Shift in bidding behavior in December may be early indicator of rebound later in 2024

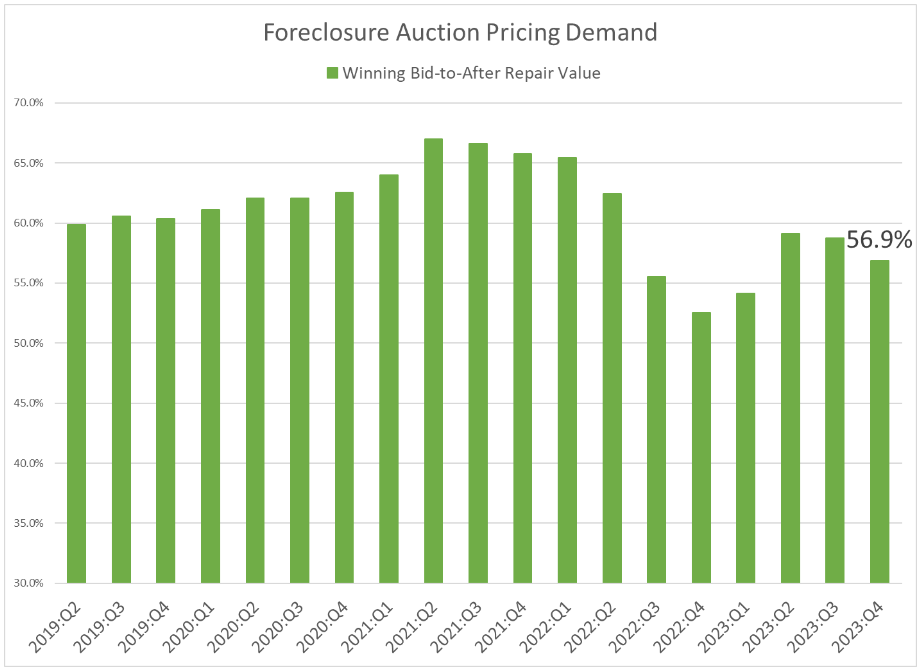

Foreclosure auction bidders continued to bid more conservatively in the fourth quarter of 2023, an indication that local community developers purchasing and rehabbing distressed properties are still expecting a sluggish retail housing market in early 2024.

For the second consecutive quarter, buyers at foreclosure and bank-owned (REO) auctions pulled back on the amount they were willing to pay relative to the after-repair value of properties.

The average ratio of winning bid to after-repair value dropped to 56.9 percent in the fourth quarter for foreclosure auctions, down from 58.8 percent in the previous quarter but still higher than the 52.5 percent in the fourth quarter of 2022, when the housing market was reeling from a flurry of rapid interest rate increases. The after-repair value is based on a Automated Valuation Model (AVM) run at the time of foreclosure auction, and assumes a good, fully repaired property condition.

The fourth quarter of 2023 was the second consecutive quarter with a quarterly decrease in the price-to-value ratio at foreclosure auction following two consecutive quarterly increases in the first half of 2023. A parallel pattern occurred for REO auctions over the last four quarters.

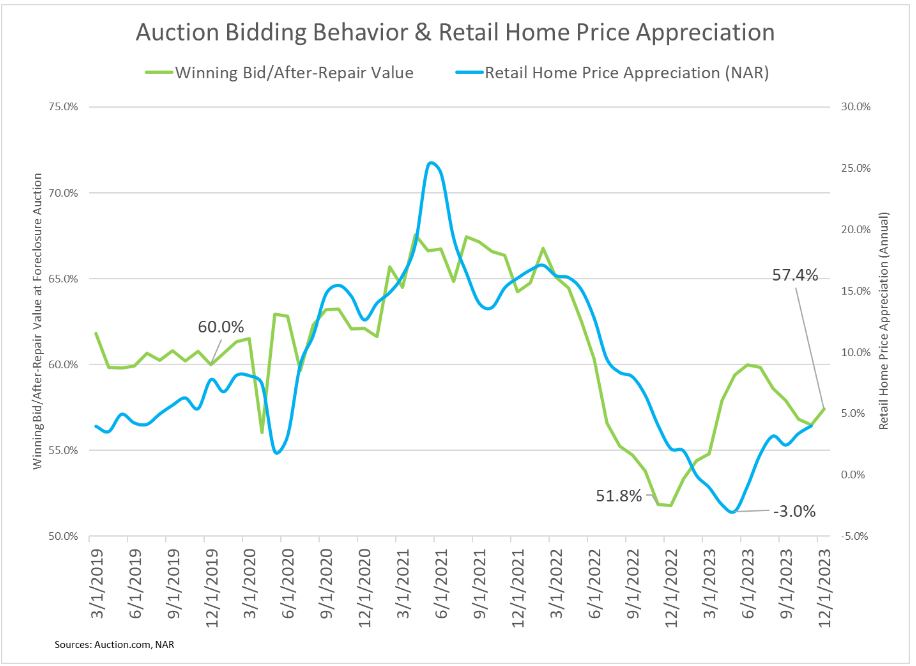

A Bidding Shift in December

Masked by the quarterly numbers was a shift in bidding behavior in December that could be an early sign local community developers expect a late-year drop in mortgage rates in 2023 to provide the residential real estate market with a shot in the arm later in 2024. The average ratio of winning bid to after-repair value at foreclosure auction in December was 57.4 percent, up from 56.5 percent in the previous month following five consecutive monthly decreases.

The local community developers -who are the primary buyers at foreclosure auction are typically reselling or renting back into their local retail housing market following about six months of renovation. These local community developers are typically real estate investors who buy 10 or fewer investment properties a year, all within their local market that they know well and care about. The price these distressed properties are willing to pay at auction provides a good forward-looking indicator of trends in retail home prices in the coming six months.

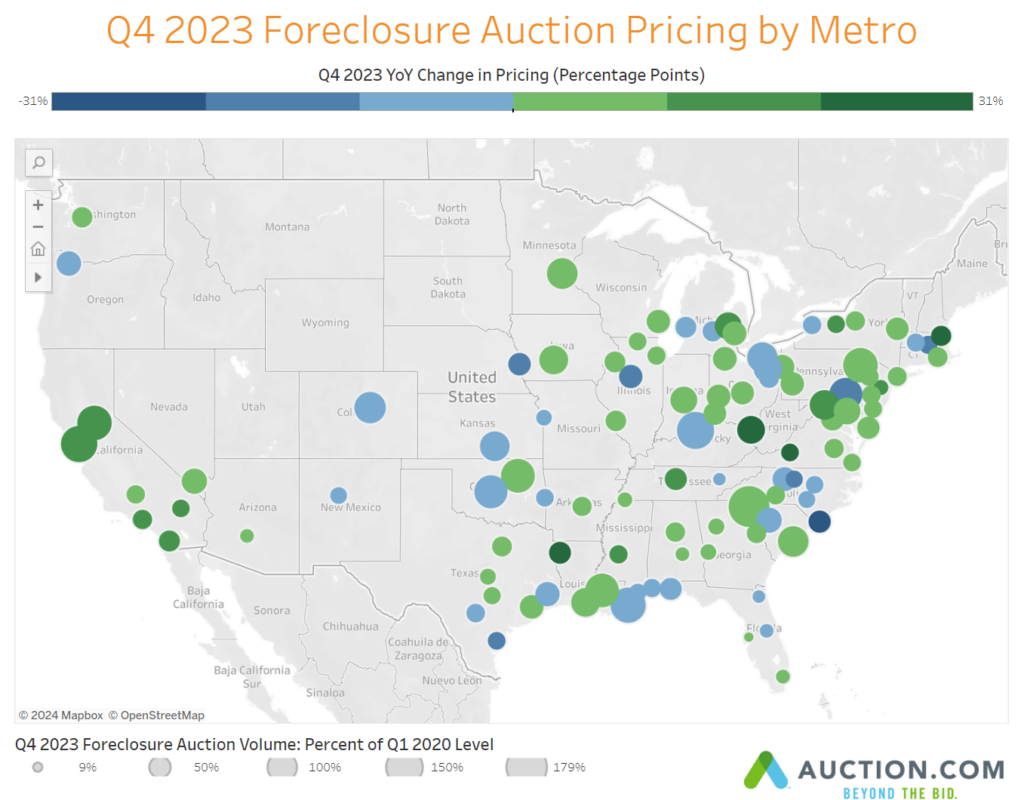

Pricing by Market

Aside from the shift in December, the conservative bidding behavior in Q4 2023 indicates that despite all the talk of a soft landing in 2024, local community developers are still wary about the housing market in early 2024.

States with the biggest annual drop in price-to-value ratio at foreclosure auction included Wyoming, Alaska, Montana, Delaware, Kentucky and North Carolina. The ratio dropped 5 points or more from a year ago in all six of these states.

Among 102 metropolitan statistical areas analyzed in the data, those with the biggest annual drop in price-to-value ratio at foreclosure auction were Myrtle Beach, South Carolina, York, Pennsylvania, Omaha, Nebraska, Worcester, Massachusetts, Corpus Christi, Texas, Peoria, Illinois, Greensboro, North Carolina, Gulfport, Mississippi, and Fort Smith, Arkansas. All nine of these markets posted a drop of at least 10 points in the price-to-value ratio in the fourth quarter of 2023 compared to a year ago.

Among larger markets, those posting a year-over-year drop in the price-to-value ratio included Cleveland (down 1 point), New Orleans (down 7 points), Akron (down 3 points), Oklahoma City (down 2 points), and San Antonio (down 5 points).

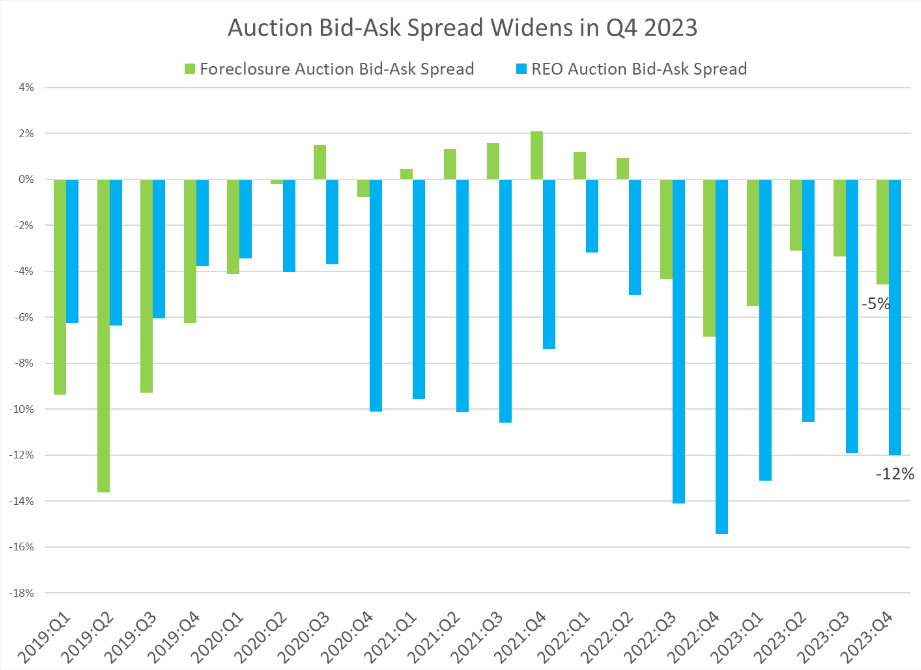

Distressed Property Demand Slips as Bid-Ask Spread Widens

Demand for distressed properties slipped lower in the fourth quarter as the Bid-Ask spread between what bidders were willing to pay (Bid) and seller pricing (Ask) widened.

The sales rate at foreclosure auction dropped by 3 points in the fourth quarter compared to the previous quarter, although it was still up 6 points from the fourth quarter of 2022 — a market that was reeling from skyrocketing mortgage rates in the second half of 2022.

Interest from potential bidders was still strong, with the average saves per property brought to auction increasing 7 percent in the fourth quarter compared to the previous quarter and up 29 percent from a year ago. But that interest didn’t translate into a higher sales rate, likely because of a widening bid-ask spread between what bidders were willing to pay and seller pricing. That bid-ask spread increased to 5 points in the fourth quarter, up from 3 points in the previous quarter.

The bid-ask spread for REO auctions also widened in the fourth quarter compared to the previous quarter, albeit slightly, helping to chill bidding competition during the quarter. The average number of bids per REO property brought to auction decreased 6 percent compared the previous quarter and was down 4 percent from a year ago.

Foreclosure auction sales rates and REO bids per property in Q4 2023 were still elevated relative to pre-pandemic levels, likely a function of low supply, but the pullback in these demand metrics relative to the previous quarter indicates that local community developers purchasing distressed properties are staying disciplined in their acquisition strategy, sticking to the pricing that they believe reflects current and future market conditions.

Distressed Property Supply Still Constrained

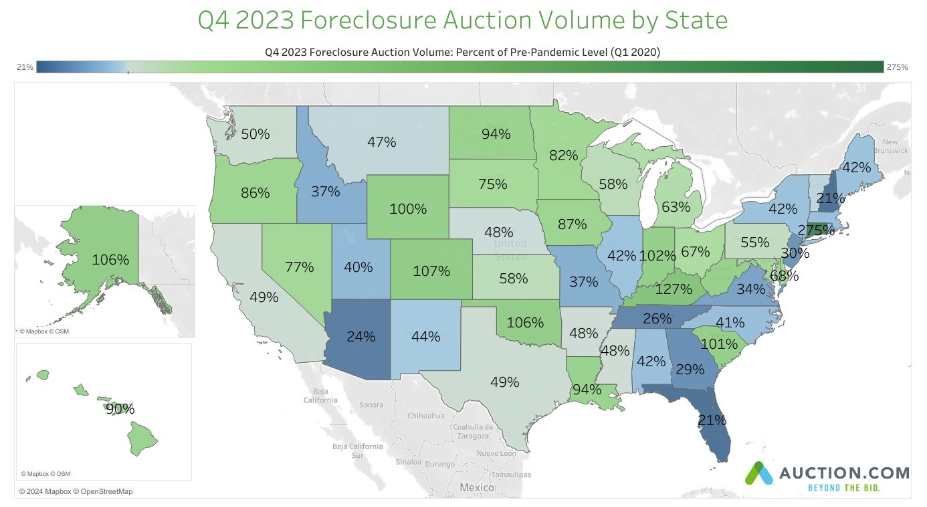

Supply of distressed properties brought to auction continued to be constrained in the fourth quarter, with foreclosure auctions dropping below 50 percent of pre-pandemic levels for the first time in two years and REO auctions dropping below 40 percent of pre-pandemic levels for the first time in five quarters.

Eight states had foreclosure auction volume in Q4 2023 that registered above pre-pandemic levels: Connecticut, Kentucky, Colorado, Oklahoma, Alaska, Indiana, South Carolina and Wyoming.

Fourth quarter foreclosure auction volume was less than 40 percent of pre-pandemic levels in nine states: New Hampshire, Florida, Arizona, Tennessee, Georgia, New Jersey, Virginia, Idaho and Missouri.

States with the most foreclosure auction volume in Q4 2023 were Ohio, Texas, Illinois, New York and Florida.