Average price per square foot for REO auctions above pre-pandemic and year-ago levels

Demand for distressed residential properties dipped slightly in March but quickly rebounded in April and May to above pre-pandemic levels, according to proprietary data from Auction.com.

“I’ve been buying and buying and buying,” said one Auction.com buyer in a May 21 phone interview. “I’m probably doing more than I did last year, and I had a big year last year.”

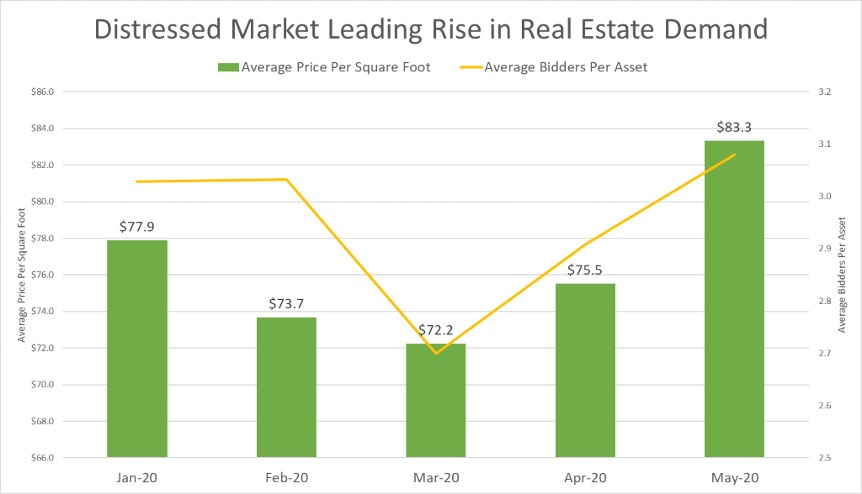

Data from the Auction.com marketplace, which accounts for 74 percent of online bank-owned (REO) auction inventory, shows that both the average number of bidders per property and the share of properties with multiple bidders in May exceeded pre-pandemic levels reached in January and February. That strong buyer demand has translated into rapidly rebounding prices and price execution.

Buoyant Buyer Demand

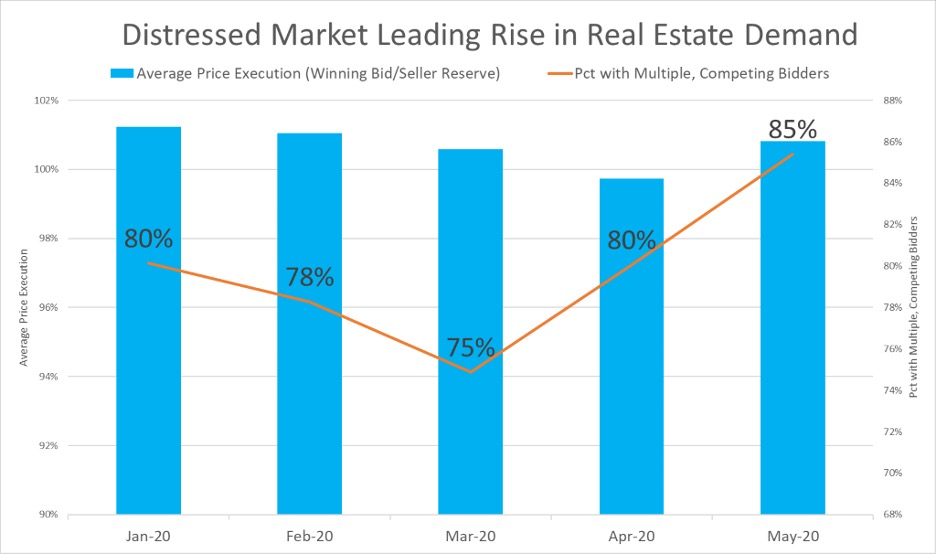

The Auction.com data shows 85 percent of all REO auctions sold in May had multiple, competing bidders, up from 80 percent in April to a new year-to-date high. The share of REOs sold with multiple, competing bidders also exceeded year-ago levels in every month so far in 2020 except for March.

Meanwhile, the average number of bidders per REO sold on the online auction platform has exceeded year-ago levels in every month so far in 2020, including March, increasing to a year-to-date high in May.

The retail housing market has also experienced a recent increase in multiple-offer situations, although the share of properties with multiple, competing offers in the retail market is still well below the level in the distressed property marketplace. Data from Redfin shows that 49.4 percent of offers made by Redfin agents on the Multiple Listing Service (MLS) nationwide faced competition in May, up from 43.9 percent in April. Redfin offers facing competition dropped to a 10-year low of just 9 percent nationwide in December 2019, even while 75 percent of REO properties sold on the Auction.com platform had multiple, competing bidders.

Rapidly Rising Prices

Strong buyer demand for distressed properties during the pandemic has placed upward pressure on sales prices and price execution relative to the seller reserve.

REO properties purchased on the Auction.com platform in May sold for an average $83.30 per square foot, up from the previous month to a new year-to-date high. The $83.3 average price per square foot was also up 8 percent from a year ago. By comparison, retail home prices appreciated just 2 percent in May 2020 compared to a year ago, according to the National Association of Realtors.

After dipping slightly below 100 percent in April, average price execution for REOs sold on the Auction.com platform quickly bounced back above 100 percent in May. Price execution represents the sales price as a percentage of the reserve set by the seller in the auction environment. Even with the slight drop in April, average price execution has stayed above year-ago levels for every month so far in 2020.

Hottest Markets for Distressed Demand

Nine of the top 10 metro areas with the highest price execution for REOs sold in May were located in Florida or Ohio, according to the Auction.com data.

Leading the way was the Melbourne-Titusville-Palm Bay metro area in Florida with an average price execution of 118.9 percent, followed by Dayton, Ohio (105.7 percent) and West Palm Beach, Florida (105.4 percent).

The only metro area outside of Florida and Ohio with a top 10 price execution in May was Portland-Salem, Oregon, with an average price execution of 103.3 percent for the month.

The Portland-Salem metro area also ranked second highest in terms of average price per square foot for REO auctions sold in May, at $153.4. The Los Angeles-Riverside-Orange County metro area in Southern California ranked first for average price per square foot in May, at $166.0.