Some investors moving to buy-and-hold rental strategy as market shifts

High-volume home flippers are proceeding with caution as a shifting real estate market and growing competition compress profits and heighten the risk of losing money on deals.

“If you have 30 rehabs going at once, and 30k into each one as equity on the loan, it may seem like you are a millionaire, but if the market takes a 10 percent haircut through a combo of depreciation and bad rehab estimates you are instantly broke,” said Jason Medley, a real estate investor and founder of the Collective Genius, a mastermind group of about 120 real estate investors from across the country who each flip about 100 homes each year.

Medley believes the housing market is at or near its peak and will soon experience a correction or worse, and that belief is fueling caution among members of his mastermind group, many of whom got burned in the last housing market downturn.

“There is one thing that I am completely and absolutely sure of: I don’t want to start over. How do you make sure that doesn’t happen? You exercise caution,” he said. “Get back down to the basics … underwrite your deals better… get into a position of cash … so if foreclosures do surge you can participate as a victor rather than a victim.”

Some Still High on Flipping

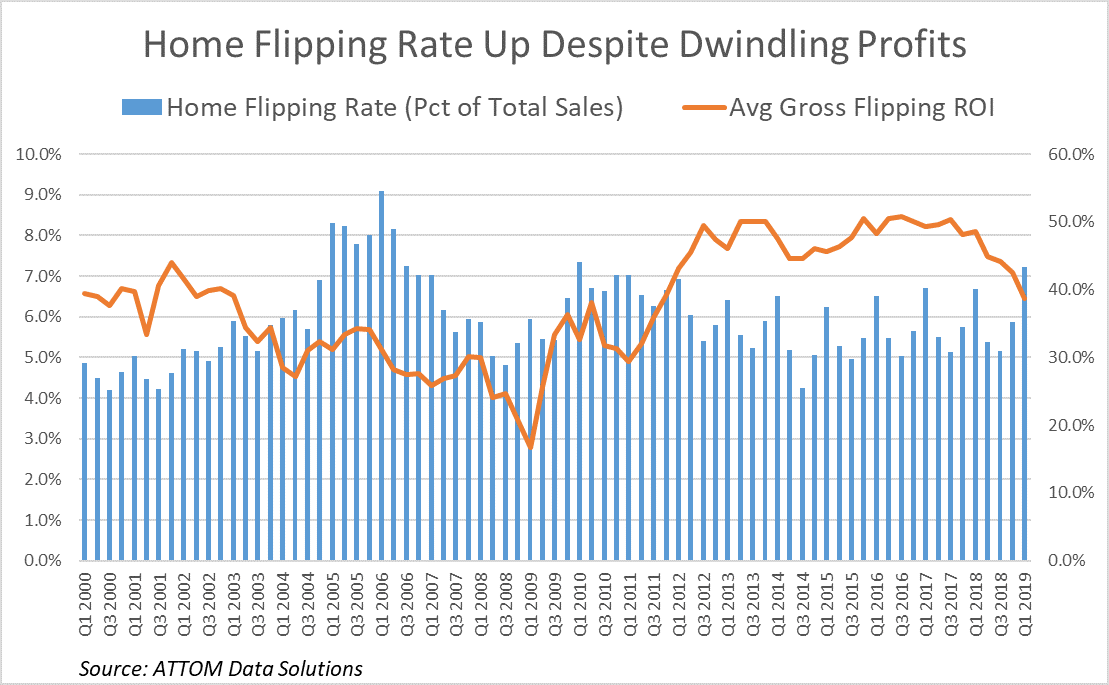

Even while the high-volume investors in Medley’s group are shying away from the traditional fix-and-flip investing strategy, a combination of mom-and-pop investors and so-called iBuyers contributed to a nine-year high in the rate of home flipping in the first quarter of 2019, according to ATTOM Data Solutions.

The ATTOM data shows flippers averaged 1.31 completed flips during the quarter, indicating the majority of home flippers are low-volume, mom-and-pop investors completing one or two deals a quarter. These mom-and-pop investors may be willing to operate on thinner profit margins because they have less exposure to a market shift than larger investors working dozens of deals at any given time.

On the other end of the volume spectrum, so-called iBuyers represent another variety of home flipping that continues to grow even as the housing market slows. These iBuyers, which include Opendoor, Offerpad and Zillow Offers, rely on computer-driven valuations to make quick cash offers for homes that they resell quickly on the retail market at a slightly higher price point after performing light rehab. Computer-driven iBuying platforms purchased nearly 5,000 homes in the Phoenix metro area alone in 2018, accounting for about 5 percent of all home sales in that market for the year, according to a recent Wall Street Journal article.

Profits at Seven-Year Low

But profits from flipping don’t appear to be a big concern for iBuyers, at least profits as measured by the traditional fix-and-flip model. Gross flipping profits — the delta between the flipper’s purchase and sale price — were not enough to cover rehab and holding costs for Zillow Offers in the first quarter, according to an analysis of the company’s earnings statement by Curbed, which found that the Zillow Offers program operated at a $45.2 million loss for the quarter. That calculates out to a $109,190 loss per flip for the 414 homes Zillow sold during the quarter, according to Curbed.

Increased competition from both iBuyers on the high-volume end and mom-and-pop investors on the low-volume end are compressing home flipping profits across the board. The average gross flipping return nationwide dropped to a more than seven-year low of 38.7 percent in the first quarter of 2019, according to the ATTOM data.

“Commit to Losing Money”

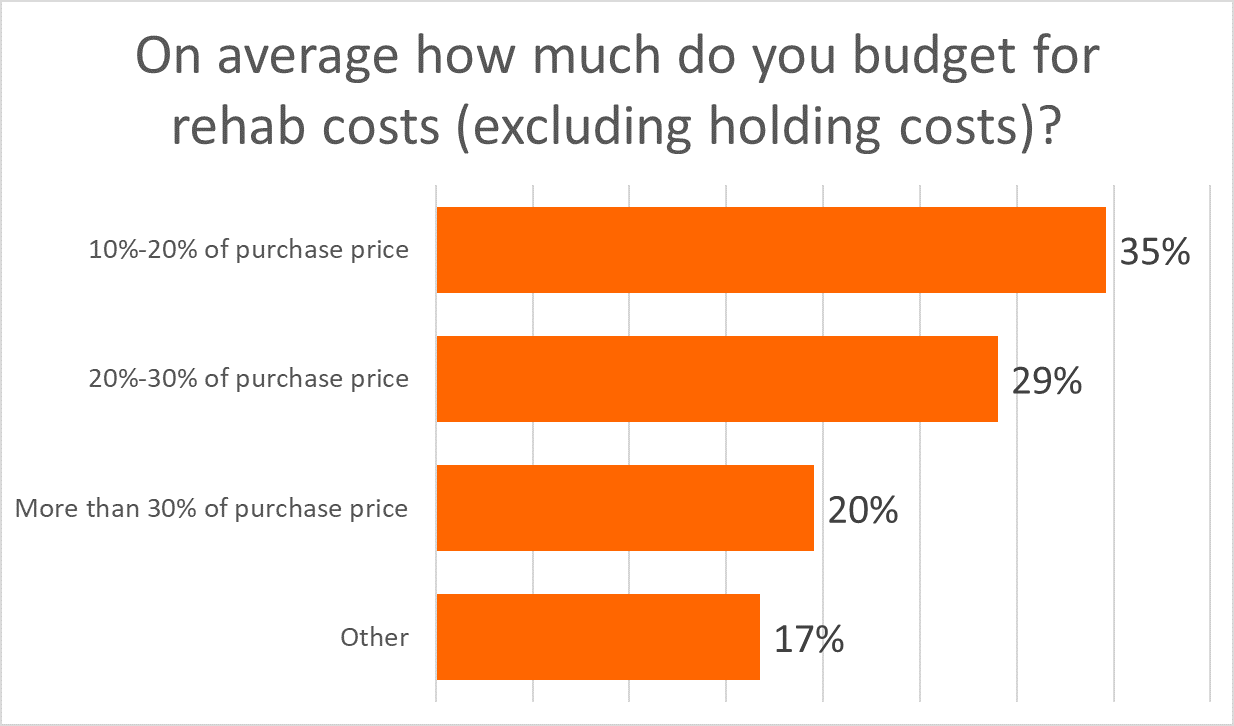

Investors making that 38.7 percent average gross return per flip would be hard-pressed to cover holding and renovation costs, according to a June 2019 survey of more than 200 investors who have purchased multiple properties on the Auction.com platform. Thirty-five percent of respondents said they budget 10 to 20 percent of the purchase price for rehab costs, and another 28 percent said they budget 20 to 30 percent of the purchase price for rehab costs. Meanwhile, 49 percent said they budget an additional 10 percent for holding costs.

For some investors in some markets, the renovation and holding costs exceed any spread between the purchase and sale prices, making flipping a losing proposition.

“The rehab and holding costs now exceed the difference between the sale price and the (after-repair) market value,” said one of the Auction.com survey respondents. “In essence, I would have to commit to losing money or the strong risk of loss given the current pricing structure … for Midwestern market properties.”

Shifting to Rentals

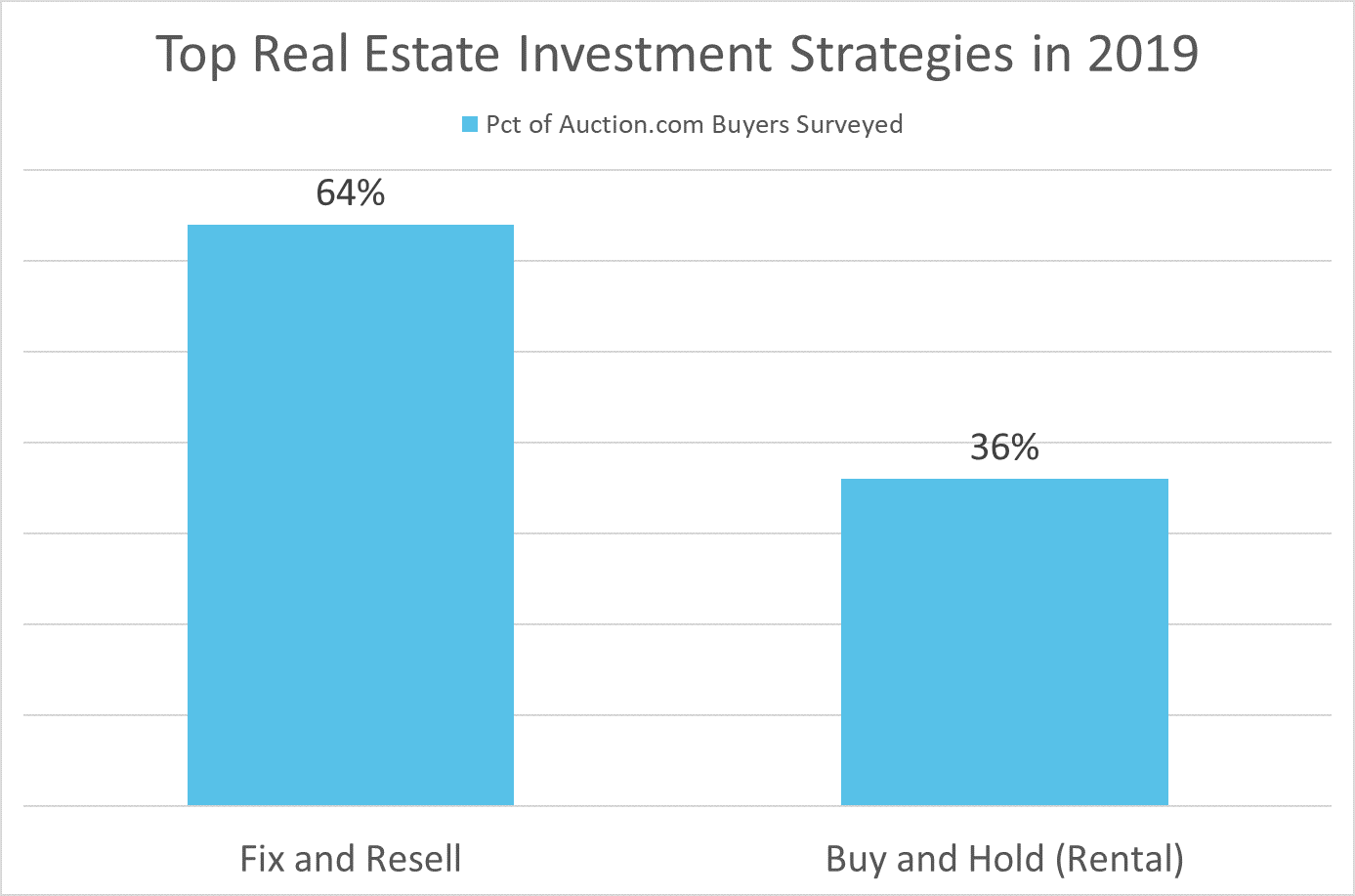

The compression of home flipping profits is prompting some investors to shift investing strategies from fix-and-flip to buy-and-hold: more than one in three investors surveyed by Auction.com selected buy-and-hold as their top investing strategy for 2019. An additional 8 percent said their top investment strategy was to fix and resell to other investors as turnkey rentals.

“The market conditions do impact (my investment strategy) for sure,” said Paul Lizell, a Philadelphia-area real estate investor who said that his investing company JP Homes typically buys between 65 and 130 properties a year via foreclosure and bank-owned auction. “More inventory, a little less demand so I’m picking up more rentals than I have in the past.”

The buy-and-hold rental investment strategy provides investors more flexibility upfront on acquisition price, according to Lizell, who also has developed a training program to help investors purchase properties at auction.

Rising rents in most parts of the country give buy-and-hold investors an extra cushion for positive cash flow from rental properties. An Auction.com analysis of average rent data from the U.S. Department of Housing and Urban Development (HUD) shows that 63 percent of counties nationwide posted a year-over-year increase in average rental rates for three-bedroom homes in 2019 compared to 2018. Among 522 counties with a population of at least 100,000, fair market rents on three-bedroom properties rose an average of 3.9 percent.

Lizell recommends that investors buy below the property’s full market value after repairs for fix-and-flip properties, but that upfront discount could be lowered if the property can be held as a rental.

“If I was going to flip the property I might be able to pay 80 (thousand) for it, but if it was a rental I might be able to pay 90 (thousand),” he said.