Foreclosure auction sales rates plummeted a year before home prices began dropping in 2006

Lee Kearney is all-too-aware of the warning signs he missed in 2005 leading up to the housing market crash.

“I kept buying in a downward market and I was stuck with all this inventory that I wasn’t able to sell,” said Kearney, a Tampa, Florida-based real estate investor who said he’s purchased more than 2,000 homes at foreclosure auction since 2005.

But Kearney began pulling back on his foreclosure auction purchases two years ago because he saw signs of another downturn coming in the Florida markets where he invests. The rate of home price appreciation slowed to a crawl, and he faced increasing competition from other buyers at the auction.

A Broader Base of Buyers

Growing competition from a new breed of foreclosure auction buyer is evident in proprietary foreclosure sales rate data from Auction.com, which leverages marketing and technology to attract a broader base of buyers to the foreclosure auctions sold through its platform.

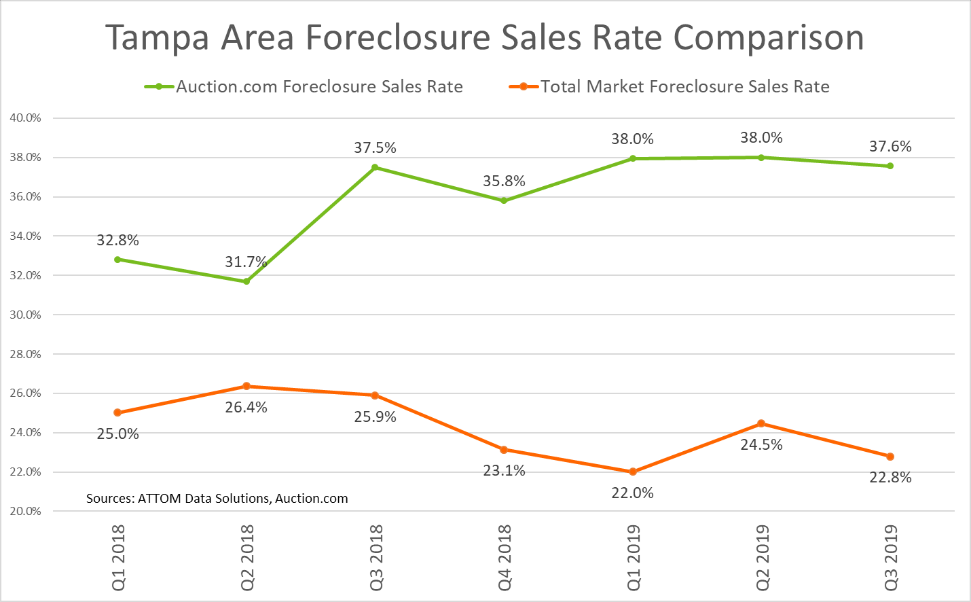

More than 37 percent of Tampa-area properties brought to foreclosure auction on the Auction.com platform in Q3 2019 sold to third-party buyers, well above the overall market rate of 22.8 percent and up compared to a year ago for the fourth consecutive quarter. By contrast, the overall market foreclosure sales rate in Tampa declined on a year-over-year basis for the third consecutive quarter in Q3 2019.

“Real estate investors purchasing fewer than five properties a year now comprise more than half of all repeat buyers using the Auction.com platform,” said Ali Haralson, chief business development officer at Auction.com. “Because they operate at smaller scale and with extremely low costs, these buyers represent a broader and more sustainable source of demand at foreclosure auction, particularly later in a housing cycle when margins are compressed.”

Canaries in the Coal Mine

Conversely many large-scale foreclosure auction buyers are proceeding with caution given their greater exposure to a home price correction, according to Kearney, CEO of Spin Companies, a group of real estate investing businesses.

“What you’re finding now in Tampa, the general sentiment is ‘all the stuff is sitting around, margins are declining,’” he said, noting that at one point he was purchasing as many as 50 properties a week. “I’m hearing all the same sentiments I was hearing 10 years ago.”

Kearney and high-volume foreclosure auction buyers like him are canaries in the coal mine of the housing market, and their collective behavior signals coming market corrections and crashes as well as market rebounds and recoveries, according to an Auction.com analysis of public record data from ATTOM Data Solutions.

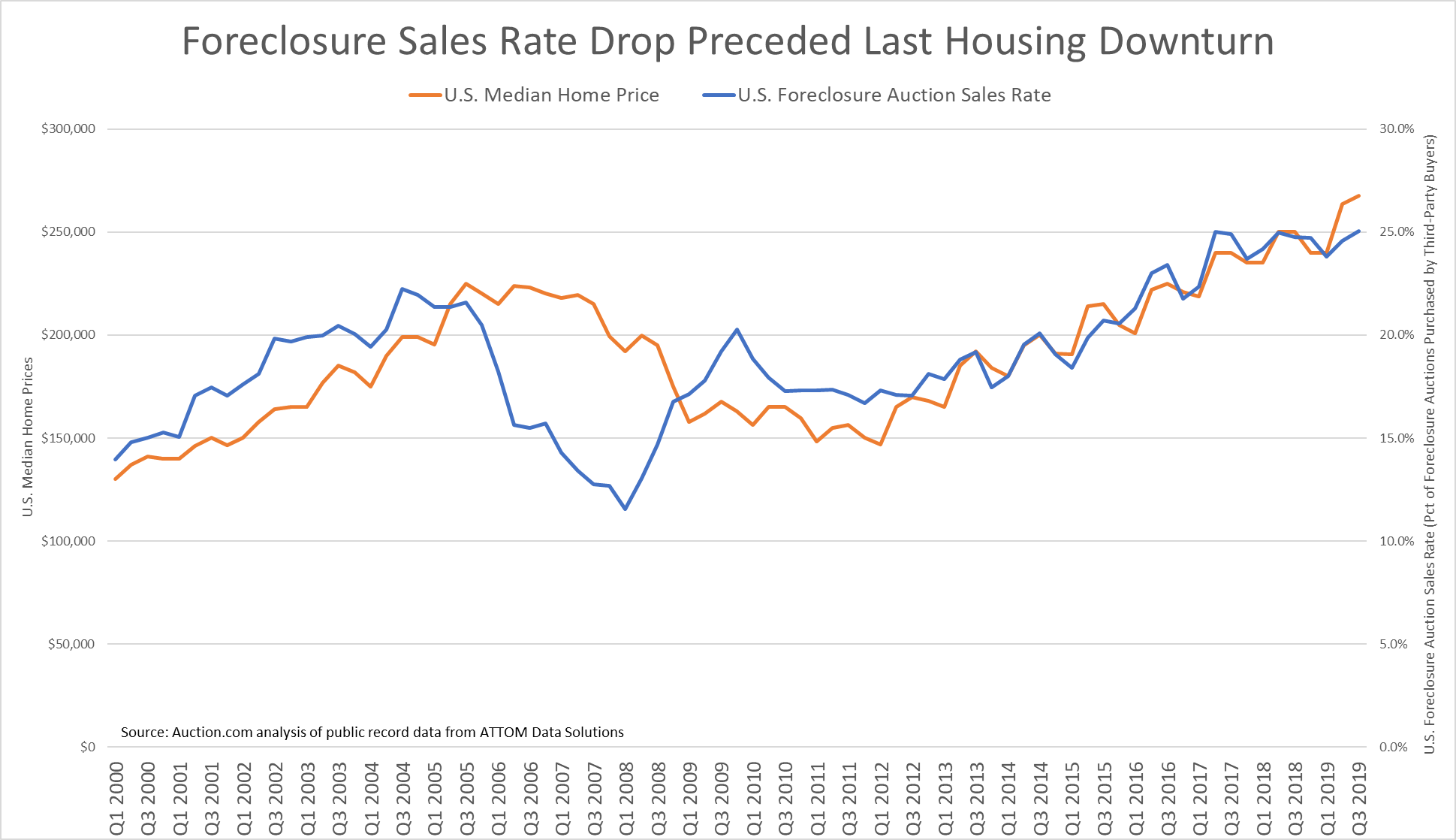

The analysis shows that the U.S. foreclosure third-party sales rate increased to a pre-recession high of 22.2 percent in Q3 2004. But in Q3 2005 the foreclosure sales rate began 12 consecutive quarters of year-over-year declines, ending up at an all-time low of 11.6 percent in early 2008.

Home prices didn’t start falling on a year-over-year basis until Q3 2006, a year after the foreclosure sales rate began its plunge. The home price drop in Q3 2006 kicked off 23 consecutive quarters with flat or declining home price appreciation nationwide. When the dust finally settled in Q1 2012, home prices had dropped a cumulative 35 percent.

Tip of the Spear

Southern California real estate investor Bruce Bartlett saw the warning signs back in 2005 and started selling the “meager” portfolio of properties he had acquired investing part-time.

“In 2005 I predicted the crash,” said Bartlett, explaining that the huge disparity between home prices and incomes in Southern California led him to believe it was time to sell his properties there and exchange them for more reasonably priced properties in Texas. “I put my money where my mouth was, and I sold.”

Median home prices in the Los Angeles-Long Beach-Anaheim metropolitan statistical area plummeted 45 percent between Q3 2007 and Q1 2012, but real estate investors had started to sharply curtail purchases at foreclosure auction a year before that price drop began. The metro’s foreclosure auction sales rate dropped 37 percent year-over-year in Q3 2006, the first of nine consecutive quarters with year-over-year decreases.

“Flippers are the tip of the spear because they have the best information,” said Bartlett, who eventually started investing full-time and now owns Flip Great, a company that renovates properties on behalf of homeowners. “There is a point in time where they see prices are flattening out and prices are going down … so flippers stop buying, or some percentage of them.