Fewer price declines, but pace of appreciation still slowing in 59 percent of markets Bellwether coastal California markets still posting year-over-year home price declines.

Lower mortgage rates stopped the bleeding of home price declines in a handful of local housing markets in Q3 2019, but most markets continued to see a slowing rate of home price appreciation — an indication that lower rates alone will not save U.S. real estate from a widespread slowdown.

A new report from the National Association of Realtors shows that median home prices declined from a year ago in 12 U.S. metro in Q3 2019, down from 16 metro areas in the previous quarter and 25 metro areas in the first quarter of 2019.

But NAR chief economist Lawrence Yun cautioned that the lower mortgage rates alone will not fix the underlying root issue of affordability over the longer run.

“The housing market has been seeing reacceleration in home prices as more buyers want to take on lower interest rates in the midst of insufficient supply,” said Yun in the press release issued with the NAR report. “Unfortunately, income and wages are not rising as fast and will make it difficult to buy once rates rise.”

Coastal California Prices Still Falling

The inability of lower mortgage rates to assuage the intractable affordability issue absent of increased housing supply and wage growth is evident in the high-priced markets where median home prices continued to decline in the third quarter, even after the drop in mortgage rates: San Jose, California (down 4.6 percent), San Francisco, California (down 2.5 percent), and San Diego, California (down 0.8 percent).

Other markets with year-over-year decreases in the NAR report included Bridgeport, Connecticut (down 2.5 percent); Oklahoma City, Oklahoma (down 0.7 percent); Anaheim, California (down 0.5 percent); and Naples, Florida (down 0.2 percent).

The 12 metros with declining home prices in the NAR report represented 7 percent of all 178 metros analyzed in the report. A broader analysis of 314 U.S. metros using public record data from ATTOM Data Solutions shows 41 metro areas (13 percent) with year-over-year declines in home price appreciation in Q3 2019.

Rate of Appreciation Slows in 59 Percent of Markets

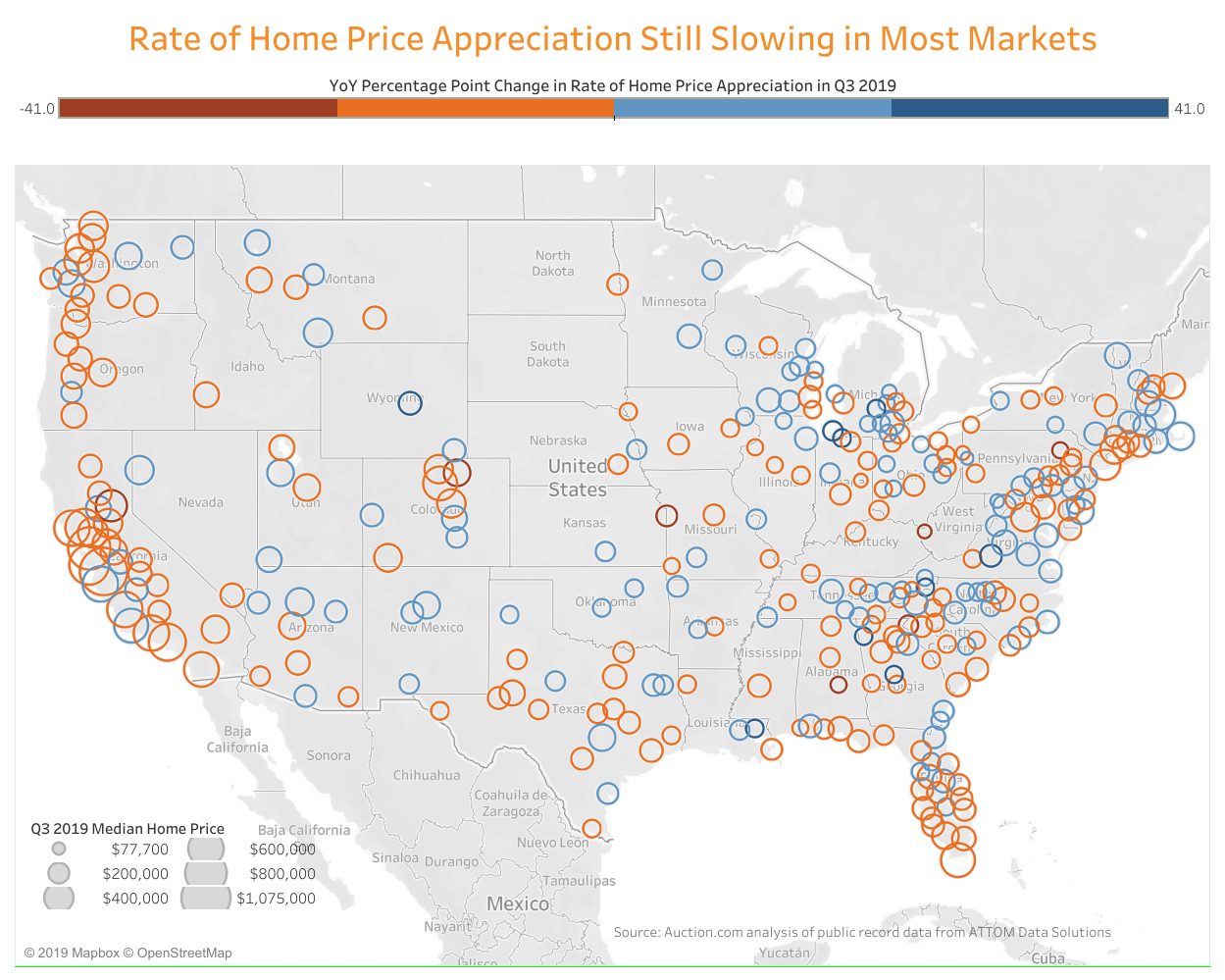

A more nuanced evaluation of home price appreciation in the 314 metros areas shows that the rate of appreciation decreased compared to a year ago in 186 metro areas (59 percent), including New York, Los Angeles, Dallas, Houston and Washington, D.C. Three of these five markets posted median home prices above $350,000 in the third quarter.

Other major markets where the pace of home price appreciation slowed in Q3 2019 compared to a year ago included Miami, Atlanta, Phoenix, Seattle and Denver.

Resort and Rural Market Declines

The 314-market analysis shows home price declines in many of the same larger markets as in the NAR report — San Jose, San Francisco, Bridgeport and Naples. But it also shows price declines in a broad spectrum of smaller markets, from higher-priced resort towns to lower-priced markets located in more rural states.

The higher-priced small-town markets posting year-over-year declines in home prices included several California cities — Santa Cruz, Napa, Santa Rosa, San Luis Obispo and Truckee — along with Lahaina, Hawaii, Key West, Florida, and Durango Colorado. Median home prices in all these markets were above $350,000 in the third quarter of 2019.

Lower-priced smaller markets in more rural states that posted year-over-year price declines included Huntington, West Virginia, Muncie, Indiana, Davenport, Iowa, Peoria, Illinois, and Montgomery, Alabama — all of which have populations below half a million and median home prices below $120,000.