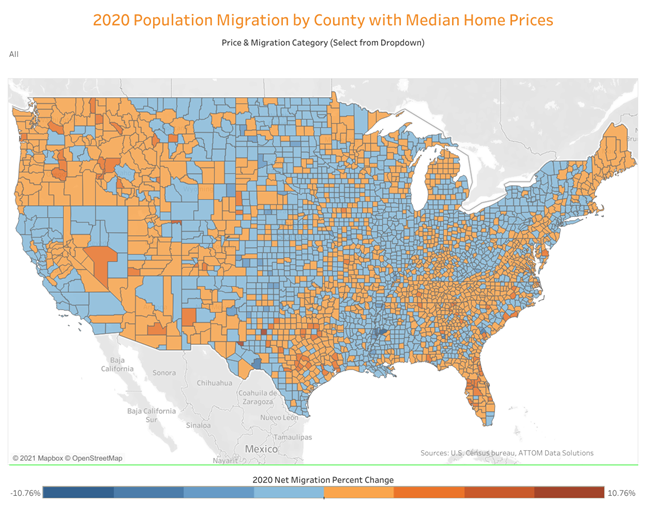

Americans fled high-priced housing markets in favor of those with more affordable homes in 2020, a trend that is breathing new life into suburban and rural markets and boosting distressed property demand from local real estate investors and even owner-occupant buyers in those markets.

“Houses are jumping 10 to 15 percent each month. It’s insane what people are getting because there is less than a one month’s supply. There is just no inventory,” said David Fisher, a real estate investor who lives in the Cleveland, Ohio, area and primarily purchases foreclosure and bank-owned properties from Auction.com and other sources.

Fisher, who holds down a full-time job while renovating and revitalizing about one property each year, said he focuses on suburban neighborhoods in four Cleveland-area counties: Cuyahoga, Lorain, Medina and Summit. All four of those counties have median home prices below $250,000, according to public record data from ATTOM Data Solutions. Two of those counties — Lorain and Medina — saw an increase in population due to positive net migration in the 12 months ending in July 2020, according to data from the U.S. Census Bureau.

Competing with Retail Buyers

Fisher acknowledged he benefits from the red-hot retail market when he sells his rehabbed homes, but increasing competition from owner-occupant buyers is making it tougher to acquire more distressed properties.

“(I’m) benefitting when I sell but (it’s) hurting me when I buy because I’m competing against retail buyers who are wanting to live there, and they are outbidding me,” he said, noting that in the past retail buyers have avoided the highly distressed properties he pursues because those properties many times require significant renovation. “These are homes that are flooded and have mold … the interiors are just trashed. … They have to be totally rehabbed, and so that’s what we do.”

The escalating demand for even highly distressed properties is evident in a broader analysis of the home price data and net migration data along with proprietary foreclosure sales data from Auction.com.

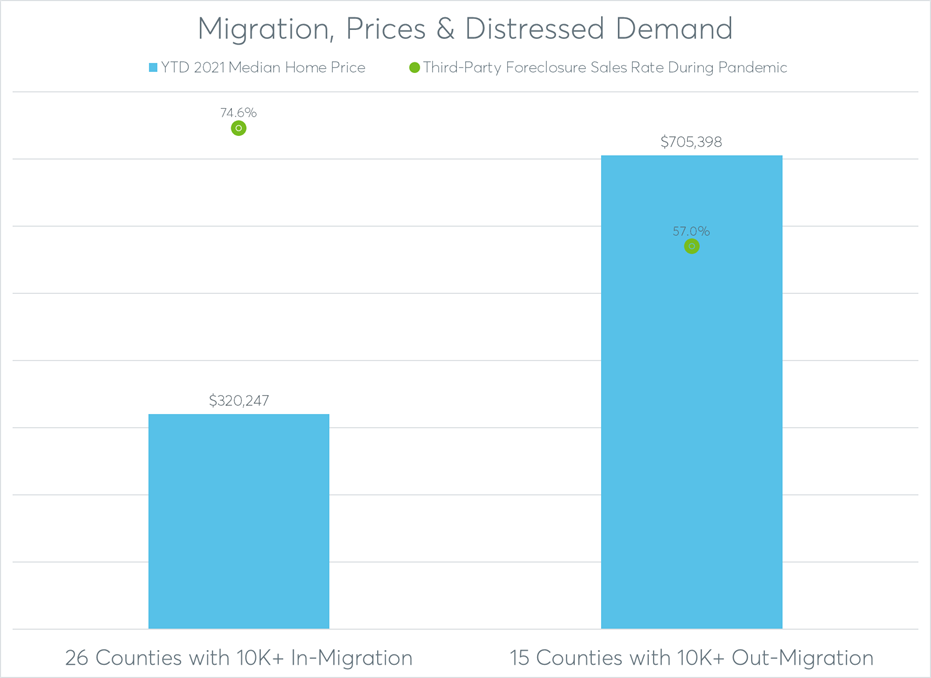

The Auction.com data shows that three out of every four properties brought to foreclosure auction between April 2020 and May 2021 (74.6 percent) sold to third-party buyers on average in the 25 U.S. counties with net migration increases of at least 10,000 people in 2020. That third-party foreclosure sales rate, which is a key indicator of demand for distressed properties, was up 39 percent in those 26 counties from an average of 53.6 percent in 2019. The median home sales price in those 26 counties was $320,247 on average in the first five months of 2021.

Demand for distressed properties has also increased in less affordable counties with strong out-migration trends, but to a lesser degree. Among the 15 U.S. counties with net migration losses of at least 10,000 people in 2020, the average third-party foreclosure sales rate was 57.0 percent between April 2020 and May 2021, up 10 percent from 2019. The median home sales price in those 15 counties was $705,398 on average in the first five months of 2021 — more than double the price in the 26 counties with the highest net migration gains.

Driving for Distressed Deals

It’s not just the larger markets with favorable affordability and strong in-migration trends— think Phoenix, Las Vegas, Dallas and Austin — that are benefitting. The average third-party foreclosure sales rate was 66.5 percent between April 2020 and May 2021 for all counties with a population of at least 10,000 and positive net migration trends. That compares with an average third-party foreclosure sales rate of 57.4 percent among all counties with a population of at least 10,000 but with negative net migration trends.

Chattanooga-based investor Steve Johnson lives within driving distance of many smaller-population counties benefitting from the flight to affordability. He’s been buying distressed properties in some of those counties after being priced out of the Chattanooga market.

“There’s not many properties that you can buy and afford here. With Remote Bid I can buy anywhere,” said Johnson, referring to a feature in the Auction.com mobile app that allows buyers to purchase at foreclosure auction remotely. This has helped him purchase properties across the state line in Georgia, where all foreclosure auctions occur on the first Tuesday of each month.

“If it’s a good enough deal and the price is right, then I’ll buy anywhere I can drive to,” said Johnson, adding that he had just returned from a road trip to visit two Georgia properties he purchased via Remote Bid in the March 2021 “Super Tuesday” foreclosure auction.

One of the Georgia properties Johnson purchased is in Houston County, a prime example of a smaller-population county with favorable migration and affordability trends. Net migration added 2,111 people to Houston County in the 12 months ending in July 2020, according to Census data. That represented a 1.34 percent increase from the county’s population of 157,427 in 2019. The median home price in the first five months of 2021 was $163,400, according to the ATTOM data.

Auction.com data shows a 60.0 percent third-party buyer foreclosure sales rate during the pandemic in Houston County, with properties selling at auction for 96 percent of estimated retail market value and 117 percent of the foreclosing lender’s credit bit — typically the amount still owed on the defaulted mortgage. This means most properties are selling above what is owed to the foreclosing lender. That is good for foreclosing lenders, but it also benefits distressed homeowners because it results in more surplus funds for them to walk away with.

The strong demand in places like Houston County is coming from buyers like Johnson who are empowered by a transparent and innovative buying platform to find and purchase deals in nearby counties with favorable affordability and demographic trends.

The analysis of all three datasets shows 365 counties nationwide fit into the Houston County mold of having positive net migration in 2020 and median home prices below $200,000 — among those with a population of at least 10,000 and at least 100 home sales so far in 2021. Tennessee and Georgia lead the way, with 47 and 35 counties respectively fitting that mold. Ohio, where investor David Fisher buys, has 21 counties fitting the mold, tied with Oklahoma for fourth most.

For Johnson, the appeal of Houston County goes beyond just the affordability and demographic trends.

“I get to go play with the grandkids at night,” he said, explaining that his son lives nearby with his family.