Nationwide foreclosure moratoria are holding back low-priced housing supply that could help ease the home affordability challenge quickly emerging as a threat to the U.S. housing market.

“Housing demand is robust but supply is not, and this imbalance will inevitably harm affordability and hinder ownership opportunities,” said Lawrence Yun, chief economist with the National Association of Realtors (NAR) in the organization’s August 2020 home sales report. “To assure broad gains in homeownership, more new homes need to be constructed.”

What Yun does not mention is an often-overlooked source of housing supply: distressed foreclosure properties that are renovated and returned to the retail market as now-livable homes that can be financed by owner-occupant buyers or rented by tenants. Even after rehab costs, those renovated foreclosures represent a more affordable alternative for homebuyers and renters than do new homes or even traditional existing retail homes.

Robust mortgage forbearance programs are prudent and necessary to help homeowners impacted by the pandemic-induced recession to avoid foreclosure — and at the macro level to prevent the housing market from being sucked under a wave of foreclosures. But foreclosure moratoria layered on top of those robust forbearance programs are holding back future low-priced inventory that the housing market badly needs to avoid a home affordability crisis.

And while the potential foreclosure supply in the short term has been severely constrained by the forbearance programs alone, there is ample distressed supply outside of forbearance that would be potentially available to the market if the moratoria were lifted. Here’s a quick breakdown of that potential supply — which adds up to more than 1 million residential properties — based on data from Black Knight Mortgage Monitor reports:

- 660,000 residential property mortgages that became delinquent prior to the pandemic declaration, are still delinquent but have not entered forbearance (55 percent of all pre-COVID delinquencies). Of these 660,000, about 180,000 had started the foreclosure process and are still actively in foreclosure.

- 400,000 residential property mortgages that became delinquent after the pandemic declaration, are still delinquent but have not entered forbearance.

Foreclosure Supply Chain

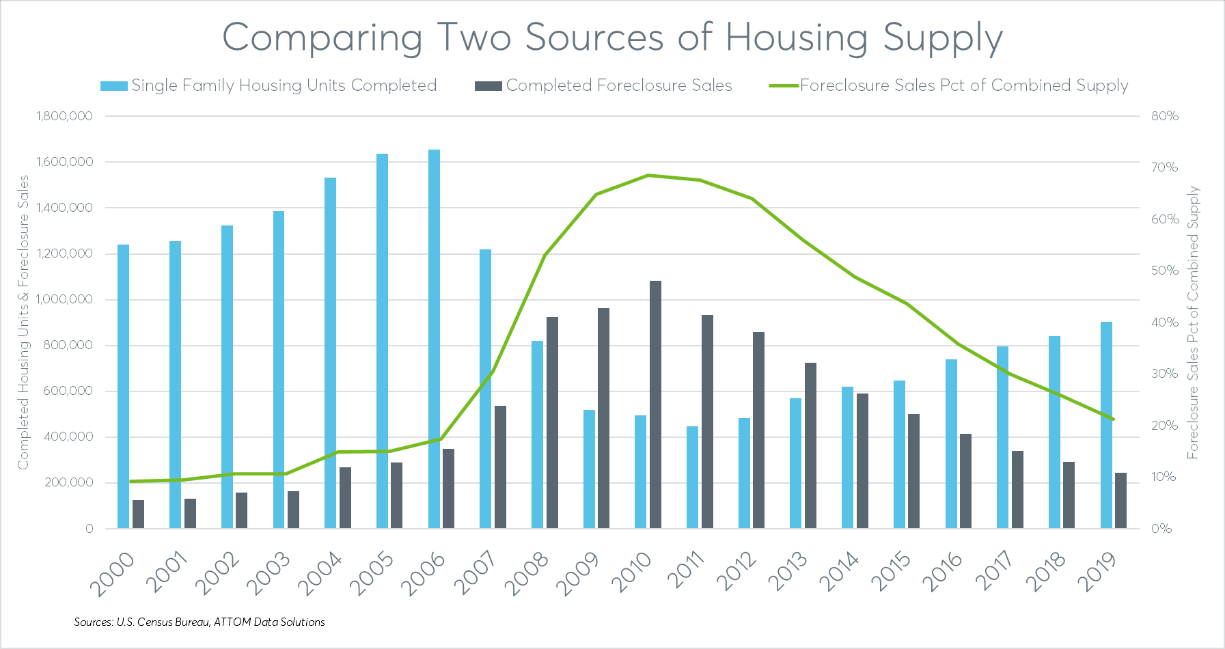

Even in the booming real estate market of 2019, nearly a quarter of a million properties completed the foreclosure process by being brought to foreclosure sale, according to public record data from ATTOM Data Solutions. The 244,258 completed foreclosures in 2019 represented a 16-year low and was 77 percent below the peak of 1,083,671 in 2010, but that number was still a respectable 6 percent of non-distressed existing home sales, according to the ATTOM data.

Foreclosure sales account for a much bigger share when compared to new housing starts as a source of housing supply. The 244,258 completed foreclosure sales in 2019 represented 27 percent of the 903,200 new single family housing starts for the year, according to Census Bureau data.

And this comparison of foreclosures to housing starts is a fair one: a housing start represents the commencement of a process that will bring new supply to the retail housing market; similarly a foreclosure sale represents the beginning of a process that sees a distressed — often uninhabitable — property renovated and returned to the retail market.

Returned to Retail

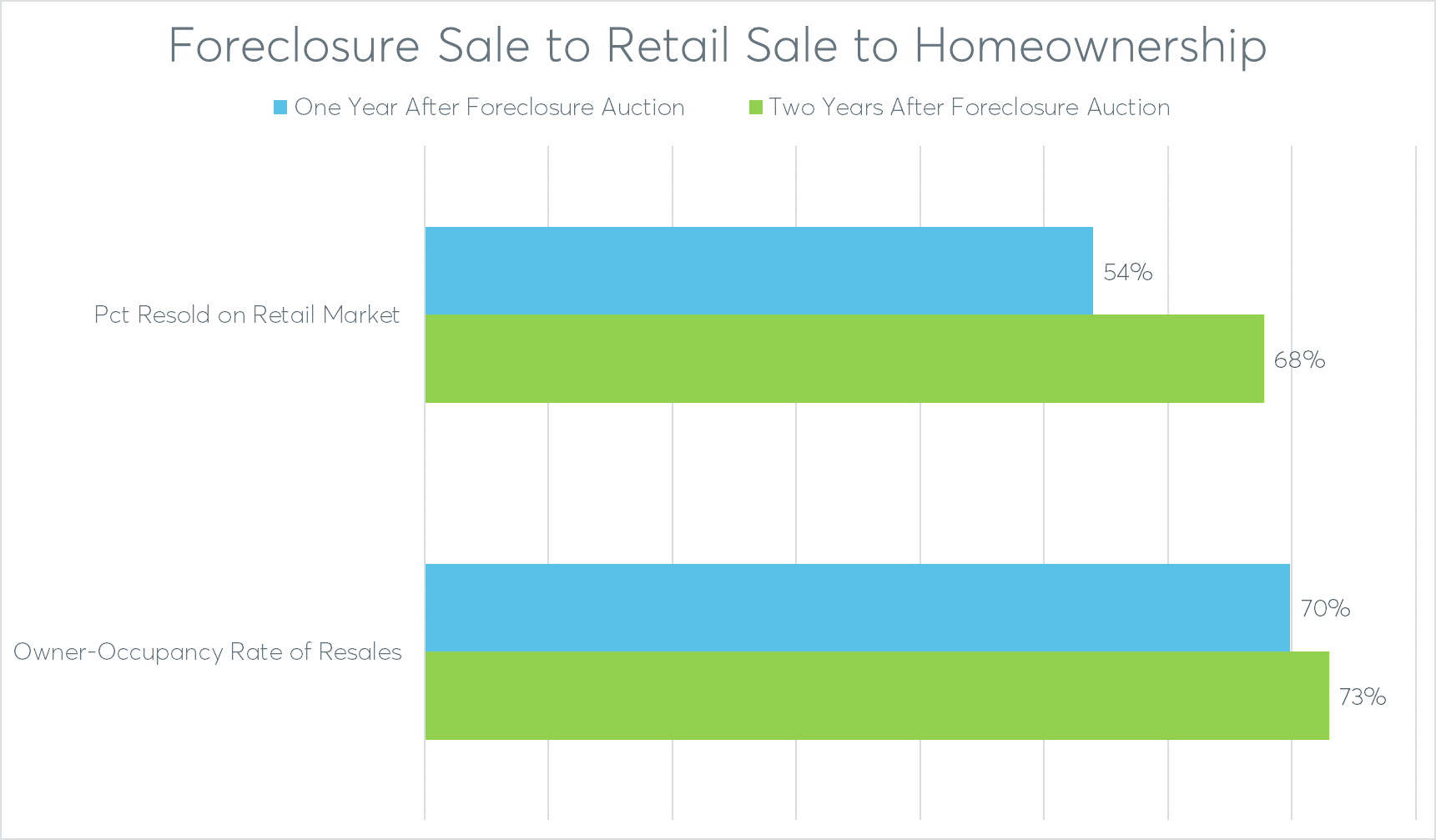

A post-foreclosure sale analysis of nearly 145,000 properties brought to foreclosure auction on the Auction.com platform in 2018 and 2019 shows that most foreclosed properties are resold on the retail market within a year and more than two-thirds are resold within two years. The analysis shows that 54 percent of properties brought to foreclosure had subsequently resold on the retail market (via an arms-length sale) within one year and 68 percent had subsequently resold within two years of the foreclosure auction.

Most of the remaining 32 percent have also been renovated and returned to the retail market as rentals. An Auction.com survey in the second quarter of 2020 shows 59 percent of buyers are renovating and reselling properties to owner-occupants as their primary investing strategy while 33 percent are renovating and holding the properties as rentals as their primary investing strategy.

Affordable Rental Supply

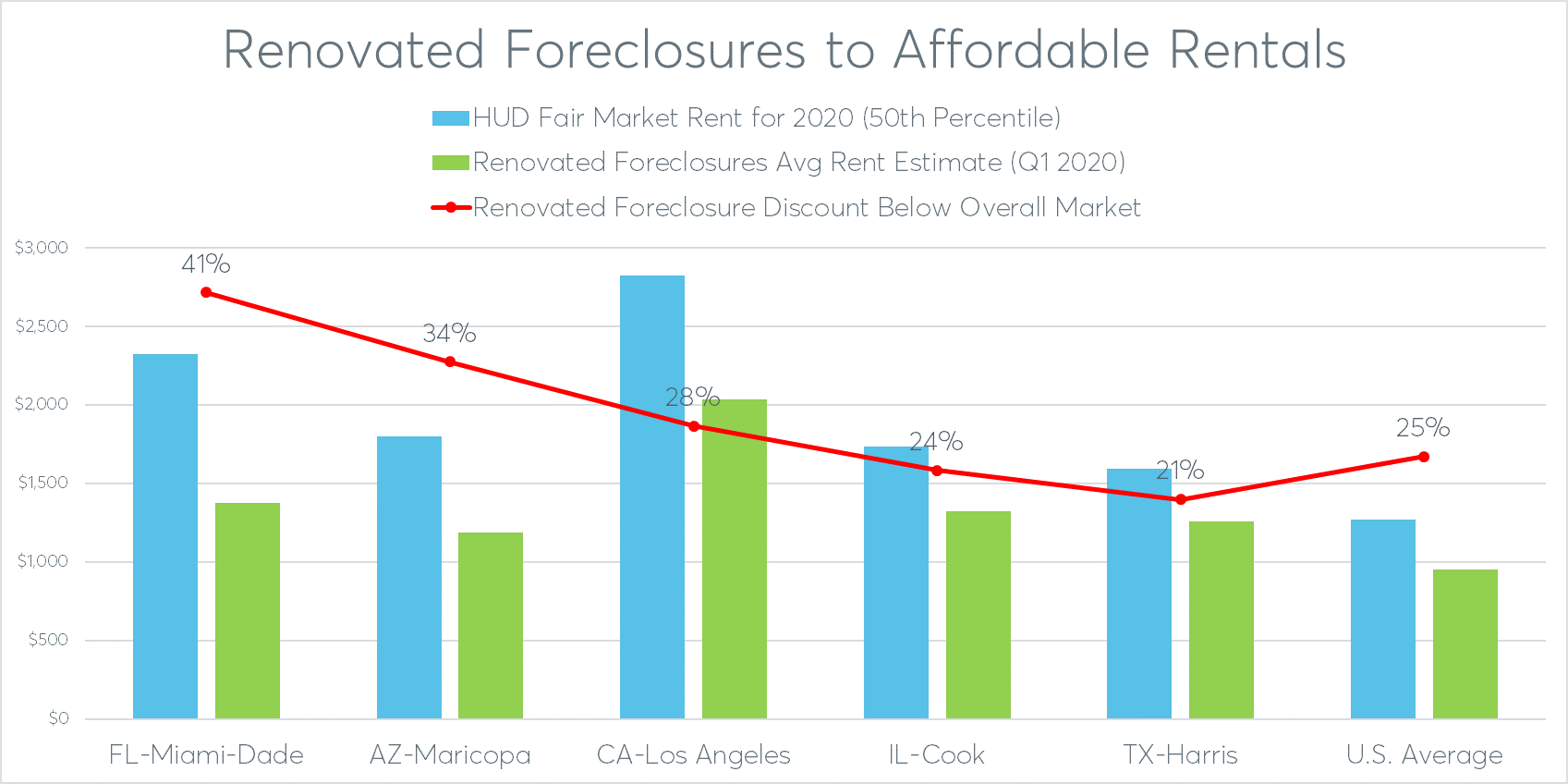

Often those renovated rental properties represent an affordable housing option at the local market level.

“We both grew up in middle-class neighborhoods and middle-class families, so we try to keep the rent where it’s affordable for the average person because we understand how difficult it is to find a place,” said Tyrone Velasquez of the investing strategy employed by him and his husband, Scott Stuber, when renovating and renting bank-owned homes they purchase via the Auction.com platform in Dayton, Ohio. “To keep it at $800 (a month), what we’re finding is it’s a sweet spot for us — we’re still making money. But it’s also working out for our tenants, which is a win-win situation for us.”

That $800 cap on rent set by Velasquez and Stuber is 28 percent below the average fair market rent of $1,114 for three-bedroom properties set by the U.S. Department of Housing and Urban Development (HUD) in Montgomery County, Ohio — where the city of Dayton is located — for 2020.

Velasquez and Stuber are not alone in renovating distressed foreclosures into affordable rentals, according to the Auction.com post-foreclosure sale analysis. Across 1,706 U.S. counties with sufficient data, the average estimated rental value of previously foreclosed homes held as rentals as of the first quarter of 2020 was 25 percent lower than the average fair market rent for three-bedroom properties set by HUD for 2020 in the surrounding county. The analysis used estimated rents at the property level provided by Collateral Analytics, a Black Knight company.

Affordable Owner-Occupant Supply

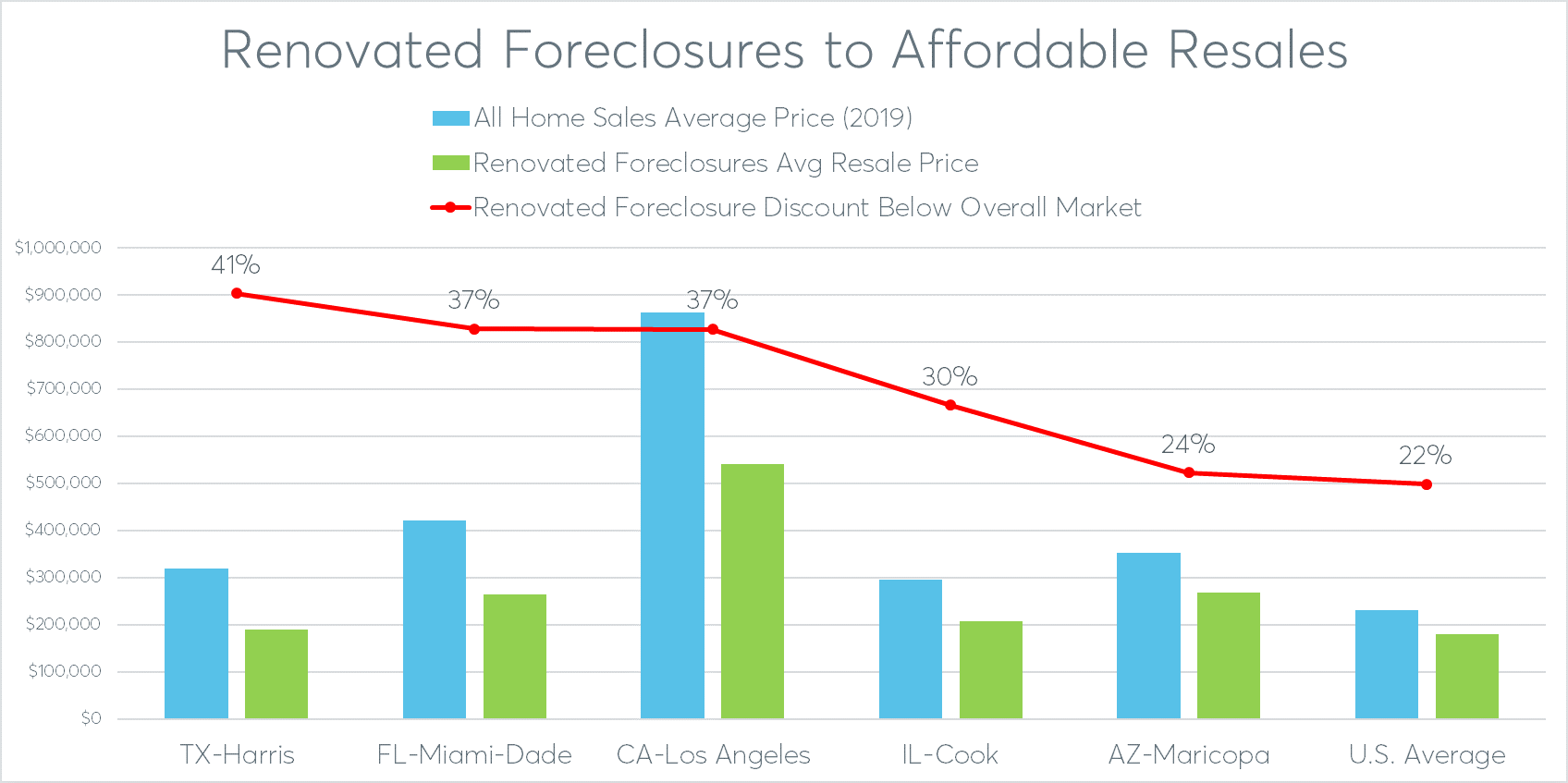

Renovated foreclosures also supply affordable housing for first-time homebuyers and other owner-occupants, according to the post-foreclosure sale analysis. Among 1,375 U.S. counties with sufficient data, the average resale price of renovated foreclosures was 22 percent lower than the average home sales price overall for the surrounding county in 2019.

The affordability advantage for renovated foreclosures was much greater in high-priced counties. Among 66 counties where the average home sales price overall was more than $500,000 in 2019, the average resale price of a renovated foreclosure was 41 percent lower than the overall average home price.

Those more affordable price points attract first-time homebuyers and other owner-occupants. The analysis shows that 70 percent of foreclosures renovated and resold to investors were owner-occupied within one year of the foreclosure sale and 73 percent were owner-occupied within two years of the foreclosure sale.

“We try to buy the starter home size, the 1200 to 1500 square feet size,” said Tracy Bamford, a part-time investor who, with her husband, renovates and resells foreclosures — mostly to first-time buyers — in Johnston County, North Carolina. The Auction.com analysis shows 80 percent of renovated foreclosures in that county were resold to owner-occupants within two years after the foreclosure auction.

“The smaller (homes) are the best because you’ve got your first-time homeowners,” Bamford continued, telling the story of a renovated foreclosure the couple sold to a first-time buyer after purchasing it at online REO auction. “She’s a young girl just starting out, just got out of college, just got her first job. The house is very close to where she works.”