Today’s investors have several real estate investing options available to them beyond just the traditional avenues. In this article, we will talk about both time-tested and emerging approaches to leveraging real estate that can help expand your investment portfolio.

One of the most popular ways to diversify your investment portfolio is to buy a property and rent it out to potential tenants or resell it for a profit after a period of appreciation. As the market has continued to evolve over the years, newer approaches to real estate investing have emerged that can help you grow that nest egg. In some cases, you can even invest in real estate with no money down.

As per a Census Bureau report released in 2022, individual investors made up 70% of rental property ownership, followed by LLCs, partnerships, and professional management firms. Leasing out property remains the most popular way for independent investors to turn a profit from real estate. However, real estate investment does not always require you to lease it out and get overly involved in every aspect of the property.

Find Investment Properties on Auction.com

From direct property purchases, Real Estate Investment Trusts (REITs), house flipping and more, aspiring investors have plenty of investment vehicles to choose from. By carefully assessing your capital availability, risk tolerance, and degree of involvement, you can pick from any of these real estate investment strategies and generate favorable results.

Why Invest in Real Estate?

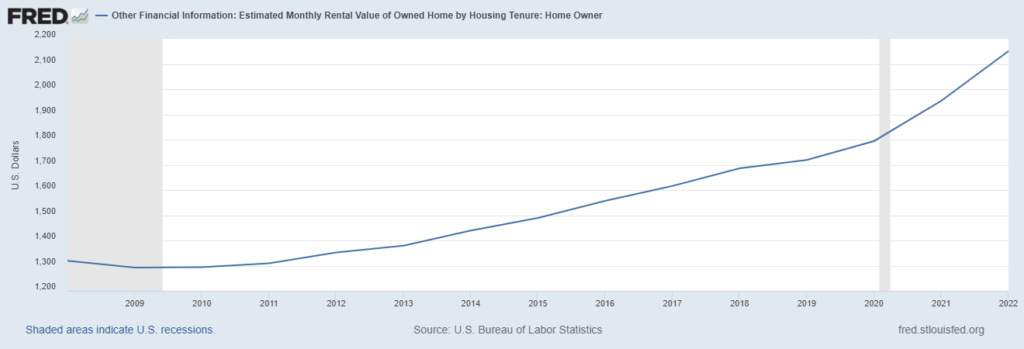

Rental property has been a time-honored investment vehicle, as shown by the Federal Reserve Economic Data (FRED) graph below. We can observe that the nationwide average rental value of homes has risen steadily throughout the past decade. If these trends are anything to go by, you may get satisfying results if you were to get on the rental bandwagon. However, there are other real estate investment instruments that may get you the returns you want.

Real estate investing today encompasses a plethora of avenues that can help you build wealth without demanding uninterrupted active participation. If your real estate investing strategy is paired with the right asset type, you can enjoy excellent returns, diversify your portfolio, maintain good cash flow, and reap considerable tax benefits.

Let’s get into these benefits in detail:

1) Steady Cash Flow: Whatever remains from your real estate investment after deducting mortgage payments and miscellaneous expenses is referred to as cash flow. Positive cash flow from steady rental income can help pay off your mortgage and build equity in the property.

2) Price Appreciation: A real estate investor can expand the profits they make from their investment properties as they typically appreciate over time. Over the long term, you can take advantage of this by selling for more than you originally paid for the properties.

3) Protection from Inflation: While most investment vehicles are not equipped to maintain their dollar value against inflation, real estate investment tends to be a convenient anomaly. As inflation increases, property prices tend to rise alongside and so, landlords can charge higher rents allowing them to hedge against inflation.

4) Leverage: The property in which you invest first and build equity in can help finance your next investment when the former appreciates. You can sell the property or access some of the equity with a cash-out refinance.

5) Flexibility of Participation: You can decide the level of active participation you can muster for your real estate investment. With enough hands-on involvement, you can control the degree of appreciation for your property with well-planned periodic revamps.

Real Estate Investment Avenues

Real estate offers you an exciting investment landscape with diverse avenues to build out your portfolio and drive great returns. Moreover, new-age real estate investors are no longer bound by geographical constraints either. As the barriers for entry continue to disintegrate, more and more investors are trickling into the real estate investing sphere, showing interest in some of the following investment avenues:

1)Rental Property

Rental property, one of the more traditional investment options, has been seeing demographically diverse buyers becoming landlords. As per a Mynd Consumer Insights Report published in Realtor Magazine, a growing crop of millennials has been realizing the potential of investment property to help build wealth. A new wave of investors who call themselves “rentvestors” are interested in continuing to rent their own home while generating income from an investment property.

Remote investing, or the practice of investing in out-of-state rental properties, is also on the rise, as per the Mynd report. Around 72% of the report’s survey respondents said they would consider buying an investment property in a city different from the one they live in. With rising inflation, nationwide residential rents are also on an upward trajectory, promising steady cashflow for potential investors.

2) Foreclosures

When a homeowner defaults on several payments on their mortgage, the lender then tries to sell or take ownership of the property (when it becomes Bank Owned or Real Estate Owned, or REO) to recover the amount owed to them. In this scenario, the property is said to have gone into foreclosure and may be listed for auction. An investor in the foreclosures market should have a comprehensive strategy that considers the end-to-end journey of the property – the method of acquisition, the intended holding period, the disposition route, and so on.

You can leverage Auction.com to choose from plenty of foreclosure and REO properties to be your next big investment. Once you decide to bid on a foreclosure property, you must carry out thorough research into the local real estate market and into the property itself.

Foreclosures may offer several advantages to potential buyers in the form of discounted prices, a quick purchase process, and with a platform like Auction.com, you can also get a closer look at the property’s due diligence details. However, before you finalize a property to bid on, you may wish to consult with a real estate attorney or other professional and research county court records to find out about its title, associated liens, and other legalities to avoid any hassles while closing on the property after you win it at auction.

3) House Flipping

Flipping properties involves two routes:

1)Buying a home when the price is low, holding on for a while as it appreciates, and then selling for a profit.

2)On the flip side, you may also find a property listed below its true value either because it’s gone into disrepair or due to other reasons. With sufficient funds for interior remodeling, a face lift to its curb appeal, and some marketing, you should be able to resell such a home for a profit.

House flippers are predominantly known to pay cash for the property and potential investors should be aware that sellers of distressed properties may expect you to make a cash offer. You could be looking at some hefty expenses with costs of remodeling added, especially if you choose to hire professionals for it. By living in the home as you work on repairing it or holding it, you can lower your risk of not being able to unload the property for a satisfactory profit. You can also work with a professional property management company for expert assistance in house flipping.

4)Real Estate Investment Trusts (REITs)

An REIT is a publicly traded security that is listed on a major stock exchange and invests in specific property types such as residential or commercial buildings, warehouses, retail outlets, healthcare facilities, or hotels. REITs have traditionally helped investors generate competitive total returns for themselves, arising from high dividend income and long-term capital appreciation.

Nareit reports that nearly 170 million Americans live in households that are invested in REITs. You can use an REIT as an excellent portfolio diversifier that has very low correlation with other stocks and bonds. This independence helps reduce overall portfolio risk, while potentially offering a high return on investment.

5)Real Estate Crowdfunding

Real estate crowdfunding is for those investors who are eager to get into real estate investing but are intimidated by the high expenses and nuances involved in it. With this investment approach, you can diversify your investment portfolio through fractional equity in real estate assets.

Platforms that enable real estate crowdfunding pool individual investors’ funds together via private REITs that you may not find through traditional brokerages. Typically, a host initiates a real estate investment project, contributing a majority of the funds.

The host then invites additional funding from individuals through a crowdfunding platform. Investors then commit funds in exchange for fractional ownership and receive income from the property proportional to their investment amount.

Final Thoughts on Real Estate Investing

Real estate investors can ensure steady returns on their investments through rental income, returns on crowdfunded assets, renovation and reselling, appreciation, and other profits generated from a property’s business application. As an investor, you can expect a potentially steady cash flow, flexibility in the extent of your involvement in the investment, tax deductions, a diversified portfolio, and inflation hedging. You can choose to invest in REITs, crowdfund a property, or flip a home, finalizing your asset of choice only after an intricate assessment of your risk tolerance and financial capability. If investing in foreclosure properties is something you are interested in, then you can begin your journey on Auction.com by clicking the link below.

Create A Free Auction.com Account