Could this be a sign a decade-long decline in foreclosure activity has finally found a floor?

U.S. foreclosure starts increased 2 percent from a year ago in January 2019, the second consecutive month with a year-over-year increase following 41 consecutive months where the numbers were down or unchanged from a year ago, according to the latest ATTOM Data Solutions foreclosure market report.

Could this be a sign a decade-long decline in foreclosure activity has finally found a floor?

U.S. foreclosure starts — defined as the first public notice starting the foreclosure process — hit a new low of 26,564 in December 2017. That was the lowest going back as far as data is available, April 2005. The 29,382 foreclosure starts nationwide in January were still far below the average of more than 155,000 per month between 2008 and 2010, but the increases of the last two months could signal that the credit pendulum has swung as far as it will away from risk.

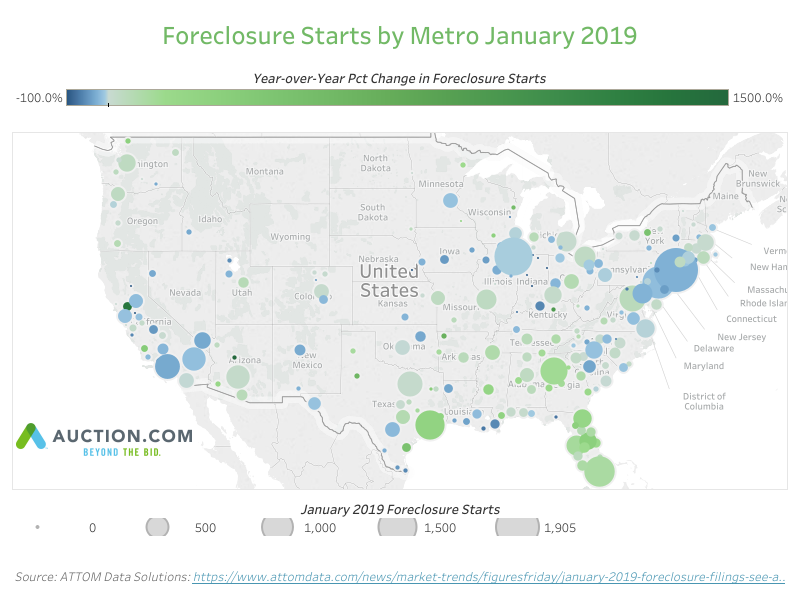

Foreclosure starts up in 47 percent of local markets

Local market numbers in some leading markets also suggest there is no more risk to be squeezed out of the mortgage market — risk that was understandably being squeezed out in reaction to the overly risky loans that helped trigger the financial crisis and Great Recession more than 10 years ago. Foreclosure starts in January increased from a year ago in 104 of 219 metropolitan statistical areas analyzed in the report (47 percent).

Some of the local market increases are eye-popping: Miami foreclosure starts increased 93 percent from a year ago; Houston foreclosure starts were up 221 percent; Atlanta foreclosure starts were up 119 percent; Tampa-St. Petersburg foreclosure starts were up 104 percent; and Orlando foreclosure starts were up 266 percent.

The dramatic increases in these five major markets — with the possible exception of Atlanta — can be attributed to the ripple effect of hurricanes that hit the markets back in late 2017. These hurricanes triggered foreclosure moratoriums, which slowed foreclosure starts to a snail’s pace for several months before banks ramped back up again. This natural disaster-driven catch-up scenario may explain the triple-digit increases in these markets.

Not just natural disaster driven

But the natural disaster effect does not explain double-digit increase in foreclosure starts in other major — and purportedly healthy — housing markets such as Dallas-Fort Worth (up 12 percent); Phoenix (up 14 percent); Seattle (up 33 percent); Portland (up 30 percent); and Austin, Texas (up 63 percent).

The numbers in Austin in particular point to a longer-term pattern in rising foreclosure starts. The 63 percent year-over-year increase in January marked the 12th consecutive month with a year-over-year increase in the metro area.

More distressed inventory

This recent uptick in foreclosure starts signals a change in the distressed market that parallels the larger retail housing market. The supply of distressed homes has been steadily drying up over the last seven years. But if the trend of the last two months continues, that that downward trajectory will reverse in 2019 — albeit at what appears to be a steady, measured pace.

Just as a recent uptick in inventory in the retail housing market means home sellers need to adjust their pricing assumptions and overall strategies in 2019, this recent uptick in distressed inventory will have similar implications for lenders and servicers disposing of distressed assets.