Cooldown in price appreciation necessary to avoid an eventual correction or crash

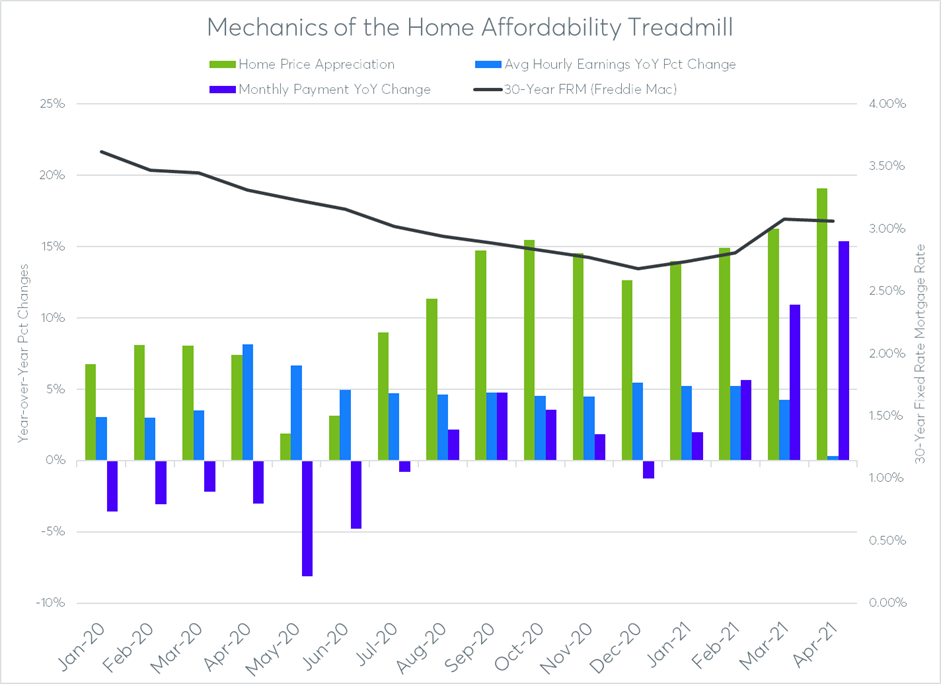

U.S. median home prices increased 19 percent from a year ago in April 2021, the ninth consecutive month with a double-digit annual increase, according to data from the National Association of Realtors.

But until the last three months, that incredible run–up in home price appreciation hadn’t resulted in worsening affordability. In the 12 months prior to February — most of those during the COVID-19 pandemic — the monthly payment to buy a median-priced home actually decreased an average of 1 percent a month compared to the previous year.

That improving affordability came thanks to the twin magic bullets of falling mortgage rates and accelerating wage growth, both resulting from massive government stimulus enacted in the wake of the pandemic declaration in March 2020.

Over the 12-month period ending in January 2021, the average 30-year fixed-rate mortgage was down an average of 21 percent a month compared to the previous year, according to the Freddie Mac Primary Mortgage Market Survey.

Meanwhile, average annual wage growth during that 12-month period was 5 percent, according to the Bureau of Labor Statistics. That 5 percent average during the pandemic was more than twice the historical average of 2 percent prior to the pandemic going back to 2006.

Affordability Treadmill

Together, wages, mortgage rates and home prices can be thought of as an affordability treadmill in action. Wages represent the energy available to the runner on the treadmill (picture an energy drink sitting in the cupholder), while home prices and mortgage rates both represent two different forms of resistance that can be adjusted on the treadmill — pace and incline.

Using the treadmill analogy, a rapidly lowered incline (mortgage rates) combined with some chugging of the energy drink (wages) has motivated the runner (homebuyers) to repeatedly hit the up-arrow on pace (home prices). Up until February, even that dramatic increase in pace hadn’t created any additional strain on homebuyers in terms of affordability. In fact, the strain on homebuyers was less than it was a year ago — helping to explain why they have been willing to so aggressively bid up home prices.

Falling Behind

Affordability trends reversed course in February, March and April as mortgage rates (incline) ticked higher while wage growth (energy) slowed to 4 percent in March and fell flat in April. Despite the additional resistance from higher mortgage rates and less energy from wage growth, homebuyers kept hitting the up-arrow on pace, driving home prices higher at an even faster rate in those three months than in the previous three months.

But the combination of accelerating pace, steeper incline and slowing energy meant that homebuyers started to lose ground on the affordability treadmill in February and March. In both months, the annual increase in the monthly mortgage payment to buy a median-priced house was higher than the annual increase in wages.

The recent downturn in mortgage rates along with the Federal Reserve’s stated desire to maintain policies that keep a lid on interest rates should give homebuyers some relief — or at least not additional resistance — in the short term. Of course, the Fed may find it tougher to hold down interest rates given the recent 4.2 percent jump in the Consumer Price Index in April. This increase was well above economists’ expectations of a 3.6 percent increase and more than twice the 2 percent inflation target that the Fed seeks to maintain.

Even if the Fed continues to hold the line on interest rates, the problem with less resistance in the form of lower mortgage rates (incline) is it may motivate homebuyers to keep ratcheting up prices (pace). That will eventually cause additional strain on homebuyers, particularly if wage growth continues to falter.

Chugging more energy drink and continuing to lower the incline may work in the short term to help a runner from falling behind on a treadmill. It may even give the runner the ability to increase the pace temporarily. But the long-term solution to keep from falling behind on a treadmill — or falling off the treadmill altogether — is to enter cooldown mode. Cooldown mode dramatically slows the pace to a leisurely walk that helps prevent the runner from overheating.

Absent organic wage growth not stimulated by massive government spending, a similar cooldown in home price appreciation in the second half of 2021 would be the ideal scenario that could help prospective homebuyers from falling too far behind on the affordability treadmill. A cooldown would also help keep homeownership in reach for more buyers, helping to bridge the wealth gap that has only widened in the aftermath of the COVID-19 pandemic.

Such a cooldown is not unthinkable. Back in late 2018 and early 2019, rising mortgage rates provided the catalyst for a cooldown in home price appreciation, which dropped into the low single digits before picking back up again in late 2019. The longer the market goes without such a cooldown period, the more risk of a correction or even crash in home prices.