Slowing Home Price Appreciation Dampening Foreclosure Prevention Efforts

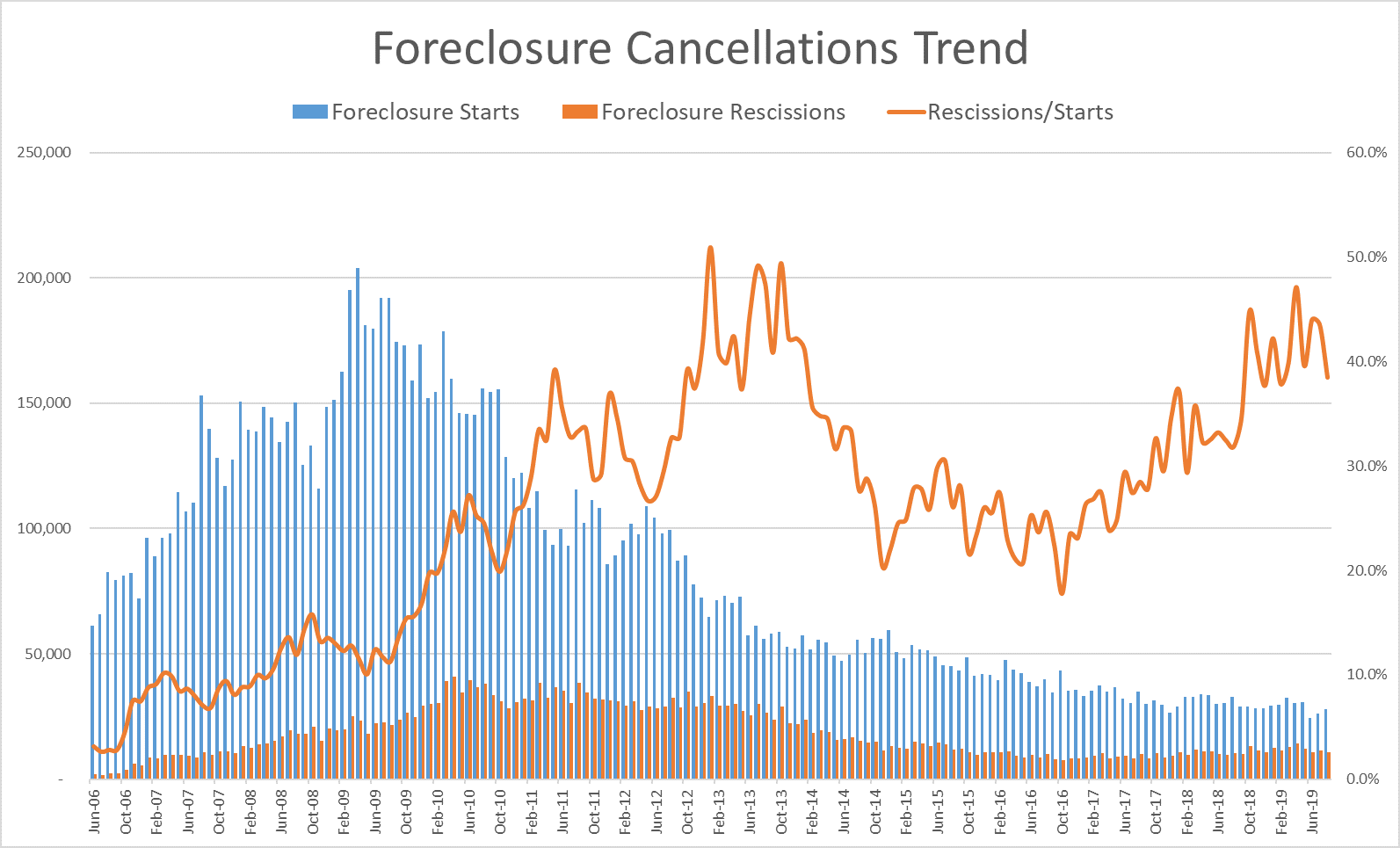

Lenders have been cancelling a growing share of foreclosure proceedings over the past three years, accelerating the pace at which the distressed market is shrinking.

Foreclosure rescission notices — documents publicly recorded when a lender discontinues foreclosure proceedings — were filed on 14,552 U.S. residential properties in April 2019, according to data from Quantarium. Those foreclosure rescissions were 47.7 percent of all foreclosure starts reported by ATTOM Data Solutions in August — a more than five-year high in terms of that percentage.

Home Equity Lifeline

It’s no longer distressed homeowners stuck in underwater legacy loans left over from last decade’s housing bubble driving the upward trend in foreclosure cancellations. Instead it’s more recent vintage loans with more equity that give distressed homeowners a better chance to stop the foreclosure process through loan modification or refinance.

According to the Q2 2019 Foreclosure Prevention Report from the Federal Housing Finance Administration (FHFA), the organization that oversees Fannie Mae and Freddie Mac, 80 percent of all FHFA loan modifications completed so far in 2019 have at least 20 percent equity. That’s up from 76 percent in 2018 and up from 58 percent in 2016, when the upward trend in foreclosure rescissions began. The same report shows that 51 percent of all FHFA loan modifications so far in 2019 were on loan vintages of 2009 or later, up from 47 percent in 2018 and 25 percent in 2016.

The increasing foreclosure cancellations trend has had a compounding effect on the distressed sales marketplace. While foreclosure starts in 2019 are on pace to decline 9 percent from the previous year, the total number of completed foreclosures is on pace to decline 20 percent, according to an analysis of ATTOM public record data by Auction.com, which accounts for close to 50 percent of all foreclosure auction sales.

Trend Reversing Course

The upward trend in rescissions has started to reverse course in the last four months following the 66-month high in April, indicating that a weakening housing market may be giving distressed homeowners fewer lifelines to help pull them out of foreclosure.

A total of 11,023 foreclosure rescission notices were recorded in August 2019, representing 39.5 percent of all foreclosure starts reported by ATTOM in the same month. The 39.5 percent is still well above the long-term average of one in five foreclosure starts being cancelled, but it is down 17 percent from the April 2019 peak.

Four months prior to that April 2019 peak in foreclosure cancellations, annual home price appreciation nationwide dropped to just 0.8 percent in December 2018 — the lowest level since when home prices were still declining in early 2012, according to an Auction.com analysis of public record data from ATTOM. The rate of home price appreciation has picked up nationally in the last few quarters, hitting 7.9 percent in Q3 2019.

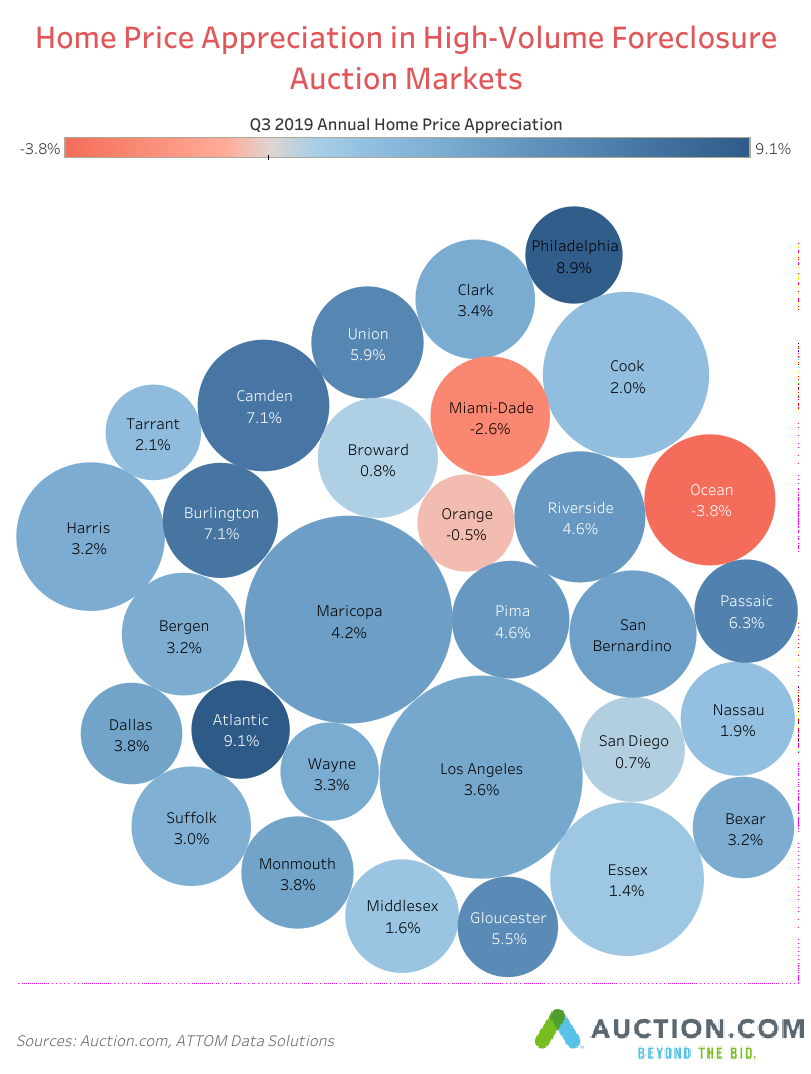

Slower Appreciation in High-Volume Markets

But the rate of home price appreciation is not picking up in some parts of the country, notably in some areas with the largest volume of properties being brought to foreclosure auction.

The top five states with the most scheduled foreclosure auctions on the Auction.com platform in Q3 2019 all posted annual home price appreciation below the national average of 7.9 percent for the quarter: New Jersey (2.6 percent annual home price appreciation), California (2.6 percent), Texas (2.1 percent), Florida (4.0 percent), and Arizona (5.1 percent).

Among the top 30 counties with the most scheduled foreclosure auctions in Q3 2019, only two posted annual home price appreciation above the national average: Atlantic County, New Jersey (up 9.1 percent); and Philadelphia County, Pennsylvania (up 8.9 percent).

Meanwhile, three of the top 30 counties with the most scheduled foreclosure auctions in Q3 2019 posted year-over-year declines in median home prices: Ocean County, New Jersey (down 3.8 percent); Miami-Dade County, Florida (down 2.6 percent); and Orange County, California (down 0.5 percent).

The slowing — and in some cases negative — pace of home price appreciation means slower or even negative growth in home equity. And that means fewer distressed homeowners will have a sufficient equity cushion to avoid foreclosure should they encounter a delinquency-triggering event.