iBuyer Retreat and Shrinking Home Flip Profits Highlight Elevated REO Holding Risk

Major iBuyers Zillow, Redfin, Opendoor and Offerpad all recently halted property acquisitions as a result of the coronavirus pandemic, a move that highlights the quickly escalating risk involved with holding foreclosed properties as REO (real estate owned) with the goal of rehabbing and reselling on the retail market.

“With whole cities shutting down nearly all commerce, no one can say what a fair price is right now, so we’re not making any instant offers,” said Redfin CEO Glenn Kelman in a Marketwatch article that went on to note that the iBuyers are scrambling to sell off their existing inventory. “Beyond the costs of keeping those homes on these companies’ balance sheets, which could produce significant losses, there’s also the risk that they will see smaller returns when they go to sell those properties in the future if home prices drop.”

Although iBuyers take issue with being labeled home flippers, the business model is in effect an updated, technology-enabled variant of home flipping. iBuyers acquire homes by making direct, all-cash offer to homeowners, usually before a property is listed for sale on the Multiple Listing Service (MLS). After some rehab, iBuyers then resell the homes on the market within months of the purchase date at a higher price point.

Shrinking Home Flipping Profits

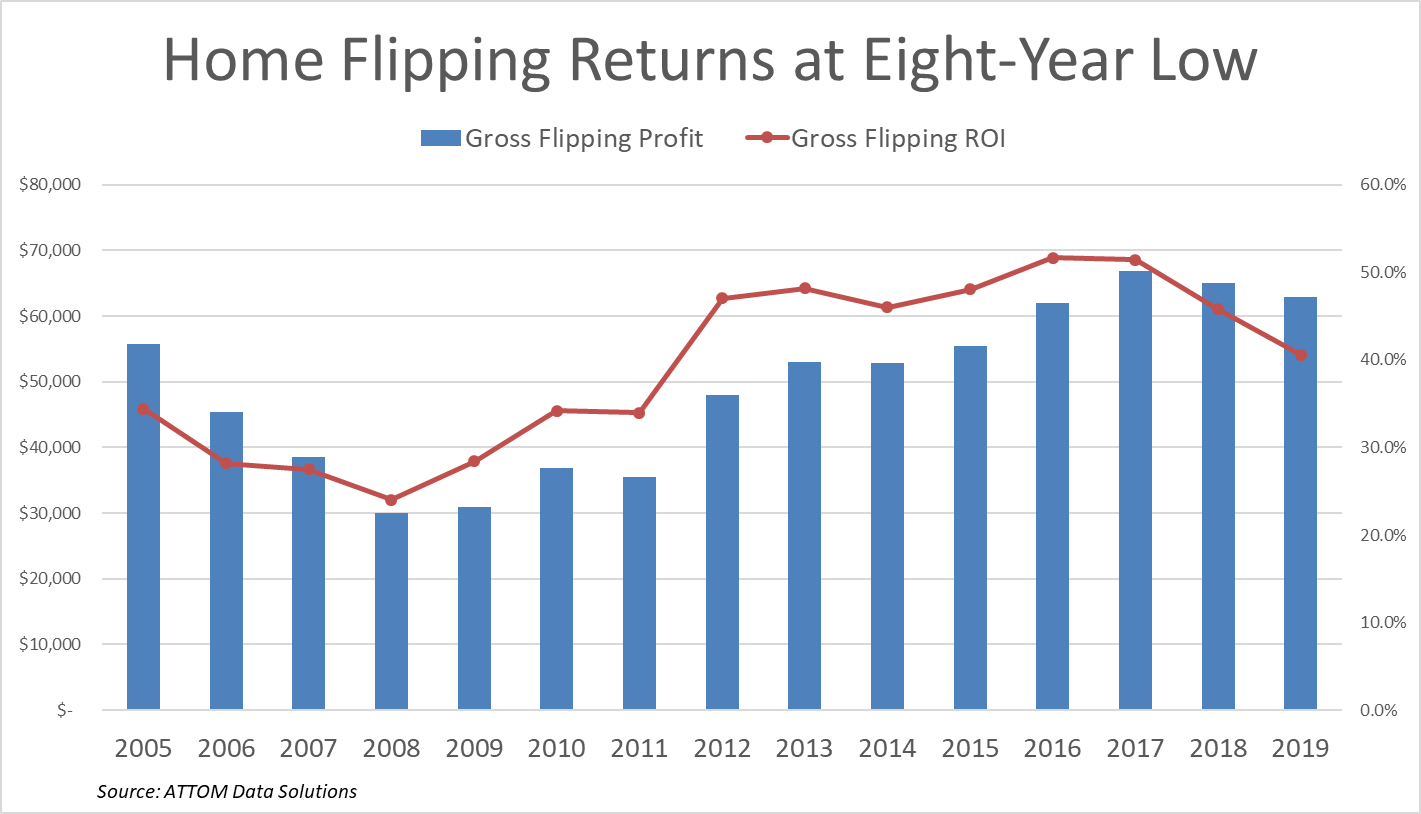

Even before the coronavirus crisis, home flipping was becoming increasingly risky, with average returns dropping to at an eight-year low in 2019, according to ATTOM Data Solutions. That trend alone provides evidence that mortgage servicers are often better off allowing local investors to shoulder the risk of responsibly returning distressed properties to the retail market.

U.S. homes flipped in 2019 — sold for the second time in a 12-month period — were sold for an average of $62,900 more than the purchase price,. That average gross flipping profit represented a 40.6 percent average gross flipping return on investment — the lowest average gross flipping ROI since 2011. It’s important to note that those are gross profits and don’t include the rehab, holding and sales costs that come with a successful home flip.

“It’s not a pie in the sky if anyone is thinking that,” said one real estate investor operating in rural Washington Parish, Louisiana. The investor described one recent property that she and her husband purchased for $150,000. After rehab costs of $30,000 and holding costs for the 11 months it took to resell, the couple netted a $10,000 profit. “We live in a small town, and people just think you’re making a killing.”

Increased Investor Demand

Despite not “making a killing” with home flipping in the 50-mile radius in which they invest, the Louisiana investor said she and her husband have ramped up their real estate investing recently, rehabbing and reselling about five homes in the past year.

“Something you could be doing to improve your life while you were doing your main job,” she said of how she views the couple’s part-time real estate investing.

That’s a similar perspective to Alan Goodwin, who bought his first investment property in 2019.

“I am a flipper trying to add a more than 15 percent return to my retirement funds,” said Goodwin, adding that his first purchase was in the San Antonio metro area. He said he bought the 3-bed, 2-bath home for $170,000 and made a net profit of $16,000 after rehab, holding and closing costs when he resold it seven months later.

Goodwin and the Louisiana investor both fit the profile of most investors purchasing on the Auction.com platform — 73 percent said they purchased between one and five homes in 2019, according to the 2020 Auction.com Buyer Survey. And among that group who purchased between one and five properties, 65 percent said they expect their purchases to increase in 2020.

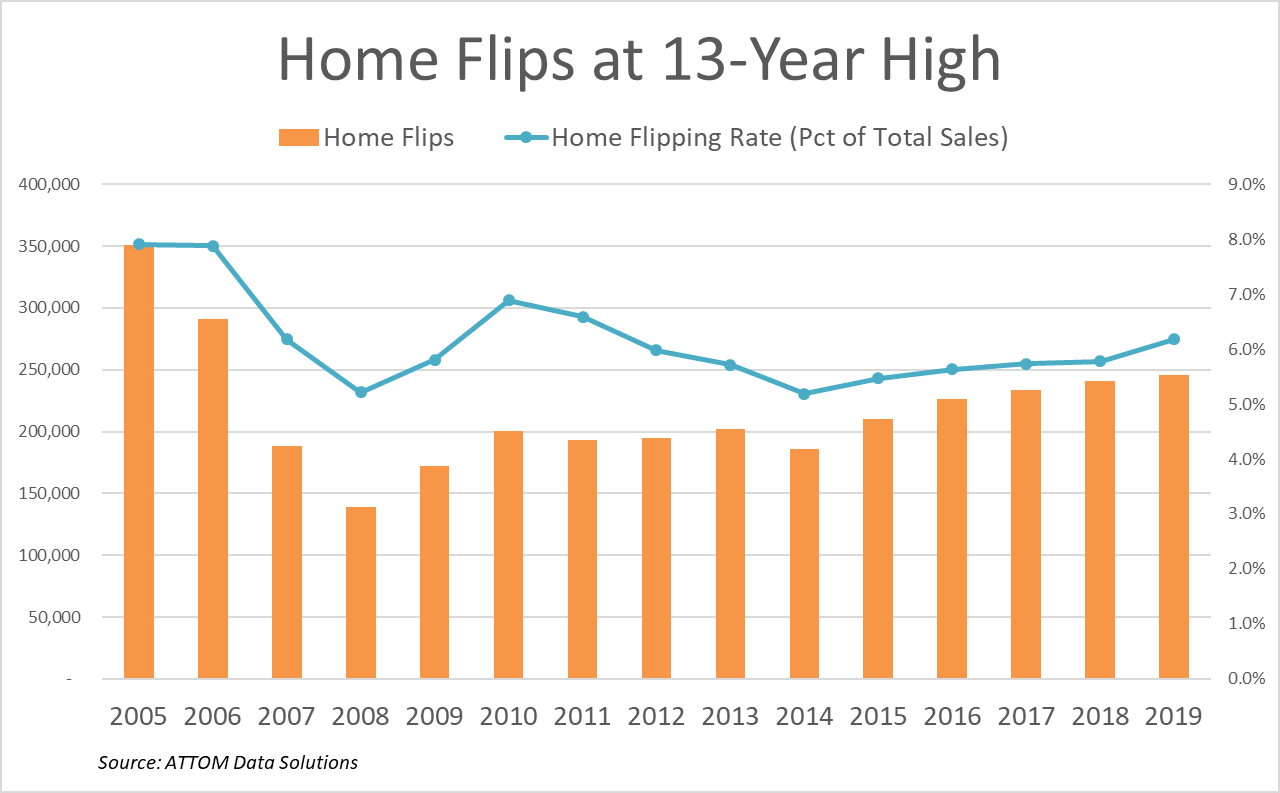

Shrinking profits didn’t deter investors nationwide from completing more flips in 2019, according to the ATTOM report, which shows that more than 245,000 homes across the country were flipped during the year — a 13-year high.

Better Price Execution at Auction

The combination of decreased home flipping profits and increased home flipping activity represents an opportunity for mortgage servicers to kill two birds with one stone by selling at foreclosure auction or online REO auction: avoid the additional risk of holding an REO property for an extended period; and realize better price execution due to still-strong demand from auction buyers.

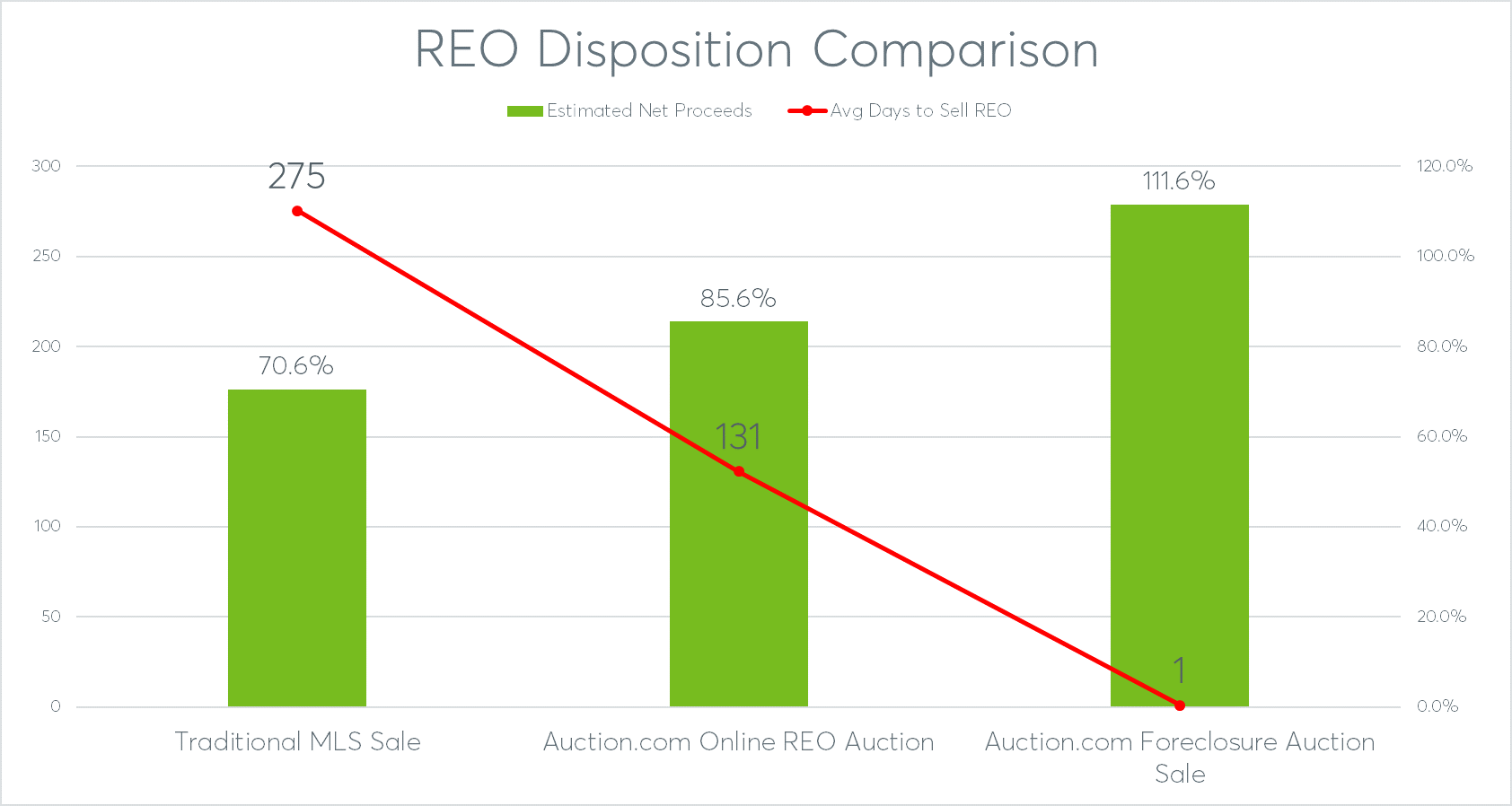

Properties sold to third-party buyers at foreclosure auction performed 41 points better in terms of net proceeds for the mortgage servicer and 274 days faster than did properties that reverted to REO and were subsequently sold on the Multiple Listing Service, according to an analysis of 165,000 properties brought to foreclosure auction on the Auction.com platform in 2018 and 2019. Conducted in Q1 2020, the analysis matched public record data and MLS data from Collateral Analytics to the Auction.com data to track subsequent sales of reverted REO properties.

Reverted REO properties that were sold via online auction performed 15 points better in terms of net proceeds while selling 144 days faster, according to the analysis.

Net proceeds were calculated by dividing the resale price of the property by the credit bid originally set by the servicer at the foreclosure auction and then subtracting estimated holding, rehab, sales and closing costs. Holding costs were estimated at 10 percent annually while sales and closing costs were estimated at 7.5 percent for MLS sales, 5 percent for foreclosure auction sales, and 1.5 percent for online REO auctions. Rehab costs were estimated at 10 percent annually, for MLS sales only.