One of the oldest – and still most widely-held – beliefs in the world of real estate is the importance of a property’s location. There’s ample evidence to support this premise: look at the difference in prices for similar properties in the same zip code that happen to be located inside and outside of a high profile gated community. Check out the home price appreciation in markets with highly rated school systems compared to price trends in adjacent markets with lower quality schools. Or, more tellingly, check out the difference in prices in almost identical homes located mere blocks apart, but affected by any sort of almost random variable: different schools, proximity to train tracks or loud freeways, adjacency to flood or fire zones, and so forth.

Successful real estate investors know better than the typical homeowner the importance of location, and the impact it has on their ability to generate a solid return on investment, whether from fixing and flipping a property, or buying a property and converting it into a rental unit. And savvy investors take the evaluation of location down to the “micro-market” level, determining which neighborhoods to invest in; which sections of neighborhoods potentially offer the best returns; and what strategy they should deploy on a given property within that section of the neighborhood. For example, is it best to make minimal repairs and rent a property at the low end of local rent rates, or invest in high-quality upgrades and charge a premium rent? Is it better to buy and flip the nicest house on the block, or is it a better strategy to look for the least expensive property in an upscale neighborhood? There are no answers that are absolutely right or wrong for any of these questions, but experienced investors generate successful results by understanding what works best in their geography, and what approach they’re best suited to deploy.

More broadly, geography can be a deciding factor in what type of real estate investing someone does, or where certain types of investment approaches make the most sense.

For instance, investors looking for foreclosure inventory like the properties marketed on Auction.com will find much less inventory in states that are further along in the housing market recovery. California, Arizona and Washington State have smaller percentages of homes in foreclosure than states like New York, New Jersey, Florida, Illinois, Michigan, Pennsylvania and Ohio. So investors looking for a steady stream of foreclosure and bank-owned properties might want to cast their nets into the more fertile fishing grounds of the Midwest and Northeast than Coastal California or the Pacific Northwest. Some forecasters suspect there are markets more likely than others to see an uptick in foreclosure activity, as you’ll see in the article 10 Cities Primed for Foreclosure.

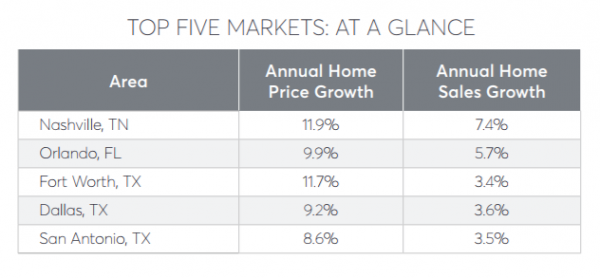

Flippers typically do better in markets with a low inventory of homes for sale, rising home prices and strong demand. That sounds a lot like cities along the coast of California, and places like Seattle, Portland and Austin. But our research team also listed Nashville, Orlando, Fort Worth, Dallas and San Antonio as the five “hottest housing markets” in the country in our recently issued Summer 2017 report. All five cities feature growing populations, improving local economies and strong home sales.

And investors who specialize in rental properties often look for markets with more affordable homes, which they can buy and then rent out at reasonable rates. We have a number of Auction.com buyers who target Midwestern states like Michigan, Ohio and Indiana, and Southeastern states like Georgia and the Carolinas – and even northern and central Florida – for those types of opportunities.

Geography can determine your investment strategy. And your strategy can also determine which geography makes the most sense for you. But wherever your investing takes you, we appreciate your business, and wish you continued success.