The key to choosing which properties to bid on is doing your due diligence before the auction starts. Auction.com offers many financial tools and features that can help you be more competitive. Here’s some information to help you plan a winning bidding strategy:

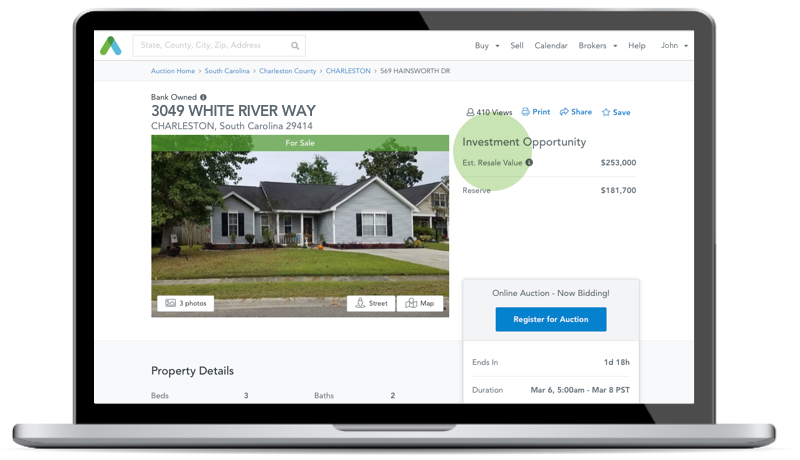

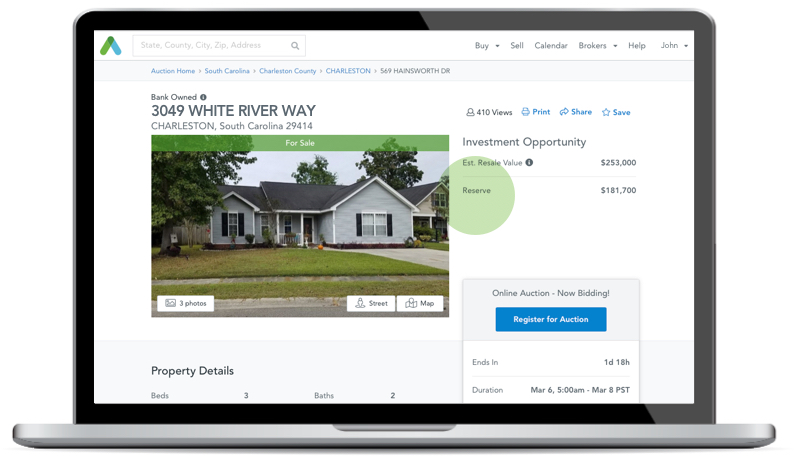

Estimated Resale Value (ERV)*

Located on the property detail pages (PDP), ERV is an estimate of a property’s potential resale value. This value assumes that all needed repairs and upgrades on the property are complete. Auction.com works with a third party to get automated values, which use historical data from public records.

ERV is helpful because it helps you calculate potential returns on a property and determine a bidding strategy and ultimately, a potential profit margin after accounting for the estimated costs of repairs.

Reserve/Credit Bid

For bank-owned properties, the reserve is the lowest price that the seller is willing to accept to purchase the house. Located on the PDP, the reserve is set when the listing is created but may not be disclosed until a bid reaches that amount.

For foreclosure properties, a credit bid is a bid placed by the lender. Credit bids are not always shared and when they are, they usually are revealed just before the sale.

Knowing the reserve and credit bid gives you the minimum bid you need to place to win the property. That way, you can weed out all the properties that are beyond your budget or strategize your bidding strategy for multiple properties at the same time. Make sure to save properties to your dashboard to receive an email from Auction.com if the reserve and/or credit bid is disclosed.

Available Financing

Your PDP will tell you if financing is available when purchasing a property. For bank-owned properties, you can see the financing options on the PDP. For most foreclosure property purchases, you will be required to pay in cash or cashier’s check, but how you acquire your funds is up to you. Here are some ways to finance your purchase:

- All cash — Most in-person auctions require a cash payment (or cashier’s check). This money can come from your savings or even your checking account.

- Hard money lender — Hard money lenders offer unsecured loans that typically have higher interest rates and larger down payment requirements than other sources.

- Line of credit — A line of credit is a set dollar amount from a bank or credit union that you can borrow from.

- Private money — Private money comes from a source that isn’t typically in the business of loaning money, such as a family member, business partner or a friend.

- Conventional loan — Some bank-owned properties allow conventional financing to pay for a property. On the PDP of a bank-owned property, you’ll learn whether a property allows financing.

It’s imperative to know that payment rules can vary state to state. So make sure to check the auction and your state’s requirements before the sale.

Potential Returns Properties**

Auction.com tries to make property selection as easy as possible by identifying houses that have potential returns.* A potential return is an estimate of what a buyer might save below the ERV. Auction.com identifies these nationwide properties via a list available to you on the website.

Once you find a property on the list that interests you, click the link to the PDP and save the property to your dashboard.

*The Est. Resale Value of the property is based on an automated value obtained from a third party, assuming the property has no deferred maintenance and is very well maintained. The ERV is provided for informational purposes and no representation or warranty is made regarding its accuracy. You are encouraged to conduct your own due diligence and seek independent professional advice regarding valuations of properties.

**Potential returns are estimates before repair costs are calculated. The potential return is based on the difference between the Estimated Credit Bid and the Est. Resale Value (ERV) of the property as determined by an automated value obtained from a third party, assuming the property has no deferred maintenance and is very well maintained. This content is provided for informational purposes and no representation or warranty is made regarding its accuracy. You are encouraged to conduct your own due diligence and seek independent professional advice regarding valuations of properties.