Distressed homeowner avoids foreclosure and walks away with equity selling on Auction.com.

Analysis of non-auction pre-foreclosure sales shows evidence of lowball pricing and equity stripping

Completed foreclosure volume has plateaued at less than half of pre-pandemic levels in early 2024, but an increasing number of homeowners are facing foreclosure, and an increasing share of those distressed homeowners are choosing to sell prior to the state-mandated foreclosure auction.

“We got into trouble, and foreclosure was looming. That’s what brought us to Auction.com,” said an Orlando homeowner who decided to proactively sell his property via an auction that he controlled rather than lose it at an auction controlled by state laws governing the foreclosure process. “This was an emotional roller coaster for me to sell. … I never thought I was going to sell that house. I thought I built it to be there until the day I passed away.”

Auction.com recently launched SmartSale, a product that opens up the Auction.com marketplace to individual distressed sellers like the Orlando homeowner.

“SmartSale is a transformative solution for families facing the threat of foreclosure,” said Doug Whittemore, Head of Strategic Growth at Auction.com. “We are empowering distressed customers with real choices to protect their equity and transition confidently to the next chapter of their lives.”

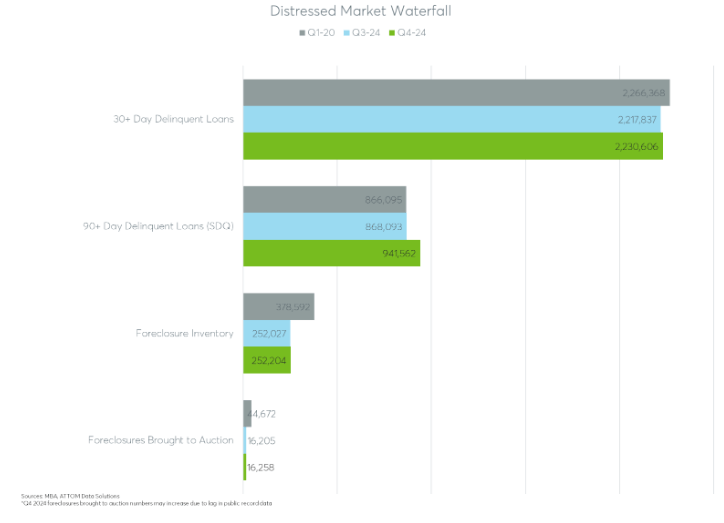

Foreclosure is looming for more homeowners in early 2025 with the inventory of seriously delinquent mortgages (those 90 days or more delinquent or in foreclosure) rebounding to above pre-pandemic levels in late 2024, according to an Auction.com analysis of the Q4 2024 National Delinquency Survey published by the Mortgage Bankers Association (MBA).

That analysis found an estimated 941,000 seriously delinquent loans nationwide, up 8 percent from the previous quarter and up 13 percent from a year ago. That 941,000 was also above the pre-pandemic level of 866,000 in the first quarter of 2020. During the pandemic, a nationwide foreclosure moratorium on government-backed mortgages was in place for 21 months, ending in December 2021.

Deeper Distress

That moratorium, combined with a generous pandemic forbearance program and new loss mitigation programs, helped many homeowners avoid foreclosure permanently. But for some homeowners, the extra time afforded by those foreclosure prevention efforts only resulted in a deeper well of distress.

“We owed three years’ worth of property taxes,” said the Orlando homeowner, adding that he also owed $35,000 in interest payments to his lender on top of the missed mortgage payments. The Orlando homeowner said he took out the mortgage in foreclosure after he was forced to close his transportation business of 22 years in 2018.

The foreclosure clock is starting for an increasing number of homeowners across the country. Foreclosure starts in December 2024 were up 50 percent from the previous month and up 30 percent from a year ago, according to data from Intercontinental Exchange (ICE).

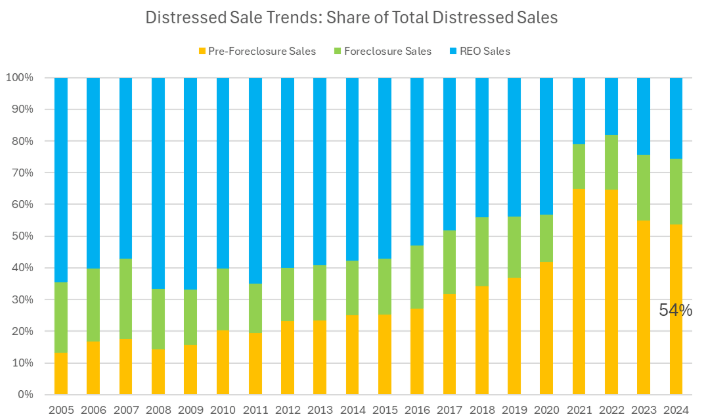

More homeowners who start the foreclosure process are deciding to sell before the foreclosure auction (pre-foreclosure), allowing them to avoid the red flag of a foreclosure on their credit history while taking more control over the sale. An Auction.com analysis of public record data shows that these pre-foreclosure sales increased 38 percent to a six-year high of more than 158,000 in 2021 and remained elevated in 2022 and 2023 at more than 100,000.

That increase in pre-foreclosure sales during the foreclosure moratorium occurred even while other distressed sales — foreclosure auction sales and bank-owned (REO) sales — were decreasing. That combination resulted in pre-foreclosure sales accounting for a record-high 65 percent of all distressed sales in 2021 and 2022. Pre-foreclosure sales accounted for 55 percent of all distressed sales in 2023 and are on track to hit 54 percent of all distressed sales in 2024 — still well above the average of 28 percent between 2012 and 2019.

Selling Faster, Higher, Better

For many distressed homeowners, selling via auction may be the best option to ensure the highest and best offer while closing in a truncated timeframe.

“It was at a point where I didn’t have the time to sell (on the traditional retail market),” said the Orlando homeowner, explaining why he opted to sell via auction. “I know it can take a while (on the traditional retail market) if you want to get what the property is worth.”

The Orlando homeowner also noted an auction sale allowed him and his family to avoid the hassle that comes with opening the home for showings to prospective buyers, many of whom may be nonserious buyers.

“That is a pain, a real pain. The showings, the getting ready,” he said, noting that his family continued to live in the house after he decided to sell. “People call, they don’t show up. You have to rearrange your schedule. … It’s a nightmare. A real nightmare.”

The Orlando pre-foreclosure home received a winning bid above its auction reserve price — the minimum amount the owner was willing to take to sell the property — after three days of bidding on Auction.com. The property attracted more than 40,000 views and more than 90 saves from prospective buyers on the website. During the three days of bidding, five bidders competed against each other to secure the winning bid and buy the home.

The homeowner said he was surprised at the speed of the sale, and the favorable price point at which it sold given his experience with car auctions in the past.

“I used to buy cars at the auction for my transportation business,” he said. “A lot of times the vehicles would go through, and they wouldn’t sell because they had a reserve price … they would wait until the next date, and they would go through the lane again.”

But despite that experience, the Orlando homeowner believed auction was his best opportunity to get the highest and best offer for his home while selling quickly so he could avoid foreclosure.

“If it doesn’t sell, I’m definitely going to foreclosure,” he said, explaining his mindset at the time of the sale. “If (the lender) had foreclosed, I would have lost all of the control.”

Instead, he was able to avoid foreclosure while walking away with a sizable amount of equity to help him and his family with a fresh start.

Pre-Foreclosure Predators

The Orlando homeowner said he received some offers from real estate investors before he decided to list his home on Auction.com. He instinctively distrusted those offers.

“There were a lot of different deals that I didn’t feel comfortable with,” he said, adding that one would have required him to wait 45 days after signing over ownership of the home before any possibility of payment — likely a wholesale investor trying to flip the sales contract to another investor for a fee. “They thought desperation would make people do whatever they ask them to do. … They are unscrupulous people. You don’t even know who you’re talking to.”

He contrasted that to his experience selling through Auction.com.

“Walter was fantastic,” he said of his point of contact at Auction.com. “He was not one of those people who was just into himself. He actually took the time to get to know me. There’s not enough that can be said about Walter. Every time I called him, he picked up the phone, or he called me right back.”

Signs of potentially predatory behavior like the offers the Orlando homeowner encountered show up in the pre-foreclosure sale data.

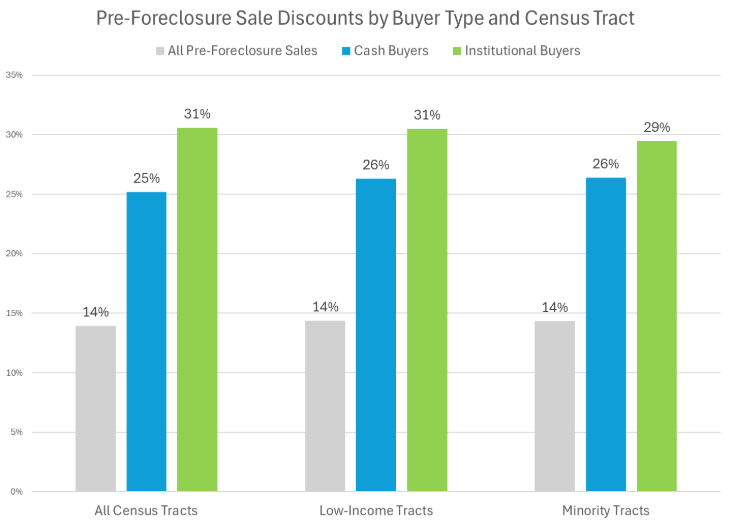

Buyers classified as institutional investors — usually corporations, companies or limited liability companies (LLCs) — bought pre-foreclosure properties at an average discount of 31 percent below estimated “after-repair” value, according to an Auction.com analysis of more than 10,000 properties scheduled for foreclosure auction that never went to foreclosure auction but were instead sold on the traditional retail market in 2024. The after-repair value is the estimated full market value of the property in fully repaired condition.

That 31 percent average discount for institutional investors — who accounted for 35 percent of the pre-foreclosure purchases analyzed — was more than double the average 14 percent discount for all pre-foreclosure buyers and more than five times the average 6 percent discount for individual pre-foreclosure buyers.

Properties selling pre-foreclosure may understandably sell at a discount due to the condition of the property. Many pre-foreclosure properties have fallen into disrepair due to deferred maintenance and may not even be in financeable condition in some cases. Among the pre-foreclosure sales analyzed, those purchased without financing (all-cash purchases) sold at an average discount of 25 percent below the estimated after-repair value.

While a higher discount for cash purchases is expected given the likely unfinanceable condition of the homes being sold, there is evidence that at least some of the buyers are quickly flipping the properties for a profit without adding any value through renovations.

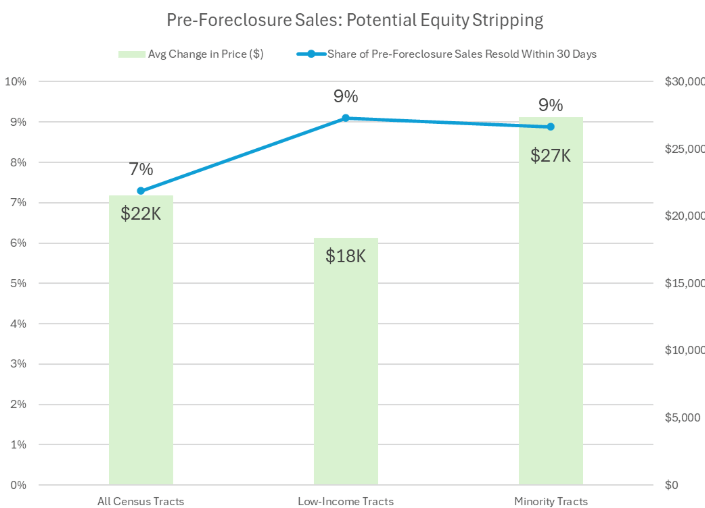

Among the same 10,000 pre-foreclosure sales in 2024, 763 (7 percent) were resold within 30 days or less of the original pre-foreclosure sale date. Those quick flips were sold for an average of nearly $22,000 more than the original pre-foreclosure sale purchase price — a 7 percent jump in price in less than 30 days.

These types of quick flips are often done by investors known as wholesalers who buy a property at a lowball price only to turn around and sell to another investor at a higher price without adding any value through renovations. The 7 percent number is likely underestimating wholesaling activity given that many wholesalers never take ownership of the property, but instead “flip” the purchase agreement they have with the seller to a new buyer.

“We’re seeing a huge amount of wholesalers enter the market, which means fewer properties are making it to the foreclosure auction,” said Landon Cunninghman, a veteran foreclosure auction buyer in Spokane, Washingtion.

“I can’t believe these guys are not regulated to some extent,” continued Cunningham, who also helps run a real estate investor financing company called Inland Capital. “It just disrupts the natural course … if they actually took the property to foreclosure these people would get more in terms of excess proceeds. They are selling themselves short.”

By listing properties in a transparent, competitive marketplace with hundreds of thousands of buyers nationwide who are experienced in buying distressed properties, Auction.com’s SmartSale product helps distressed homeowners guard themselves against lowball offers and equity-stripping wholesalers.

“Every distressed customer deserves a chance to protect their equity,” said Ali Haralson, President of Auction.com. “SmartSale expands our platform’s capabilities to make that possible, bringing the power of our established marketplace directly to homeowners.”

“I would say I felt very comfortable with the whole process, and I would do it again,” said the Orlando homeowner. “I would rather try that first to see if it would sell at that price because I know Walter would get it done.”