Jumps in Local Rental Vacancy Rates Show Increasing Risk in Some Pockets of the Country

U.S. rental vacancy rates in Q1 2019 point to continued strength in the rental market for many areas of the country, with some important exceptions.

Nationwide, rental vacancy rates in the first quarter of 2019 were unchanged from a year ago, coming in at 7.0 percent in Q1 for the fourth consecutive year, according to the latest report from the Census Bureau. Rental vacancy rates were down from a year ago in 40 of 75 major metropolitan statistical areas analyzed in the report (53 percent).

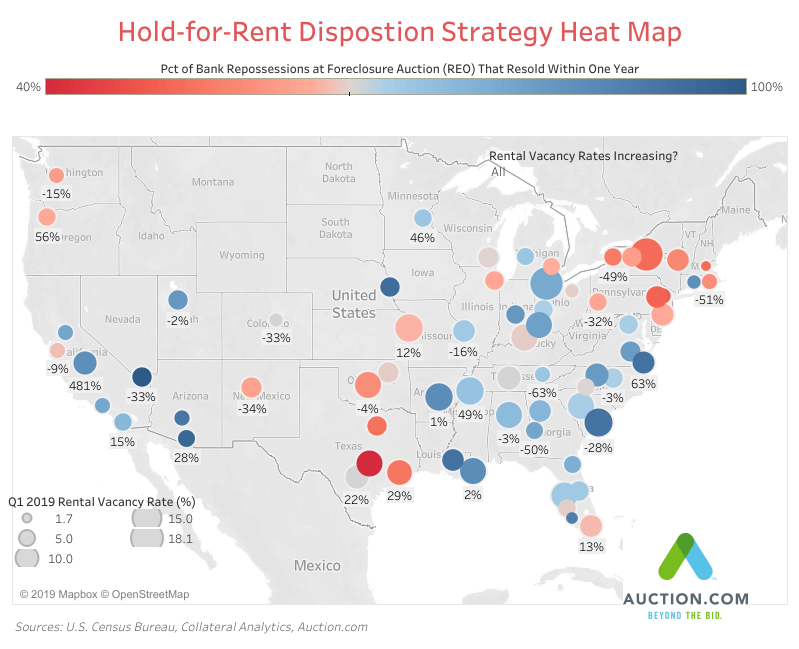

But sharp increases in rental vacancy rates in pockets of the country indicate the hold-for-rent distressed disposition strategy — in which mortgage servicers repossess, rehab and rent foreclosure properties — will carry elevated risk in some local markets.

Rental Vacancies Rising in the South

At the regional level, rental vacancy rates were down from a year ago in three of the four regions: Northeast (down 2 percent), Midwest (down 1 percent), and West (down 12 percent). The lone exception was in the South, long considered the sweet spot for the rental market given its growing population and more affordable housing.

Rental vacancy rates in the South region increased 5 percent from a year ago to 9.2 percent — the highest among the four regions and well above the national average. The relative affordability of housing in the South could be slowing the rental market there as more renters are able to successfully make the leap to homeownership. The South was the only region with a quarter-over-quarter increase in homeownership rates in Q1 2019, according to the same Census Bureau report.

Increases in Memphis, Austin, Tampa, Nashville, San Antonio

Southern metro areas with somewhat surprising year-over-year increases in rental vacancy rates in the first quarter included Memphis, Tennessee, the epicenter of the single family rental market over the last several years (up 49 percent); Austin, Texas, a darling of the economic and housing boom (up 41 percent); Tampa-St. Petersburg, Florida, another single family rental hotspot (up 19 percent); Nashville, Tennessee, another housing boom darling (up 7 percent); and San Antonio, Texas (up 22 percent).

And it’s not the law of small numbers at work creating the large percentage increases in these southern cities. All five of the aforementioned metros posted rental vacancy rates above the national average of 7.0 percent in the first quarter, led by Memphis at 13.0 percent, Austin at 12.3 percent, and Tampa-St. Petersburg at 11.8 percent.

Three of the five markets with the highest Q1 2019 rental vacancy rates among the 75 metro areas analyzed in the report were in the Midwest or Northeast — Toledo, Ohio (18.1 percent); Syracuse, New York (17.9 percent); and Kansas City, Missouri-Kansas (13.1 percent). But two of the top five were in the South region — Charleston, South Carolina (13.6 percent); and Little Rock, Arkansas (13.2 percent).

Hold-for-Rent Avoided in Higher-Risk Rental Markets

The majority of properties repossessed by lenders at foreclosure auction (REO) are selling within a year in most of the higher-risk rental markets, an indication that many lenders are veering away from the hold-for-rent disposition strategy in these markets.

Nationwide, 66 percent of REO properties are being resold within a year, according to an Auction.com analysis of more than 11,000 properties that reverted to lenders at foreclosure auction in the three months ending in February 2018.

Lenders had resold more than two-thirds of REO properties within a year in three of the five markets with the highest rental vacancy rates, with the two exceptions being Syracuse (51 percent of REOs resold within a year); and Kansas City (64 percent).

Other markets with above-average rental vacancy rates and below-average REO resale rates included Philadelphia, Miami, Houston, Albany, New York, and Allentown, Pennsylvania.

Spike in Rural Rental Vacancy Rate

Meanwhile rental vacancy rates outside of metropolitan areas shot up 25 percent from a year ago, according to the report. That stood in stark contrast to the trend in both urban and suburban areas, where rental vacancy rate were down 3 to 5 percent.

The rental vacancy rate in markets outside of metropolitan areas was 10.0 percent, above any other location category or region covered in the report. Rural markets typically aren’t coping with the twin challenges of low inventory and unaffordable home prices that are common in many other parts of the country, and that means less demand for rentals.

The hold-for-rent distressed disposition strategy will likely be tougher for mortgage servicers to execute in 2019 in rural markets as well as in metro areas with elevated rental vacancy rates. And some of the metro areas with higher hold-for-rent risk may be surprising given their previous status as rental market darlings — places such as Memphis, Austin, Tampa, and San Antonio.