Most REO auction buyers in 2021 were owner-occupants or local community developers — 99 percent of buyers purchased five or fewer properties, and 74 percent purchased within 100 miles of where they live.

Bank-owned auctions have become more palatable for owner-occupant homebuyers as the scarcity of retail housing inventory persists.

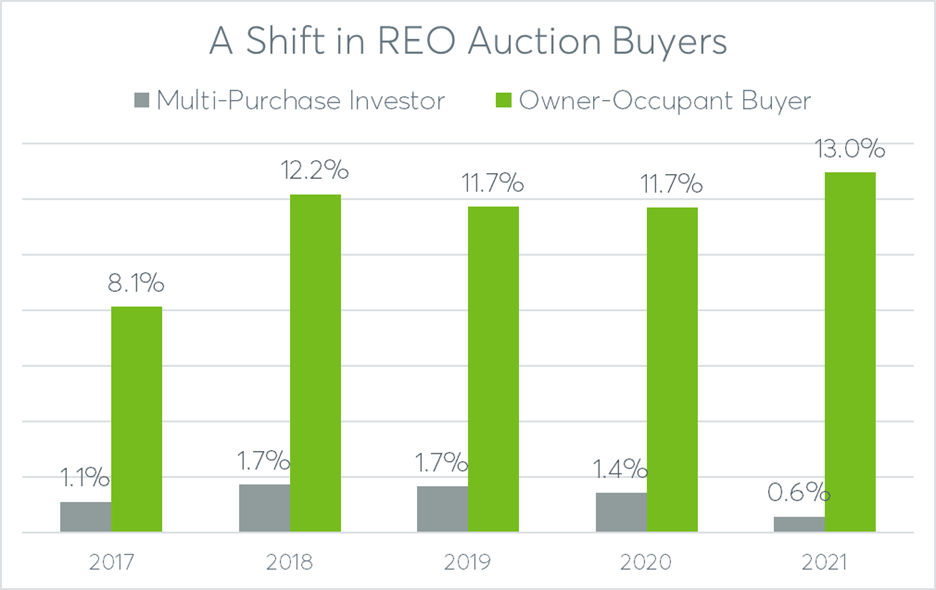

Thirteen percent of all real estate owned (REO) properties sold via online auction in 2021 were to owner-occupant buyers, up from less than 12 percent in 2020 and up from a low of 8 percent in 2017 to the highest level since 2012, according to data from Auction.com.

Seventy-one percent of REO auction buyers in 2021 identified themselves as non-owner-occupant buyers, on par with recent years. But the share who identified as multi-purchase buyers dropped to less than 1 percent, the lowest share since as far back as the Auction.com data is available.

States with the highest share of owner-occupant REO auction buyers in 2021 were Idaho (43 percent), Hawaii (25 percent), Maine (23 percent), New Mexico (22 percent), and Washington (21 percent). The top three states in terms of sold REO auction volume in 2021 all posted owner-occupancy rates above the national average: Illinois (15 percent), New York (17 percent), and Florida (17 percent).

Cleveland-area REO auction buyer David Fisher has observed more competition from owner-occupant buyers.

“I’m competing against retail buyers who are wanting to live there, and they are outbidding me,” said Fisher, who said he has been investing part-time for about 20 years, rehabbing and reselling about one property per year.

Owner-occupant buyers may be increasingly turning to distressed property auctions because of the lack of inventory in the retail market. There were 1.11 million homes for sale as of the end of November 2021, down 13 percent from a year ago and representing a 2.1-month supply, according to the National Association of Realtors (NAR). A six-month supply is typically considered to be a balanced market between supply and demand.

Rehab Required

The increase in owner-occupant buyers at REO auction is happening despite the challenges that often come with purchasing a distressed property.

First, retail buyers may be in for a bit of a surprise when dealing with the distressed condition of most REO homes, which often have months or years of deferred maintenance.

“These are homes that are flooded and have mold … the interiors are just trashed with six feet of water in the basement for a year. They have to be totally rehabbed, and so that’s what we do,” Fisher said, noting that the properties he purchases eventually end up in the hands of owner-occupants. “I sell it to a family who is happy to get a turnkey, beautiful home, and I make a little. It’s like a win-win.”

Like Fisher, most local community developer buyers purchasing distressed properties on Auction.com are reselling to owner-occupants after rehab, according to a 2021 buyer survey. That means that many distressed homes initially sold to these non-owner occupant buyers are resold to an owner-occupant following renovations. A post-auction analysis of nearly 73,000 resales of properties originally purchased at foreclosure auction and REO auction between 2017 and 2020 shows that 72 percent were owner-occupied as of September 2021.

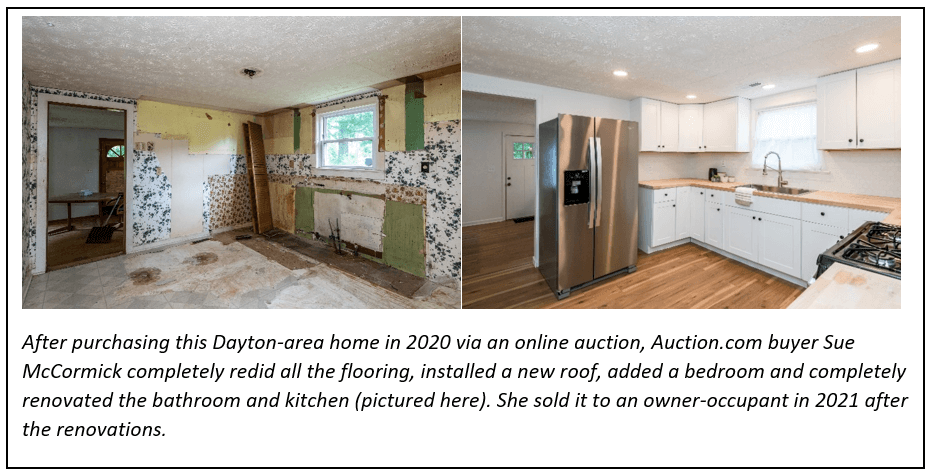

Walking into a trashed property for the first time after a sight-unseen auction purchase can be a surprising for inexperienced distressed property buyers.

“As a fairly new real estate investor, I have to tell you that I was a bit overwhelmed the first time I walked through the actual property,” said Sue McCormick of her first Auction.com purchase in 2020. “It was in a state of disrepair that I just wasn’t counting on. I was a little overwhelmed my first walk through.”

McCormick ended up successfully rehabbing and reselling the home to an owner-occupant and has since purchased four more properties on Auction.com. The majority of REO buyers purchasing on Auction.com are local community developers like McCormick. In 2021, 89 percent of REO buyers only purchased one property during the year, and 99 percent purchased five or fewer REO properties during the year. Those 99 percent of buyers accounted for 93 percent of all REO sales on the platform for the year.

REO auction buyers in 2021 purchased an average of 236 miles from where they lived at the time of purchase, and 74 percent of REO auction buyers purchased within 100 miles, according to the Auction.com data.

Hard-to-Find Financing

McCormick noted that financing can be another obstacle for distressed property buyers. She has secured financing from private lenders, sometimes known as hard-money lenders, to fund some of her investment purchases. Conventional financing typically utilized by owner-occupant buyers is often unavailable for distressed properties because of the condition and the fact that many are not available for an interior inspection.

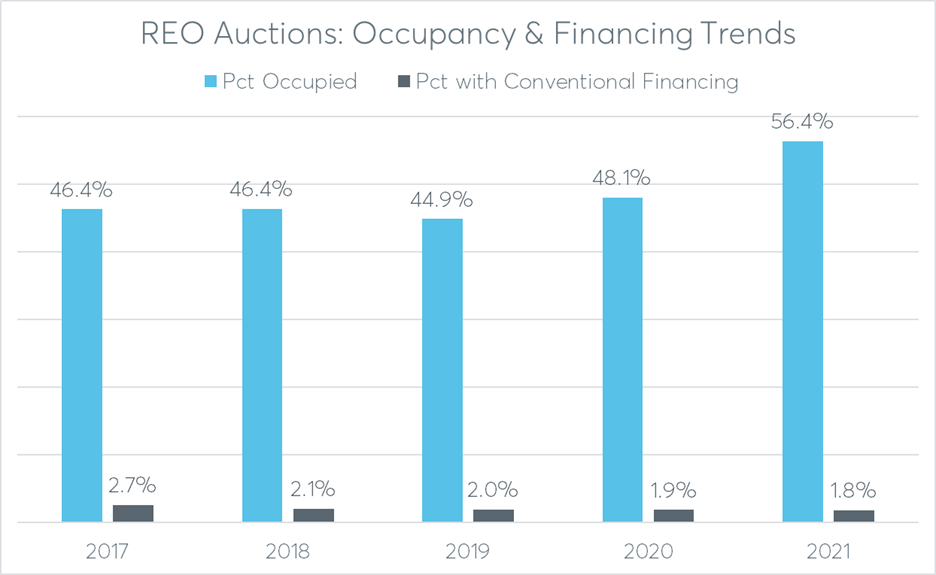

Conventional financing was available for less than 2 percent of REO properties brought to auction on the Auction.com platform in 2021, on par with previous years. States with the highest share of REO properties with conventional financing available were Texas (9.2 percent), Florida (7.9 percent), Montana (6.3 percent), Hawaii (4.3 percent) and Illinois (3.9 percent).

Often Occupied

Dealing with a current occupant is another challenge facing many REO auction buyers. More than half of all REO auctions brought to auction on the Auction.com platform in 2021 were occupied. The share will likely rise in 2022 given that foreclosure moratoriums and eviction moratoriums lifted in late 2021, paving the way for more occupied REOs to be sold.

On the other hand, local community developer buyers are typically more knowledgeable about the vagaries of the area’s eviction proceedings and more able to accurately budget eviction or relocation costs. Additionally, these local buyers are more willing to allow the current occupant to stay in the property as a tenant. According to the 2021 buyer survey, more than 60 percent of Auction.com buyers who hold properties as rentals said they offer to rent back to the current occupant — often at market or below-market rent.

“We have rented out to a few people that were occupying the property. We’ll generally offer it to them at 20 percent under what the normal rent prices are,” said Michael Hallman, an Auction.com buyer who has purchased occupied REOs in three Chicago-area counties: Cook, DuPage and Will. “We will maintain the property and we will put new furnace, new air conditioning in. If anything breaks, we’ll fix it.”

Although Hallman’s primary investing strategy is to resell rehabbed REO homes to owner-occupants, offering current occupants the option to rent back from him allows him to avoid eviction proceedings, which he said can take up to a year in Cook County.

“You can take cash for keys, you can rent the property out from us, or if you’re planning to move, we can offer you financial assistance for moving,” said Hallman, who likes to involve his three kids when renovating and cleaning up properties. “We treat them the way we want to be treated. … What goes around comes around. I just believe that, and if we treat them nice, then they will always remember that.”