Rehabbed Foreclosure Homes Selling 45 Percent Below New Homes on Average

A limited supply of affordable homes is the bee in the bonnet of an otherwise strong U.S. housing market recovery of the last seven years, according to the 2019 State of the Nation’s Housing report from the Harvard Joint Center for Housing Studies.

“With the economy on sound footing and incomes ticking up, household growth has finally returned to a more normal pace,” the authors conclude on the first page of the 44-page report published in June. “Housing production, however, has not. The shortfall in new homes is keeping the pressure on house prices and rents, eroding affordability — particularly for modest-income households in high-cost markets.”

The most significant factors behind that shortfall are “rising land prices and regulatory constraints on development,” according to Chris Herbert, managing director of the Harvard Joint Center for Housing Studies. Those factors are making it “unprofitable to build for the middle market.”

Rehabs for the Middle Market in Raleigh

While it may be unprofitable to build new homes for the middle market, many real estate investors and developers have found it profitable to renovate distressed homes for that same middle market. Those investors are buying up foreclosures and other properties and then rehabbing them into move-in-ready inventory that is still affordable for first-time homebuyers and low-income renters.

“We try to buy the starter home size, the 1200 to 1500 square-foot size,” said Tracy Bamford, a Johnston County, North Carolina resident who said she and her husband have flipped 15 homes in the last seven years in and around the Raleigh region. “The very last house we sold, we actually sold it before we had it fixed up … (to) a young girl just starting out, just got out of college and just got her first job. The house is very close to where she works, and she wanted it.”

Tracy Bamford and her husband fix and flip about two homes a year in the Raleigh, North Carolina, area even while both are holding down full-time jobs. The couple purchased this Benson, North Carolina, property on Auction.com and resold it five months later after putting about $17,000 into property renovations.

Bamford said that most recent home flip represents a fairly typical deal for her and her husband: they purchased it through an online bank-owned auction on Auction.com and resold it for $150,000 to a first-time homebuyer after putting $15,000 into renovations.

“If you put that much into the house it’s not a huge profit,” she said. “My husband and I both work full time but we want to make sure our daughter can go to college and we can go on vacation. And we both enjoy it.”

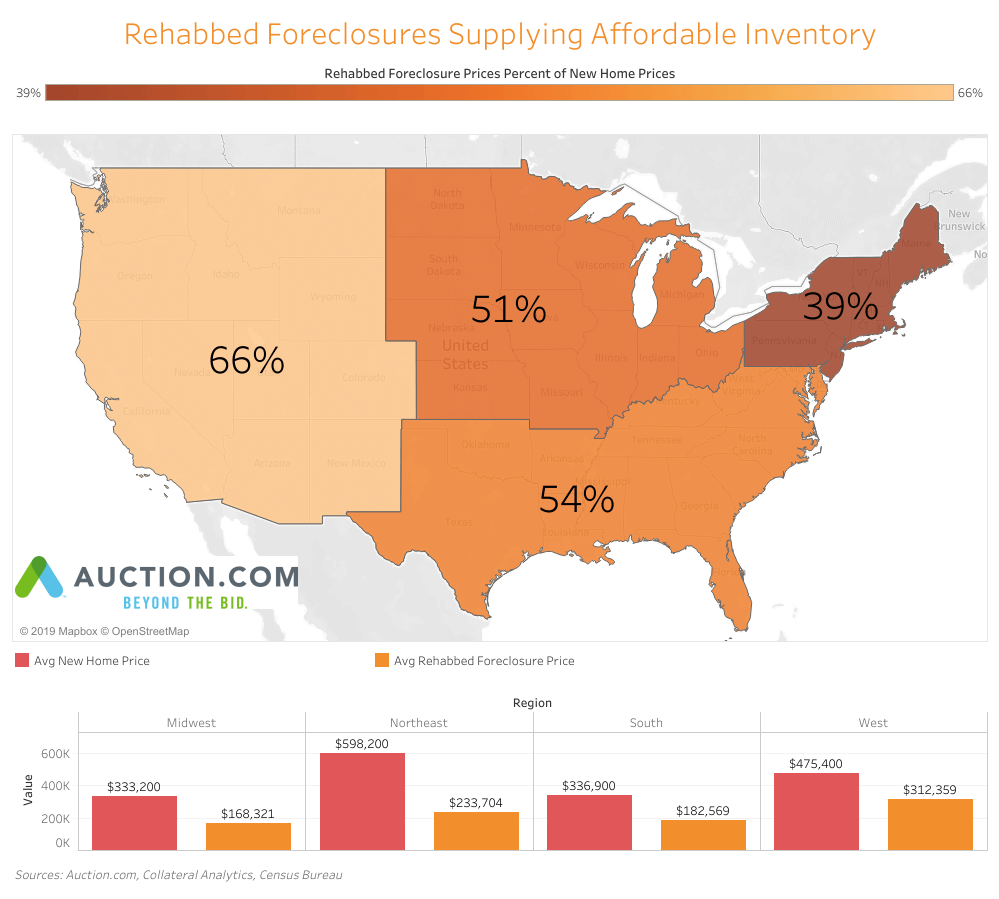

Flipped foreclosure auction homes resold for an average sales price of $211,608 in 2018, 31 percent below the average sales price of all existing homes sold nationwide during the year, according to an analysis of Auction.com and public record data. The average price for a flipped foreclosure auction home was 45 percent below the $385,000 average sales price for new homes sold in 2018, according to the U.S. Census Bureau.

The Auction.com data shows that the rehabbed foreclosure homes sold an average of 153 days after the initial purchase at foreclosure auction. An Auction.com survey of more than 200 repeat foreclosure auction buyers in June found that 64 percent budget at least 20 percent of the property’s acquisition price for rehab costs.

“I like to buy houses (in) bad shape so I can remodel the entire house,” wrote one of the survey respondents.

Renovating Affordable Rentals in Dayton

The majority of homes purchased at foreclosure auction end up in the hands of owner-occupants a year after the auction purchase, according to an Auction.com analysis of homes that sold at foreclosure auction via its platform in Q2 2018. As of July 2019, 56 percent of those homes were owner-occupied.

While most real estate investors resell to owner-occupants, some investors are tapping into the strong demand for quality rentals that are still affordable.

“What we’ve been doing is buying properties that are distressed, well under market value … now we’ve been more holding and renting,” said Scott Stuber, a Denver, Colorado, resident who has been investing in real estate with his husband since 2013. “We’ve been purchasing properties on Auction.com, private estates, foreclosures. We have bought 12 houses in Dayton in the past year.”

Scott Stuber and his husband started buying and rehabbing distressed homes like this one in Estes Park, Colorado that they purchased as a foreclosure after it was flooded in a 2013 flood. They purchased the property for $129,000 and put $97,000 into rehab before reselling a year later. In the past two years the couple has started purchasing properties at foreclosure auction in Dayton, Ohio, and are rehabbing and holding those homes as affordable rentals.

Stuber grew up in Ohio, and the couple has kept one of the Dayton homes to stay in during their frequent trips to the city. Stuber works full-time for the couple’s investment company, Nuremberg Properties, while his husband works at a full-time corporate job in Colorado.

“We generally do all the work ourselves. You can take a big chunk out of construction costs that way,” Stuber said, noting that the quality renovations are meant to attract long-term tenants. “We paint everything; if they need new floors, we put in new floors. We tear out the kitchen, put in a brand new kitchen and put in a new bathroom. Those are the things that are important to long-term tenants.”

Stuber said Nuremberg Properties typically spends about $10,000 to $12,000 on renovations, which can sometimes be more than the property’s purchase price. Despite the extensive rehab, Nuremberg Properties typically rents out the rehabbed homes — two-bed, one-bath “Servicemen Bungalows” — for an affordable $700 to $800 a month.

“We don’t want any property we have to rent for more than $800 a month. … We try to keep the lease price affordable for the everyday working person,” he said. “Tyrone and I both grew up in middle class families … Our goal has been to try to keep housing affordable for any tenant that is interested in renting from us.”

A 42 Percent Boost in Affordable Inventory

The rehabbed rental properties produced by Nuremberg Properties is an example of the type of affordable rental inventory that is on the decline nationwide despite a strong need for it, according to the Harvard study.

“At the lower end of the market, though, the number of units renting for under $800 fell by one million in 2017, bringing the total loss from 2011–2017 to four million,” the study claimed, adding that this trend is increasing the cost burden for many renters. “Cost-burden rates for modest-income renter households, however, continue to rise, and with burdens affecting households higher up the income scale, the issue of rental affordability is increasingly getting attention at the state and local level.”

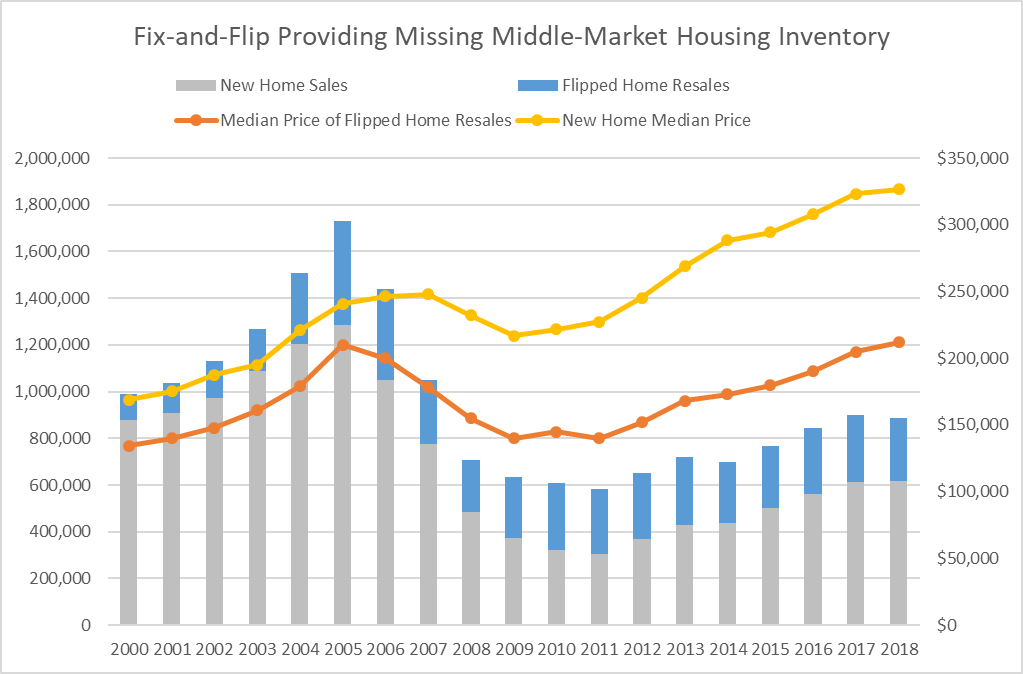

How much inventory are distressed property rehabbers returning to the retail market, either to owner-occupants or renters? An analysis of public record home flipping data from ATTOM Data Solutions shows a total of 259,499 existing homes were flipped in 2018 — 42 percent of the 617,000 new homes sold for the year, certainly not a drop in the bucket when it comes to supplying more move-in-ready inventory.

Furthermore, flipped homes were resold at a median price point of $212,000 in 2018 — more than $114,000 below the $326,400 median sales price for new homes sold in 2018, according to the Census bureau. That’s $114,000 closer to that elusive middle market the Harvard study argues is in short supply.