Affordability challenges, policy changes and remote bidding draw more owner-occupants to auctions

Birmingham, Alabama, real estate agent Karina Barone learned about buying distressed properties at auction seven years ago from a prospective homebuyer client.

“That’s how I learned about Auction.com, with my client next to me, speaking Spanish to her,” said Barone, a former ballerina originally from Argentina who works with many lower-income buyers looking to buy their first home. “That was my first transaction with Auction.”

The transaction allowed Barone’s client to build wealth through homeownership, and it opened a new source of leads for Barone’s burgeoning real estate business.

“You have to see what she did with that house,” said Barone, noting that the client and her husband did most of the renovation work themselves. “When she bought it, it was a $35,000 house. Now it’s worth about $180,000. … She still lives there after seven years.”

“After that, Auction.com was always on my radar,” Barone continued, recounting several similar stories of owner-occupant buyers for whom a distressed property auction represented an affordable entry point into homeownership.

“That makes me feel so good when people like her are trying to find a cheap house,” Barone said, referring to another client who purchased a distressed property at auction to live in. That deal came with no commission for Barone, but it produced a flood of referrals. “Out of this very sweet girl, I have 10 other transactions. Everything was started because I didn’t mind not making money in one of my first transactions with her.”

Appeal of Online Auctions

According to recent buyer survey data and sales data from Auction.com, Barone’s owner-occupant buyer stories are common.

A survey of more than 400 Auction.com buyers in January 2024 found that 13 percent of respondents described themselves as owner-occupant buyers, down slightly from 15 percent in a 2023 survey but up from just 8 percent in a 2022 survey.

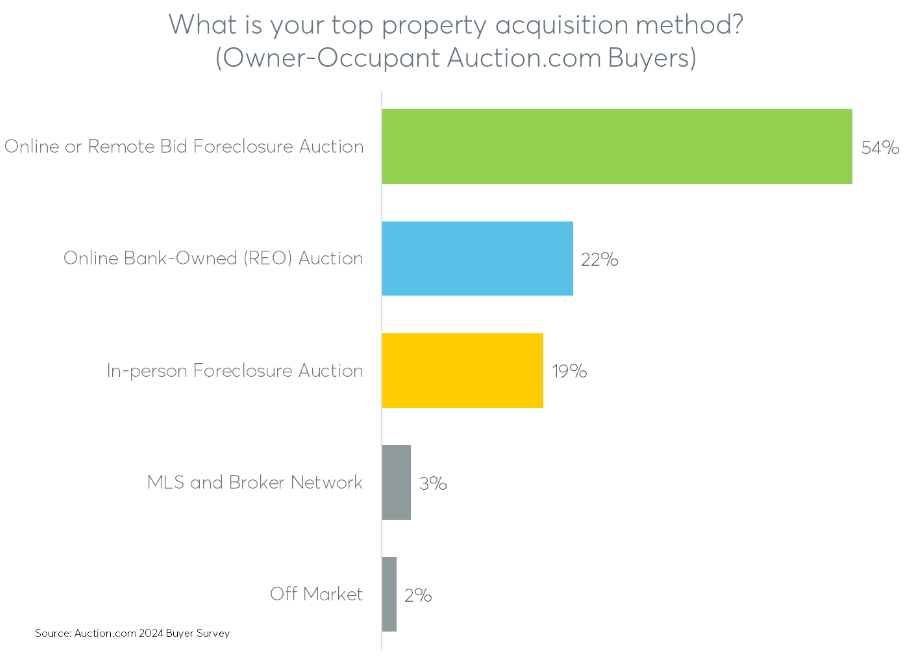

The owner-occupant share is even higher for bank-owned (REO) auctions, which are generally more accessible to owner-occupant buyers than the foreclosure auctions also conducted on Auction.com. That’s because the REO auctions are online, conducted over a period of days, and allow for a closing timeline that lasts approximately 30 to 45 days. In contrast, the foreclosure auctions are usually in-person at the county courthouse, are conducted in a few hours or even minutes, and often require full cash payment — typically in the form of cashier’s checks — on the spot for the winning bidder.

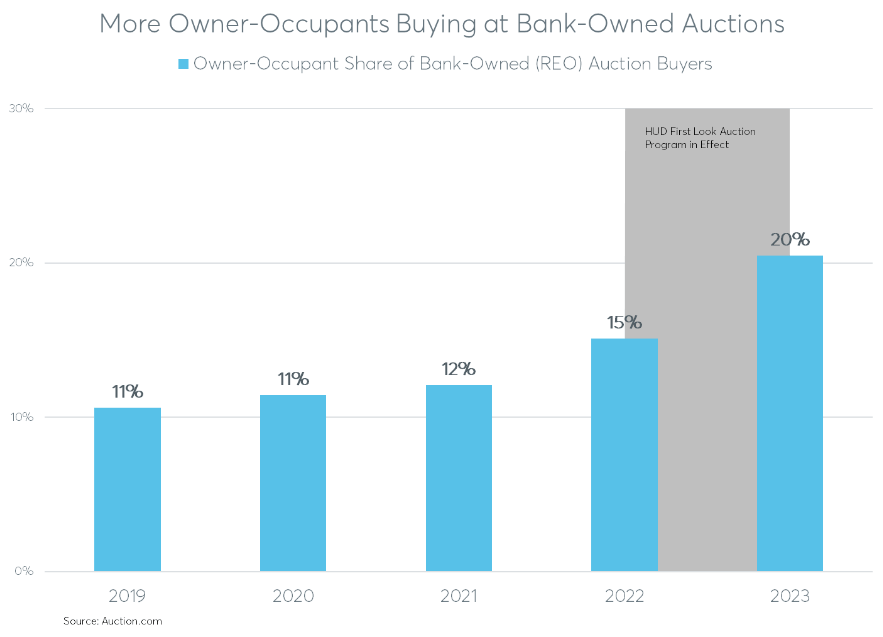

Given those differences, it’s unsurprising that the REO auctions attract a higher share of owner-occupant buyers. Auction.com sales data shows that 20 percent of all REO auction sales in 2023 went to owner-occupant buyers, up from 15 percent in 2022, 12 percent in 2021 and nearly double the 11 percent in both 2020 and 2019. So far in 2024 — based on an admittedly limited sample size — the owner-occupant share of REO auction purchases has skyrocketed to 37 percent.

Among owner-occupant buyers who responded to the 2024 Auction.com survey, 76 percent ranked either online auctions or Remote Bid auctions — which allow bidders to participate in the foreclosure auctions remotely via their mobile phone — as their preferred property acquisition method. Only 19 percent of owner-occupant buyers ranked in-person foreclosure auctions as their preferred property acquisition method.

“I still work full time, so I can only explore online auctions,” wrote one survey respondent from Kentucky.

Impact of HUD Policy Change

The share of owner-occupant purchases at REO auction was boosted in August 2022 by a policy enacted by the U.S. Department of Housing and Urban Development (HUD). The policy created a 30-day “first look” auction during which only owner-occupants and nonprofit organizations could bid on REO properties where the defaulted mortgage had been insured by the Federal Housing Administration (FHA).

An Urban Institute analysis of Auction.com data concluded that the first look policy increased the share of properties brought to auction that went to owner-occupants by about 4 percentage points and more than doubled the share of auction sales that went to owner-occupants.

“Data from Auction.com demonstrate that the more generous first-look policies enacted in mid-2022 have improved the likelihood of owner-occupants purchasing distressed homes at a lower cost,” wrote Laurie Goodman and Jung Hyun Choi of the Urban Institute in a summary of the analysis.

Data published with the Urban Institute analysis also suggest that a robust share of owner-occupants are buying at REO auction, even without the benefit of an exclusive first look auction period. Among REO properties sold at auction without any first look auction, 14.3 percent went to owner-occupants.

Homeownership for “Regular Working People”

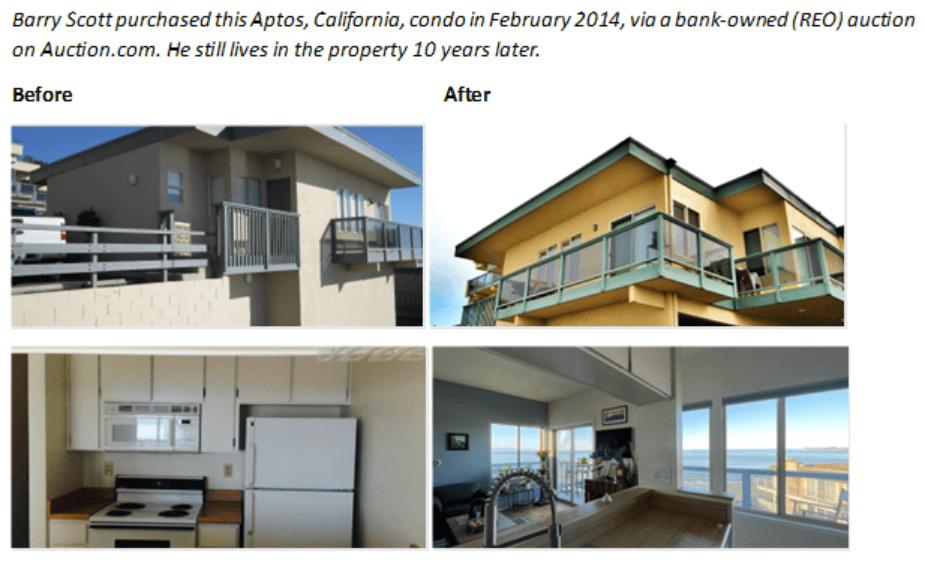

Barry Scott is one of those owner-occupant buyers who purchased at REO auction without the benefit of an exclusive first look auction period.

“The living here is just so nice,” said Scott, sitting in his Aptos, California, oceanfront condo almost 10 years to the day after buying the home on Valentine’s Day of 2014. A panoramic view of the Pacific Ocean shimmered behind Scott as he spoke. “If it wasn’t for Auction.com I wouldn’t be here. There’s just no way on earth.”

The California program director for a national nonprofit remarked that public education and nonprofits aren’t high-pay industries so finding an affordable home in this coastal community was a real long shot.

“It’s not just here, it just feels like it’s everywhere in California and even nationwide,” said Scott, providing his perspective of housing affordability challenges. “We have school teachers, and we have firefighters, and we have just regular working people. They can’t afford to buy so they rent, and even the rent is too high, so they live 50 miles away.

“We have a super housing problem,” he continued. “It’s just good to know that people who are motivated and are willing to use untraditional approaches can find something. People who really are caught in the affordability challenge but are willing to do some homework and try an untraditional approach to acquiring a piece of property: Auction.com has to be in their toolkit.”

“We have a super housing problem,” he continued. “It’s just good to know that people who are motivated and are willing to use untraditional approaches can find something. People who really are caught in the affordability challenge but are willing to do some homework and try an untraditional approach to acquiring a piece of property: Auction.com has to be in their toolkit.”

Beauty in the Eye of the Beholder

Although it’s more than 2,000 miles away and much less pricey than coastal California, the Birmingham market also has its share of affordability challenges, particularly for the lower-income clients that Barone often works with.

“I like the idea of people that do not have a house and cannot afford one, can buy one,” she said, explaining that distressed properties being sold at auction often fit into the affordability box for her clients. “The center part of Birmingham is run down … so the properties are very, very cheap there.”

Barone told the story of a young client who recently purchased one of those distressed properties.

“He bought a $25,000 house, and when he bought that house his eyes shined,” she said. “I didn’t see what he saw. I saw a destroyed house, but he saw a palace.”