A case study from the Cleveland, Ohio, neighborhood of Slavic Village

Grassroots neighborhood stabilization initiatives and convenient online access to distressed inventory are both attracting more local buyers of bank-owned homes, boosting community wealth creation in the form of rising home values for owner-occupants and investor returns that feed back into the local economy.

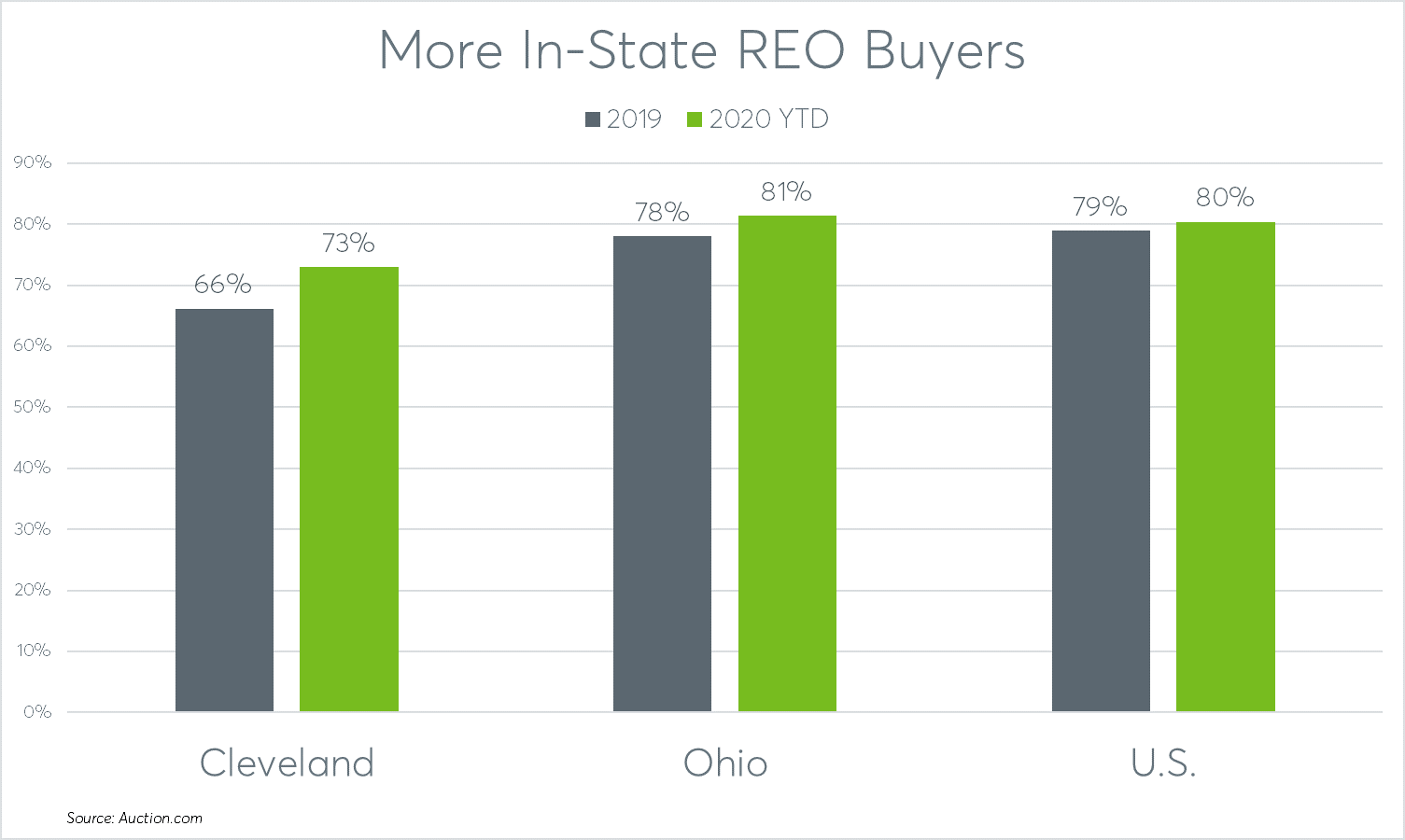

Nationwide, 80 percent of bank-owned (REO) homes sold online via the Auction.com platform through the first nine months 2020 were to buyers located in the same state as the property, up from 79 percent in 2019. The share of in-state REO buyers increased in 33 states and the District of Columbia, according to the Auction.com data.

The increase in local REO buyers is more dramatic in markets like Cleveland, where low home prices and potentially high returns have historically drawn a high percentage of out-of-state buyers. So far in 2020, 73 percent of properties purchased in Cleveland via the Auction.com platform were by in-state buyers, up from 66 percent in 2019 and up from 62 percent in 2018.

Other cities posting a more than five percentage point gain in the share of in-state REO buyers included Philadelphia, Tampa, Little Rock, Jackson, Mississippi, and Montgomery, Alabama.

Incubating Local Investors

The emergence of local investors is welcome news for Chris Alvarado, executive director of the Slavic Village Development (SVD), a Cleveland, Ohio-based non-profit community development corporation that promotes neighborhood stabilization through housing development, local business development and community organizing.

“It’s important for us to rebuild that community of investors in our neighborhood. We know that not everyone can own their own home and we want there to be quality rentals in the neighborhood and we are happy to work with investors on that,” he said, adding that his organization runs a program called Neighbors Invest in Broadway, designed to encourage local investors to purchase and renovate distressed properties with the end goal of getting those properties occupied.

Hundreds of vacant, distressed properties in the five-square-mile neighborhood of Slavic Village have been rehabbed and re-occupied as a result of the Neighbors Invest in Broadway initiative, according to Alvarado. This has multiplied the volume and impact of home renovations beyond what SVD can do on its own through a program called Slavic Village ReDiscovered.

Alvarado said his organization carefully vets the investors it works with to ensure the investors are responsibly renovating the distressed properties they purchase.

“The good investors are the ones that have the ability to make improvements to properties,” he said, adding that the responsible investors are building wealth by adding value to the properties and the neighborhood.

Ian Beniston, executive director at the Youngstown Neighborhood Development Corporation, another non-profit promoting neighborhood stabilization in hardscrabble Ohio neighborhoods, echoed those sentiments.

“We do see the need for those smaller investors to generate the product,” he said. “I don’t have any problem with people making money; it’s all about how people do it … if you’re just going to do the bare minimum just to get the electric on just to get someone in there to rent, I’m not interested in that.”

The growing momentum among local investors in Cleveland is helped by repeat buyers, according to Alvarado.

“We get a lot of investors who come back repeatedly, which is important for us because when the Great Recession hit, we lost a lot of our best investors,” he said, noting that repeat investors are more likely to have realistic expectations when it comes to renovation costs.

“It behooves us to give the best possible information to anyone who is buying properties in this neighborhood,” he said. “You may be buying … for $10,000, but you’ll need to put in $30,000 in renovations and (then) you’ll have a property that’s worth more than $40,000.”

Investor Ripple Effect

SVD’s ReDiscovered program was the first pebble in the pond of revitalizing Slavic Village, which was devastated by foreclosures in the aftermath of the Great Recession.

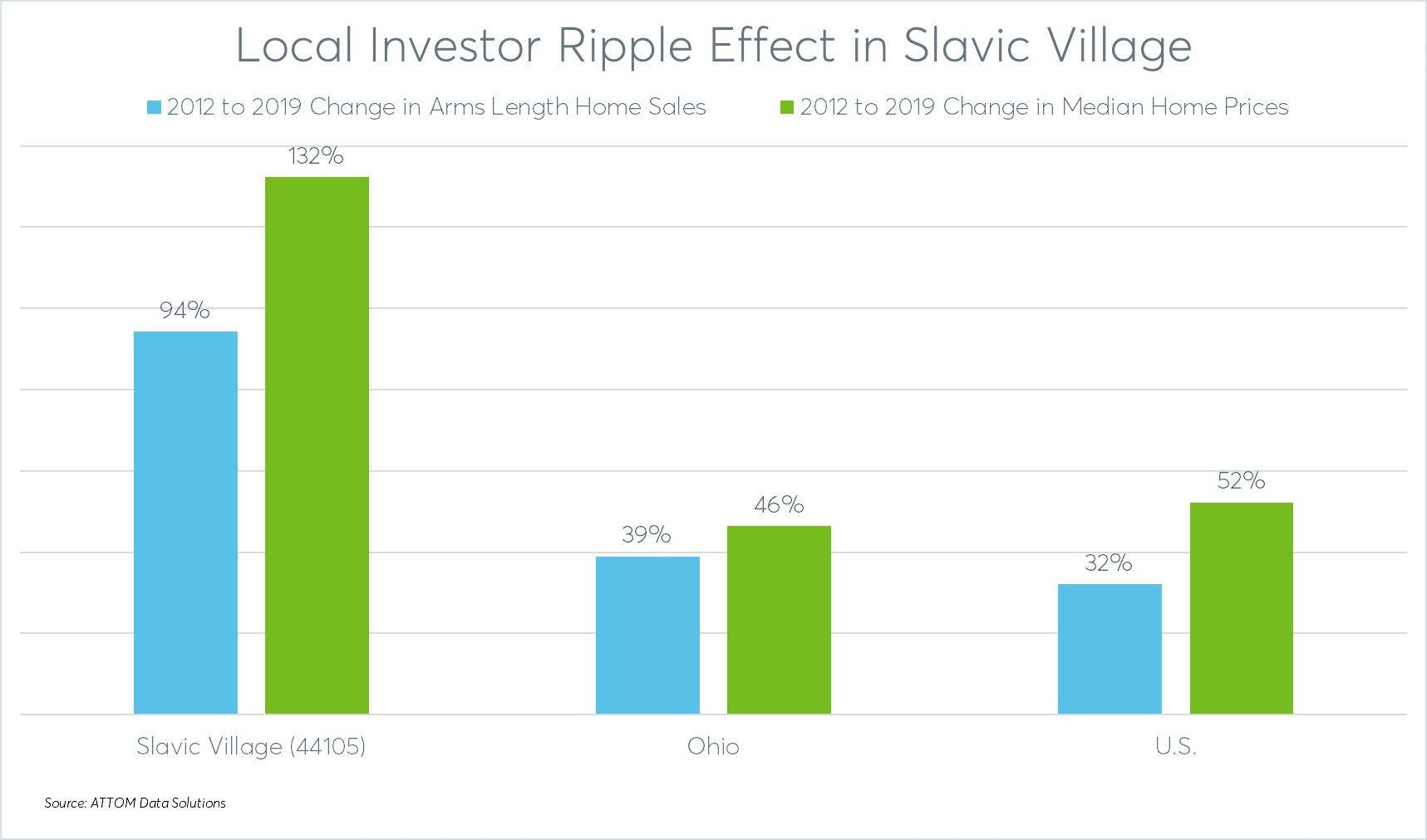

“When we started the Slavic Village ReDiscovered project, you could count the number of arms-length transactions on one hand,” said Alvarado, referring to market rate transactions that didn’t involve foreclosure or any other type of forced distress sale.

Now arms-length transactions are more common, thanks in part to the ripple effect of the Neighbors Invest in Broadway program, which has attracted other buyers and investors not participating directly in any SVD initiative. That last milestone is a key measure of successful neighborhood stabilization, according to Alvarado.

“Now sales are taking place independently of the work that Slavic Village is doing,” he said. “The real sign of success for us is when we see a critical mass of investors who are able to do the renovations … Flipping properties in a positive way.”

Arms-length home sales in the Slavic Village zip code of 44105 were up 94 percent in 2019 compared to seven years earlier — at the bottom of the housing market in 2012, according to data from ATTOM Data Solutions. That increase was nearly three times the 32 percent increase nationwide during the same time period. Median home prices in Slavic Village increased 132 percent from 2012 to 2019, more than 2.5 times the increase seen both nationwide and statewide during the same period.

Community Wealth Creation

Rising home values lift all boats in the neighborhood. Alvarado said homes sold to owner-occupants through SVD’s ReDiscovered program in 2014 had appraised values from the mid-$50,000s to the low $60,000s. Those same properties now have appraised values from the mid-$80,000s to the low $90,000s, giving the owners more home equity wealth and more motivation to continue to improve their homes, according to Alvarado.

“Because they’ve moved up the market it justifies more extensive improvements including even green home improvements,” he said, adding that he views median home values of $100,000 as an important milestone of homeownership wealth. “That’s our four-minute mile.”

The responsible real estate investing taking hold in the Slavic Village neighborhood also helps to create wealth for local entrepreneurs — the local investors buying and rehabbing the distressed properties.

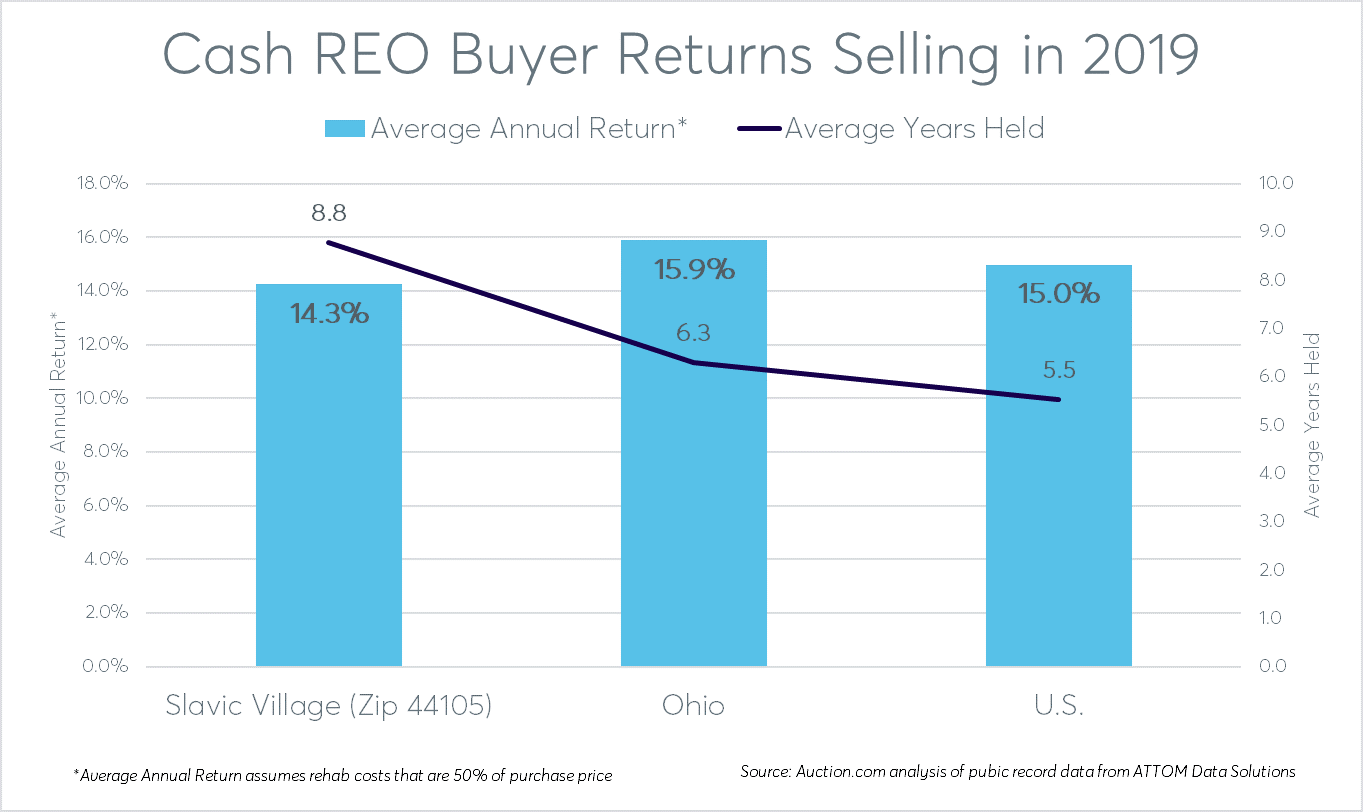

In the 44105 zip code that includes Slavic Village, cash buyers of REO properties — likely real estate investors — resold for an average of $19,250 more than the REO purchase price, among those who sold in 2019, according to an Auction.com analysis of public record data from ATTOM Data Solutions.

According to the analysis, the investors held the REO properties nearly nine years on average and had purchased for a median price of $10,250. That pencils out to an average annual return of 14.3 percent — assuming the investor spent 50 percent of the purchase price on rehab and not including any rental returns generated over the nine years.

“Local investors have it down,” Alvarado said. “Because most of them are renting them they don’t have to rely on the appraised value to get their return.”

The Slavic Village investor returns were not far below the returns for cash-buying REO investors statewide in Ohio (15.9 percent annual return) and nationwide (15.0 percent annual return), according to the analysis.