Demand from buyers at auction rebounds in Q1 2024 even as supply flatlines, pushing prices higher

Demand from buyers of distressed properties at auction rebounded in the first quarter of 2024 after slumping in late 2024 even as the supply of distressed properties available at auction flatlined, according to proprietary data from Auction.com, the nation’s largest distressed property marketplace that accounts for nearly half of all properties sold at foreclosure auction nationwide.

The combination of rising demand and flatlining supply put upward pressure on prices at distressed property auctions, and the average winning bid at both in-person foreclosure auctions and online bank-owned (REO) auctions increased by double-digit percentages from a year ago in the first quarter. Additionally, the average price bidders were willing to pay relative to estimated after-repair value also increased on a year-over-year basis, both for in-person foreclosure auctions and online REO auctions.

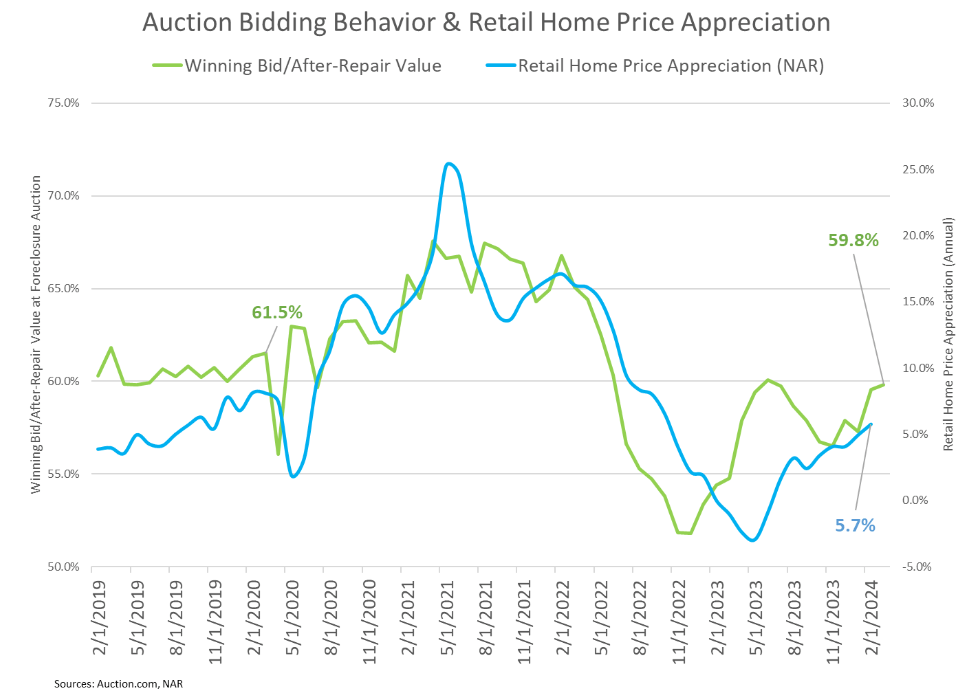

The rebounding demand and more aggressive price-to-value bidding from distressed property auction buyers indicates that these buyers are expecting the retail market to gradually acclimate to higher-for-longer mortgage rates over the next six months given that Federal Reserve did not reduce rates in its March meeting and said in that meeting that it “does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.”

Buyers at distressed property auctions are primarily local community developers whose continued success hinges on accurately predicting retail housing market conditions three to six months in the future. The distressed properties purchased by these buyers today will be sold or rented back into the retail market in about three to six months, the typical time it takes to complete renovations.

Bidding behavior on the Auction.com marketplace anticipated the rapid rebound in retail home price appreciation following the pandemic, and it anticipated the floor in retail home price appreciation in early 2023.

More conservative bidding behavior on Auction.com in the fourth quarter of 2023 had indicated that local community developers were anticipating a retail market slowdown in early 2024 — likely in large part because of stubbornly elevated mortgage rates. But that bidding behavior turned a corner in December and continued to become increasingly aggressive throughout the first quarter of 2024, an indication that local community developers are expecting the retail market slowdown will be relatively short-lived.

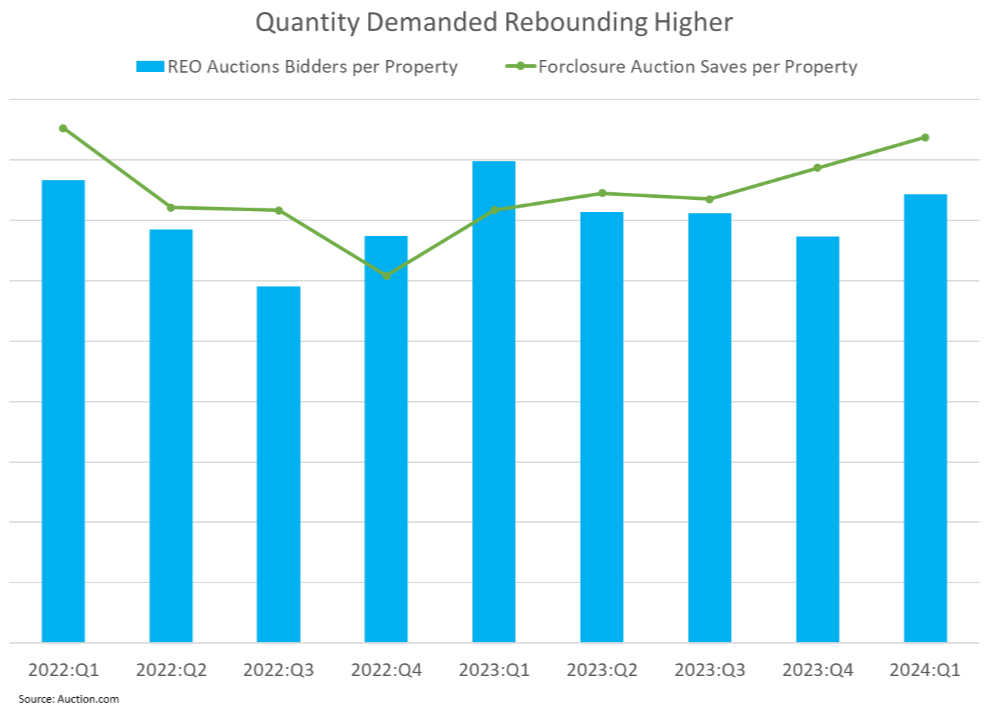

Quantity Demanded

An increase in the average number of online saves by prospective buyers and bidders per property brought to auction both point to an increase in quantity demanded from potential buyers at distressed property auctions.

The average number of online saves per property for in-person foreclosure auctions increased to an eight-quarter high in the first quarter, up 6 percent from the previous quarter and up 17 percent from the first quarter of 2023.

The average number of bidders per property brought to online bank-owned (REO) auction increased 10 percent from the previous quarter but was still down 7 percent from a year ago.

Also pointing to an increase in quantity demanded was an increasing sales rate — the percentage of properties brought to auction that sell to third-party buyers — both for in-person foreclosure auctions and for online REO auctions.

The sales rate for in-person foreclosure auctions in the first quarter of 2024 increased 7 percent from the previous quarter and increased 9 percent from a year ago to a seven-quarter high. The sales rate for online REO auctions jumped 24 percent from the previous quarter and was up 9 percent from a year ago, also to a seven-quarter high.

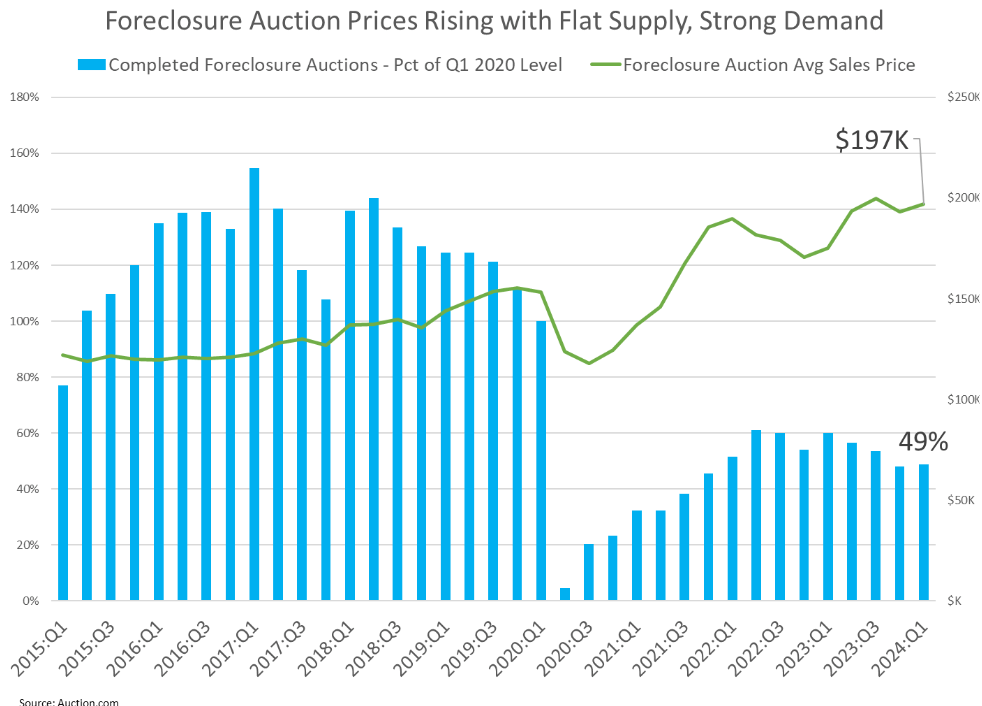

Quantity Supplied

Even as demand for distressed properties sold at auction increased in the first quarter, the supply of distressed properties flatlined at less than half of pre-pandemic level, both for in-person foreclosure auctions and online REO auctions.

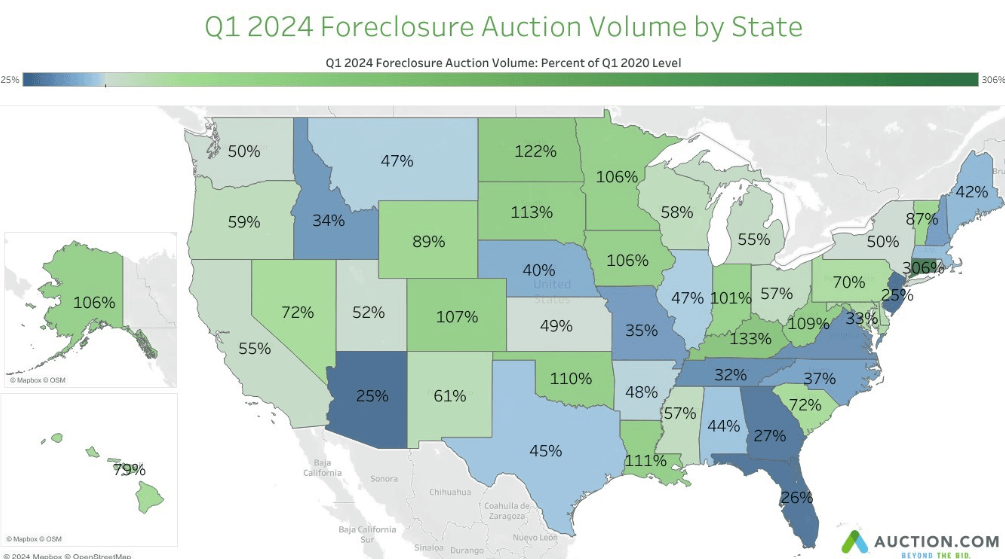

The number of properties brought to foreclosure auction on the Auction.com platform in Q1 2024 was at 49 percent of the Q1 2020 level, up slightly from 48 percent in the previous quarter but down from 60 percent in the first quarter of 2023.

Bucking the national trend, there were 12 states with foreclosure auction volume above Q1 2020 levels, led by Louisiana, Indiana, Oklahoma, Minnesota and Kentucky. Among states with the most foreclosure auction volume, Ohio was at 57 percent of its Q1 2020 level, Illinois at 47 percent, Texas at 45 percent, New York at 50 percent and Florida at 26 percent.

The supply of properties brought to REO auction in the first quarter flatlined at 38 percent of the Q1 2020 level, unchanged from the previous quarter and down from 45 percent a year ago.

Only one state was above its Q1 2020 level in terms of REO auction volume: Nevada at 124 percent. Other states closest to Q1 2020 levels were Colorado, South Dakota, California, North Dakota and Michigan. Among states with the most REO auction volume, Illinois was at 30 percent of its Q1 2020 volume, Michigan at 72 percent, New York at 49 percent, Pennsylvania at 39 percent and Texas at 49 percent.

Price Demanded

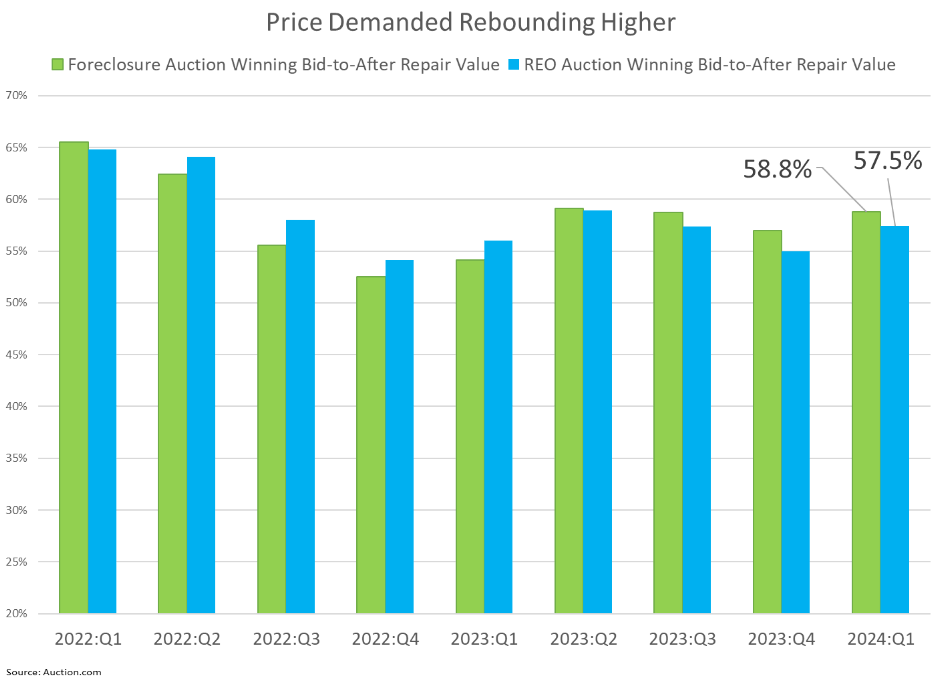

A rebound in the average price buyers were willing to pay relative to estimated after-repair value in the first quarter — both for in-person foreclosure auctions and online REO auctions — indicates that buyers have become more confident in the strength of retail home price appreciation in the second half of 2024. After-repair value is the estimated value of a property in fully repaired, or renovated, condition.

This winning bid-to-value metric for in-person foreclosure auctions increased 3 percent from the previous quarter and increased 9 percent from a year ago. For online REO auctions, this price-to-value metric increased 5 percent from the previous quarter and was up 3 percent from a year ago.

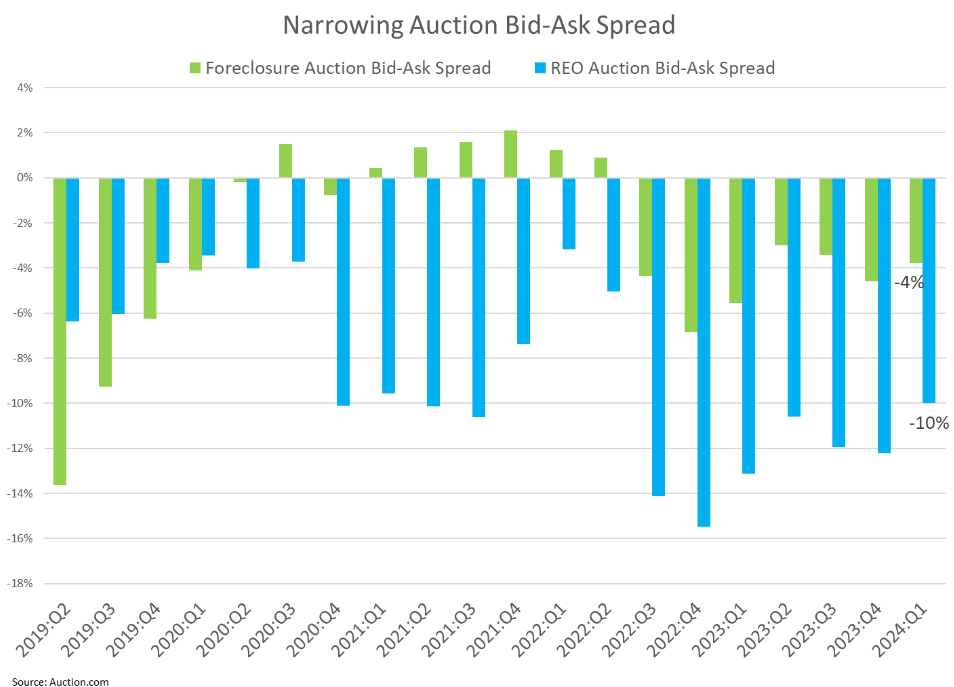

Price Supplied & Bid-Ask Spread

Sellers of distressed properties at auction — primarily banks, nonbanks, mortgage servicers and government-sponsored entities — were not as aggressive in increasing their asking price relative to estimated after-repair value in the first quarter, narrowing the bid-ask spread between what bidders were willing to pay and what sellers were willing to take.

In the auction environment, the asking price is the minimum amount the seller is willing to take — or in some cases required to take as governed by state foreclosure auction statutes — to sell a property. This asking price is called the credit bid for foreclosure auctions and the reserve price for REO auctions.

The average credit bid-to-value ratio for foreclosure auctions on the Auction.com platform in the first quarter of 2024 increased 2 percent from the previous quarter and was up 7 percent from a year ago. The average reserve-to-value ratio for online REO auctions on the Auction.com platform in the first quarter was flat from the previous quarter and down 2 percent from a year ago.

The less aggressive change in pricing by sellers, combined with the more aggressive increase in pricing by buyers, resulted in a shrinking bid-ask spread in the first quarter, both for in-person foreclosure auctions and for online REO auctions.

The bid-ask spread for foreclosure auctions was 4 percentage points in the first quarter, down from 5 points in the previous quarter and down from 6 points in the first quarter of 2023. The bid-ask spread for online REO auctions was 10 percentage points in the first quarter, down from 12 points in the previous quarter and down from 13 points in the first quarter of 2023.