Emerging Technology Empowers Strategic Pricing Changes in “Minutes, not Months”

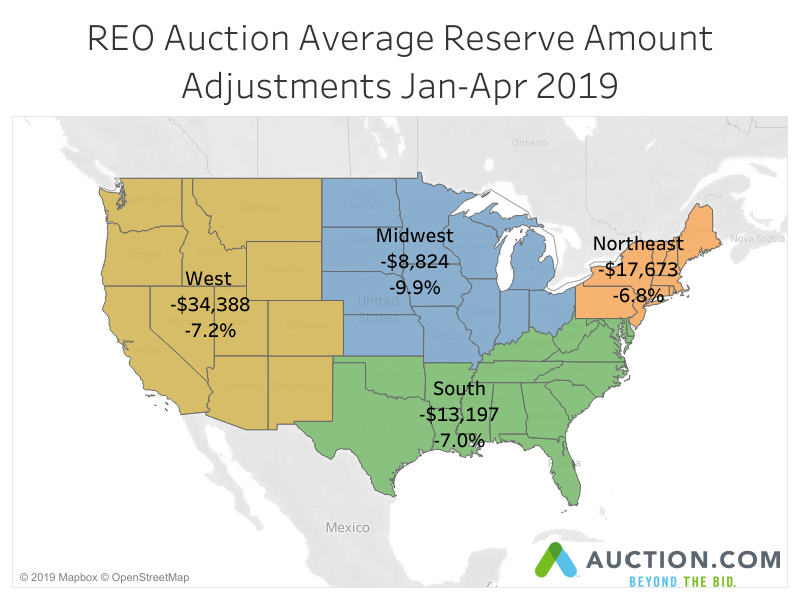

As the retail housing market continues to swing between a strong seller’s market and a more favorable buyer’s market, distressed property sellers are accelerating price adjustments on foreclosed homes, according to an Auction.com analysis of proprietary data from its Portfolio Interact seller dashboard.

“Given the volatility in today’s housing market, sellers are looking for ways to track and adjust pricing in real time, not over months but in minutes,” said Jason Allnutt, CEO at Auction.com. “Portfolio Interact and other proprietary tech from Auction.com are increasingly empowering sellers to nimbly fine-tune pricing strategy as market conditions and buyer behavior shift.”

The number of seller-initiated price changes — in the form of adjusted auction reserve amounts — increased 29 percent in April 2019 compared to a year ago for REOs being sold via the Auction.com platform, which has 4.9 million registered account users as prospective buyers.

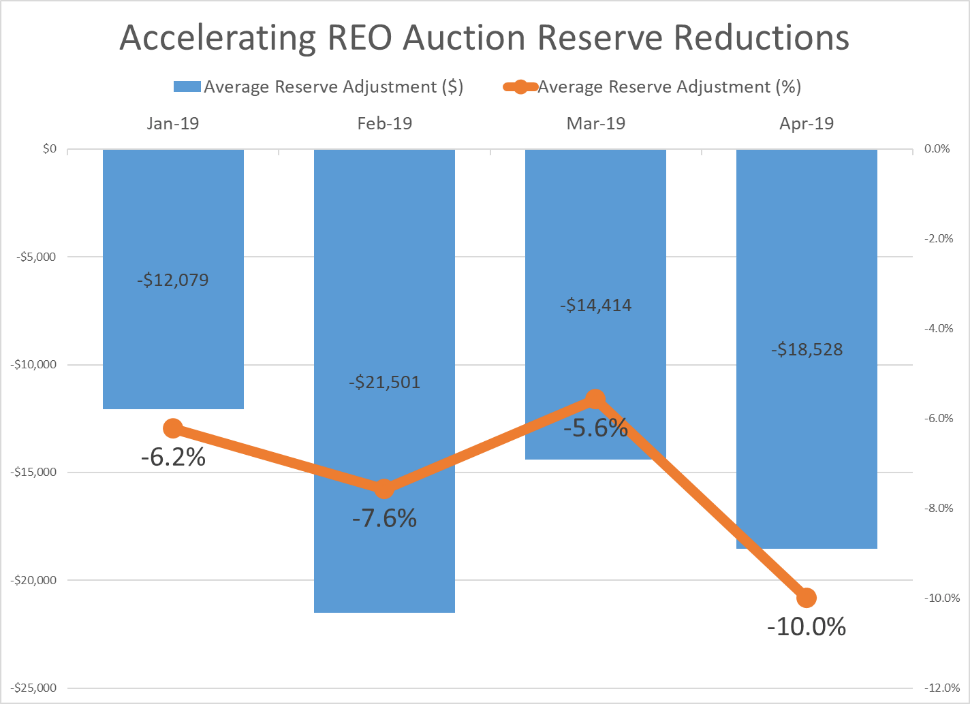

The average price adjustment in April was a reduction of $18,528 in the reserve amount, up 27 percent from an average $14,414 reserve reduction in March and up 45 percent from an average $12,792 reserve reduction in April 2018.

And average reserve reductions didn’t just ratchet up in terms of dollar amount: distressed property sellers cut auction reserve amounts by an average of 10.0 percent in April 2019 — the biggest percentage reduction since March 2018.

Price Cuts Attracting More Buyers

More aggressive price cuts on REO auction properties in April indicate that lenders selling foreclosed homes are increasingly aware of shifting housing market conditions, and are willing to adjust pricing to sell more quickly rather than take on the additional risk of holding a property in inventory.

That strategy appears to be working, with the sales rate of foreclosed properties on the Auction.com platform in May reaching the highest level since July 2018. That higher sales rate — the percentage of REO homes available for auction that sell — demonstrates that lower auction reserves are helping to drive more bidding activity from real estate investors and other REO auction buyers using the Auction.com platform.

A similar pattern showed up back in March 2018, when U.S. existing home sales began a six-month slide lower, according to the National Association of Realtors. Foreclosed property sellers using the Auction.com platform adjusted reserve amounts an average 11.0 percent lower in March 2018, compared to an average reserve reduction of just 3.3 percent the previous month.

Following the more aggressive pricing reductions in March 2018, the Auction.com REO sales rate jumped 141 basis points in April 2018.

Fewer Price Cuts Follow Real Estate Rebound

The Portfolio Interact data also provides evidence that distressed sellers are pulling back on price cuts when the housing market swings back toward a seller’s market. Following an 11 percent month-over-month spike in existing home sales in February 2019, the average REO auction reserve adjustment in March was a 5.6 percent reduction, compared to an average 7.6 percent reduction the previous month.

Additionally, 11 percent of distressed sellers making pricing adjustments actually increased the reserve amount in March, up from 8 percent in February and just 5 percent a year ago. This shows that distressed sellers were willing to effectively raise prices for a growing share of REO auction properties during the month.

All this points to an environment in which distressed sellers are nimbly adapting their auction pricing strategy to the ebbs and flows of the housing market, empowered by innovative tools such as Portfolio Interact — a web-based business intelligence interface that allows lenders and servicers to monitor and manage portfolios of distressed properties scheduled for auction in real-time. Portfolio Interact is part of the Auction Interact product suite that also includes recently launched Bid Interact, an online interface allowing distressed property sellers to adjust pricing on demand during an auction event.

Whether the market is ebbing or flowing, the Auction Interact suite of products provides the transparency and functionality sellers need to quickly adjust pricing strategy to most effectively dispose of distressed assets given changing market conditions and buyer behavior.