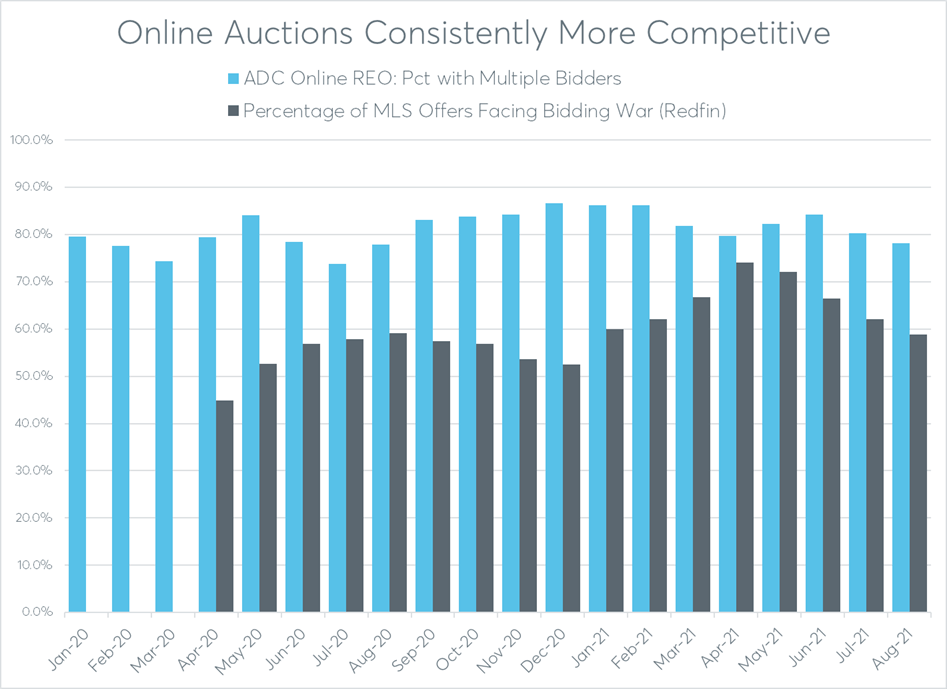

Bidding wars in the retail housing market dipped to a 13-month low of 58.8 percent in August, according to Redfin, which attributed the dip to cooling demand from frustrated buyers.

“Sellers are still pricing their homes very high, but a lot of buyers have had enough and are no longer willing to pay the huge premiums they were six months ago. Instead of 25 to 30 offers on turnkey homes, we’re now seeing five to seven,” said Nicole Dege, a Redfin real estate agent in Orlando, Florida, in the bidding wars report released by Redfin.

That perspective aligns with a nearly four-decade low in consumer sentiment when it comes to buying a home. Only 29 percent of consumers said it was a good time to buy a home in September 2021, down from a recent peak of 63 percent in March to the lowest level since 1982, according to data from the University of Michigan consumer sentiment survey.

Consistently More Competitive

Despite this softening of demand in the retail housing market, several key demand metrics for distressed properties trended higher in August, according to data from the Auction.com marketplace.

The average number of bids per bank-owned (REO) property sold on Auction.com in August increased to a three-month high of 12.1 in August while the winning bid as a percentage of the seller’s reserve increased to a new all-time high of 104.9 percent for the month. Preliminary data from September shows those metrics on track to meet or beat the August levels.

The share of REO auction sales with multiple bidders dipped to 78.2 percent in August from 80.2 percent in July, but it was still slightly above the August 2020 level of 77.9 percent. The share of multiple bidders for REO auctions has consistently outperformed the share of retail sales with bidding wars during the pandemic — by an average of 22 percentage points over the 17 months ending in August.

Renovation Required

“The acquisition side is very hard. Especially in what we’re trying to do; we’re buying these distressed properties,” said Will Wenzel, who started investing in real estate full-time in March 2020, just before the COVID-19 pandemic was declared. “More people are doing what we’re doing. They’re showing up at the auction or they are bidding on Auction.com.”

Wenzel purchased an REO property on Auction.com in September 2020. The Weston, Connecticut, property received a total of 32 bids from 20 bidders while available for bidding on Auction.com. Wenzel’s winning bid was 116.4 percent of the estimated value of the property in its condition at the time of auction based on a third-party appraisal of the home.

Wenzel still purchased the property at a discount of 24 percent below its estimated “after-repair” market value. Achieving that after-repair value required him to make extensive renovations to the home before reselling, which fits well into his investing strategy.

“We do like distressed assets because we love to do the work correctly,” said Wenzel, noting that he has partnered in his investing business with a long-time friend who is an architect. “We completely renovate the homes. … We’re having an architect draw up new plans and submitting those plans.”

Wenzel’s investing strategy is also grounded in the massive demographic shift to the suburbs that he expects to see as millennials age — a shift the pandemic has accelerated. His single-family investment purchases are centered in the Connecticut suburbs where he grew up.

“These suburbs they’ve really been lacking investment the last 10 years. They need people like us to come in and invest,” he said. “You have the housing stock sitting on the market and it’s kind of obsolete in terms of being useful to the next generation. … The work has to be done. We’re just doing the work.”

Benefiting Banks and Borrowers

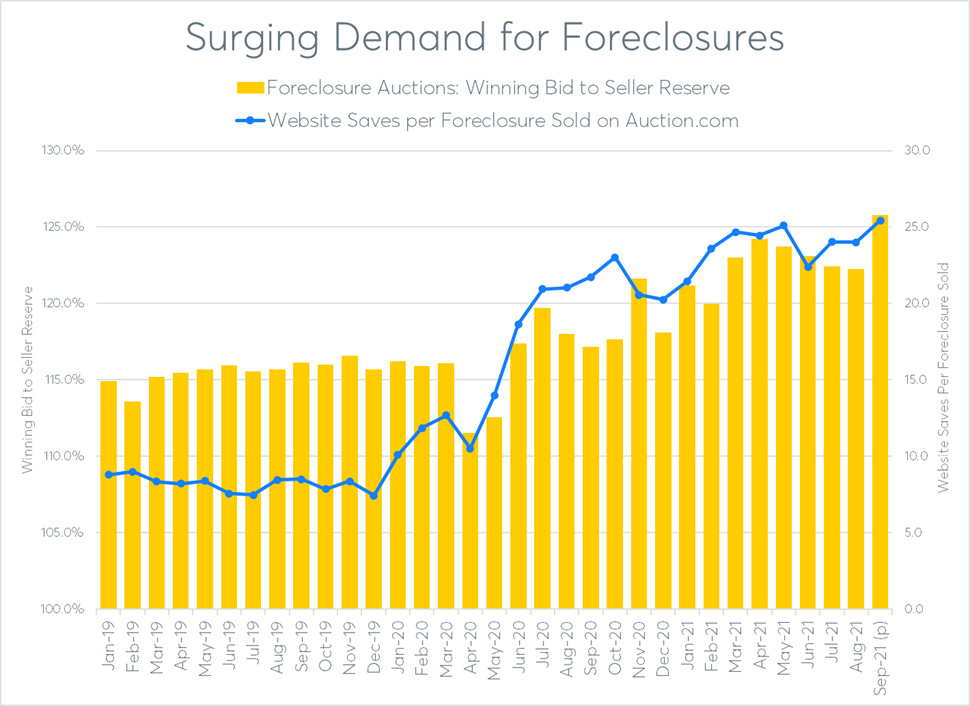

It’s not just online REO auctions that are seeing strong demand from buyers during the pandemic. Live — and often in-person — foreclosure auctions have also seen a surge in demand that has continued into recent months.

Properties sold at foreclosure sale in August were saved by Auction.com users an average of 24.0 times each, matching a three-month high and up from an average of 21.0 saves a year ago. Saves per property sold — a key indicator of demand — were on track to increase to an all-time high in September.

Price execution relative to the bank’s reserve at foreclosure auction — another key indicator of demand — was flat in August compared to the previous month but was still up from a year ago and on track to increase to a 100-month high of 125.8 percent in September.

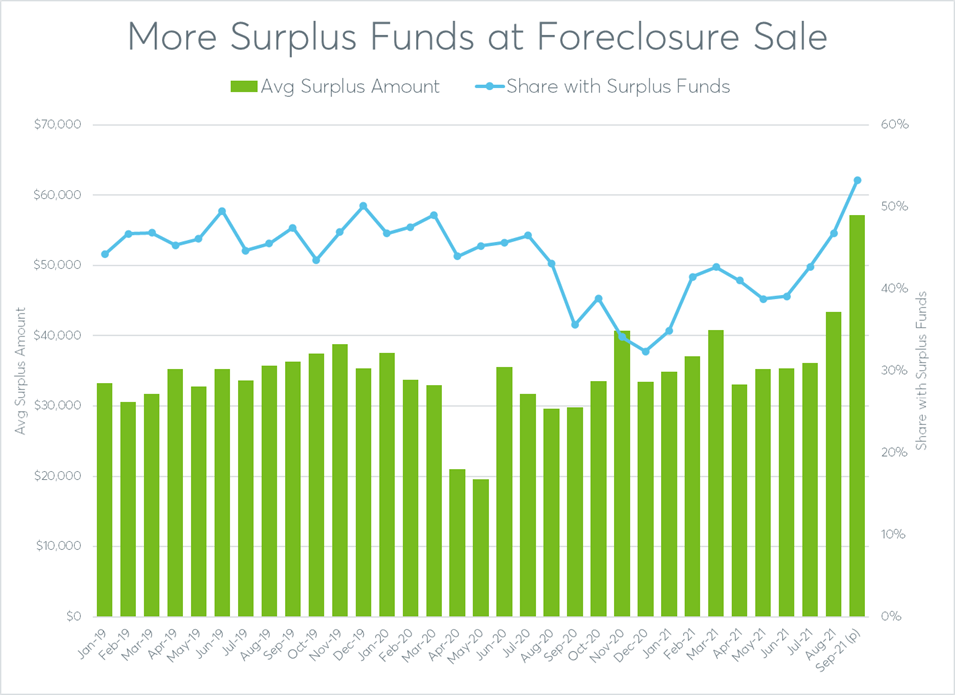

The high price execution driven by strong demand at foreclosure auction isn’t just benefiting the banks foreclosing on the homes. For an increasing share of foreclosure sales, it’s also benefiting distressed homeowners in the form of surplus funds generated at the auction above the amount owed to the foreclosing bank. These surplus funds are distributed back to the distressed homeowner after any junior lien holders are paid.

In August, 47 percent of foreclosure sales on the Auction.com platform generated surplus funds, up from 43 percent in both the previous month and a year ago. The average surplus generated in August was $43,440, a 98-month high.

Transforming Neighborhoods

The rising share of foreclosure sales with surplus funds is driven by strong demand from Auction.com buyers like Sue McCormick, who started investing in 2020 even while continuing to hold down a full-time day job.

Of the three foreclosure auction purchases McCormick has made via Auction.com in 2021 — all in her hometown market of Dayton, Ohio — the winning bid has been an average of 132 percent of the bank’s reserve. The properties were saved 19 times each on average by Auction.com users.

Like Wenzel, McCormick is still purchasing at a discount below after-repair market value — a 33 percent discount on average for her three 2021 purchases. But she also is adding value to the homes she purchases through extensive rehab before reselling to owner-occupant buyers. That in turn lifts surrounding home values while improving homeownership rates in the neighborhoods where McCormick grew up.

“Some of the areas where I grew up have taken a big hit,” she said. “There are really some beautiful, legacy areas that still exist. And then there are some areas that have been hard hit by things like drugs and crime. Some of those areas I’m investing in, and they’re starting to turn.”