Distressed Sellers Benefiting as Buyer Demand Remains Strong

Real estate investors chasing good deals are helping to bolster distressed home sales even in some markets that lost population due to migration in 2018.

“You’re always going to be able to buy cheap in cities that are declining in population,” said Jared Garfield, owner of ROI Turnkey, a company that buys, rehabs and resells rental-ready investment properties.

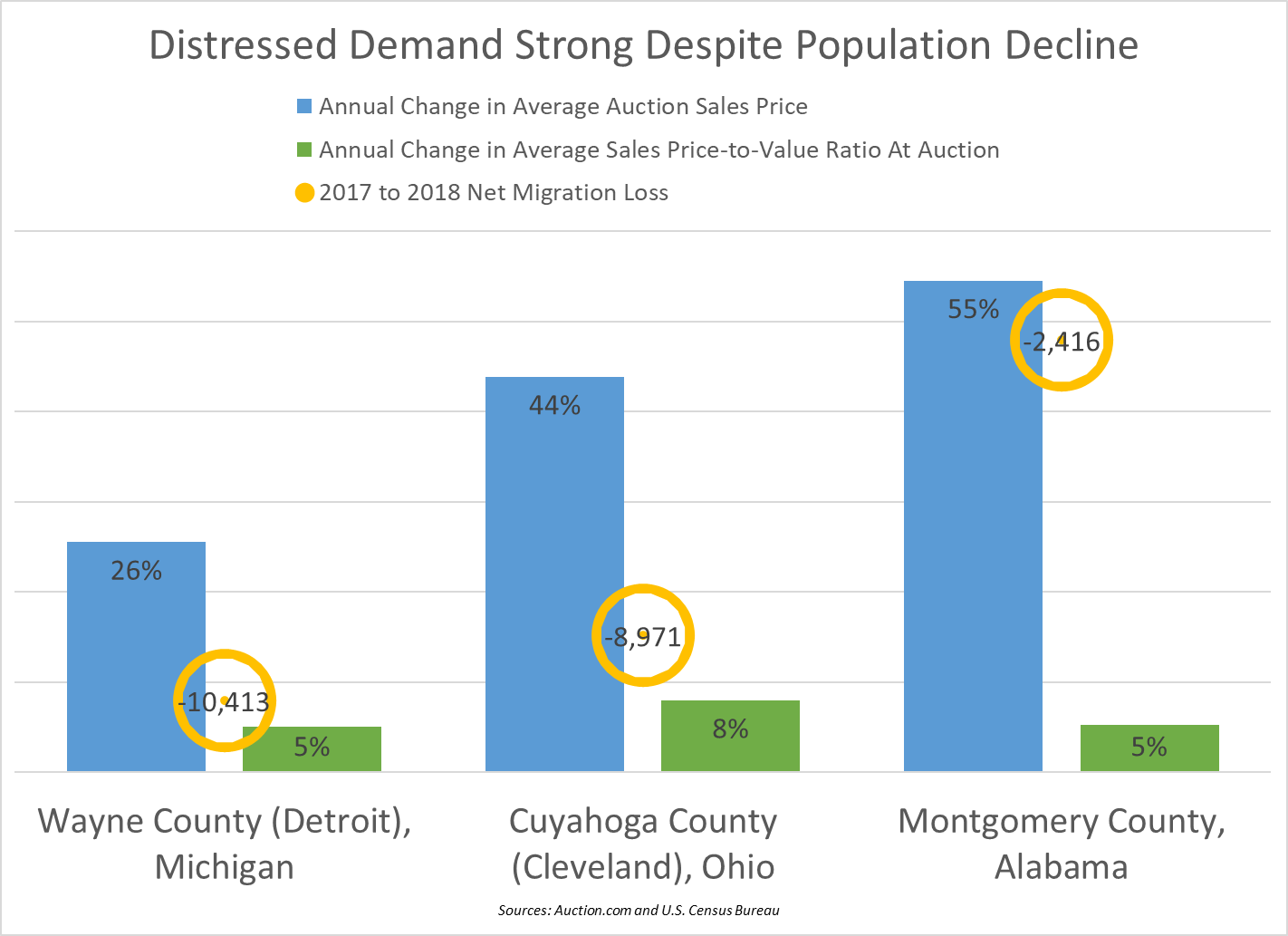

Garfield said some real estate investors are willing to buy in declining-population markets like Detroit, Cleveland and his home base of Montgomery, Alabama, because prices there are still low enough to generate potentially robust cash-flowing rental returns — at least on paper.

Distressed Sellers Benefiting

Investor interest in lower-priced markets is benefiting sellers of distressed properties in counties that are losing population, according to an Auction.com analysis of proprietary foreclosure auction sale data and recently released population data from the U.S. Census Bureau in 379 counties nationwide.

The Census data tracks population changes from 2017 to 2018, most pertinently changes caused by migration into or out of each county. The Auction.com analysis compared that net migration data to completed sales of nearly 65,000 properties at foreclosure auction in 2017 and 2018.

More Distressed Supply

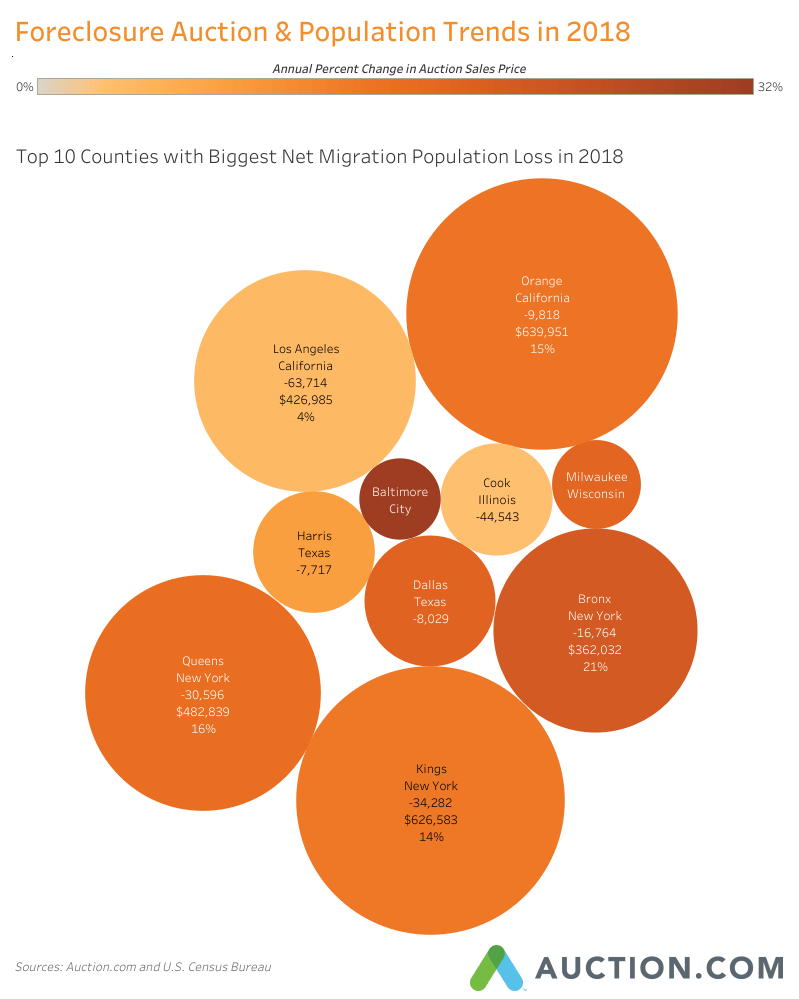

The analysis of Auction.com and Census data shows that the number of properties sold at foreclosure auction in 2018 increased an average of 34 percent compared to 2017 among the top 10 counties with the biggest population declines caused by net migration in 2018.

Nationwide the increase in foreclosure auction sales was just 2 percent, and in the top 10 counties with the biggest population increases caused by net migration, the number of foreclosure auction sales declined an average of 18 percent.

More Distressed Demand

The increased distressed supply is not placing downward pressure on average sale prices or sales price-to-value ratios, according to the Auction.com analysis. In the top 10 declining-population counties, the average sales price at foreclosure auction was up 15 percent in 2018 on average, compared to an average 9 percent increase in the top 10 population-gaining counties.

Meanwhile the ratio of sales price to estimated market value in the top 10 population-gaining counties was 84.4 percent on average compared to an 85.5 percent average ratio in the declining-population counties. That means distressed sellers were selling for closer to full market value in those areas losing population than in those areas gaining population, indicating stronger demand for distressed properties in top markets losing population.

These trends are evident in the local markets called out by Garfield: Detroit, Cleveland and Montgomery, Alabama (see chart below).

“We are still losing (population),” Garfield said of Montgomery. “I think if we’re honest with ourselves, most of our cash flow markets today face that. And you have to have a strategy to combat that.

“Investors can succeed in these markets that are losing population by looking for bright spots,” Garfield continued. “To find those bright spots, look for zip codes with gentrification, in-migration or new development.”

Chronic Supply Shortages

Not all counties losing population to migration in 2018 were down-and-out Rust Belt markets that have been losing population for decades — Detroit and Cleveland being prime examples. Some of the counties near the top of the list are relative newcomers to the declining-population trend: places like Los Angeles County and Orange County in California; the New York City boroughs of Brooklyn and Queens; and even the Texas counties of Dallas and Harris (Houston) — although in the case of the Texas counties, surrounding suburban counties are still seeing population increases due to net migration.

While places like Los Angeles and New York may be experiencing net migration losses, these markets still have a chronic undersupply of housing relative to demand, and that is helping to continue to push up home prices — particularly on lower-priced distressed properties. The average foreclosure auction sales price increased 14 percent in Brooklyn and was up 16 percent in Queens in 2018, according to the data from Auction.com. The average auction sales price in Los Angeles County only increased 4 percent, but auction prices were up 15 percent in nearby Orange County.

Declining Population Not Death Knell of Distressed Demand

This is all good news for foreclosure auction sellers because it shows that declining population is not the death knell of demand for distressed real estate — at least not yet. In both the lower-priced Rust Belt markets and higher-priced coastal markets with declining populations, demand for distress is increasing as evidenced by the above-average sales price increases along with the increases in average price-to-value ratios. Foreclosure auction sellers may be pleasantly surprised at the strength of demand they get for properties brought to auction in these markets in 2019.