interaction has been rising, according to proprietary data from the Auction.com platform.

A growing number of Multiple Listing Services and real estate brokerages are cancelling all open houses while placing common-sense limits on property showings, appraisals and closing appointments, all of which typically require some degree of person-to-person interaction.

These preventative measures will likely throw a wet blanket on retail home sales and price appreciation in the coming months, depending on how extreme, widespread and lengthy those measures turn out to be.

From In-Person to Online

It’s not just the retail housing industry impacted by the risk of in-person interactions in light of the coronavirus. The combination of nationwide foreclosure moratoriums and local courthouse closings are temporarily cutting off distressed inventory available to real estate investors at foreclosure auctions – which are inherently in-person events that typically draw dozens if not hundreds of people, depending on the day and the county.

Denver-based real estate investor Bijan Green said he already obtains most of his investment property inventory from online auctions of bank-owned (REO) homes given the convenience of buying remotely in whichever markets have inventory matching his investing criteria.

“REO auctions represent 95 percent of my business just because of the efficiency of always having inventory,” said Green, adding he targets three-bedroom, two-bathroom homes that he can purchase for $80,000 to $100,000 and rent for $900 to $1200 a month after rehab.

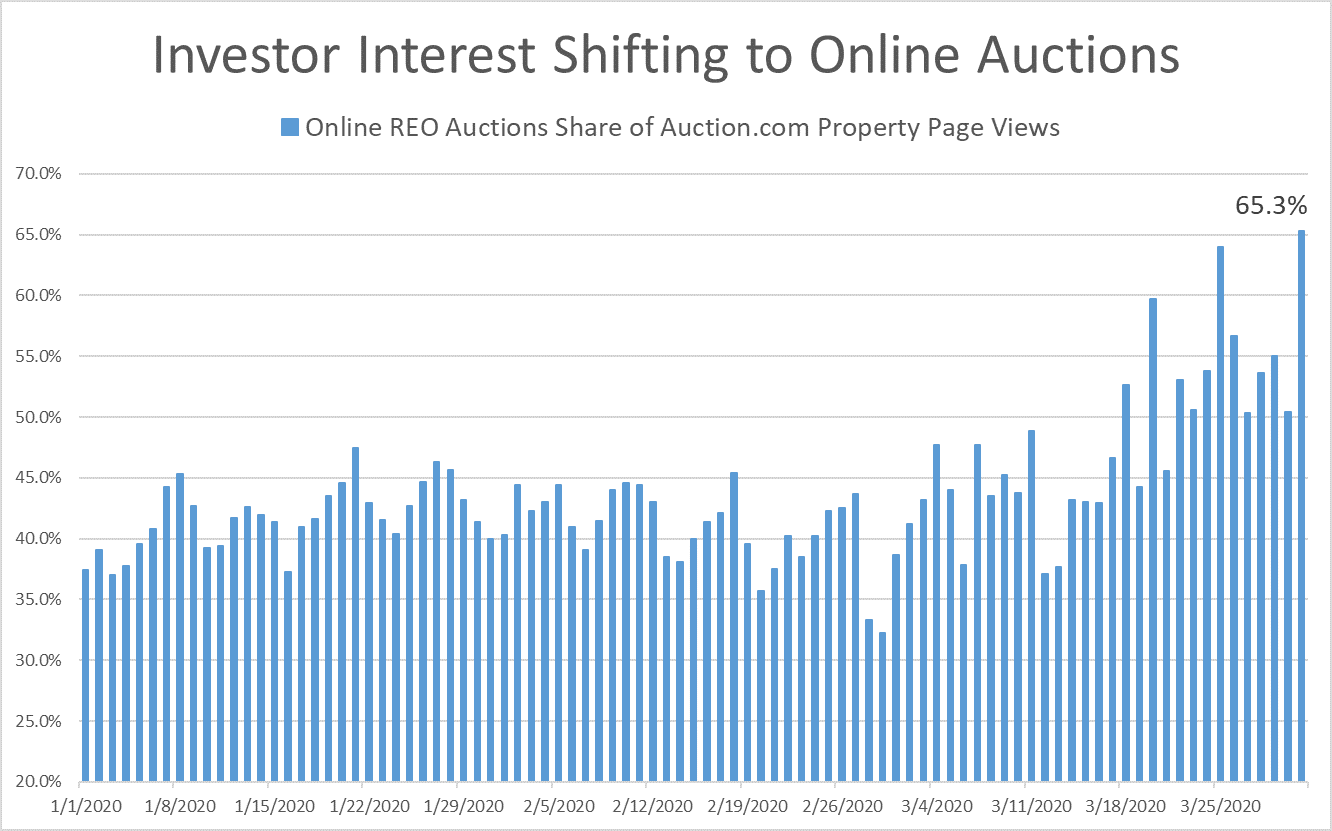

Recent website traffic data from Auction.com indicates that more investors are following Green’s lead and turning to the efficiency and convenience of online REO auctions as home sales involving in-person interaction become less available.

Properties available for online auction accounted for more than 50 percent of individual property page views on the Auction.com website on March 18 – the first day this year that online REO auction properties have accounted for more than half of all property page views. The share of page views for online REO auctions has continued to trend higher since then, hitting a new high of 65 percent on March 31.

Historically, in-person foreclosure auction properties accounted for more than half of all property page views on Auction.com, but the recent change indicates buyers are shifting their focus from those in- person auctions to online auctions.

More Bidding Wars

Online REO auctions aren’t just attracting more interest from prospective buyers in the form of website traffic, they’re also attracting more competing bidders. More than 89 percent of online REO auction properties sold so far in the first quarter of 2020 have attracted multiple competing bidders, up from 85 percent in the previous quarter and up from 86 percent in the first quarter of 2019 to the highest level as far back as data was available, Q3 2017.

Additionally, online REO auction properties sold so far in Q1 2020 on the Auction.com platform have seen an average of 4.2 unique bidders per property and an average of 15.5 bids per property – with both of those metrics up from the previous quarter and a year ago.

In 34 of 81 metro areas analyzed in the Auction.com data, 100 percent of online REO auction properties sold in Q1 2020 attracted multiple bidders, including Houston, Washington, D.C., Columbus, Ohio, Orlando, and Virginia Beach. Even in somewhat less competitive markets like Duluth, Kalamazoo, and Scranton, at least 60 percent of all online REO auction properties sold so far in Q1 2020 attracted multiple, competing bidders.

Green, the Denver-based real estate investor, said he purchased 25 properties in 2019 and is gearing up to buy more in 2020, even given the recent market volatility.

“I’ve been preparing for that,” he said, noting he has cash on hand to buy more properties. “Veteran real estate investors who were caught in the last economic downturn are waiting around to see ‘When can I buy again?’. Some of the guys that have been in the game for 30 to 40 years have been sitting on the sidelines, waiting for this particular scenario in the market to buy again.”