One distressed homeowner and her lender thought her home was underwater. She walked away with $40,000 in equity after a pre-foreclosure auction sparked a flurry of competing bids.

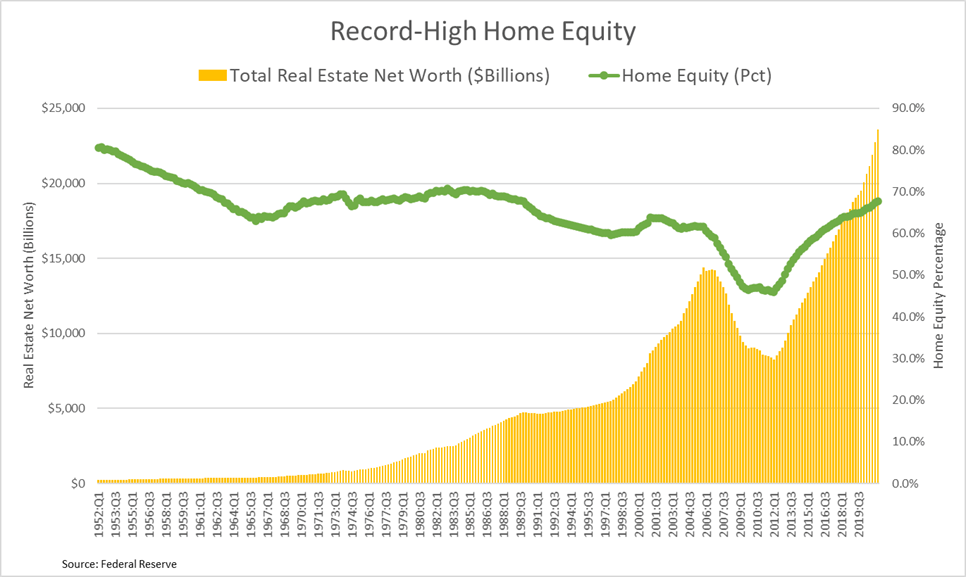

Nearly a decade of positive home price appreciation accelerated by a pandemic-triggered homebuying frenzy over the past 18 months means homeowners have more equity than ever before.

Data from the Federal Reserve shows household net worth increased to a new record high of $142 trillion in the second quarter of 2021. Nearly $24 trillion of that came from real estate net worth — the value of real estate assets minus real estate liabilities (mortgages). Real estate net worth was also at a record high, up $879 billion from the previous quarter and up $2.9 trillion from a year ago.

Uncovering Hidden Home Equity

The surging equity trend extends to homeowners in financial distress and behind on their mortgage payments. But many distressed homeowners — and in some cases even their lenders — may not realize that rapid home price appreciation over the past two years has resulted in a previously underwater home now having equity.

In these hidden equity cases, a competitive and transparent pre-foreclosure auction marketplace will not only uncover any equity by gaining the highest and best offer for the home, it also will help homeowners avoid foreclosure and the damaging credit hit that comes with it.

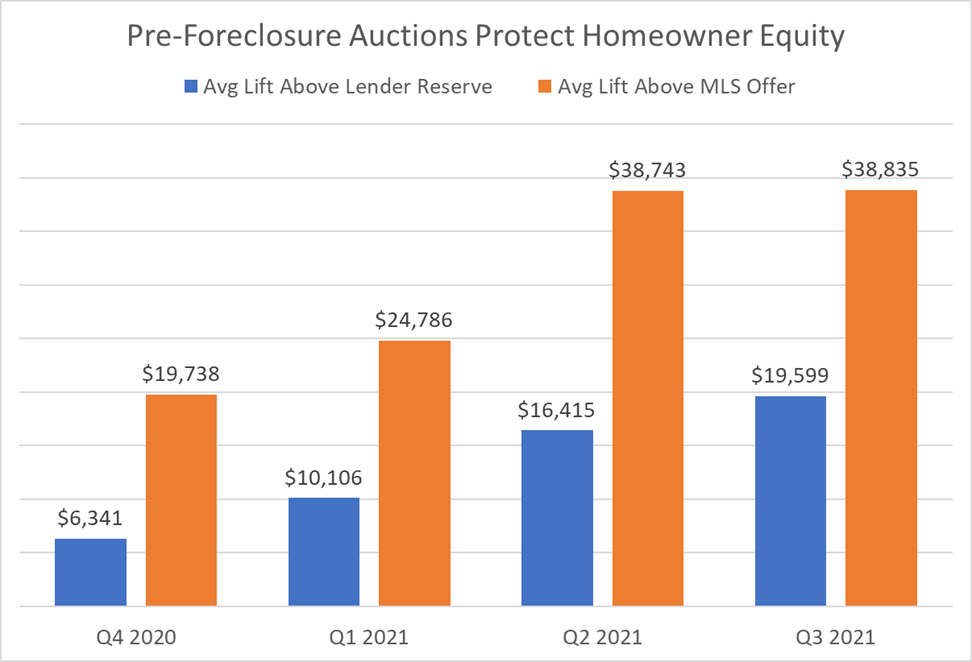

The benefits of a robust pre-foreclosure auction marketplace — when combined with the power of the traditional, multiple listing service (MLS) marketplace — can be seen in early results from a pilot pre-foreclosure sale program launched by Auction.com in 2020. This market validation program (MVP) allows distressed homeowners, in coordination with their lender, to place properties up for auction on Auction.com — often while concurrently listing them on the MLS.

To date, nearly half of pre-foreclosure properties offered through MVP have received a winning bid on Auction.com that was higher than the highest offer received through the MLS. Of these, the winning bid is an average of 19 percent higher — or nearly $35,000 higher — than the offer received on the MLS.

Additionally, 82 percent of the winning auction offers have come from a new buyer that did not submit an offer on the MLS. The remaining 18 percent represented situations where a prospective buyer was motivated to outbid his or her original MLS offer in the auction environment.

Discovering $40K in Equity

The competitive MVP auction marketplace helped Pam Mormino sell her home in the St. Louis area for $70,000 above what it was listed for on the MLS.

“I needed to do a short sale because it didn’t appraise out enough for what I owed, which was $165,000. So, I listed it with the Realtor for a $134,900,” she said.

After the home was listed in July 2021, it received a high offer of $159,000 through the MLS. In August it was put up for auction on Auction.com, where it received a winning bid of $205,666 — $45,000 more than the highest MLS offer and $40,000 above the total debt owed to the lender — during a single auction run. During the week-long auction, the property was saved by 48 Auction.com users and received 43 bids from five competing bidders.

“Elated,” Mormino said when asked to describe her emotions after the successful sale that allowed her to avoid foreclosure and walk away with cash to show for the home’s equity. “It really relieved so much stress on me.”

Visit Auction.com/MVP for more information.