While real estate experts rarely reach consensus on anything new in the industry, there is a common agreement among all that location is one of the most important factors for the success of rental properties in NJ. Location determines not only the supply and demand for rentals but also the rental income and rental expenses and ultimately the return on investment. So, before buying a property, real estate investors should study the market carefully and make sure that they are choosing the most profitable location for owning a rental.

Search New Jersey Foreclosures

Why Should You Invest in the New Jersey Real Estate Market?

Speaking of location, New Jersey has been one of the top choices for investing in real estate and rental properties. The strategic location of the state of NJ right next to New York City to the northeast and Philadelphia to the southwest makes it a top place for buying a traditional investment property if you are in search of high rental demand. In addition, the beautiful beaches, as well as other natural attractions, make New Jersey a top destination for short-term rentals too.

What makes New Jersey an ideal location for first-time real estate investors and others with a limited budget is the relatively low property prices. According to data from Mashvisor, a real estate data analytics company which helps real estate investors find lucrative traditional and Airbnb rental properties in NJ and the US housing market, there are plenty of profitable locations in New Jersey where you can buy an income-generating investment property for sale under $300,000 and even under $200,000. So, if you are looking for affordability, you should definitely explore the NJ real estate investment market.

What Are the Best Locations to Invest in Rental Properties in New Jersey State?

New Jersey covers a vast geographical area, so real estate investors need to know where exactly the most profitable places for rental properties are. Here we have ranked the locations which will yield the highest return on investment property in NJ, according to data and calculations from Mashvisor. Mashvisor takes its investment properties data from the MLS and other public sources; the traditional rental comps from Rent Jungle, Hotpads, MLS, and Zillow; and the short-term rental comps from Airbnb. The return on investment metric used here is the capitalization rate, or cap rate for short.

So, following is a list of the top city and county locations for investing in a traditional long-term rental property in New Jersey:

Highest Cap Rate for Traditional Long-Term Rentals Markets in New Jersey State

Data Source: Mashvisor, September 2018

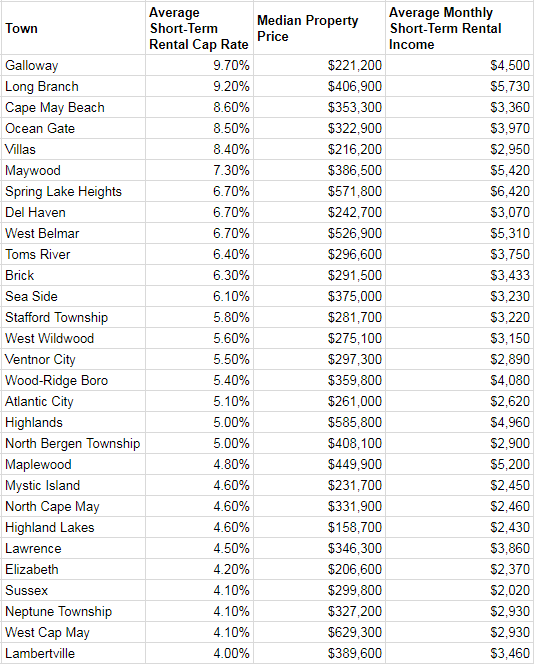

In case you are interested in buying an investment property to rent out on a short-term basis, look at the list of the most profitable places to do that in New Jersey below. However, before you decide to rent out your property on Airbnb or another similar platform, make sure you study the local legislation carefully in terms of short-term apartment or housing rentals restrictions and bans.

Highest Cap Rate for Short-Term Rentals Markets in New Jersey State

Data Source: Mashvisor, September 2018

What Is Cap Rate in Real Estate Investing?

In case you are new to the world of real estate investments, we will take you through the concept of capitalization rate. Cap rate is one of the most popular metrics for measuring the return on investment of rental properties. It is obtained by dividing the net operating income (NOI) of the investment property by its current market value (CMV).

According to real estate experts, a good cap rate is above 8% or even above 12%. However, beginner investors should know that the rental business has become so competitive that anything above 3-4%, especially on the city level, is a good return. When you consider the markets above, remember that these are just city averages, while in each of these towns you will be able to find investment properties for sale with much higher cap rates.

How Can You Push Your Return on Investment Even Higher?

Regardless of which return on investment metric you look at, the profitability of your property is the difference between how much rental income you make from it and how much you paid for it. Thus, buying cheap investment properties is one of the best ways to make extra money with real estate. So, when you start looking for cheap rental properties in New Jersey to start or expand your real estate investment career, don’t forget to explore available foreclosures, bank-owned properties, and short sales. You don’t have to buy an expensive property to succeed in real estate investing.

Search New Jersey Foreclosures

Daniela Andreevska is Marketing Director at Mashvisor, a real estate analytics tool which helps real estate investors quickly find both traditional and new Airbnb apartment rentals as well as other investment properties. A research process that usually takes 3 months can now take 15 minutes. We provide all the real estate information in easy to understand visualizations.

The information in this blog post is being provided for informational purposes only and not for the purpose of providing legal or real estate investment advice, and no liability is assumed by Auction.com (or Ten-X, LLC) with respect to such information.