Existing Home Sales Jumped 11.8 percent in February Compared to the Previous Month

Existing home sales jumped 11.8 percent in February compared to the previous month, according to data released in late March by the National Association of Realtors.

That jump was a surprise to many in the housing industry after months of downward-trending data, but buyers using the Auction.com platform were already foreshadowing this bounce-back in home sales based on data pulled in the first week of March — three weeks before the NAR report.

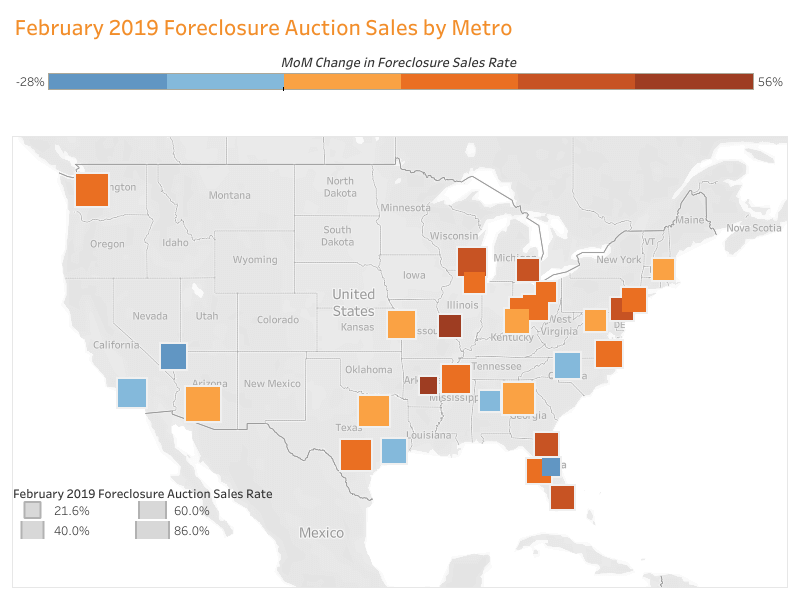

The Auction.com data shows that the rate of homes selling to third-party buyers at foreclosure auctions in February jumped 9 percent compared to the previous month, the biggest month-over-month jump since February 2015. The 11.8 percent increase in February home sales was also the biggest increase in four years, according to NAR.

Local Market Fortune-Tellers

Buyers at the foreclosure auction — which is a live event that takes place locally at the county level — tend to be seasoned real estate investors who closely monitor local housing market trends. To stay in business and make a profit, these investors must be proficient at reading the local market tea leaves — both the current market and the future market given that they often rehab and resell the homes they purchase at auction in about six to 12 months.

As skilled local market fortune-tellers, foreclosure auction buyers provide valuable forward-looking intel into the broader real estate market. The rate at which these investors purchase homes scheduled for foreclosure auction provides a good barometer for the strength of their demand for inventory, which in turn provides a good predictor of the strength of the retail housing market these investors will be selling into over the next six to 12 months.

2015 All Over Again?

The 9 percent jump in the February foreclosure auction sales rate pales in comparison to a 31 percent month-over-month spike in this metric back in February 2015. This jump came following a year (2014) in which elevated mortgage rates (consistently above 4.0 percent) put the brakes on the U.S. housing market. The rate of annual home price appreciation fell as low as 3.4 percent in July 2014, according to data from ATTOM Data Solutions.

If the 2014 pattern sounds eerily familiar, it’s because it parallels the slowdown in 2018, when elevated mortgage rates (consistently hovering at or above 4.5 percent for the last eight months of the year) put the brakes on the U.S. housing market. Annual home price appreciation dropped to an 81-month low of 3.3 percent in September 2018, according to ATTOM.

The February jump in investor demand at the foreclosure auction coupled with the jump in overall home sales volume indicates both the distressed and retail real estate markets are responding positively to the recent drop in mortgage rates — similar to the market’s response back in 2015.

The February 2015 month-over-month spike in foreclosure sales rate turned into a longer-term trend: the foreclosure sales rate increased on a year-over-year basis in eight of 12 months for the year. If a similar long-term trend plays out in the distressed market in 2018, expect to see the retail market post a solid rebound as well. If the February jump in foreclosure sales rate does not translate into a longer-term trend, the broader housing market may be in for a more extended slowdown that not even dropping mortgage rates can rescue.