Winning the Auction

If you are the highest bidder when an auction ends, here’s what to expect.

Note: We recommend gathering all of the required information before starting your contract because you will need to complete the form in one sitting. Download this printable checklist to be prepared.

Be prepared when you win the auction. Visit the REO WINNING BIDDER RESOURCE CENTER

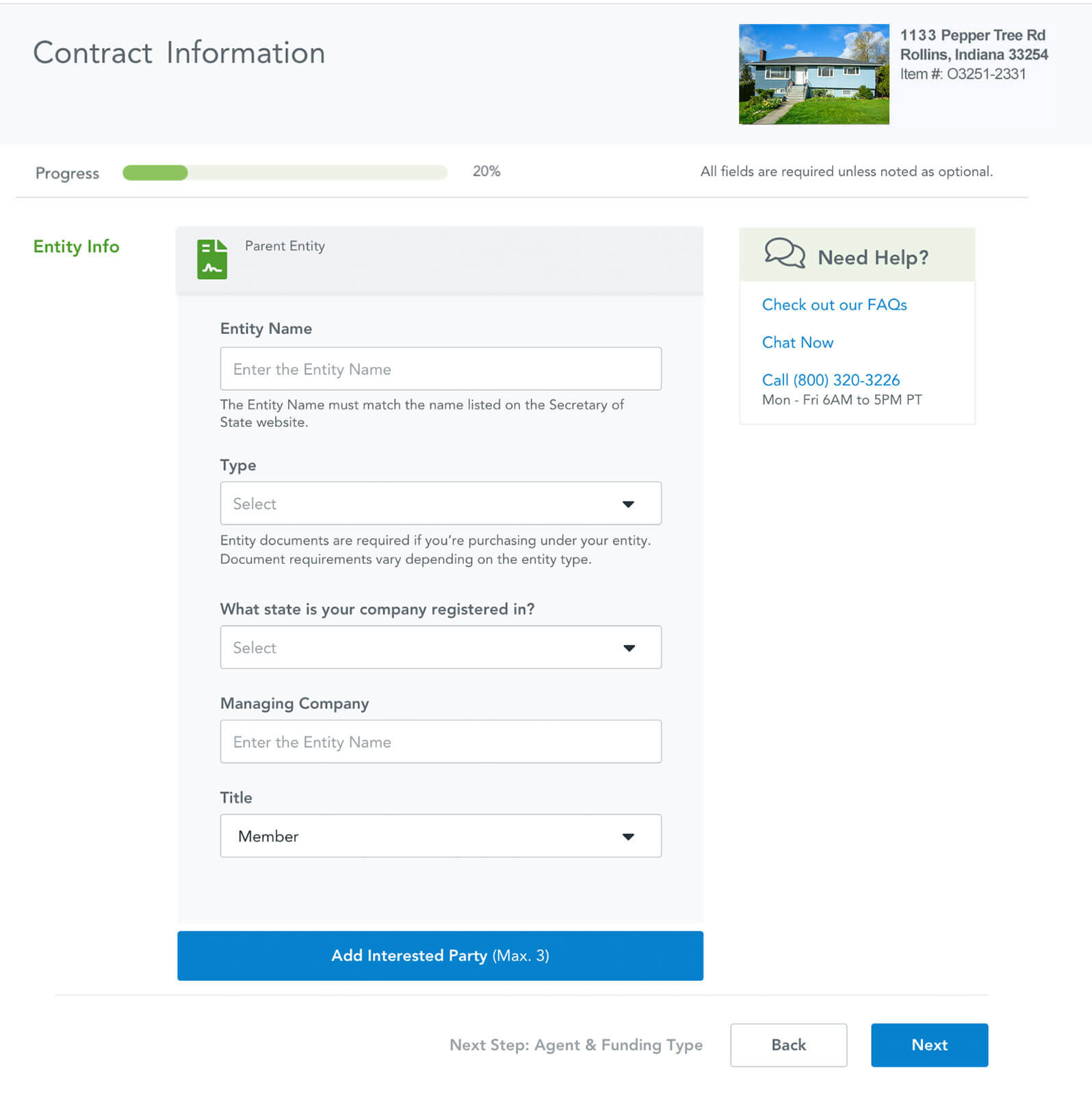

Submitting Contract Information

You will receive an email that confirms you have the highest bid. Then you will need to send us important information via a form on our site. To access this form, log in to Auction.com and click the Post Auction tab in your Dashboard. Then click on the blue “Details” button. Make sure to submit the form within 1 business day.

The information you submit via this form will be used to generate your contract, so please be sure it is correct.

Watch this video to learn how to submit your contract information.

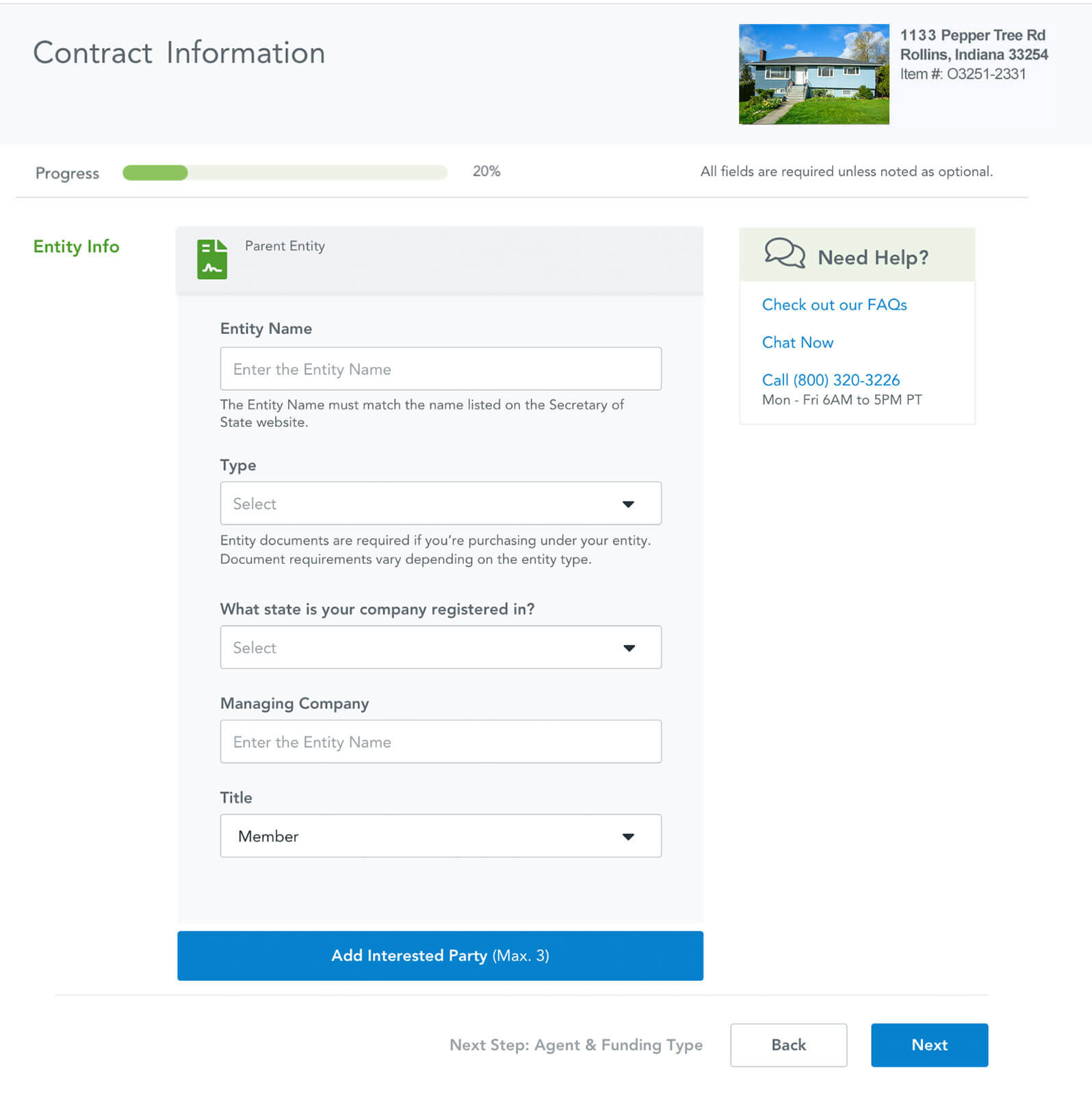

If you are purchasing as an entity (such as an LLC or

Trust), you will need to upload additional documentation to your dashboard. This varies depending on entity type, but may include items such as a Certificate of Good Standing from your state’s Secretary of State or a signed and notarized Declaration of Trust. Download our printable checklist to preview all information you’ll need to submit.

You can also add signers into the contract yourself, even if they are part of another entity. Complete this section in your Purchase Profile in advance, so when you win, you do not have to fill out this information again.

Next, you will submit agent information (if applicable) and choose your source of funding. There are many types of funding options, so be sure to learn more about funding types ahead of time.

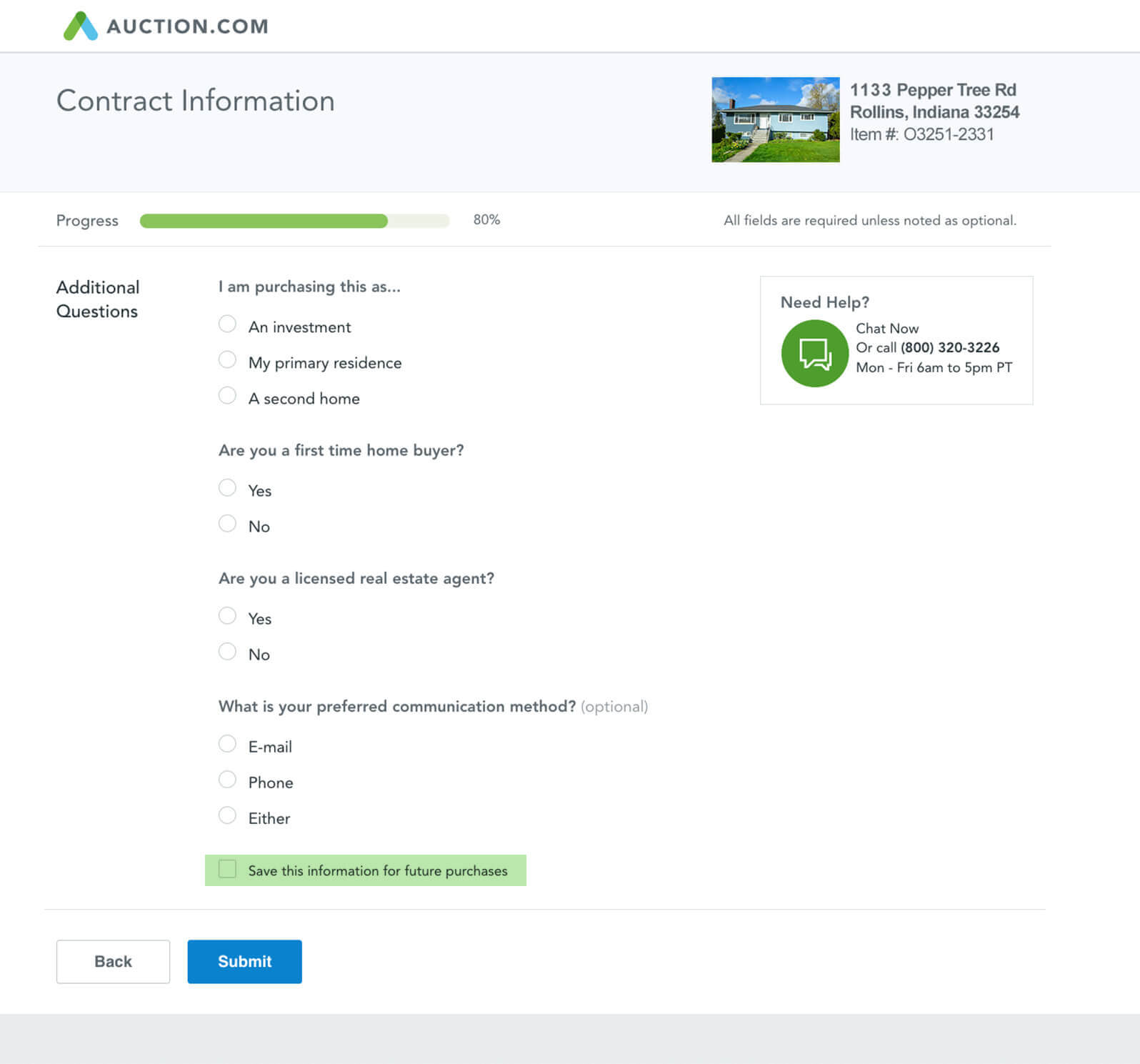

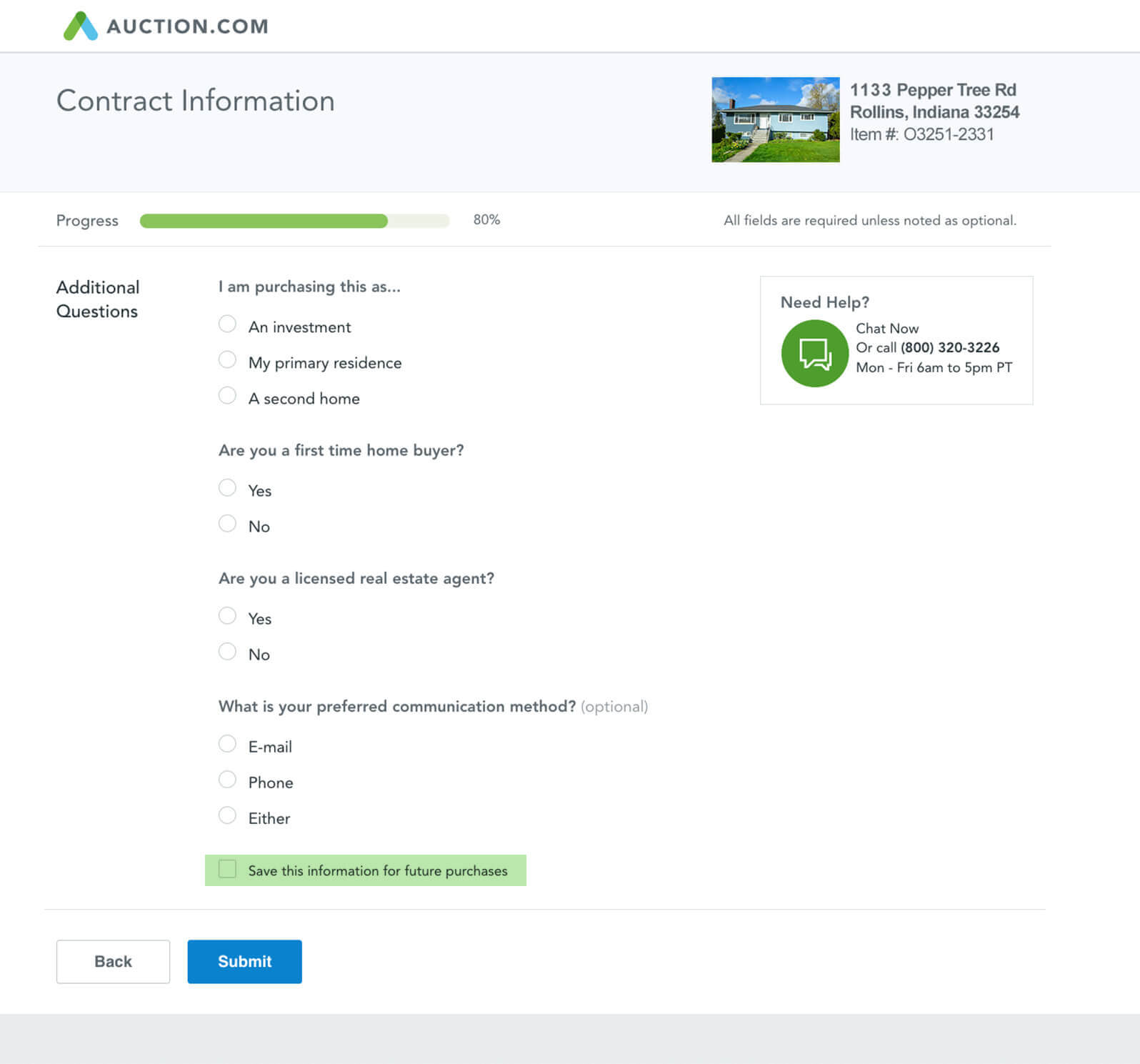

Purchase Profile

After the questions, there is a checkbox that will allow you to save this information as a

Purchase Profile so that you can use it again on future contract information forms.

You will then be asked to name the profile, which you should do in a way that will help you remember. For instance, if you’re buying the property with your 401K, you can name the profile “My 401K.” Your Purchase Profile can also be created ahead of time so that you can always have a smoother contracting experience.

You can access your Purchase Profile from the homepage. Just hover over the word “Dashboard” and scroll down to select the Purchase Profiles tab. Note: You will need to have an account and log-in to gain access.

You can create as many Purchase Profiles as you’d like and can also edit and delete them.

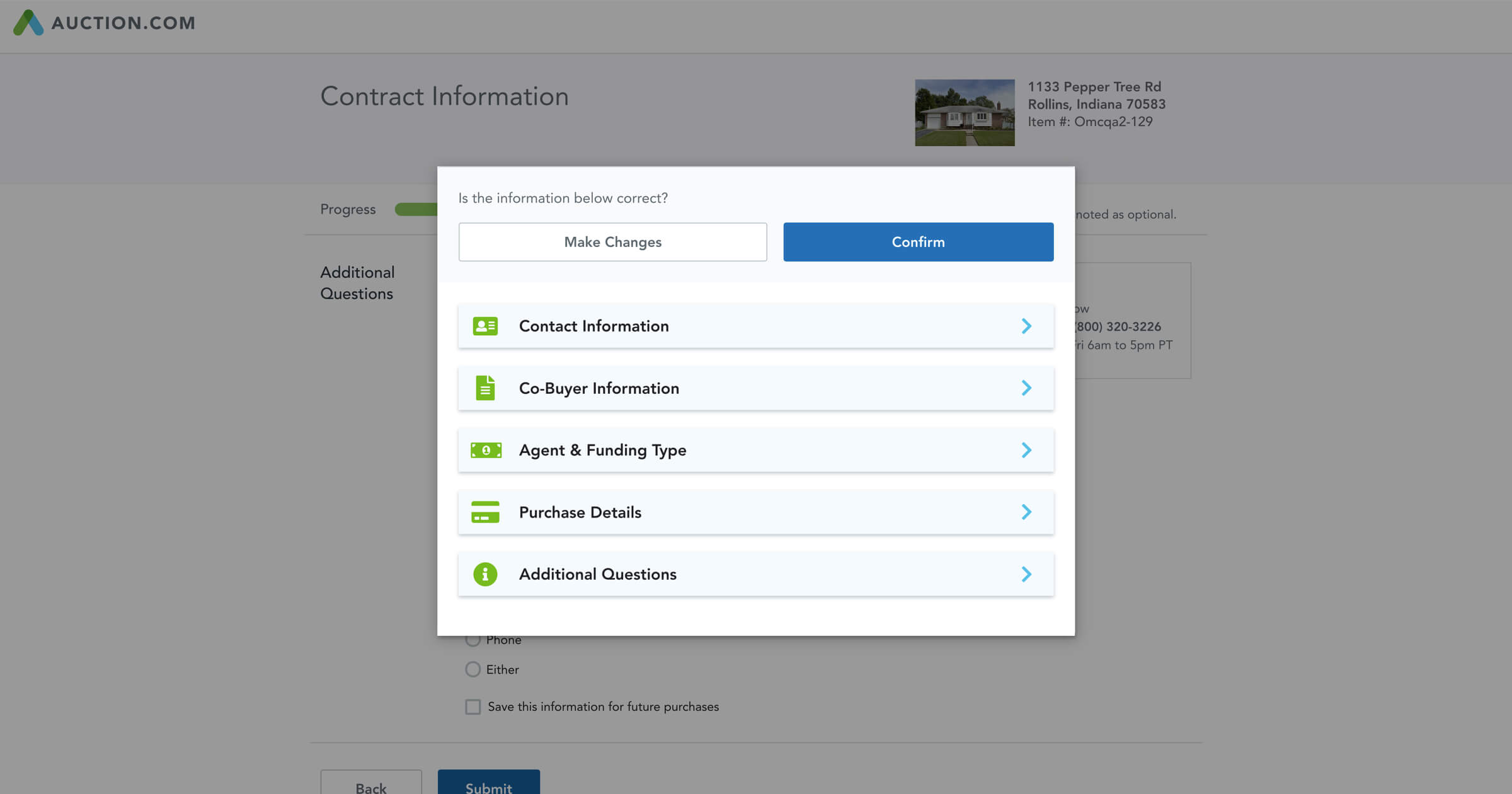

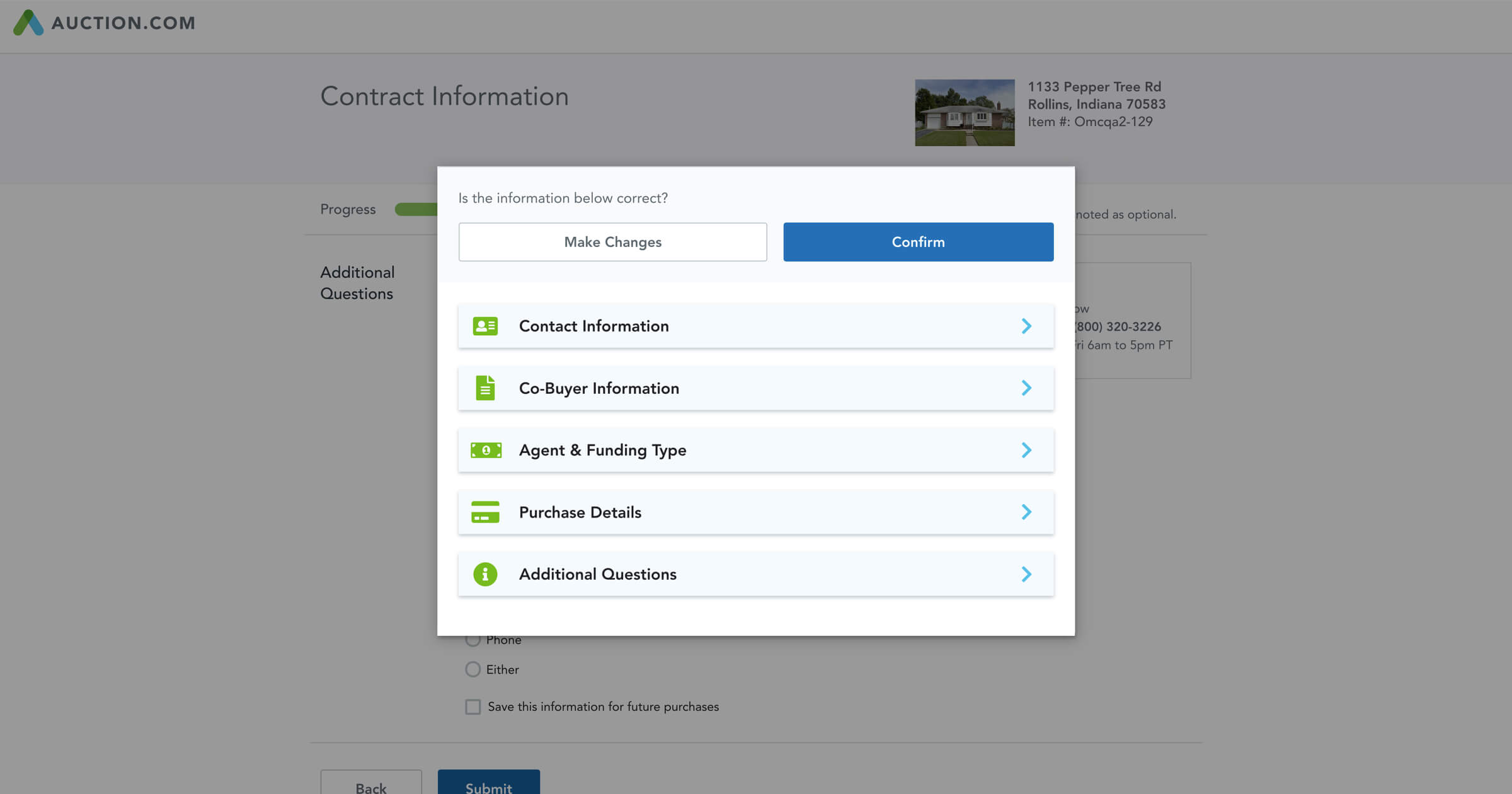

The summary page gives you the opportunity to expand and edit your contract information before you submit it.

Click “confirm” if your information is correct. Your contract will then be generated and sent to you electronically. You will need to sign your contract and return it within 1 business day to avoid cancellation.

Learn about the DocuSign paper process.

The “Thank You” page shows you the next steps in the closing process, so you’ll know what to expect.

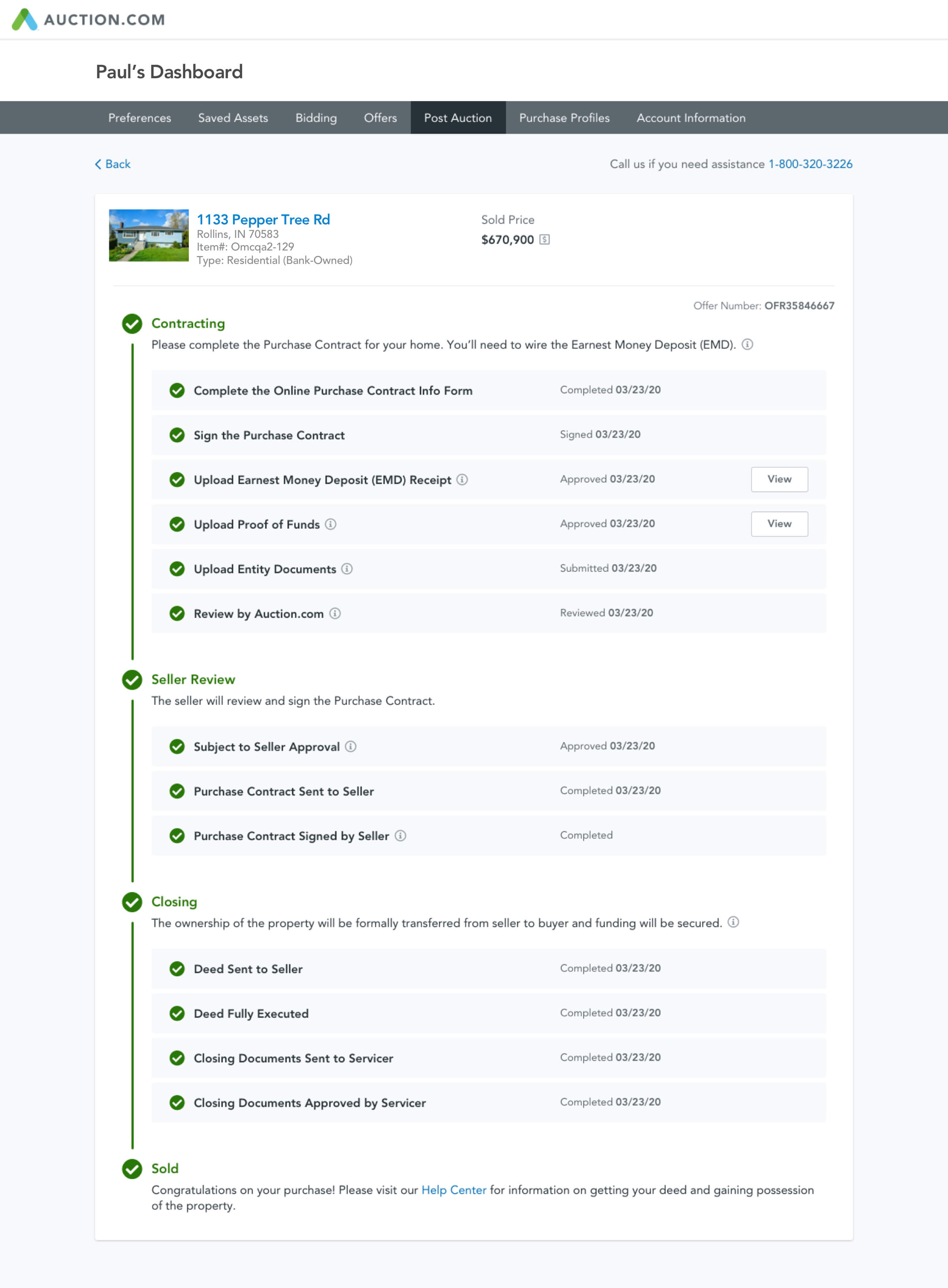

Post Auction Section

In the Post Auction section of your Dashboard, you can track your contracting and closing progress. Scroll through the section below to see an example of tasks required to close on a property. The Post Auction tab is where you will upload your contracting documents, track seller approvals and follow the closing process until the property is officially yours.

Upload Documents

In the Post Auction section, you can upload your Proof of Funds, Entity Documents (if applicable) and Earnest Money Deposit wire receipt after wiring the Earnest Money to the closing company.

Proof of Funds

You will need to upload a copy of your Proof of Funds into your dashboard within 1 business day of winning the auction before we send your contract to the seller for approval. Your Proof of Funds can be an electronic file of your recent bank or brokerage account statements, a line of credit or other documentation showing you have enough funds for the purchase.

Earnest Money Deposit

Wire your Earnest Money Deposit to the closing company within 1 business day of receiving your wire transfer instructions, unless otherwise specified in the contract. Be sure to upload your wire transfer receipt into your dashboard on the same day.

Entity Documents

If you are purchasing as an entity (such as an LLC or Trust), you will need to upload additional documents into your dashboard. Download our printable checklist to review all the information you may need to submit.

The Closing Process

With the contract signed, your next step is closing. The closing specialist brings all parties together by working with your agent (if applicable), the seller and closing company to ensure a smooth and efficient closing process.

All bank-owned properties bought at auction are “Subject to Seller Acceptance.” Every bank-owned property has a Reserve Price that is set by the seller, which is the minimum price a seller may be willing to accept. Please know that regardless of whether the buyer meets the Reserve Price or not, there is no guarantee that their bid will be accepted by the seller.

You’ll still need to complete your online contract form, purchase agreement, and submit your Proof of Funds and Earnest Money Deposit (if requested) while your bid is being reviewed by the seller.

If your bid is accepted, you’ll be right on schedule with your contracting process and your Earnest Money Deposit will be applied toward your purchase. If your bid is not accepted, your deposit will be returned.

The closing process typically takes 30 to 45 days from seller’s execution of the contract.

Buyer’s Premium

Some properties sold on Auction.com require a “Buyer’s Premium“, an amount that the winning bidder pays to Auction.com. The Buyer’s Premium is usually 5% of the winning bid or $2,500, whichever is greater and will be added to the winning bidder’s offer amount. (Note: A Buyer’s Premium is only required if you are the winner). You can also filter our site for properties without a Buyer’s Premium or check the property details section of the property page.

Earnest Money Deposit

The Earnest Money Deposit is a deposit that you put down on a property to let

the seller know that you are serious about buying it. The Earnest Money Deposit is required by

the seller – not Auction.com. It goes toward the final closing costs – it’s not an extra

charge. The deposit requirements are located at the bottom of the property details page under the transaction details section,

so make sure to check prior to bidding.

- The required amount is typically 5% of the total purchase price or $2,500 (whichever is greater).

- If you are the winning bidder, you can add your choice of closing company to your contract form.

- You will have 1 business day after the auction to submit your Earnest Money Deposit to the designated closing company, unless otherwise specified in your contract. Your Earnest Money Deposit is usually sent by wire transfer and you’ll need to upload a copy of the closing company’s receipt of funds in your dashboard on the same day for approval before we send your contract to the seller.

Proof of Funds

The winning bidder will need to provide Proof of Funds following the auction.

Proof of Funds will be required whether you are purchasing with cash or obtaining financing.

If you are obtaining financing, please provide your loan pre-approval letter. Proof of Funds

must be in the form of cash, cash equivalent or readily marketable securities listed on a

major exchange (New York Stock Exchange, NASDAQ) and must be available immediately without

restrictions. Some examples of acceptable Proof of Funds include:

- Recent bank statements

- Brokerage account statements (stocks, mutual funds, ETFs)

- Bank letters

- A line of credit that is ready to use

Types of Auction Funding

On Auction.com, our sellers choose which types of funding they allow for each individual

auction. For example, some auctions only accept cash as payment.

To know which forms of funding are approved, see the individual auction information or contact

our customer service team.

You may have the option to choose one of these types of funding when you submit information for

your contract after an auction:

- Cash: Where a buyer uses funds readily available to purchase. Note that

funds are sent to the closing office via a cashier’s check or wire rather than physical

cash.

- Conventional Loan: Traditional financing that is typically used for

residential home purchases. However, many distressed property sales do not accept

conventional loans as funding sources.

- FHA Loan: A special loan issued by federally qualified lenders that is

insured by the Federal Housing Administration (FHA). This is designed for low-to-moderate

income borrowers who are unable to pay a typical down payment. However, this type of

funding is not permitted in the majority of distressed property sales.

- VA Loan: Financing available to qualifying Veterans that is guaranteed by

the US Department of Veterans Affairs. The loan is issued by qualified lenders, but most

distressed property sales do not accept VA loans as acceptable funding.

- Other: All types of funding not listed above. This may include hard money

loans (financing obtained from a private business or individual used to purchase real

estate), lines of credit (where equity converted from an existing property is used to pay

for a second property), or retirement funds (such as a 401k or IRA).

Bidders should secure their source of financing before bidding on a property.

Closing Costs

You should estimate your Closing Costs before the auction starts so you can be

prepared in case you are the winning bidder. Your Closing Costs would typically include title,

settlement and county recording fees, along with any fees required by your local jurisdiction

and terms of your contract. If you are financing the property, you may have additional fees

associated with the loan.

Buy Under a Separate Entity

If you plan to buy property as a separate entity, here’s what you need to know.

You may purchase properties under different entity types. Please seek professional and/or legal

advice regarding which type of entity meets your business, tax and liability needs.

There are specific documents you must submit for each entity.

Below are links to the required documents for certain entity types:

- Limited Liability Company (LLC) – A limited liability company encompasses

the tax treatment of a partnership or sole proprietorship and the liability treatment of a

corporation. Please download the requirements document for this

entity.

- Incorporation (INC) – A corporation is an entity that is separate and

apart from its owners, and there are various types of corporations. Please download the requirements document for this

entity.

- Limited Partnership – A limited partnership (LP) consists of two or more

partners who operate the company jointly and each partner’s liability may be limited to

each partner’s level of investment. Please download the requirements document for this

entity.

- Trust – A trust is an entity that acts as a fiduciary that manages and

transfers property for the benefit of the beneficiaries. Please download the requirements document for this

entity.

- General Partnership– A general partnership is an arrangement consisting

of two or more people who agree to share in all assets, profits and financial and legal

liabilities of a business. Members must sign a Partnership Agreement. Please download the

requirements document

for this entity.

- Limited Liability Limited Partnership – Limited Liability Limited

Partnership consists of one or more general partners and one or more limited partners.

Typically, while the general partners manage the LLLP, the limited partners’ interest is

purely financial. Please download the requirements document for this

entity.

- 401K Plan – A 401k Plan is an employer-sponsored investment savings

account funded with post-tax money along with the employer’s contribution limits. Please

download the requirements document

for this entity.

- Pension Plan – A pension plan is a type of retirement plan in which an

employee adds money into a fund that is matched (or contributed to) by an employer based

on employee income and length of employment. Please download the requirements document for

this entity.

- IRA – An individual retirement account (IRA) is a form of individual

retirement plan that provides tax advantages for retirement savings. There are several

different types of IRAs, with each having its own tax implications and eligibility

requirements. Please download the requirements document for this

entity.

To buy property under separate entities, the following Auction.com documents

may be required. Check the links for requirements by entity type above for more details. *

To learn more, download the Residential

Entity Requirements document.

Questions? Contact our Customer Care team at (800) 320-3226.

* Some sellers may require additional information, so

check with your closing company.

Gaining Possession

Congratulations on your purchase!

Before you gain possession of a property, the property needs to be classified as closed by the designated closing company. The deed will also need to be transferred from the seller to you.

Either you or your own closing company, if applicable, will be responsible for getting the final HUD documentation and final payment wire confirmation to the closing company. Then the closing company will notify you when the property has been officially classified as closed. Only once this occurs, can you begin the process of gaining possession of your property.

Read below to find out what the next steps are:

If the property is occupied: If you’ve purchased a property that is occupied, it is important to understand your rights as well as those of the current occupant prior to attempting to gain access. Please consult with your attorney and review local and state guidelines for more information.

If the property is vacant: If you’ve closed on a vacant property with a lockbox code, we will send you an email with the code so you can access the keys. If there is no lockbox code but there is a listing agent assigned to the property, we recommend you check with the listing agent who may be able to provide you with the keys if available. If the agent does not have the keys or if there is no listing agent assigned to the property, you may want to contact a local locksmith to unlock and rekey your home. As the property owner it is also your right to remove any lockbox located at the property. To verify whether the property was assigned a listing agent, please check your buyer dashboard.