A small business owner in Ohio feeds a virtuous cycle of jobs, affordable housing and legal immigration by renovating distressed properties purchased at auction

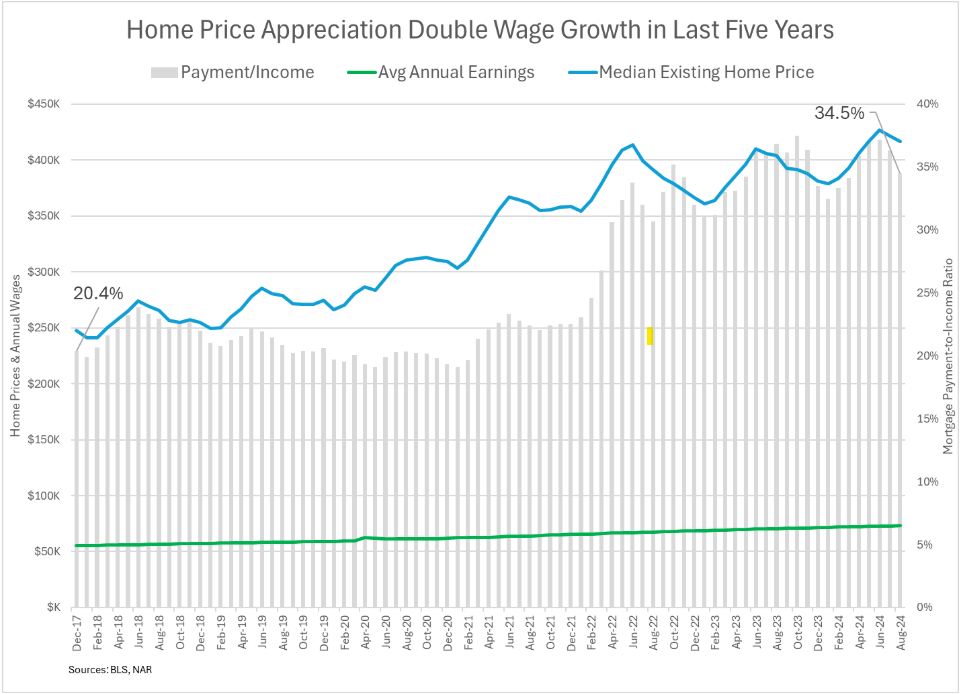

Home prices have shot up 49 percent over the past five years while average weekly wages are up just 25 percent over the same period, putting homeownership further out of reach for even average wage earners. For lower-income workers, homeownership can often seem completely out of reach.

“What we do is very hard labor. It’s hard work. We pay good wages, but you don’t make what an autoworker makes,” said Wilson Lewis, owner of a landscaping company in the Akron, Ohio, area who provides affordable workforce housing to his employees, several of whom are Mexican citizens in the country on work visas.

Providing affordable workforce housing helps Lewis attract and retain employees in a market where workers are hard to find, and it provides his Mexican employees with a path to citizenship and homeownership.

“When they come, we let them stay until they can get on their feet,” he said, referencing an employee named Antonio now living in one of three houses Lewis owns and rents out to his employees. “He pays us a minimal rent. He’ll stay there until he can get his own place. The next in line will be Roberto.”

‘Four for Four’ in Homeownership

Antonio and Roberto are the fifth and sixth employees who are on their way to citizenship and homeownership thanks to the affordable workforce housing provided by Lewis.

“We’re four for four,” he said, referring to four other employees who have already gone down this path. “The four guys we put through this system all own their own homes.”

Affordable, stable housing is foundational for this system, as Lewis describes it.

“(We) can sponsor them so they can get a green card so they can stay year-round. Then they can apply for the rest of their family to come. And then their families have a place to stay,” he said. “We are on our fifth guy that’s bringing a family. All of them are still working here. I don’t have anything over their head, but they are very loyal. … They appreciate the freedoms that we have, and the security that we have (in this country).”

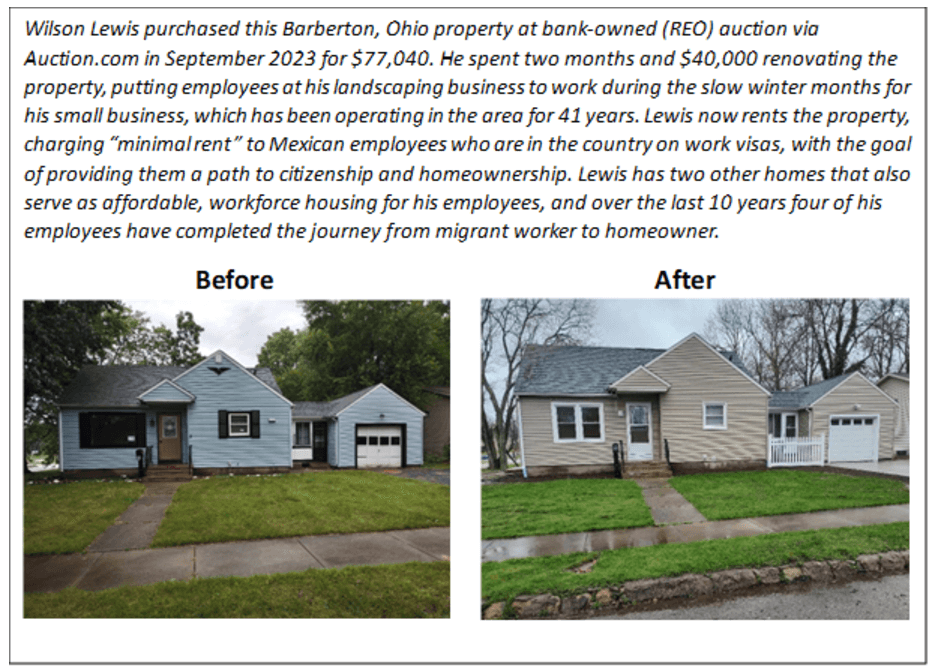

From Auction to All-Star

Lewis has been able to provide affordable workforce housing by purchasing distressed properties at auction. He purchases the properties at a discount below full after-repair value due to their distressed condition and then puts his employees to work renovating the properties during the slow winter months for his landscaping business. That allows him to complete cost-efficient but still high-quality property rehab while keeping his workers busy and employed throughout the entire year.

“We go above and beyond when we are renovating them,” he said, referencing his most recent purchase, a bank-owned property that he purchased via Auction.com. Lewis said the renovations on that property took two months and included new carpets, new appliances, new windows, new siding, along with the tearing out some trees and a back patio and retaining wall that were falling into disrepair.

“We turned it around and now it’s the shining star of the street. … The people in the neighborhood were absolutely thrilled,” he said, noting that the renovations cost $40,000 and would have been much higher if his employees weren’t doing the work. “If we weren’t doing the work ourselves, we would have probably put $120,000 into this property.”

Renovated but Affordable

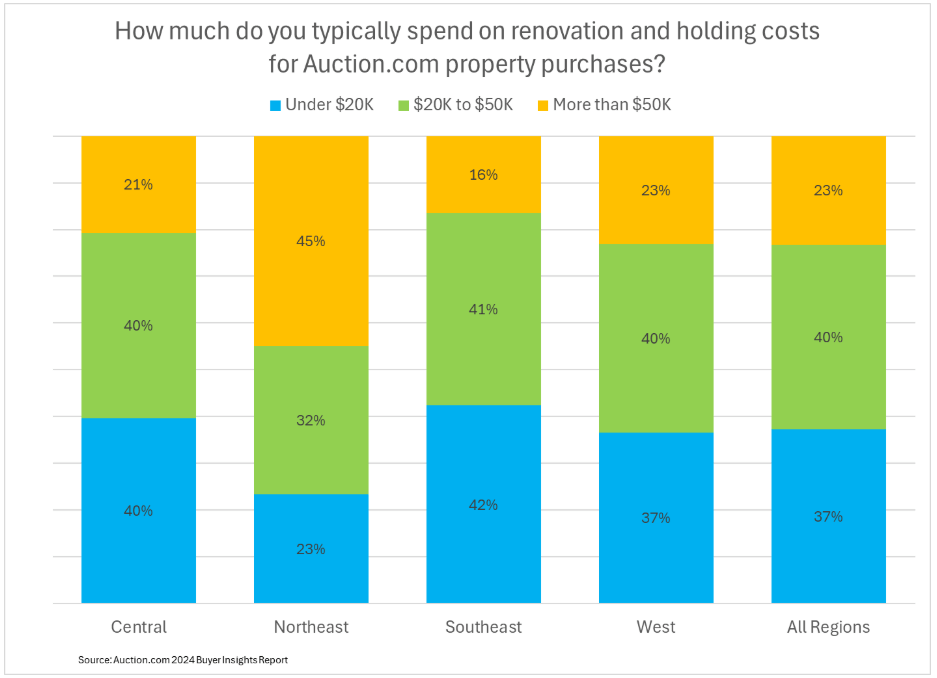

Such extensive renovations are not uncommon for buyers of distressed properties at auction, according to a survey of more than 400 Auction.com buyers in early 2024. Nearly two-thirds of the buyers surveyed (63 percent) said they typically spend more than $20,000 on renovations, and nearly one-fourth (23 percent) said they typically spend more than $50,000. The average sale price of REO properties sold on Auction.com in 2024 through September was $153,688.

Buyers were more likely to spend more on renovations in the Northeast, where Lewis is located, likely because of older housing stock compared to other regions of the country. More than three-fourths of buyers in the Northeast (77 percent) said they typically spend at least $20,000 on renovations, while 45% said they spend at least $50,000.

Despite the extensive renovations that most distressed property buyers like Lewis employ, the renovated properties they supply to the retail market as rentals or resales are still affordable, according to an analysis of more than 100,000 properties resold after being purchased on the Auction.com platform between 2018 and 2024.

The average resale price of renovated properties resold by Auction.com buyers was $282,960. That price required 26.7 percent of the median family income in the surrounding Census tract on average, assuming 5 percent down and a 30-year fixed-rate mortgage with the average interest rate at the time of purchase. The average monthly rent on renovated homes held as rentals was $1,613, representing 24.1 percent of the median family income in the surrounding Census tract on average.

One Big Happy Family

Like Lewis, most distressed property buyers are small business owners with several employees, according to the 2024 Auction.com buyer survey. More than half of buyers surveyed (51 percent) said their real estate investing supports between three and 10 jobs, and another 12 percent said their investing supports more than 10 jobs. Lewis said his landscaping business employs about 50 people, and he keeps them all working through the slower winter months with his property renovations.

“We don’t lay anyone off in the winter. They get paychecks 52 weeks a year,” he said. “We are just one big happy family. We take care of each other. They have committed to helping us and we have committed to helping them.”

Like Lewis, most Auction.com buyers are closely tied to the communities where they are buying and care about those communities. Nine in 10 buyers surveyed described themselves as local community developers (78 percent) or owner-occupant buyers (13 percent). More than 8 in 10 buyers (82 percent) said improving neighborhoods was one of their top three motivations for investing in real estate, the second highest behind building wealth (97 percent ranked as a top-three motivation). More than half of buyers (57 percent) ranked creating jobs as a top-three motivation, the third highest motivation.

“We’ve been in business for 41 years, and we’ve got six guys who have been here over 30 years,” Lewis said, explaining how his care for his community and employees is driving his desire to provide affordable housing that is still high quality. “We want to do absolute top-notch, no-stone-unturned work. We want them to have nice places that they are proud to be in.”