652 Hornady DrMonroeville, AL 36460, Monroe County

Price Insights

Property Details

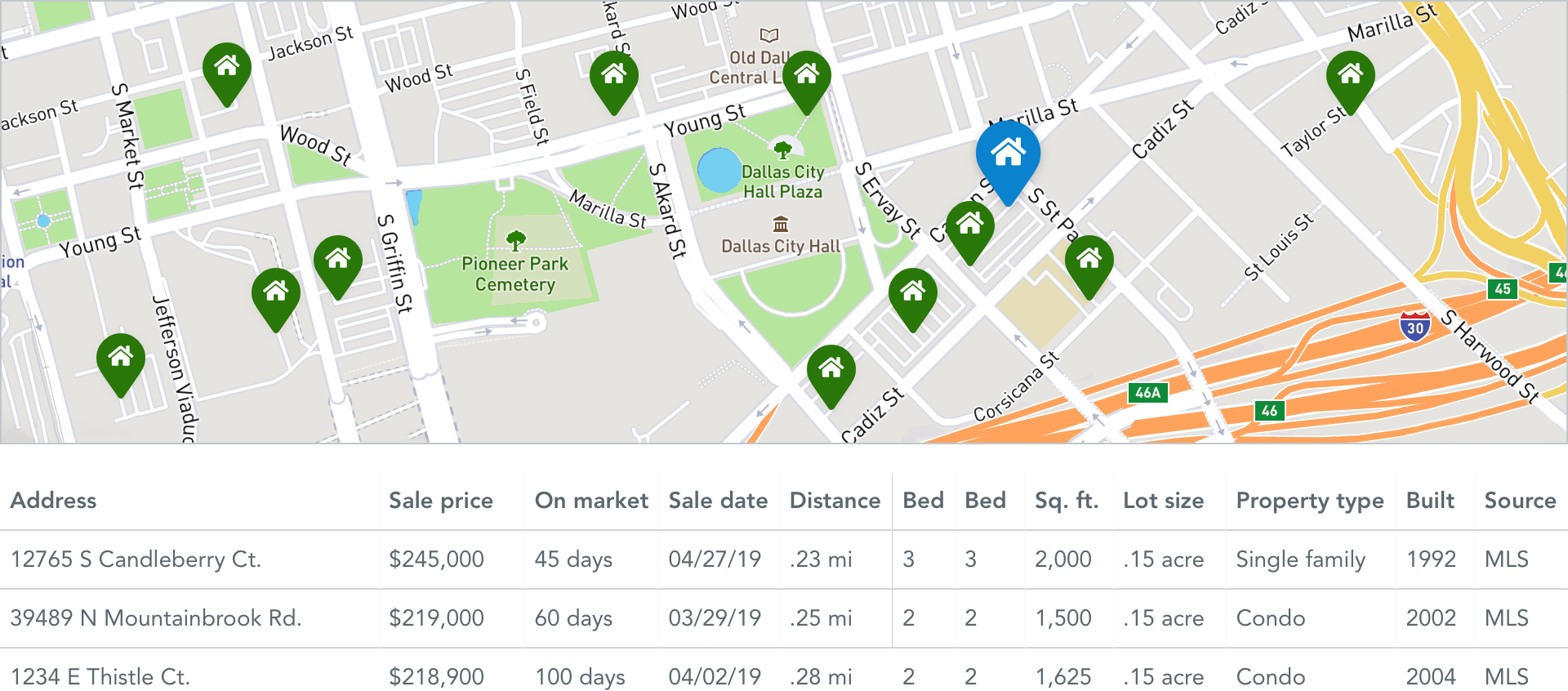

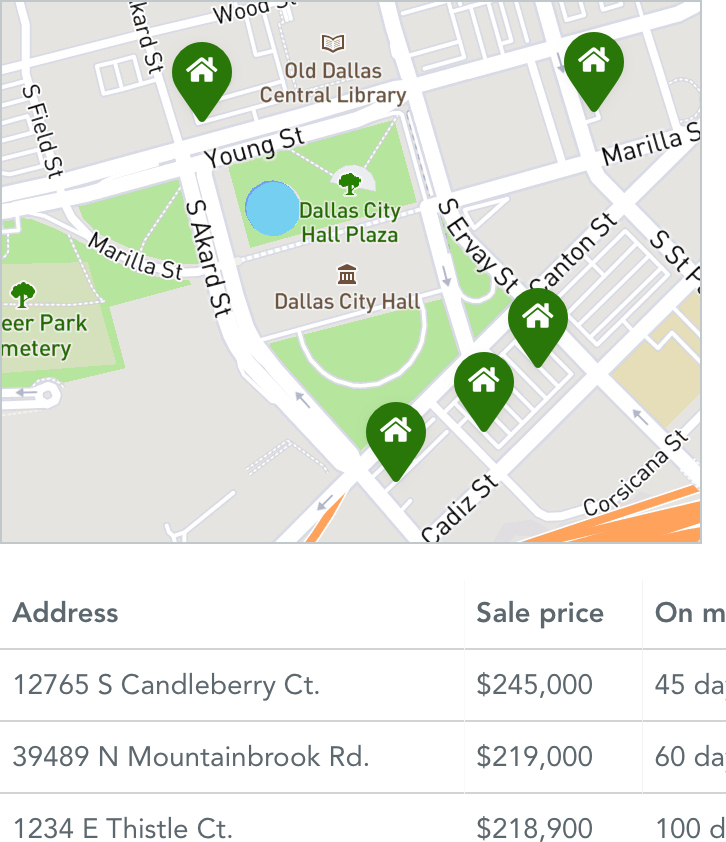

Similar Properties

Market Analysis

Due Diligence

Learn how to perform due diligence.

Top FAQs

Like other real estate transactions, you should conduct careful due diligence before purchasing a property at auction. Common research items include local market value, property condition, and title report.

Please note, Auction.com is not the seller for any property made available online, and all information and photos to Auction.com have been made available on this page.

If you are the highest bidder at the end of an auction, here are your post-auction obligations:

- Contract Information: You'll receive an email confirming you have the highest bid. You will then need to provide important contracting information by filling out a form online. You can preview the required information on this form as a printable checklist. Make sure to submit the form within 1 business day.

- Purchase Agreement: Once everything is verified, the Purchase Agreement will be generated and you will need to sign and return the document for the seller to review and sign.

- Proof of Funds: You need to provide Auction.com a copy of your Proof of Funds by email within 2 business days.

- Earnest Money Deposit: Unless otherwise specified on your purchase agreement, you will need to send the Earnest Money Deposit to the closing company within 2 business days of receiving the transfer instructions. Send Auction.com a copy of your confirmation receipt within 1 business day of sending funds.

Transaction Details

• All bank-owned properties bought at auction are, "Subject to Seller Acceptance." Both buyer and seller must sign the purchase agreement for the bid to be considered accepted.

• Buyer will be assessed a $55 Document Generation paid at closing.

• If you are the Winning Bidder, an Earnest Money Deposit of 5% of the Total Purchase Price or $2,500 (whichever is greater) is required.

• Buyer may receive a Special Warranty Deed or equivalent if buyer is able to purchase a title insurance policy without delaying the closing (title fees typically cost between $500 and $1,500 and are based on the purchase price of the property). If buyer does not purchase a title insurance policy, buyer will receive a Quitclaim Deed or equivalent, with no express or implied warranties of title.

• Title fees typically cost between $500 and $1500 and are based on the purchase price. Escrow fees typically range between $850 to $1,375. These fees may vary based on the location of the property. These fees shall be paid in accordance with the applicable purchase sale agreement.

• Any delinquent HOA/COA assessments shall be paid in accordance with the applicable purchase sale agreement.

• Property is being offered as is, where is.

• This property is being offered exclusively through Auction.com before it will be available to the broader market. Please be aware that in rare instances, issues arise that may require the seller to cancel the transaction due to this early availability.

• Until the seller's reserve price is met, Auction.com may counter bid on behalf of the seller. Counter bidding gives buyers and sellers more flexibility to find a mutually agreeable price. Counter bids do not occur after the seller's reserve price is met. Learn more about reserve pricing.

Auctioneer Licensing Information