Share of REO Auctions with Competing Bidders Rises to Highest Level in Last Seven Quarters

Three out of four bank-owned properties that sold at online auction in Q3 2019 attracted competing bids from at least two unique bidders, according to an analysis of bidder behavior on the Auction.com platform.

The analysis was based on data from more than 38,000 bank-owned (REO) homes sold between Q1 2018 and Q3 2019 on Auction.com, which has 5.2 million registered users who are potential bidders. Sold properties were considered to have multiple competing bids when at least two bidders bid on the same property during the same auction event. Over the course of multiple auction events, 93 percent of properties received bids from multiple bidders during the quarter.

The analysis also showed an average 6.3 unique bidders and an average of 24.0 bids for each REO sold on the Auction.com platform in Q3 2019 — up from an average 6.2 bidders and 23.7 bids per REO sold in the third quarter of 2018.

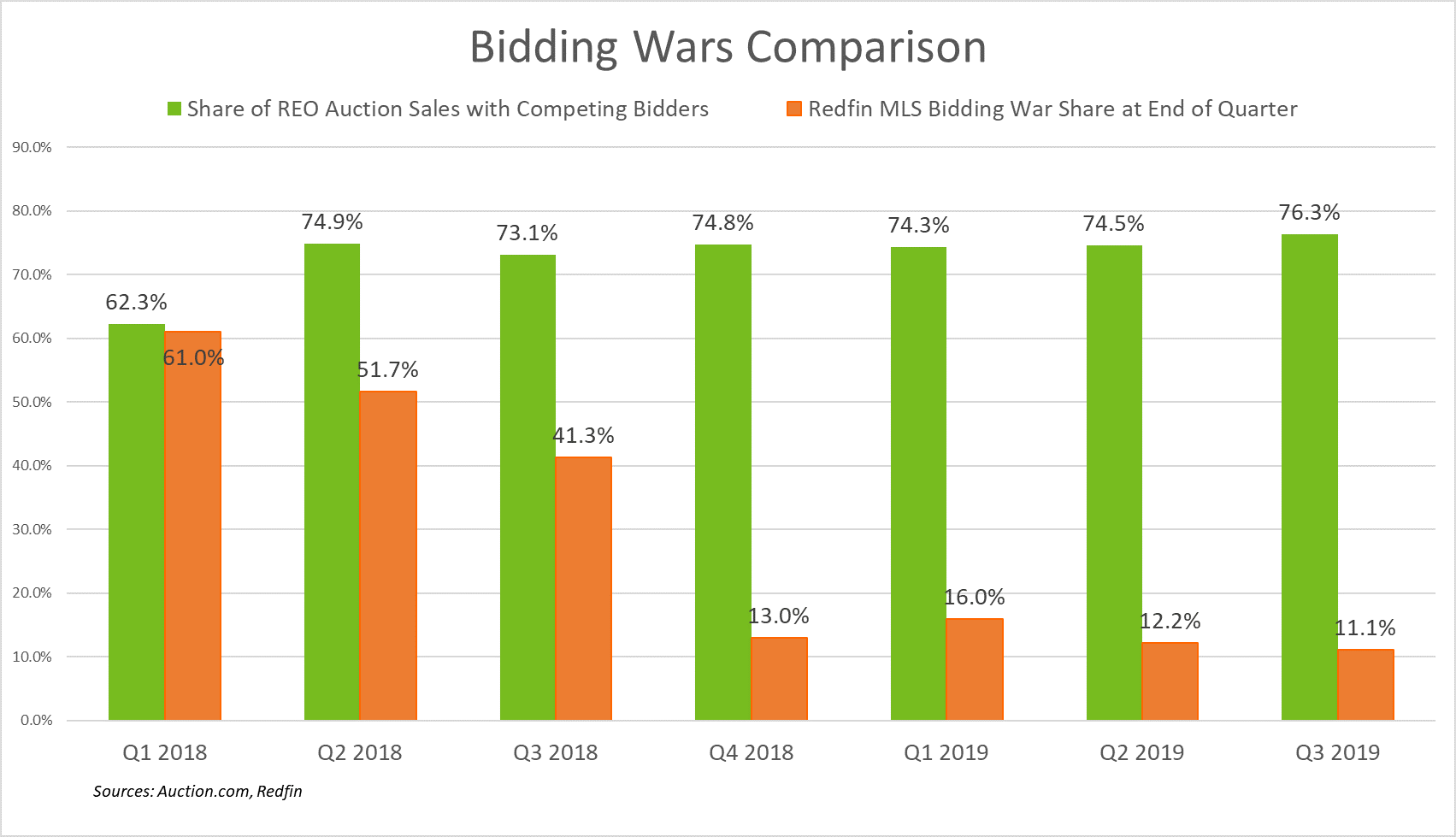

The 76.3 percent competing-bidder share for REO auction sales stands in stark contrast to multiple-offer activity in the retail housing market. Just 11.1 percent of offers submitted by Redfin agents faced competing offers from other prospective buyers in September — up from an eight-year low of 10.4 percent in August but still down from 41.3 percent a year earlier, according to the real estate brokerage.

Recession fears contributed to the drop in the so-called “bidding wars” for retail homes listed on the Multiple Listing Service (MLS), according to Redfin Chief Economist Daryl Fairweather as quoted in the company’s August bidding war report.

“Despite remaining near three-year lows, mortgage rates have failed to bring enough buyers to the market to rev up competition for homes this summer,” the report quoted her as saying. “Recession fears have been enough to spook some would-be buyers from making the big financial commitment of a home purchase.”

But those recession fears have not decreased bidding competition for bank-owned properties sold via online auction. In fact, just the opposite: the 76 percent share of Auction.com online REO auctions with competing bidders in Q3 2019 was up from 75 percent in Q2 2019 and up from 73 percent in Q3 2018 to the highest level in the last seven quarters analyzed.

“The Auction.com platform is the go-to source for distressed housing inventory that typically can’t be found anywhere else. When combined with our robust marketing efforts, that inventory consistently attracts multiple competing bids,” said Ali Haralson, chief business development officer at Auction.com. “Those multiple competing bids deliver optimal prices for our sellers, who in turn continue to deliver more inventory based on our proven performance.”

Florida REO auction sales drew the highest share of competing bidders among all states in the third quarter with 91.4 percent, followed by Colorado (91.3 percent), Nevada (90.9 percent), California (89.9 percent), and Washington (86.5 percent). Puerto Rico also posted a high share of competing bidders with 88.1 percent).

“There is a good balance of opportunity on Auction.com,” said Ty Stanley, a real estate investor who operates Real Home Solutions Ltd. Co., buying properties in Florida. “If anything I get outbid by others. … Trying to find something affordable is pretty tough, in good areas. If there is something that pops up affordable it’s going to go pretty fast.”

The share of REO auctions with competing bidders in Q3 2019 was 100 percent in four of 90 major metro areas analyzed: Naples, Florida; Sacramento, California; Sarasota-Bradenton, Florida; and Tallahassee, Florida. Rounding out the top five with the highest share of competitive bidders in Q3 2019 were Orlando, Florida (97.2 percent); and Atlanta, Georgia (97.1 percent).