Housing Affordability Returned to Historically Normal Levels by the End of the First Quarter of 2019

Housing affordability returned to historically normal levels by the end of the first quarter of 2019 after three consecutive quarters where homes were less affordable than historic averages, according to a recent report from ATTOM Data Solutions.

The report noted that an average wage earner buying a median-priced home nationwide in the first quarter would need to spend 32.7 percent of his or her income on monthly house payments — including property taxes and insurance. That percentage is exactly on par with the long-term historic average, and down from the previous three quarters where average wage earners would need to spend close to 35 percent of income to buy.

Boosted Auction Buyer Confidence

Better affordability in the retail market could boost confidence among buyers of foreclosure auction and bank-owned (REO) auction properties. Many of these auction buyers will resell back into the retail market in a relatively short time frame, which means home affordability can impact the scope of demand for their rehabbed retail product.

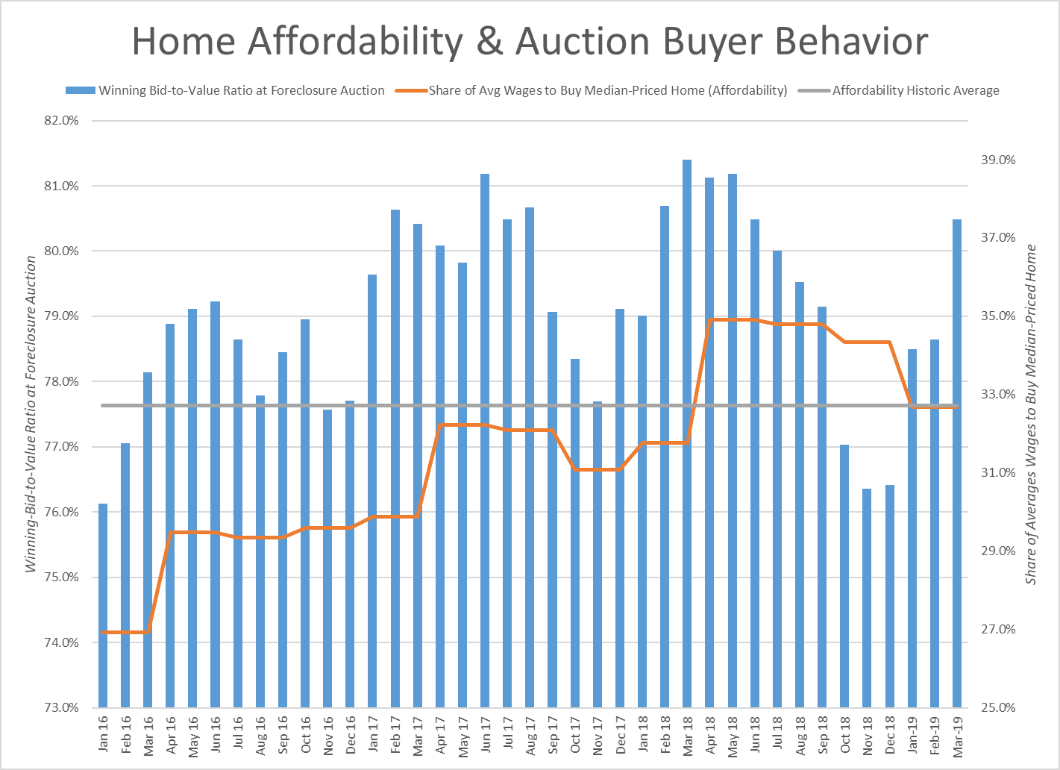

Improving confidence among foreclosure auction buyers is already evident in proprietary data from Auction.com, which is involved in selling close to 50 percent of all properties sold at foreclosure auction nationwide. Winning bidders at foreclosure auctions in March paid an average of 80.5 percent of the full “after-repair” market value of the homes purchased. While that’s still a good deal for those buyers, it’s the highest average price-to-value ratio since May 2018, indicating strengthening demand from these buyers. Not coincidentally, May 2018 was also right about when home affordability levels dropped below historic norms for the first time in more than nine years, pumping the brakes on the retail housing market.

Stronger Wage Growth, Slowing Price Appreciation

Stronger wage growth and slowing home price appreciation both pulled in the same direction of better affordability in the first quarter. The latter two trends come as a welcome relief to a market plagued by chronic weak wage growth that has consistently been outpaced by home price appreciation over the past seven years of the housing recovery.

According to ATTOM, since bottoming out in the first quarter of 2012, median home prices have increased 66 percent while average weekly wages have risen just 7 percent during the same time. That pattern changed in the third quarter of 2018, when average weekly wages tracked by the Bureau of Labor Statistics increased 3.6 percent annually — the biggest increase in seven years.

Meanwhile, annual home price appreciation tracked by ATTOM in the third quarter of 2018 was at 4.3 percent, dropping to 3.5 percent in the fourth quarter before rising again to 4.2 percent in Q1 2019.

Mortgage Rates Icing on the Affordability Cake

The important icing on the sweet affordability cake was falling mortgage rates. The average 30-year fixed rate mortgage dropped to 4.27 percent in March, according to Freddie Mac. That was down on a monthly basis for the fourth consecutive month and down on a year-over-year basis for the first time after 13 consecutive months with a year-over-year increase.

Given recent signals from the Federal Reserve Board that it may not raise interest rates again this year, real estate investors and other foreclosure auction buyers are calculating that the downward trend in mortgage rates will continue, improving affordability even more later in the year and thereby expanding the pool of retail buyers for their rehabbed product.

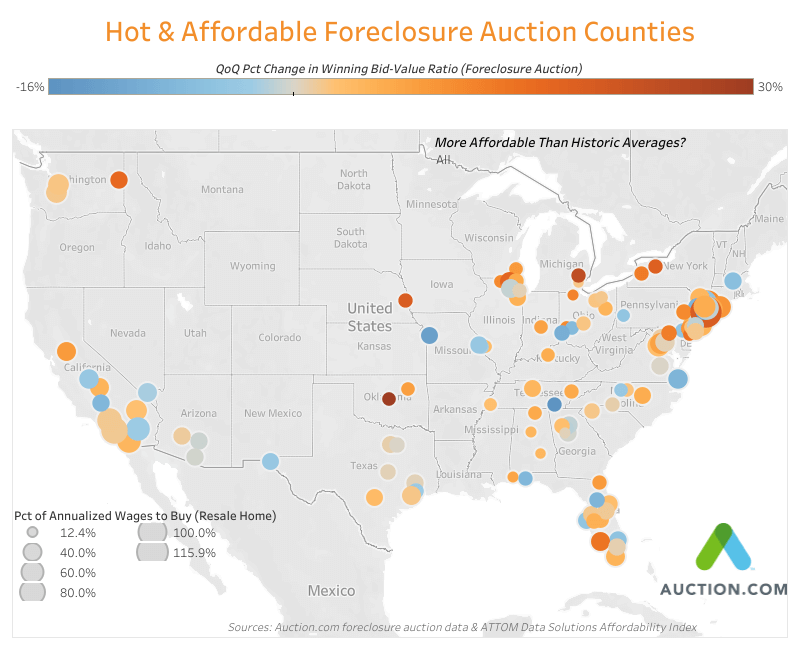

Foreclosure auction buyers may continue to tread cautiously in the markets where dropping mortgage rates are not enough to tip the affordability scales in their favor. While affordability improved in the nearly two-thirds of the local markets analyzed by ATTOM — 308 of the 473 counties included in the report — affordability actually worsened in one-third of local markets.

Markets where affordability worsened in the first quarter and was still below historically normal levels included Orange County, California, Kings County (Brooklyn) New York, Dallas County, Texas, King County (Seattle), Washington, and Alameda County, California in the San Francisco metro area.

Conversely, markets where affordability improved in the first quarter and was better than historically normal levels included Cook County (Chicago), Illinois, Miami-Dade County, Florida, Santa Clara County (San Jose), California; Middlesex County (Boston), Massachusetts, and Allegheny County (Pittsburg), Pennsylvania.