Foreclosure Auction Volume Increased 31 Percent in Q3 2025 as Buyer Demand Deteriorated to a Nearly Three-Year Low

Distressed supply continues to build while buyer engagement softens across most markets

October 21, 2025

KEY POINTS

- Foreclosure auction volume increased 4 percent quarter-over-quarter and 31 percent year-over-year to a 10-quarter high — the highest level since Q1 2023.

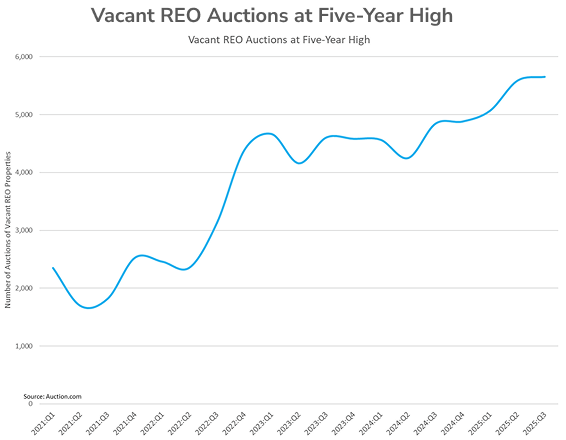

- REO auction volume rose 1 percent from the previous quarter and 15 percent annually, also reaching a 10-quarter high.

- Vacant REO properties accounted for 54 percent of REO auction volume — the highest share since Q4 2021.

- Foreclosure auction sales rate fell 2 percent quarter-over-quarter and 12 percent year-over-year to an 11-quarter low.

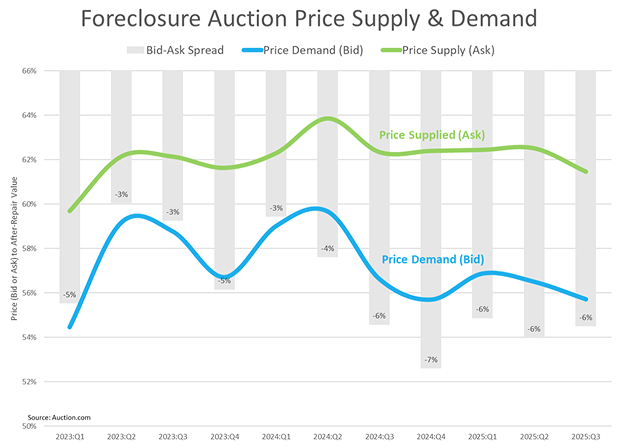

- Buyer price demand at foreclosure auction averaged 55.7 percent of after-repair value, which went down slightly from 56.5 percent in Q2 and 56.6 percent a year ago.

- Bid-ask spread remained flat at foreclosure auction but widened slightly at REO auction despite seller price reductions.

OVERVIEW

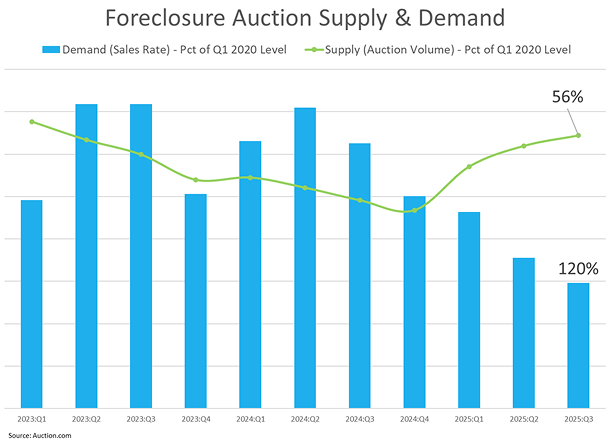

Auction.com’s Q3 2025 marketplace data reveals a continued rise in distressed property supply, particularly at foreclosure auction, even as buyer engagement and pricing behavior softened. The increase in completed foreclosure auctions — up 31 percent year-over-year — signals a more active pipeline, driven by lower equity levels, and the expiration of foreclosure moratoriums on VA-insured loans. However, buyer caution remains evident, with declining sales rates and subdued bidder activity suggesting ongoing market hesitancy.

“The primary concern is the growing number of houses for sale,” wrote an Arkansas-based Auction.com buyer in response to a buyer sentiment survey in late September. “This creates a buyers’ market; therefore, you can expect to sell a property for less than you would have a year ago.”

Including this Arkansas-based buyer, 36 percent of buyers surveyed said market conditions are making them less willing to buy distressed properties at auction, down from 38 percent in the previous quarter but still up from 34 percent a year ago.

Nineteen percent of buyers surveyed said market conditions are making them more willing to buy at auction, unchanged from the previous quarter but down from 21 percent a year ago. Forty-five percent of buyers surveyed said market conditions are not affecting their willingness to buy, up from 42 percent in the previous quarter and flat from a year ago.

“I make decisions based on the activity within the specific area that I’m looking to purchase,” wrote one Illinois-based buyer who said market conditions are not impacting her willingness to buy at auction. “There are some areas that are still thriving regardless of what is happening at the federal level.”

DISTRESSED DEMAND

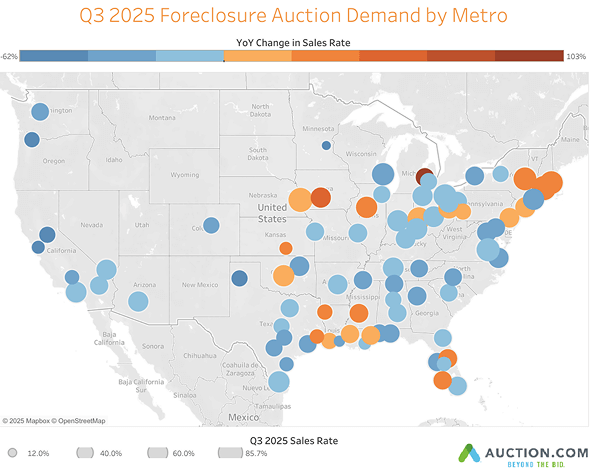

The foreclosure auction sales rate in Q3 2025 declined 2 percent quarter-over-quarter and 12 percent year-over-year, ending the quarter at an 11-quarter low — the lowest since Q4 2022. September marked a 65-month low, with sales rates falling in 73 percent of major markets analyzed, including Chicago (down 3 percent), Houston (down 35 percent), Dallas–Fort Worth (down 16 percent), Detroit (down 7 percent), and Atlanta (down 30 percent). Markets bucking the trend included New York City (up 13 percent), Philadelphia (up 12 percent), Pittsburgh (up 16 percent), Orlando (up 22 percent), and Baton Rouge (up 7 percent).

REO auction demand also softened. Bidders per asset dropped 2 percent quarter-over-quarter and 14 percent year-over-year to a 23-quarter low — the lowest since Q4 2019. September marked a 90-month low in bidder intensity.

“Tariffs and other monetary polices of the current GOP administration (are) suppressing the property resale market and driving my renovation costs much higher, causing me to really think if a foreclosure investment is worth pursuing,” wrote a Montana-based buyer in response to the survey.

Still, this Montana buyer said he is planning to buy more properties at auction in the next three months than he did in the previous three months, a sentiment that was echoed by 37 percent of buyers surveyed, unchanged from the previous quarter but down from 39 percent in Q4 2024.

By comparison, 17 percent of buyers said they planned to buy fewer properties in the next three months, down from 20 percent in both the previous quarter and a year ago. Forty-six percent said they planned to buy the same amount in the next three months, up from 43 percent in the previous quarter and 40 percent a year ago.

“Fewer investors buying foreclosures which makes it easier to purchase,” wrote one survey respondent from Arizona. He said market conditions are making him more willing to buy.

Price Demand

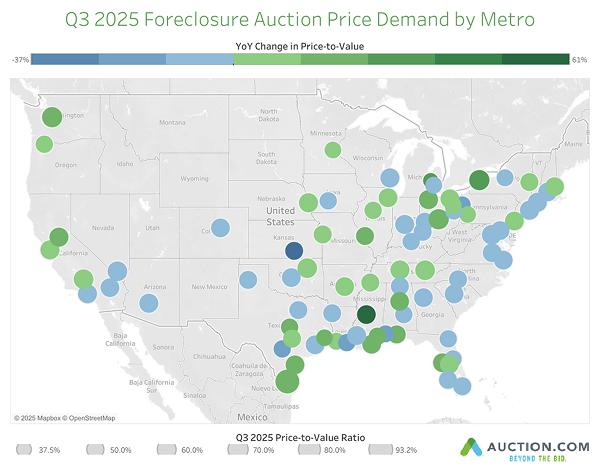

Foreclosure auction buyers were willing to pay an average of 55.7 percent of estimated after-repair value in Q3 2025, down slightly from 56.5 percent in Q2 and 56.6 percent a year ago. Price demand ticked up to 55.9 percent in September, suggesting a tentative floor.

The after-repair value is the estimated market value of a home in fully repaired condition. Most properties sold at foreclosure and REO auction are in distressed condition with substantial renovations needed to bring them to fully repaired condition.

“Overall expectation that housing prices are falling and will continue to fall,” wrote one survey respondent from Indiana. He said he was bidding lower relative to after-repair value at auction due to market conditions in the last 90 days.

Nearly one in four buyers surveyed (23 percent) said they had lowered their bidding relative to after-repair value, unchanged from both the previous quarter and a year ago. Only 1 percent of buyers surveyed said they were bidding higher relative to after-repair value, down from 3 percent in the previous quarter but unchanged from a year ago.

Price demand decreased in 51 percent of major markets, including New York City, Houston, Dallas, Detroit, and Atlanta.

“Bidding lower prices to hedge for declining prices and climbing inventories,” wrote a Texas-based survey respondent.

However, 49 percent of markets saw increases, including Chicago, Philadelphia, Minneapolis–St. Paul, St. Louis, and New Orleans.

“I am buying more to hold and rent than I was before (when) I was buying to flip and sell,” wrote a Minnesota-based survey respondent.

Top-performing markets included McAllen, Texas; Columbus, Ohio; Buffalo, New York City; Seattle, Washington; and Bakersfield, California — all with average bid-to-value ratios above 67 percent.

Weaker price demand was observed in Flint, Michigan; Minneapolis–St. Paul; Beaumont, Texas; Pittsburgh, Pennsylvania; and Akron, Ohio — all below 47 percent.

REO auction buyers paid an average of 53.6 percent of after-repair value — down from 55.6 percent in Q2 and 54.4 percent a year ago to a 29-quarter low. September saw a modest rebound from an 83-month low of 52.8 percent in August.

DISTRESSED SUPPLY

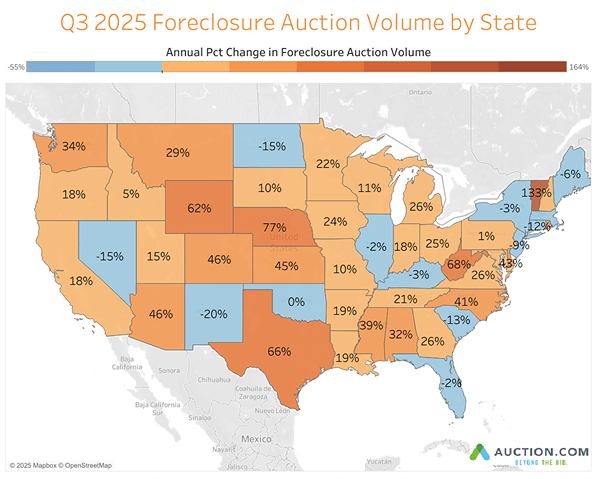

Completed foreclosure auctions rose 4 percent quarter-over-quarter and 31 percent year-over-year to a 10-quarter high — the highest since Q1 2023. Scheduled foreclosure auctions were down 2 percent from Q2 but went up 21 percent annually, reaching 62 percent of the Q1 2020 benchmark.

Foreclosure auction volume increased across all loan types, led by VA-insured loans (up 504 percent annually), privately held loans (up 28 percent), and FHA-insured loans (up 22 percent).

Foreclosure auction volume increased from a year ago in 38 states, including Texas (up 66%), California (up 18%), Michigan (up 26%), Colorado (up 46%), and Arizona (up 46%).

REO auction volume rose 1 percent quarter-over-quarter and 15 percent year-over-year to a 10-quarter high, reaching 43 percent of pre-pandemic levels. Vacant REO properties accounted for 54 percent of REO auction volume — the highest share since Q4 2021.

“Occupied versus vacant properties is a big one for me,” wrote a survey respondent from California. “It’s been extremely hard in the past to evict persons from the property.”

DISTRESSED PRICING

Sellers lowered pricing at both foreclosure and REO auctions in Q3 2025. The average credit bid-to-after-repair value at foreclosure auction fell 105 basis points from Q2 and 88 basis points from a year ago.

Despite this, the bid-ask spread remained flat at 6 percentage points — unchanged from Q2 and a year ago — due to a corresponding decrease in buyer pricing.

“I have bought less houses the last couple of years because prices are so high,” wrote a Michigan-based survey respondent.

At REO auction, seller pricing dropped 108 basis points quarter-over-quarter and 225 basis points year-over-year. This narrowed the bid-ask spread to 12 percentage points from 14 points a year ago, although it widened slightly from 11 points in Q2.

“Purchase price compared to what my assessment shows the ARV (After-Repair Value) to be greatly affects how many properties I buy a year along with interest rates,” wrote a survey respondent from Maryland.

MACROECONOMIC TRENDS

Rate

Probability

Index

Sentiment Index

HOUSING & MORTGAGE TRENDS

Home Sales

Prices

Mortgage Rate

Mortgage Rate