5648 Tughill DrTampa, FL 33624, Hillsborough County

Price Insights

Property Details

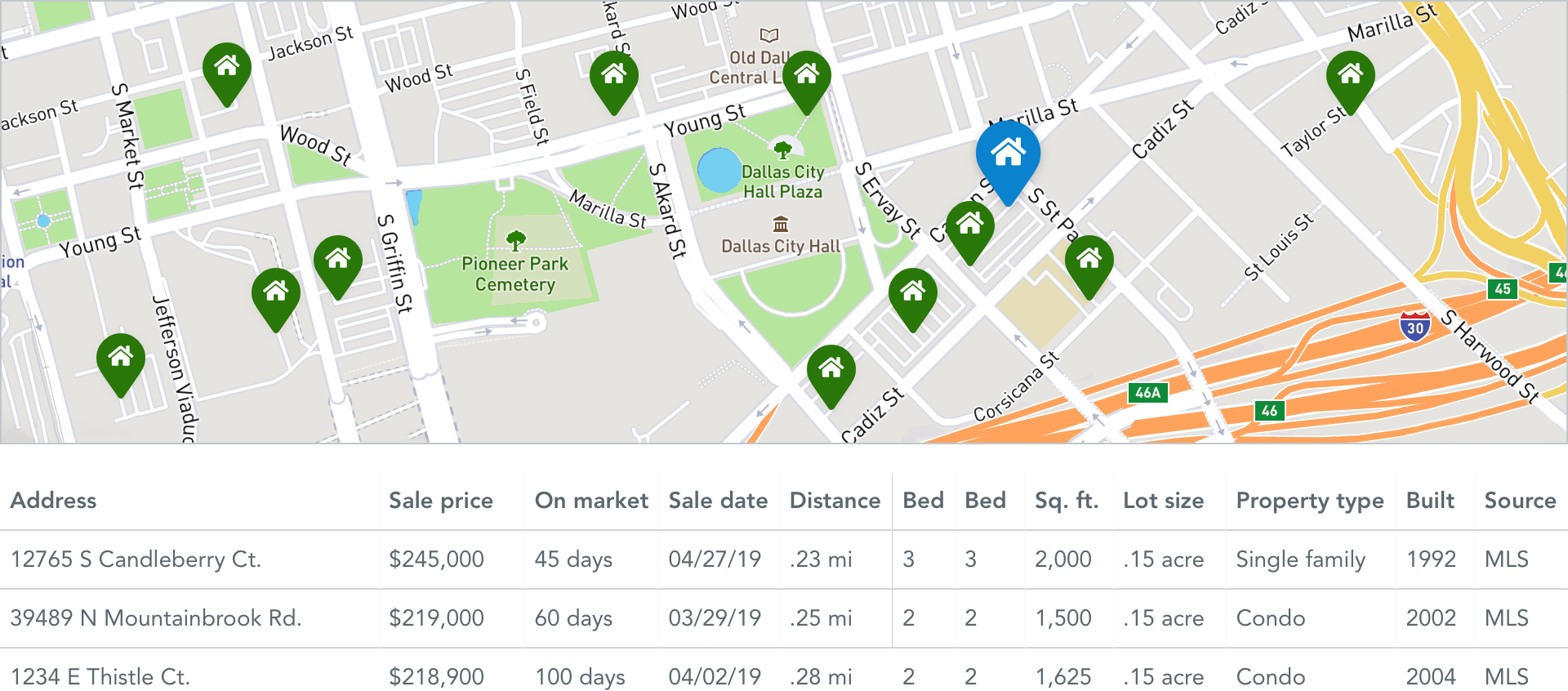

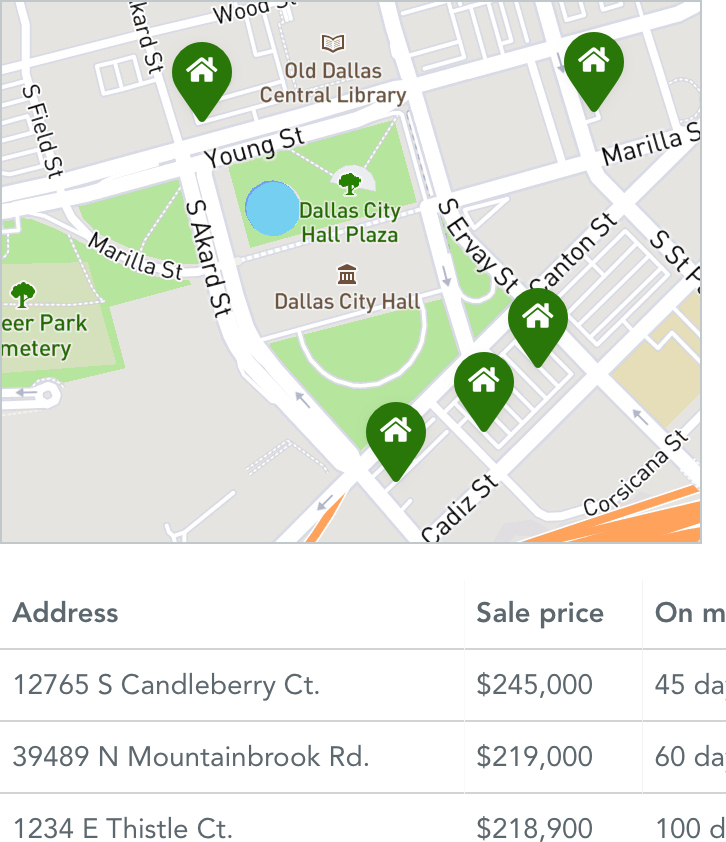

Similar Properties

Market Analysis

Due Diligence

Learn how to perform due diligence.

Top FAQs

The foreclosure process starts when a homeowner stops paying their mortgage. The lender sends the homeowner a notice, giving them a period of time to pay, or the property goes to auction. The homeowner can take steps to either postpone or cancel the auction. At the auction, the bank won't bid more than the credit bid.

The purchaser at the auction is essentially paying off the mortgage and is responsible for any additional liens attached to the property. If no one bids above the credit bid, the property goes back to the bank. And, it becomes a real-estate owned (REO) property for sale.

Interior access is not available for any property sold at a foreclosure auction. All foreclosed properties are sold as is, where is.

You'll need to estimate any repair or upgrade costs from a distance. Even if you think the home is vacant, treat it as occupied. These homes have not transferred ownership yet. So, walking on or entering the property is trespassing and a crime.

All counties have different payment requirements. Some require the full amount of the winning bid at the sale. Others only need a deposit and the balance is due at a later date.

Generally, payment is required in the form of cashier's check at the auction. Be sure you know your maximum budget when preparing for the auction. Some investors bring multiple checks in different denominations. This allows them to get the payment as close to the bid as possible. If you bring more than the winning bid, you will be sent a check from the trustee for the difference.

Keep in mind you will only be able to bid up to the amount you brought. You will not be allowed to go to the bank for more funds.

Foreclosure properties are sold a couple different ways.

- In some states, Auction.com is appointed by the foreclosure attorney to conduct the sale.

- In other states, the sale is done by a court-appointed official (usually the sheriff).

Auction.com often lists properties auctioned by the county. We do this to provide you with a wide range of options for your next investment.

Most mortgage lenders want a property inspection or appraisal. So, they won't provide loans on occupied properties.

These properties are sold as-is and without interior access. You must pay the full amount with a cashier's check. Make sure you check the property page for specific details on fund requirements.

Some investors use other sources to get cashier's checks. These can include hard-money loans or lines of credit. But, to use one of these types of loans, the loan can't require property inspections or appraisals.