If you’re thinking about flipping a house, don’t be fooled into thinking it’s as easy as it looks on reality TV shows. Buying, rehabbing and selling a distressed property may take a lot of work. But with the right mindset and tools, flipping can be a profitable and rewarding experience.

Many investors have pocketed $30K, $50K and even $100K per flip, but they have done so using the right resources and tools.

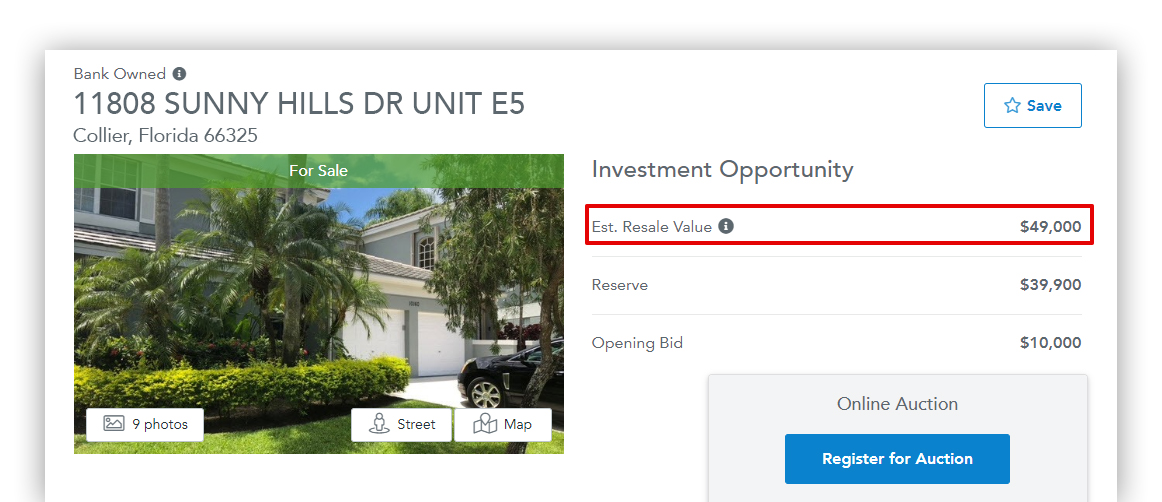

Tools are crucial to the success of a flip. And we’re not talking about hammers and screwdrivers here, although they can come in handy. We’re talking about financial tools, such as the Estimated Resale Value (ERV)* of a property.

Estimated Resale Value (ERV) is crucial to success

The Estimated Resale Value (ERV) is calculated with an automated valuation model using the sale of similar homes in the same neighborhood that are very well maintained with no deferred maintenance. The Estimated Resale Value (ERV) gives investors a good idea of what they can sell the home for at its highest value, after all repairs and upgrades are complete, and the property is in excellent condition.

This tool should be in every flipper’s arsenal. It’s essential when deciding whether to purchase an investment property because investors can deduct their estimated repairs from this financial tool and determine their bidding strategy and ultimately, their profit margin.

In an effort to help buyers make better investment decisions, Auction.com is now providing the Estimated Resale Value (ERV) on many properties. It can be found on the property details page, along with other financial information.

*The Est. Resale Value of the property is based on an automated value obtained from a third party, assuming the property has no deferred maintenance and is very well maintained. The ERV is provided for informational purposes and no representation or warranty is made regarding its accuracy. You are encouraged to conduct your own due diligence and seek independent professional advice regarding valuations of properties.